by Calculated Risk on 4/22/2020 08:51:00 AM

Wednesday, April 22, 2020

AIA: Architecture Billings Index Decreased Sharply in March

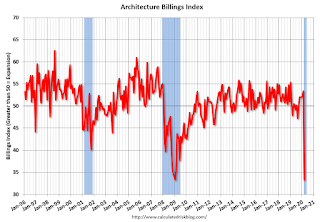

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index points to major downturn in commercial construction

Reflecting the deteriorating conditions in the overall economy, demand for design services from architecture firms recorded a record fall, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score of 33.3 for March reflects a decrease in design services provided by U.S. architecture firms (any score below 50 indicates a decrease in billings). During March, both the new project inquiries and design contracts scores dropped dramatically, posting scores of 23.8 and 27.1 respectively.

“Though most architecture firms have made quick transitions to remote operations, the complete shutdown of business activity is severely impacting architects,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “The dramatic pullback in new and ongoing design projects reflects just how quickly and fundamentally business conditions have changed across the country and around the world in the last month as a result of the COVID-19 pandemic.”

...

• Regional averages: West (45.3); South (44.2); Midwest (44.2); Northeast (38.4)

• Sector index breakdown: institutional (46.9); multi-family residential (43.3); commercial/industrial (41.9); mixed practice (40.6)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 33.3 in March, down from 53.4 in February. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This was the largest one month decline on record for this index. This also matches the lowest level for this index during the Great Recession.

MBA: Mortgage Applications Decreased, Purchase Applications down 31% YoY

by Calculated Risk on 4/22/2020 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 0.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 17, 2020.

... The Refinance Index decreased 1 percent from the previous week and was 225 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 3 percent compared with the previous week and was 31 percent lower than the same week one year ago.

...

“Mortgage applications were essentially unchanged last week, as a slight drop in refinance activity was offset by a 2 percent increase in purchase applications. California and Washington, two states hit hard by COVID-19, saw another week of rising activity – partly driving the overall increase. Despite the weekly gain, the purchase index remained close to its lowest level since 2015, and was over 30 percent lower than a year ago,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The pandemic-related economic stoppage has caused some buyers and sellers to delay their decisions until there are signs of a turnaround. This has resulted in reduced buyer traffic, less inventory, and March existing-homes sales falling to their slowest annual pace in nearly a year.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) remained unchanged at 3.45 percent, with points remaining unchanged at 0.29 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

Note the Fed has stepped up buying of MBS last month and that helped with liquidity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is down 31% year-over-year.

Purchase activity has fallen sharply.

Note: Red is a four-week average (blue is weekly).

Tuesday, April 21, 2020

Wednesday: Mortgage Purchase Index, Architecture Billings

by Calculated Risk on 4/21/2020 07:45:00 PM

CR Note: The mortgage purchase application survey will give us further hints about the housing market.

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:00 AM, FHFA House Price Index for February 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

• During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

April 21 Update: US COVID-19 Test Results

by Calculated Risk on 4/21/2020 04:59:00 PM

Test-and-trace is a key criterion in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: The Financial Times reports that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

This is just test results reported daily.

There were 151,627 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 18% (red line). The US probably needs enough tests to push the percentage below 5% (probably much lower based on testing in New Zealand).

All experts agree: We need many more tests!

A few Comments on Weekly and Continued Unemployment Claims

by Calculated Risk on 4/21/2020 02:16:00 PM

We will probably see a decline in initial weekly unemployment claims this week. The consensus is initial claims will decrease to 4.145 million, from 5.245 million last week. That is still a huge number of initial claims.

The extremely high level of claims will probably continue for several weeks. But it will be important to track Continued Claims too - since many of these people won't be returning to work for some time.

Here is a graph of continued claims since 1967.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

Continued claims have already increased to a new record high of 11,976,000 (SA) and will increase further over the next few weeks.

During the Great Recession, initial weekly claims were a helpful measure of the recovery. Although weekly claims will likely remain elevated for some time, they will decline significantly from the recent levels.

This time it will be more important to track continued claims as a measure of the eventual recovery - - since continued claims are likely to stay at a high level until the crisis abates.

Lawler: Las Vegas Home Sales Plunged in First Half of April

by Calculated Risk on 4/21/2020 01:27:00 PM

Housing economist Tom Lawler has been looking for high frequency data for housing.

Today, he sent me this story from the Las Vegas Review-Journal: Las Vegas housing market slows amid coronavirus turmoil

Lawler notes: According the above, net signed contracts for existing homes in the first half of April 2020 were down 57% from the comparable period of 2019 while net signed contracts for new homes in the first half of April of this year were down 79% from the comparable period of last year. (YOY gross sales contracts were down 47% for existing homes and down 60% for new homes).

Comments on March Existing Home Sales

by Calculated Risk on 4/21/2020 11:20:00 AM

Earlier: NAR: Existing-Home Sales Decreased to 5.27 million in March

A few key points:

1) This is mostly pre-crisis data. Existing home sales are counted at the close of escrow, so this report is mostly for contracts signed in January and February. Sales will decline sharply in April and May.

2) Existing home sales were up 0.8% year-over-year (YoY) in March.

2) Inventory is very low, and was down 10.2% year-over-year (YoY) in March. Inventory will probably stay low as people wait to list their homes - and do not want strangers in their house. This is the lowest level of inventory for March since at least the early 1990s.

Signed contracts will probably be down sharply year-over-year in April and May.

Note that existing home sales picked up somewhat in the second half of 2019 as interest rates declined.

Sales NSA in March (415,000) were just above sales last year in March.

Note that sales have been in the middle of the range recently - not absurdly high like in 2005, and not depressed like in 2010 and 2011.

With the pandemic, sales will decline sharply over the next few months.

NAR: Existing-Home Sales Decreased to 5.27 million in March

by Calculated Risk on 4/21/2020 10:13:00 AM

From the NAR: Home Sales Increase Year-Over-Year Despite Expected Monthly March Sales Decline Due to Impact of COVID-19

Existing-home sales fell in March following a February that saw significant nationwide gains, according to the National Association of Realtors®. Each of the four major regions reported a dip in sales, with the West suffering the largest decrease.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, dropped 8.5% from February to a seasonally-adjusted annual rate of 5.27 million in March. Despite the decline, overall sales increased year-over-year for the ninth straight month, up 0.8% from a year ago (5.23 million in March 2019).

...

Total housing inventory at the end of March totaled 1.50 million units, up 2.7% from February, but down 10.2% from one year ago (1.67 million). Unsold inventory sits at a 3.4-month supply at the current sales pace, up from three months in February and down from the 3.8-month figure recorded in March 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in March (5.27 million SAAR) were down 8.5% from last month, and were 0.8% above the March 2019 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.50 million in March from 1.46 million in February. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 1.50 million in March from 1.46 million in February. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 10.2% year-over-year in March compared to March 2019.

Inventory was down 10.2% year-over-year in March compared to March 2019. Months of supply was increased to 3.4 months in March.

This was close to the consensus forecast. I'll have more later …

Monday, April 20, 2020

Tuesday: Existing Home Sales

by Calculated Risk on 4/20/2020 07:16:00 PM

Note: Existing home sales are counted at the close of escrow, so the report tomorrow is mostly for contracts signed in January and February. There was probably some fall off at the end of March due to COVID.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Slightly Higher to Start The Week

While the industry has come to terms with recent challenges in terms of day-to-day volatility, mortgage rates remain higher than they otherwise would be based on financial markets. [MND's 30 Year Fixed (daily survey) 30YR FIXED - 3.44%]Tuesday:

emphasis added

• At 10:00 AM ET, Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.30 million SAAR, down from 5.77 million.

Housing economist Tom Lawler expects the NAR to report sales of 5.25 million SAAR for March.

April 20 Update: US COVID-19 Test Results

by Calculated Risk on 4/20/2020 04:45:00 PM

Test-and-trace is a key criterion in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: The Financial Times reports that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

This is just test results reported daily.

There were 137,687 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 17% (red line). The US probably needs enough tests to push the percentage below 5% (probably much lower based on testing in New Zealand).

All experts agree: We need many more tests!