by Calculated Risk on 3/24/2020 07:11:00 PM

Tuesday, March 24, 2020

Wednesday: MBA Mortgage Applications, Durable Goods

The MBA Mortgage Application data will be very interesting now. This data is timely (last week), and will probably show a sharp decline in purchase applications in key states.

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Durable Goods Orders for February from the Census Bureau. The consensus is for a 0.9% decrease in durable goods orders.

• At 9:00 AM, FHFA House Price Index for January. This was originally a GSE only repeat sales, however there is also an expanded index.

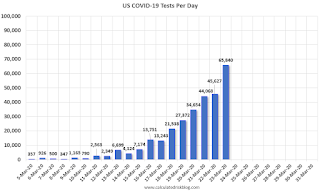

March 24 Update: US COVID-19 Tests per Day #TestAndTrace

by Calculated Risk on 3/24/2020 04:49:00 PM

Tests per day is a key number to track (along with actual cases and, sadly, deaths). But total tests were a key for South Korea slowing the spread of COVID-19. South Korea has been conducting 15,000 tests per day with a 51 million population, so the US needs to test around 100,000 per day.

Note: NYC and LA have stopped testing mild cases due to resource constraints. Hopefully testing will continue to improve, and we can test more people - this is important for test-and-trace.

The US conducted 63,851 tests in the last 24 hours.

Note: About 15% of tests were positive (red line, ht: NDD) in the most recent report (some are still pending). The high percentage of positives indicates limited testing. For Test-and-trace to be effective, the percent positive would probably be at 5% or less.

This data is from the COVID Tracking Project. Some states could do a better job of reporting the number of tests - so this is probably low.

Testing is improving, but needs to double from here to be sufficient for test-and-trace.

Test. Test. Test. But protect our healthcare workers first!

A few Comments on February New Home Sales

by Calculated Risk on 3/24/2020 11:12:00 AM

New home sales for February were reported at 765,000 on a seasonally adjusted annual rate basis (SAAR). Sales for the previous three months were revised up, and sales in January were revised up to a new cycle high of 800,000 - the highest sales rate since May 2007.

Earlier: New Home Sales at 765,000 Annual Rate in February.

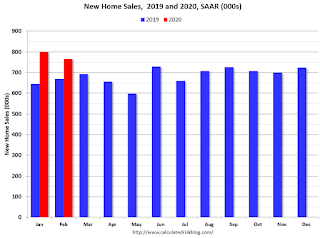

This graph shows new home sales for 2019 and 2020 by month (Seasonally Adjusted Annual Rate).

New home sales were up 14.3% Year-over-year (YoY) in February. The comparisons are easy over the first five months of the year, but sales will probably be down YoY for the next several months - at least - due to COVID-19.

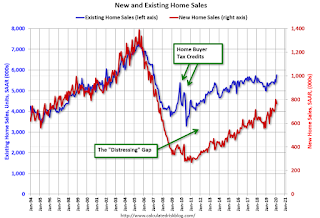

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

Now the gap is mostly closed. However, this assumes that the builders will offer some smaller, less expensive homes.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust - and is getting close to the historical ratio.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Over the next several months, both new and existing home sales will be negatively impacted by COVID-19.

Richmond Fed: "Fifth District manufacturing activity remained fairly flat in March"

by Calculated Risk on 3/24/2020 10:18:00 AM

From the Richmond Fed: Manufacturing activity remained fairly flat in March

Fifth District manufacturing activity remained fairly flat in March, according to the most recent survey from the Federal Reserve Bank of Richmond. The composite index remained close to 0, rising from −2 in February to 2 in March.This survey was taken in the first half of March, and the impact of COVID-19 isn't apparent yet.

Survey results suggested a drop in employment but continued growth in wages in recent weeks.

emphasis added

New Home Sales at 765,000 Annual Rate in February

by Calculated Risk on 3/24/2020 10:13:00 AM

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 765 thousand.

The previous three months were revised up, combined.

"Sales of new single-family houses in February 2020 were at a seasonally adjusted annual rate of 765,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 4.4 percent below the revised January rate of 800,000, but is 14.3 percent above the February 2019 estimate of 669,000. "

emphasis added

Click on graph for larger image.

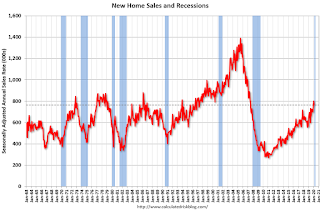

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are just at a normal level.

The second graph shows New Home Months of Supply.

The months of supply increased in February to 5.0 months from 4.8 months in January.

The months of supply increased in February to 5.0 months from 4.8 months in January. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of February was 319,000. This represents a supply of 5.0 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is close to normal.

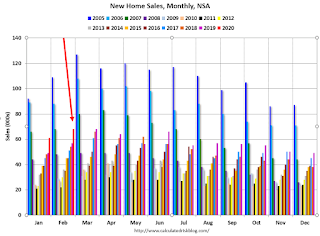

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In February 2020 (red column), 68 thousand new homes were sold (NSA). Last year, 57 thousand homes were sold in February

The all time high for February was 109 thousand in 2005, and the all time low for February was 22 thousand in 2011.

This was above expectations of 750 thousand sales SAAR, and sales in the three previous months were revised up, combined. This was a strong report with sales up 14.3% year-over-year. I'll have more later today.

This was prior to COVID-19 crisis.

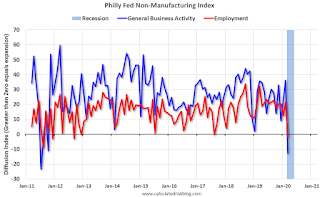

Philly Fed: "Nonmanufacturing firms reported a significant weakening in activity this month"

by Calculated Risk on 3/24/2020 08:39:00 AM

From the Phily Fed: March 2020 Nonmanufacturing Business Outlook Survey

Note: Survey responses were collected from March 5 to March 19.This graph shows the Philly Fed Nonmanufacturing General Activity and Employment indexes.

Nonmanufacturing firms reported a significant weakening in regional nonmanufacturing activity this month, according to results from the Nonmanufacturing Business Outlook Survey. The survey’s indexes for general activity at the firm level, sales/revenues, new orders, and full-time employment all fell sharply and into negative territory this month, coinciding with developments related to the coronavirus. …

The diffusion index for current general activity at the firm level fell sharply from 36.1 in February to -12.8 in March, its lowest reading since July 2011 … The full-time employment index fell 23 points to -1.7.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Some of this survey was in early March, but it is clear the COVID-19 is having a significant on nonmanufacturing activity.

Monday, March 23, 2020

Tuesday: New Home Sale, Richmond Fed Mfg

by Calculated Risk on 3/23/2020 08:07:00 PM

The new home sales data is for February (pre-crisis), but the Richmond Fed manufacturing survey was taken in March and will likely show a sharp decline.

Note that the Philadelphia Fed Non-Manufacturing Survey will be released tomorrow morning. I usually don't cover this, but I'll post on it tomorrow.

Tuesday:

• At 10:00 AM ET, New Home Sales for February from the Census Bureau. The consensus is for 750 thousand SAAR, down from 764 thousand in January.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for March.

March 23 Update: US COVID-19 Tests per Day #TestAndTrace

by Calculated Risk on 3/23/2020 05:24:00 PM

Note: Test-and-trace is one of the keys to getting the economy back on track.

1. First, we need to provide our healthcare workers with whatever they need (masks, gowns, ventilators, beds, etc). This should be a national priority.

2. We need a national shelter-in-place order with a national disaster declaration. The sooner as many people as possible stay home, the less the spread. For those that work - thank you! - we need social distancing.

3. We need test-and-trace ready to go once we have adequate testing capacity.

4. We need to fund and fast track both vaccines and treatment medications.

5. We need swift action on both monetary and fiscal policy (The Fed has delivered "Whatever it takes", but we are still waiting on fiscal policy).

Tests per day is a key number to track (along with actual cases and, sadly, deaths). But total tests were a key for South Korea slowing the spread of COVID-19. South Korea has been conducting 15,000 tests per day with a 51 million population, so the US needs to test around 100,000 per day.

Note: NYC and LA have stopped testing mild cases due to resource constraints. Hopefully testing will continue to improve, and we can test more people - this is important for test-and-trace.

The US conducted 65,840 tests in the last 24 hours.

Note: About 15% of tests were positive in the most recent report (some are still pending). The high percentage of positives indicates limited testing.

This data is from the COVID Tracking Project. Some states could do a better job of reporting the number of tests - so this is probably low.

Testing is improving, but needs to double from here to be sufficient for test-and-trace.

Test. Test. Test. But protect our healthcare workers first!

Black Knight's First Look: National Mortgage Delinquency Rate Increased slightly in February

by Calculated Risk on 3/23/2020 11:05:00 AM

From Black Knight: Black Knight’s First Look: Foreclosure Starts Hit Lowest Level on Record; Mortgage Delinquencies Edge Slightly Upward from January’s Record Low

• Foreclosure starts fell 25% from January 2020, and 20% from the year prior, hitting their lowest level on record since Black Knight began publicly reporting the metric in January 2000According to Black Knight's First Look report for February, the percent of loans delinquent increased 2.0% in February compared to January, and decreased 15.6% year-over-year.

• The national foreclosure rate also ticked lower in February, falling to 0.45%; the lowest it’s been since 2005, and within one basis point of an all-time low

• Delinquencies were up slightly from January, but remain more than 15% below last year’s levels

• Prepayment activity rose by nearly 8% month-over-month as early 2020 rate declines have begun to impact refinance activity

The percent of loans in the foreclosure process decreased 2.5% in February, and were down 11.2% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.28% in February, up from 3.22% in January.

The percent of loans in the foreclosure process was decreased to 0.456% from 0.46% in January.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Feb 2020 | Jan 2020 | Feb 2019 | Feb 2018 | |

| Delinquent | 3.28% | 3.22% | 3.89% | 4.30% |

| In Foreclosure | 0.45% | 0.46% | 0.51% | 0.65% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,737,000 | 1,705,000 | 2,019,000 | 2,198,000 |

| Number of properties in foreclosure pre-sale inventory: | 239,000 | 246,000 | 264,000 | 331,000 |

| Total Properties Delinquent or in foreclosure | 1,976,000 | 1,951,000 | 2,284,000 | 2,528,000 |

Fed: Whatever it Takes Announcement

by Calculated Risk on 3/23/2020 09:19:00 AM

From the Federal Reserve: Federal Reserve announces extensive new measures to support the economy. There are several actions in the announcement including:

The Federal Open Market Committee (FOMC) will purchase Treasury securities and agency mortgage-backed securities in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions and the economy.This is especially important for the mortgage market. The Fed will buy whatever it takes to stabilize MBS.

emphasis added

There is much more in the announcement (including supporting large and small businesses). This is a "whatever it takes" moment for the Fed.