by Calculated Risk on 4/07/2020 08:00:00 AM

Tuesday, April 07, 2020

Las Vegas Real Estate in March: Sales up 6.5% YoY, Inventory down 17% YoY

Note: Las Vegas will probably see a significant decline in visitor and convention traffic over the next several months due to COVID-19. This will likely have a significant impact on local real estate. Sales in March were solid, and prices were at a new high, however sales are counted when at the close of escrow, so the contracts for these homes were signed in January and February. The impact from COVID-19 will be in future months.

The Las Vegas Realtors reported Southern Nevada home prices set new record in March despite coronavirus crisis; LVR housing statistics for March 2020

The total number of existing local homes, condos and townhomes sold during March was 3,472. Compared to the same time last year, March sales were up 5.2% for homes and up 11.7% for condos and townhomes.1) Overall sales were up 6.5% year-over-year to 3,472 in March 2020 from 3,260 in March 2019.

...

By the end of March, LVR reported 5,687 single-family homes listed for sale without any sort of offer. That’s down 19.8% from one year ago. For condos and townhomes, the 1,628 properties listed without offers in March represented a 7.0% drop from one year ago.

…

Meanwhile, the number of so-called distressed sales in March remained near historically low levels. The association reported that short sales and foreclosures combined accounted for 2.0% of all existing local property sales in March. That compares to 2.5% of all sales one year ago, 2.9% two years ago, and 9.8% three years ago.

emphasis added

2) Active inventory (single-family and condos) is down from a year ago, from a total of 8,842 in March 2019 to 7,315 in March 2020. Note: Total inventory was down 17.3% year-over-year. And months of inventory is still low.

3) Low level of distressed sales.

Monday, April 06, 2020

Tuesday: Job Openings

by Calculated Risk on 4/06/2020 08:16:00 PM

More pre-crisis data.

Tuesday:

• At 8:00 AM ET, Corelogic House Price index for February.

• At 10:00 AM, Job Openings and Labor Turnover Survey for February from the BLS.

• At 3:00 PM, Consumer Credit from the Federal Reserve.

April 6 Update: US COVID-19 Test Results

by Calculated Risk on 4/06/2020 05:21:00 PM

Note: the large increase Saturday in test results reported was due to California working through the backlog of pending tests.

Test-and-trace is a key criteria in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Notes: Data for the previous couple of days is updated and revised, so graphs might change.

Also, I'm no longer including pending tests. So this is just test results reported daily.

There were 155,063 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 19% (red line). The US needs enough tests to push the percentage below 5% (probably much lower).

Test. Test. Test. Protect healthcare workers first!

U.S. Heavy Truck Sales down 43% Year-over-year in March

by Calculated Risk on 4/06/2020 01:53:00 PM

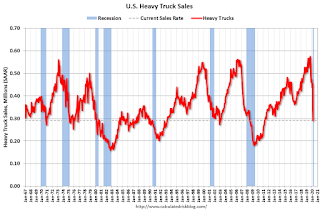

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the March 2020 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all time high of 575 thousand SAAR in September 2019.

Click on graph for larger image.

However heavy truck sales started declining late last year due to lower oil prices.

And then heavy truck sales really declined at the end of March due to COVID-19 and the collapse in oil prices.

Heavy truck sales were at 291 thousand SAAR in March, down from 453 thousand SAAR in February, and down 43% from 514 thousand SAAR in March 2019.

Heavy truck sales in April will likely be below the low of 180 thousand SAAR in May 2009, and probably below the record low of 159 thousand SAAR in 1982.

TSA checkpoint travel numbers

by Calculated Risk on 4/06/2020 10:49:00 AM

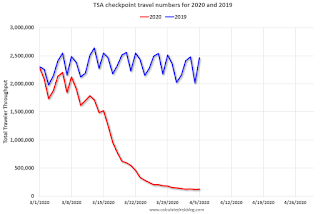

The TSA is providing daily travel numbers. (ht @conorsen)

This is another measure that will be useful to track when the economy starts to reopen.

This data shows the daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

On April 5th there were 122,029 travelers compared to 2,462,929 a year ago.

That is a decline of 95%.

Update: Framing Lumber Future Prices Down 25% Year-over-year

by Calculated Risk on 4/06/2020 09:24:00 AM

Here is another monthly update on framing lumber prices. Lumber prices declined sharply from the record highs in early 2018, and then increased until the COVID-19 crisis.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through Apr 3, 2020 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are unchanged from a year ago, and CME futures are down 25% year-over-year.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

The trade war led to significant volatility in lumber prices in 2018. Prices have fallen sharply due to COVID-19 (Note: Construction is considered an essential activity is ongoing in many areas)

Sunday, April 05, 2020

Sunday Night Futures

by Calculated Risk on 4/05/2020 06:49:00 PM

Weekend:

• Schedule for Week of April 5, 2020

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 37 and DOW futures are up 275 (fair value).

Oil prices were up over the last week with WTI futures at $26.19 per barrel and Brent at $31.97 barrel. A year ago, WTI was at $63, and Brent was at $70 - so oil prices are down by more than 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $1.92 per gallon. A year ago prices were at $2.73 per gallon, so gasoline prices are down 81 cents per gallon year-over-year.

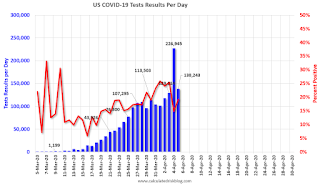

April 5 Update: US COVID-19 Test Results

by Calculated Risk on 4/05/2020 05:09:00 PM

Note: the large increase yesterday in test results reported was due to California working through the backlog of pending tests.

Test-and-trace is a key criteria in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Notes: Data for the previous couple of days is updated and revised, so graphs might change.

Also, I'm no longer including pending tests. So this is just test results reported daily.

There were 138,243 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 19% (red line). The US needs enough tests to push the percentage below 5% (probably much lower).

Test. Test. Test. Protect healthcare workers first!

Saturday, April 04, 2020

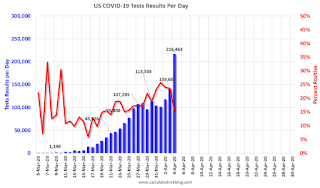

April 4 Update: US COVID-19 Test Results Increase; California to Increase Testing Fivefold

by Calculated Risk on 4/04/2020 05:59:00 PM

From the LA Times: Gov. Gavin Newsom said he ‘owns’ coronavirus testing lapses, announces task force

In a Saturday news conference, Newsom announced a task force that he said will work toward a fivefold increase in daily testing in the state by identifying supply shortages and adding testing locations.Test-and-trace is a key criteria in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

The announcement comes as California continues to see dramatic increases in people hospitalized with the virus, with 2,300 patients in the state. Another 3,267 people hospitalized are suspected of having COVID-19, but are awaiting testing results.

Overnight, the number of coronavirus patients in California’s intensive care unit beds rose nearly 11% to 1,008 people.

In all, Newsom said 126,700 people have been tested in California, a state of nearly 40 million people. Of those who have been tested, 13,000 are awaiting results.

Notes: Data for the previous couple of days is updated and revised, so graphs might change.

Also, I'm no longer including pending tests. So this is just test results reported daily.

There were 216,463 test results reported over the last 24 hours.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 16% (red line). The US needs enough tests to push the percentage below 5%.

Test. Test. Test. Protect healthcare workers first!

Schedule for Week of April 5, 2020

by Calculated Risk on 4/04/2020 08:11:00 AM

The key report this week is the March CPI.

The FOMC minutes on Wednesday might be interesting.

No major economic releases scheduled.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in January to 6.963 million from 6.552 million in December.

The number of job openings (yellow) were down 7% year-over-year, and Quits were up slightly year-over-year.

10:00 AM: Corelogic House Price index for February.

3:00 PM: Consumer Credit from the Federal Reserve.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: FOMC Minutes, Meeting of March 15, 2020

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a 5.000 million initial claims, down from 6.648 million the previous week.

8:30 AM: The Producer Price Index for March from the BLS. The consensus is for a 0.3% decrease in PPI, and a 0.1% increase in core PPI.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for April).

8:30 AM: The Consumer Price Index for March from the BLS. The consensus is for 0.3% decrease in CPI, and a 0.1% increase in core CPI.

The NYSE and the NASDAQ will be closed for Good Friday.