by Calculated Risk on 4/18/2020 04:51:00 PM

Saturday, April 18, 2020

April 18 Update: US COVID-19 Test Results

From CNBC: New York coronavirus deaths top 13,000 but hospitalization continues to drop, Cuomo says

The lack of sufficient supplies of reagents has been cited by labs in the state as the main reason they are not performing the number of tests that they are now otherwise capable of doing with their existing testing machines.The US needs someone in charge of resolving these bottlenecks!

He said that the top labs in New York have told state officials that the shortage of reagents stems from two factors: reagents tend to come from overseas sources, and the federal government has been telling test makers how to distribute their reagent supplies.

Test-and-trace is a key criterion in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: The Financial Times reports that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

This is just test results reported daily.

There were 132,989 test results reported over the last 24 hours.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 20% (red line). The US probably needs enough tests to push the percentage below 5% (probably much lower based on testing in New Zealand).

All experts agree: We need many more tests!

Schedule for Week of April 19, 2020

by Calculated Risk on 4/18/2020 08:11:00 AM

The key reports this week are March New and Existing Home Sales.

For manufacturing, the April Kansas City manufacturing survey will be released.

8:30 AM ET: Chicago Fed National Activity Index for March. This is a composite index of other data.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.30 million SAAR, down from 5.77 million.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.30 million SAAR, down from 5.77 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 5.25 million SAAR for March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for February 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a 4.000 million initial claims, down from 5.245 million the previous week.

10:00 AM: New Home Sales for March from the Census Bureau.

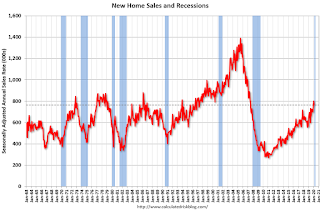

10:00 AM: New Home Sales for March from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 645 thousand SAAR, down from 765 thousand in February.

11:00 AM: the Kansas City Fed manufacturing survey for April.

8:30 AM: Durable Goods Orders for March from the Census Bureau. The consensus is for a 6.0% decrease in durable goods orders.

10:00 AM: University of Michigan's Consumer sentiment index (Final for April). The consensus is for a reading of 70.0.

Friday, April 17, 2020

April 17 Update: US COVID-19 Test Results

by Calculated Risk on 4/17/2020 05:06:00 PM

Test-and-trace is a key criterion in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: The Financial Times reports that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

This is just test results reported daily.

There were 140,304 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 17% (red line). The US probably needs enough tests to push the percentage below 5% (probably much lower based on testing in New Zealand).

All experts agree: We need many more tests!

Lawler: Early Read on Existing Home Sales in March

by Calculated Risk on 4/17/2020 01:38:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.25 million, down 9.0% from February’s preliminary pace and up 0.4% from last March’s seasonally adjusted pace.

On the inventory front, local realtor/MLS data, as well as data from other inventory trackers, suggest that the inventory of existing homes for sale at the end of March will be down about 12.0% from a year earlier. It should be noted that of late firms that track nationwide listings (such as Realtor.com and Redfin) have shown steeper YOY declines than those shown in the NAR’s existing home sales report.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up by about 8.4% from last March.

It goes without saying that April will see a massively larger decline in homes sold, and May will be extremely weak as well.

CR Note: The National Association of Realtors (NAR) is scheduled to release March existing home sales on Tuesday, April 21, 2020 at 10:00 AM ET. The consensus is for 5.30 million SAAR.

Q1 GDP Forecasts: Around -7% SAAR

by Calculated Risk on 4/17/2020 11:16:00 AM

Note: The NY Fed Nowcast and Atlanta Fed GDPNow models are based on released data and aren't capturing the collapse in the economy in the 2nd half of March. All forecasts, including the Merrill Lynch and other forecasts, are for the seasonally adjust annual rate (SAAR) of decline.

From Merrill Lynch:

We are tracking a 7% decline in 1Q. [SAAR Apr 17 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at -0.4% for 2020:Q1 and -7.9% for 2020:Q2. [Apr 17 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2020 is -0.3 percent on April 16 … There are no subjective adjustments made to GDPNow—the estimate is based solely on the mathematical results of the model. In particular, it does not capture the impact of COVID-19 beyond its impact on GDP source data and relevant economic reports that have already been released. It does not anticipate the impact of COVID-19 on forthcoming economic reports beyond the standard internal dynamics of the model. [Apr 16 estimate]CR Note: It appears GDP declined around 7% SAAR in Q1. The decline in Q2 will be much larger.

Seattle Real Estate in March: Sales up 17.6% YoY, Inventory down 30.1% YoY

by Calculated Risk on 4/17/2020 11:07:00 AM

The Northwest Multiple Listing Service reported Northwest MLS report for March shows initial disruptions from coronavirus pandemi

Like many sectors of the economy, residential real estate is experiencing disruption and uncertainty just when the vigorous spring market was ramping up. Not surprisingly, the March activity report from Northwest Multiple Listing Service, which covers 23 counties across Washington state, was mixed as guidelines affecting how brokers conduct business evolved.There were 6,735 sales in March 2020, down slightly from 6,750 sales in March 2019.

...

“We expect that all numbers will decline in April and May as a direct result of the governor’s “Stay Home” order that became effective on March 26,” stated Mike Grady, president and COO at Coldwell Banker Bain. He also expects April and May will be “bridge months” before the market returns to a “more normal” activity level, “assuming we all abide by Governor Jay Inslee’s directives.”

Windermere Chief Economist Matthew Gardner described the numbers for March as “essentially irrelevant given the fact that the economy went into freefall during the month.” He also noted that for a period, real estate was not considered to be an essential service, which he said “suggests that April’s numbers will also not be an accurate representation of the market.”

emphasis added

The press release is for the Northwest. In King County, sales were down 0.2% year-over-year, and active inventory was down 21.6% year-over-year.

In Seattle, sales were up 17.6% year-over-year, and inventory was down 30.1% year-over-year.. This puts the months-of-supply in Seattle at just 1.2 months.

The closed sales are for contracts mostly signed in January and February. There will be a significant decline in sales in coming months.

BLS: March Unemployment rates increased in 29 States

by Calculated Risk on 4/17/2020 10:14:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were higher in March in 29 states and the District of Columbia, lower in 3 states, and stable in 18 states, the U.S. Bureau of Labor Statistics reported today. Twenty-three states had jobless rate increases from a year earlier, 3 states had decreases, and 24 states and the District had little or no change. The national unemployment rate rose by 0.9 percentage point over the month to 4.4 percent and was 0.6 point higher than in March 2019

...

North Dakota had the lowest unemployment rate in March, 2.2 percent, while Louisiana had the highest rate, 6.9 percent. The rates in Alaska (5.6 percent) and Idaho (2.6 percent) set new series lows. (All state series begin in 1976.)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

At the worst of the great recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently 4 states and D.C. have an unemployment rate at or above 6% (dark blue). These are D.C., Louisiana, Nevada, Pennsylvania, and West Virginia.

A total of five states are at a series low: Alaska, Idaho, Maryland, North Dakota and Oregon.

In April, most, if not all, states will have unemployment rates well above 10%.

Phoenix Real Estate in March: Sales up 3.4% YoY, Active Inventory Down 22% YoY

by Calculated Risk on 4/17/2020 08:44:00 AM

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales were at 8,626 in March, up from 7,279 in February, and up from 8,344 in March 2019. Sales were up 18.5% from February 2020 (last month), and up 3.4% from March 2019.

2) Active inventory was at 14,257, down from 18,182 in March 2019. That is down 22% year-over-year.

3) Months of supply decreased to 2.11 in March from 2.14 months in February. This remains low.

This was another market with increasing sales and falling inventory.

Sales are reported at the close of escrow, so these sales were mostly signed in January and February. With the COVID-19 crisis, everything will change for the duration of the crisis. My guess is sales will decline significantly, and inventory will probably stay relatively low (no one wants strangers in their homes).

Thursday, April 16, 2020

April 16 Update: US COVID-19 Test Results

by Calculated Risk on 4/16/2020 05:53:00 PM

Test-and-trace is a key criterion in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: The Financial Times reports that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

This is just test results reported daily.

There were 158,309 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 19% (red line). The US probably needs enough tests to push the percentage below 5% (probably much lower based on testing in New Zealand).

All experts agree: We need many more tests!

CAR on California March Housing: Sales down 6.1% YoY

by Calculated Risk on 4/16/2020 03:18:00 PM

The CAR reported: California’s housing market begins to feel effects of coronavirus as March home sales drop, C.A.R. reports

California home sales fell from both the previous month and year in March as the coronavirus pandemic began taking a toll on the housing market, especially in the last two weeks of the month as the state’s stay-at-home order was put in place, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.CR Note: This is just the beginning of the sales decline. Existing home sales are reported when the transaction closes, so this was mostly for contracts signed in January and February. The CAR didn't include inventory, but it appears inventory is down sharply too (no one wants strangers walking through their homes right now).

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 373,070 units in March, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2020 if sales maintained the March pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

March’s sales total was down 11.5 percent from the 421,670 level in February and was down 6.1 percent from a year ago. The month-to-month drop was the first double-digit loss in more than nine years and the largest since August 2007. Additionally, the year-over-year decline was the first in nine months and the largest decrease since March 2019.

“The relatively moderate sales decrease that occurred in March is only a prelude to what we’ll see in April and May because sales were still modestly strong during the first two weeks of March before stay-in-place orders were implemented throughout the state,” said 2020 C.A.R. President Jeanne Radsick, a second-generation REALTOR® from Bakersfield, Calif. “However, pending sales, which is a better reflection of the current market conditions and consumer concerns about the coronavirus, dropped nearly 25 percent and suggest the decline could extend beyond the next couple of months, depending on the duration of the pandemic and the lockdown.”

...

California’s supply of available housing decreased in March from the prior month as the COVID-19 pandemic continued to disrupt the economy and the housing market. Potential home sellers are holding off listing their properties on the market as uncertainty about the future economic/market conditions remains. C.A.R.’s Unsold Inventory Index dropped to 2.7 months in March, down from 3.6 months both in February and March 2019. It was the lowest inventory level in three months. The index indicates the number of months it would take to sell the supply of homes on the market at the current rate of sales.

emphasis added