by Calculated Risk on 4/20/2020 03:24:00 PM

Monday, April 20, 2020

TSA checkpoint travel numbers

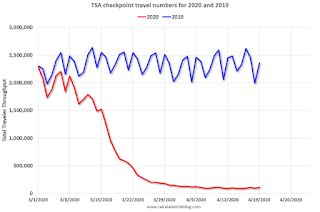

The TSA is providing daily travel numbers. (ht @conorsen)

This is another measure that will be useful to track when the economy starts to reopen.

This data shows the daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

On April 19th there were 105,382 travelers compared to 2,356,802 a year ago.

That is a decline of 95%.

Hotels: Occupancy Rate Declined 69.8% Year-over-year to All Time Record Low

by Calculated Risk on 4/20/2020 09:30:00 AM

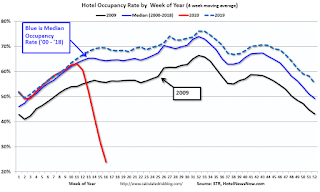

From HotelNewsNow.com: STR: US hotel results for week ending 11 April

Reflecting the continued impact of the COVID-19 pandemic, the U.S. hotel industry reported significant year-over-year declines in the three key performance metrics during the week of 5-11 April 2020, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 7-13 April 2019, the industry recorded the following:

• Occupancy: -69.8% to 21.0%

• Average daily rate (ADR): -45.6% to US$74.18

• Revenue per available room (RevPAR): -83.6% to US$15.61

“There was not much of a change from last week. As we’ve noted, RevPAR declines of this severity are our temporary new normal,” said Jan Freitag, STR’s senior VP of lodging insights. “Several weeks of data also point to occupancy in the 20% range to be the low point, and economy hotels holding at a higher occupancy level is the pattern right now.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

2020 was off to a solid start, however, COVID-19 has crushed hotel occupancy.

Note: Y-axis doesn't start at zero to better show the seasonal change.

This is the lowest weekly occupancy on record, even considering seasonality.

"Chicago Fed National Activity Index Suggests Economic Growth Decreased Substantially in March"

by Calculated Risk on 4/20/2020 09:00:00 AM

From the Chicago Fed: Chicago Fed National Activity Index Suggests Economic Growth Decreased Substantially in March

Led by declines in production- and employment-related indicators, the Chicago Fed National Activity Index (CFNAI) fell to –4.19 in March from +0.06 in February. All four broad categories of indicators used to construct the index made negative contributions in March, and three of the four categories decreased from February. The index’s three-month moving average, CFNAI-MA3, decreased to –1.47 in March from –0.20 in February. Following a period of economic expansion, an increasing likelihood of a recession has historically been associated with a CFNAI-MA3 value below –0.70.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was in a recession starting in March (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, April 19, 2020

Sunday Night Futures

by Calculated Risk on 4/19/2020 07:33:00 PM

Weekend:

• Schedule for Week of April 19, 2020

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for March. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 14 and DOW futures are down 150 (fair value).

Oil prices were down over the last week with WTI futures at $17.19 per barrel and Brent at $27.77 barrel. A year ago, WTI was at $66, and Brent was at $71 - so WTI oil prices are down about 74% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $1.78 per gallon. A year ago prices were at $2.83 per gallon, so gasoline prices are down $1.05 per gallon year-over-year.

April 19 Update: US COVID-19 Test Results

by Calculated Risk on 4/19/2020 04:55:00 PM

Note: The Phase 4 Disaster Relief package is supposed to have $25 billion to increase testing.

Test-and-trace is a key criterion in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: The Financial Times reports that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

This is just test results reported daily.

There were 167,330 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 16% (red line). The US probably needs enough tests to push the percentage below 5% (probably much lower based on testing in New Zealand).

All experts agree: We need many more tests!

Economic Outlook: Reasons for Optimism and Pessimism

by Calculated Risk on 4/19/2020 10:52:00 AM

On March 31st, I wrote:

This is a healthcare crisis, and the economic outlook is based on presumptions about the course of the pandemic. A key model suggests peak healthcare resource use will be around April 15th, but the peak will not be until May in many areas of the country. Of course, this requires cooperation of the public.There are a few reasons for optimism: Clearly social distancing is working!

Before areas can start easing restrictions, the US will need to have sufficient healthcare services and equipment, masks for everyone (it seems likely that it will be recommended that everyone wear a mask), and adequate testing to do surveillance monitoring. Right now, we are well short of all of these requirements, but making progress. It is possible we could see some restriction easing in June.

And the US does appear to be near the peak of healthcare resource usage, and there might be some progress on finding an effective treatment (although this is still uncertain). It is also possible that a vaccine will be available in early 2021.

In addition, it appears there will be a Phase 4 disaster relief package that will provide additional relief for small businesses and a substantial increase in funding for testing. The Phase 4 package is supposed to have $25 billion to increase testing. There will have to be a Phase 5 package too for relief for the states.

But there are reasons for pessimism too. Merrill Lynch economists wrote this week:

The Trump Administration has released a three-phase plan for reopening the economy. … First, and foremost, it is not clear how our public health system will meet the recommended standards for re-opening. The plan suggests that states looking to re-open should have seen a 14-day downward trend in cases. They should also have: (1) widespread availability of tests, not just for the seriously sick and health care workers, (2) the ability to aggressively track cases and isolate those who may be affected and (3) the ability to quickly and independently supply enough medical equipment and increase ICU capacity to meet surge demand. In our view, all three of these conditions will be challenging to meet.First, there is mixed messaging from the White House. They put out a three-phase plan - that is going to require some time and significantly more testing before a gradual reopening - and then, the next day the White House is pushing states to open right away. Mixed messaging is confusing and costs lives.

Also testing in the US is still limited. The key number to follow is percent positive. In the countries that are doing the best, they are testing enough people that the percent positive is well below 5%. In the US, the percent positive is close to 20% - indicating the US is not testing enough people (something all the doctors are saying).

And there is no national test-and-trace program (this is apparently being left to the states). And there is still a lack of PPE and masks. It will take some time to meet these "reopening" criteria.

Sadly, there are some people pushing to open the economy prematurely. Some claim incorrectly to be "libertarians", but they have forgotten - or never read - John Stuart Mill and the Harm Principle. And I've even encountered some people that think COVID is a "hoax".

My overall economic view remains the same as I wrote last month:

My current guess is the economy will start growing - slowly - in June (maybe July). But growth will likely be slow at first as people put their toes in the water. I don't expect a "V" shaped recovery unless there is an effective treatment or a vaccine, then growth will pick up quicker.However, opening too early would be a huge mistake, and would set back the eventual recovery.

This is all subject to the course of the pandemic. Stay healthy!

Saturday, April 18, 2020

April 18 Update: US COVID-19 Test Results

by Calculated Risk on 4/18/2020 04:51:00 PM

From CNBC: New York coronavirus deaths top 13,000 but hospitalization continues to drop, Cuomo says

The lack of sufficient supplies of reagents has been cited by labs in the state as the main reason they are not performing the number of tests that they are now otherwise capable of doing with their existing testing machines.The US needs someone in charge of resolving these bottlenecks!

He said that the top labs in New York have told state officials that the shortage of reagents stems from two factors: reagents tend to come from overseas sources, and the federal government has been telling test makers how to distribute their reagent supplies.

Test-and-trace is a key criterion in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: The Financial Times reports that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

This is just test results reported daily.

There were 132,989 test results reported over the last 24 hours.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 20% (red line). The US probably needs enough tests to push the percentage below 5% (probably much lower based on testing in New Zealand).

All experts agree: We need many more tests!

Schedule for Week of April 19, 2020

by Calculated Risk on 4/18/2020 08:11:00 AM

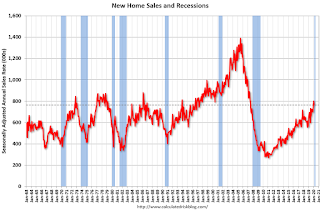

The key reports this week are March New and Existing Home Sales.

For manufacturing, the April Kansas City manufacturing survey will be released.

8:30 AM ET: Chicago Fed National Activity Index for March. This is a composite index of other data.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.30 million SAAR, down from 5.77 million.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.30 million SAAR, down from 5.77 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 5.25 million SAAR for March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for February 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a 4.000 million initial claims, down from 5.245 million the previous week.

10:00 AM: New Home Sales for March from the Census Bureau.

10:00 AM: New Home Sales for March from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 645 thousand SAAR, down from 765 thousand in February.

11:00 AM: the Kansas City Fed manufacturing survey for April.

8:30 AM: Durable Goods Orders for March from the Census Bureau. The consensus is for a 6.0% decrease in durable goods orders.

10:00 AM: University of Michigan's Consumer sentiment index (Final for April). The consensus is for a reading of 70.0.

Friday, April 17, 2020

April 17 Update: US COVID-19 Test Results

by Calculated Risk on 4/17/2020 05:06:00 PM

Test-and-trace is a key criterion in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: The Financial Times reports that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

This is just test results reported daily.

There were 140,304 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 17% (red line). The US probably needs enough tests to push the percentage below 5% (probably much lower based on testing in New Zealand).

All experts agree: We need many more tests!

Lawler: Early Read on Existing Home Sales in March

by Calculated Risk on 4/17/2020 01:38:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.25 million, down 9.0% from February’s preliminary pace and up 0.4% from last March’s seasonally adjusted pace.

On the inventory front, local realtor/MLS data, as well as data from other inventory trackers, suggest that the inventory of existing homes for sale at the end of March will be down about 12.0% from a year earlier. It should be noted that of late firms that track nationwide listings (such as Realtor.com and Redfin) have shown steeper YOY declines than those shown in the NAR’s existing home sales report.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up by about 8.4% from last March.

It goes without saying that April will see a massively larger decline in homes sold, and May will be extremely weak as well.

CR Note: The National Association of Realtors (NAR) is scheduled to release March existing home sales on Tuesday, April 21, 2020 at 10:00 AM ET. The consensus is for 5.30 million SAAR.