by Calculated Risk on 2/20/2020 12:40:00 PM

Thursday, February 20, 2020

Phoenix Real Estate in January: Sales up 18.1% YoY, Active Inventory Down 38.9% YoY

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales were at 6,328 in January, down from 7,585 in December, but up from 5,357 in January 2019. Sales were down 16.6% from December 2019 (last month), but up 18.1% from January 2019.

2) Active inventory was at 11,602, down from 18,990 in January 2019. That is down 38.9% year-over-year.

3) Months of supply increased to 2.54 in January from 2.05 months in December. This remains low.

This is another market with increasing sales and falling inventory.

Black Knight's First Look: National Mortgage Delinquency Rate Decreased in January, Lowest Level on Record

by Calculated Risk on 2/20/2020 10:15:00 AM

From Black Knight: Black Knight’s First Look: Mortgage Delinquencies Fall to Lowest Level on Record; January Sees Strongest Decline in More Than a Year

• Mortgage delinquencies fell by more than 5% in January, hitting their lowest level on record dating back to 2000According to Black Knight's First Look report for January, the percent of loans delinquent decreased in January compared to December, and decreased 14.2% year-over-year.

• January’s 14% year-over-year decline is the strongest in more than 12 months, with the rate of improvement picking up noticeably in recent months

• There are now fewer than 2 million homeowners past due on their mortgages or in active foreclosure, the fewest since March 2005

• Despite the decline in delinquencies, foreclosure starts edged upward in January, but remain nearly 15% below last year’s levels

• The number of loans in active foreclosure remained relatively flat for the month (+1,000 properties in foreclosure), and down 19,000 from the same time last year, leaving the national foreclosure rate unchanged

• Though falling by 15% in January, prepayment activity remains 113% above last year’s levels

The percent of loans in the foreclosure process increased slightly in January, and were down 9.2% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.22% in December, down from 3.40% in December.

The percent of loans in the foreclosure process was unchanged at 0.46% from 0.46% in December.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Jan 2020 | Dec 2019 | Jan 2019 | Jan 2018 | |

| Delinquent | 3.22% | 3.40% | 3.75% | 4.31% |

| In Foreclosure | 0.46% | 0.46% | 0.51% | 0.66% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,705,000 | 1,803,000 | 1,945,000 | 2,202,000 |

| Number of properties in foreclosure pre-sale inventory: | 246,000 | 245,000 | 265,000 | 337,000 |

| Total Properties Delinquent or in foreclosure | 1,951,000 | 2,047,000 | 2,210,000 | 2,539,000 |

Philly Fed Manufacturing Suggests Activity Increased in February

by Calculated Risk on 2/20/2020 09:04:00 AM

From the Philly Fed: Current Manufacturing Indicators Suggest a Pickup in Growth in February

Manufacturing firms reported an improvement in regional manufacturing activity, according to results from the February Manufacturing Business Outlook Survey. The survey’s current indicators for general activity, new orders, and shipments increased this month, suggesting more widespread growth. The firms reported expansion in employment, although at a moderated pace from January. The survey’s broad future indexes also showed improvement this month, indicating that growth is expected to continue over the next six months.This was well above the consensus forecast. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The diffusion index for current general activity rose nearly 20 points this month to 36.7, its highest reading since February 2017 … The firms reported overall increases in manufacturing employment this month, but the current employment index decreased 10 points to 9.8. Just 18 percent of the firms reported higher employment, compared with 28 percent last month. The average workweek index, however, increased 5 points.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through February), and five Fed surveys are averaged (blue, through January) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through January (right axis).

These early reports suggest the ISM manufacturing index will be solidly in positive territory in February.

Weekly Initial Unemployment Claims Increase to 210,000

by Calculated Risk on 2/20/2020 08:32:00 AM

The DOL reported:

In the week ending February 15, the advance figure for seasonally adjusted initial claims was 210,000, an increase of 4,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 205,000 to 206,000. The 4-week moving average was 209,000, a decrease of 3,250 from the previous week's revised average. The previous week's average was revised up by 250 from 212,000 to 212,250.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 209,000.

This was close to the consensus forecast.

Wednesday, February 19, 2020

Thursday: Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 2/19/2020 07:06:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 210 thousand initial claims, up from 205 thousand the previous week.

• Also at 8:30 AM, The Philly Fed manufacturing survey for February. The consensus is for a reading of 12.0, down from 17.0.

CAR on California January Housing: Sales up 10.3% YoY, Inventory down 26.9%

by Calculated Risk on 2/19/2020 04:45:00 PM

The CAR reported: California home sales maintain last year’s momentum in January, C.A.R. reports

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 395,550 units in January, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2020 if sales maintained the January pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

January’s sales total was down 0.7 percent from the 398,370 level in December and marked the second straight month that sales fell below the 400,000 benchmark. Still, sales were up a solid 10.3 percent from January 2019, largely due to weak sales of a revised 358,540 a year ago.

“The strong sales momentum that we saw in the second half of last year carried over into the new year, thanks to favorable homebuying conditions,” said 2020 C.A.R. President Jeanne Radsick, a second-generation REALTOR® from Bakersfield, Calif. “And while home sales were up double-digits from a year ago, it’s important to remember that current sales are being compared to a market that one year ago was at its lowest level in 10 years as economic uncertainties clouded the market outlook while the government shutdown delayed escrow closings.”

...

The available supply of homes for sale in the state inched up slightly after reaching an 80-month record low in December but continued to drop on a year-over-year basis for the seventh consecutive month. Housing inventory continued to fall by double digits, with active listings declining 26.9 percent in January after a 25.9 percent dip in December. The January drop was the largest since April 2013.

emphasis added

FOMC Minutes: Policy on Hold

by Calculated Risk on 2/19/2020 02:08:00 PM

From the Fed: Minutes of the Federal Open Market Committee, January 28-29, 2020. A few excerpts:

Participants generally saw the distribution of risks to the outlook for economic activity as somewhat more favorable than at the previous meeting, although a number of downside risks remained prominent. The easing of trade tensions resulting from the recent agreement with China and the passage of the USMCA as well as tentative signs of stabilization in global economic growth helped reduce downside risks and appeared to buoy business sentiment. The risk of a "hard" Brexit had appeared to recede further. In addition, statistical models designed to estimate the probability of recession using financial market data suggested that the likelihood of a recession occurring over the next year had fallen notably in recent months. Still, participants generally expected trade-related uncertainty to remain somewhat elevated, and they were mindful of the possibility that the tentative signs of stabilization in global growth could fade. Geopolitical risks, especially in connection with the Middle East, remained. The threat of the coronavirus, in addition to its human toll, had emerged as a new risk to the global growth outlook, which participants agreed warranted close watching.

...

In their consideration of monetary policy at this meeting, participants judged that it would be appropriate to maintain the target range for the federal funds rate at 1-1/2 to 1-3/4 percent to support sustained expansion of economic activity, strong labor market conditions, and inflation returning to the Committee's symmetric 2 percent objective. With regard to monetary policy beyond this meeting, participants viewed the current stance of policy as likely to remain appropriate for a time, provided that incoming information about the economy remained broadly consistent with this economic outlook. Of course, if developments emerged that led to a material reassessment of the outlook, an adjustment to the stance of monetary policy would be appropriate, in order to foster achievement of the Committee's dual-mandate objectives.

In commenting on the monetary policy outlook, participants concurred that maintaining the current stance of policy would give the Committee time for a fuller assessment of the ongoing effects on economic activity of last year's shift to a more accommodative policy stance and would also allow policymakers to accumulate further information bearing on the economic outlook. Participants discussed how maintaining the current policy stance for a time could be helpful in supporting U.S. economic activity and employment in the face of global developments that have been weighing on spending decisions.

emphasis added

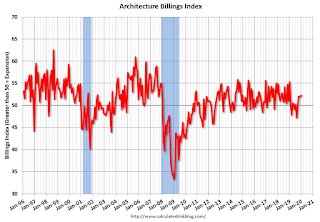

AIA: "Architecture billings continue growth into 2020"

by Calculated Risk on 2/19/2020 12:31:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture billings continue growth into 2020

Starting the year on a strong note, architecture firm billings strengthened slightly in January, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score of 52.2 for January compared to 52.1 in December reflects an increase in design services provided by U.S. architecture firms (any score above 50 indicates an increase in billings). Indicators of work in the pipeline, including new project inquiries and new design contracts remained positive, posting scores of 57.9 and 56.0 respectively.

“Despite the continued presence of volatility in the economy, design activity has begun to accelerate in recent months,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Even with the ongoing challenges facing the nonresidential construction sector, this upturn points to at least modest growth over the coming year.”

...

• Regional averages: South (56.7); West (52.1); Midwest (51.3); Northeast (45.3)

• Sector index breakdown: mixed practice (51.6); commercial/industrial (51.5); multi-family residential (51.2); institutional (51.1)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.2 in January, up from 52.1 in December. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 8 of the previous 12 months, suggesting some increase in CRE investment in 2020.

Lawler: Early Read on Existing Home Sales in January

by Calculated Risk on 2/19/2020 11:00:00 AM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.42 million in January, down 2.2% from December’s preliminary pace (which looks too high) and up 9.9% from last January’s seasonally adjusted pace.

On the inventory front, local realtor/MLS data, as well as data from other inventory trackers, suggest that the inventory of existing homes for sale at the end of January was down by about 12.0% from a year earlier.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up by about 7.0% from last January.

Note that this month’s release will incorporate benchmark seasonal adjustment revisions, which makes it a little tricky to estimate January’s seasonal adjustment factor.

Last month the National Association of Realtors estimated that existing home sales ran at a seasonally adjusted annual rate of 5.54 million, well above consensus estimates and, surprisingly, well above my estimate based on local realtor/MLS reports released before the NAR report. In looking at realtor/MLS reports released later than those available when I do my “early read,” it does appear as if my earlier sample did not reflect overall national sales. However, it also appears as if the NAR’s estimate overstated sales in the Midwest and the Northeast. If I had had access to all realtor/MLS reports for December sales I would have projected that existing home sales as estimated by the NAR ran at a seasonally adjusted annual rate of 5.50 million.

CR Note: The National Association of Realtors (NAR) is scheduled to release January existing home sales on Friday, February 21, 2020 at 10:00 AM ET. The consensus is for 5.45 million SAAR.

Comments on January Housing Starts

by Calculated Risk on 2/19/2020 09:14:00 AM

Earlier: Housing Starts decreased to 1.567 Million Annual Rate in January

Total housing starts in January were well above expectations and revisions to prior months were positive.

The housing starts report showed starts were down 3.6% in January compared to December, and starts were up 21.4% year-over-year compared to January 2019.

These were blow out numbers! Starts in December were at the highest level for starts since December 2006 (end of the bubble). However, the weather was very nice again in January (just like in December), and the weather probably had a significant impact on the seasonally adjusted housing starts number. The winter months of December and January have the largest seasonal factors, so nice weather can really have an impact.

Single family starts were up 4.6% year-over-year, and multi-family starts were up 71.3% YoY.

This first graph shows the month to month comparison for total starts between 2019 (blue) and 2020 (red).

Starts were up 21.4% in January compared to January 2019.

For the year, starts were up 3.2% compared to 2018.

Last year, in 2019, starts picked up in the 2nd half of the year, so the comparisons are easy early in the year.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but turned down, and has moved sideways recently. Completions (red line) had lagged behind - then completions caught up with starts- although starts are picking up a little again.

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions.