by Calculated Risk on 4/15/2020 09:20:00 AM

Wednesday, April 15, 2020

Industrial Production Decreased in March

From the Fed: Industrial Production and Capacity Utilization

Total industrial production fell 5.4 percent in March, as the COVID-19 (coronavirus disease 2019) pandemic led many factories to suspend operations late in the month. Manufacturing output fell 6.3 percent; most major industries posted decreases, with the largest decline registered by motor vehicles and parts. The decreases for total industrial production and for manufacturing were their largest since January 1946 and February 1946, respectively. The indexes for utilities and mining declined 3.9 percent and 2.0 percent, respectively. At 103.7 percent of its 2012 average, the level of total industrial production in March was 5.5 percent lower than a year earlier. Capacity utilization for the industrial sector decreased 4.3 percentage points to 72.7 percent in March, a rate that is 7.1 percentage points below its long-run (1972–2019) average.

emphasis added

Click on graph for larger image.

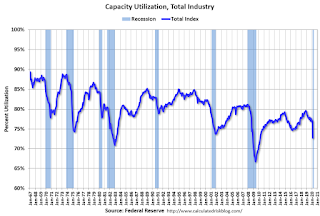

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.3 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 72.7% is 7.1% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in March to 103.7. This is 19.1% above the recession low, and 1.5% below the pre-recession peak.

The change in industrial production was below consensus expectations.

Note: The graphs show the 2020 recession starting in March 2020.

NY Fed: Manufacturing "Business activity plunged in New York State", Record Low Index

by Calculated Risk on 4/15/2020 08:46:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity plunged in New York State, according to firms responding to the April 2020 Empire State Manufacturing Survey. The headline general business conditions index plummeted fifty-seven points to -78.2, its lowest level in the history of the survey—by a wide margin. New orders and shipments declined at a record pace.This was well below the consensus forecast.

...

Labor market indicators were extremely weak. The index for number of employees fell fifty-four points to -55.3, with nearly 60 percent of respondents indicating lower employment levels. The average workweek index fell to -61.6, with 65 percent reporting shorter workweeks.

emphasis added

Retail Sales decreased 8.7% in March

by Calculated Risk on 4/15/2020 08:38:00 AM

On a monthly basis, retail sales decreased 8.7 percent from February to March (seasonally adjusted), and sales were down 6.2 percent from March 2019.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for March 2020, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $483.1 billion, a decrease of 8.7 percent from the previous month, and 6.2 percent below March 2019.

…

Due to recent events surrounding COVID-19, many businesses are operating on a limited capacity or have ceased operations completely. The Census Bureau has monitored response and data quality and determined estimates in this release meet publication standards.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 8.0% in March.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, decreased by 4.9% on a YoY basis.

Retail and Food service sales, ex-gasoline, decreased by 4.9% on a YoY basis.The decrease in March was well below expectations, however sales in January and February were revised up, combined.

Note: The graphs show the 2020 recession starting in March 2020.

MBA: Mortgage Applications Increased, Purchase Applications down 35% YoY

by Calculated Risk on 4/15/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 7.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 10, 2020.

... The Refinance Index increased 10 percent from the previous week and was 192 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 35 percent lower than the same week one year ago.

...

“The 30-year fixed mortgage rate decreased last week to the lowest level in MBA’s survey at 3.45 percent. The decline in rates – despite Treasury yields rising – is a sign that the mortgage-backed securities (MBS) market is stabilizing and lenders are successfully working through their lending pipelines,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Refinance activity has experienced a volatile four-week period, but did increase 10 percent last week. Refinancing will continue to be beneficial for the many borrowers able to lower their monthly payments during this time of economic distress.”

Added Kan, “Purchase applications decreased less than 2 percent last week – the fifth straight weekly decline. Compared to the first week of March, the purchase index was down around 35 percent, as the economic downturn and nationwide mitigation practices to slow the spread of COVID-19 have disrupted the spring homebuying season. The purchase market is still expected to rebound, as long as the public health measures to reduce the pandemic’s spread are successful and result in a broader recovery.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.45 percent from 3.49 percent, with points increasing to 0.29 from 0.28 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

Note the Fed has stepped up buying of MBS last month and that helped with liquidity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is down 35% year-over-year.

Purchase activity has fallen sharply.

Note: Red is a four-week average (blue is weekly).

Tuesday, April 14, 2020

Wednesday: Retail Sales, Industrial Production, NY Fed Mfg, Homebuilder Survey, Beige Book

by Calculated Risk on 4/14/2020 07:52:00 PM

CR Note: These releases should start to show the impact from COVID-19. The mortgage purchase application survey will give us further hints about the housing market, as will the April homebuilder survey.

The NY Fed manufacturing survey is for April, and will probably be very weak. And the Beige Book will be through April 6th.

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for March is scheduled to be released. The consensus is for a 3.0% decrease in retail sales.

• At 8:30 AM, The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of -35.0, down from -21.5.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for March. The consensus is for a 4.1% decrease in Industrial Production, and for Capacity Utilization to decrease to 73.7%.

• At 10:00 AM, The April NAHB homebuilder survey. The consensus is for a reading of 59, down from 72. Any number above 50 indicates that more builders view sales conditions as good than poor.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

April 14 Update: US COVID-19 Test Results

by Calculated Risk on 4/14/2020 05:56:00 PM

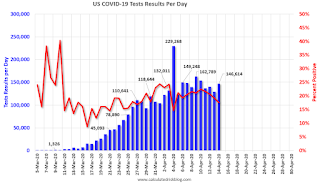

Test-and-trace is a key criterion in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: The Financial Times reports that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

This is just test results reported daily.

There were 146,614 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 17.5% (red line). The US probably needs enough tests to push the percentage below 5% (probably much lower based on testing in New Zealand).

All experts agree: We need many more tests!

The Sharp Decline in Housing Activity

by Calculated Risk on 4/14/2020 05:33:00 PM

Housing economist Tom Lawler has send me some housing data from a few areas:

The data reflect newly ratified contracts in the week ending 4/11/2020 compared to the comparable week of a year ago.

Northern Virginia, down 35%

Loudoun County, down 37%

Prince William Count down 43%

Prince George's County down 44%

Montgomery County down 44%

DC down 58%.

From the Long Island Business News: Long Island home sales down nearly 67%

The Long Island housing market, which began to feel the impacts of the COVID-19 pandemic towards the end of March, has seen a dramatic drop in sales and listings in the first half of April.From Chicago Now: Coronavirus Impact On Chicago Real Estate Market: Week 5

There were just 491 homes contracted for sale in Nassau and Suffolk counties in the first two weeks of April, down nearly 67 percent from the 1,471 homes contracted for sale in the same period a year ago, according to numbers from OneKey MLS.

The Chicago Association of Realtors released their updated numbers for the week ending April 4 yesterday morning and it continues to show a pretty bleak picture.CR Note: It looks like both sales and new inventory will decline sharply in April.

Single family home activity fell from 318 last year to 172 this year. That's a 46% drop.

Condo and townhome activity fell from 517 to 195 which is a 62% drop. Wow!

Last year there were 528 new single family home listings compared to only 255 this year. That's a 52% drop.

Last year there were 971 new condo townhome listings vs. only 352 this year. That's a 64% drop. Ouch!

Employment: March Diffusion Indexes

by Calculated Risk on 4/14/2020 01:08:00 PM

The BLS diffusion index for total private employment was at 36.0 in March, down from 57.9 in February.

For manufacturing, the diffusion index was at 36.8, down from 50.7 in February.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.

Click on graph for larger image.

Click on graph for larger image.Both indexes generally trended down in 2019 - except for a spike up in November - indicating job growth was becoming less widespread across industries (especially manufacturing).

Then both indexes declined sharply in March 2020 due to the impact from COVID-19.

The Top Ten Job Streaks

by Calculated Risk on 4/14/2020 10:37:00 AM

I'm updating these tables since the headline job streak ended in March.

Through February 2020, the employment report indicated positive job growth for a record 113 consecutive months.

| Headline Jobs, Top 10 Streaks | |

|---|---|

| Year Ending | Streak, Months |

| 20201 | 113 |

| 1990 | 48 |

| 2007 | 46 |

| 1979 | 45 |

| 1943 | 33 |

| 1986 | 33 |

| 2000 | 33 |

| 1967 | 29 |

| 1995 | 25 |

| 1974 | 24 |

| 1Ended February 2020 | |

However, if we adjust for Decennial Census hiring and firing (data here) the streak of consecutive positive jobs reports ended in January 2019 at 107 months. It makes sense to adjust for the Census hiring and firing since that was preplanned and unrelated to the business cycle.

| Ex-Census Jobs, Top 10 Streaks | |

|---|---|

| Year Ending | Streak, Months |

| 20191 | 107 |

| 2007 | 46 |

| 1979 | 45 |

| 1990 | 45 |

| 1943 | 33 |

| 1986 | 33 |

| 2000 | 32 |

| 1967 | 29 |

| 1995 | 25 |

| 1974 | 24 |

| 1Ended January 2019 | |

Small Business Optimism Decreased Sharply in March

by Calculated Risk on 4/14/2020 08:29:00 AM

Most of this survey is noise, but there is some information, especially on the labor market and the "Single Most Important Problem".

From the National Federation of Independent Business (NFIB): March 2020 Report

The NFIB Small Business Optimism Index fell 8.1 points in March to 96.4, the largest monthly decline in the survey’s history.

.

[H]iring plans experienced a significant drop from February yet finding qualified workers remains the top issue for 24% of small employers who reported this as their No. 1 problem.

…

This survey was conducted in March 2020. A sample of 5,000 small-business owners/members was drawn. Six hundred twenty-seven (627) usable responses were received —a response rate of 12.5 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 96.4 in March.

This index will decline sharply in April (and the response rate will probably decline).