by Calculated Risk on 11/17/2019 11:56:00 AM

Sunday, November 17, 2019

Hotels: Occupancy Rate Increased Slightly Year-over-year

From HotelNewsNow.com: STR: US hotel results for week ending 9 November

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 3-9 November 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 4-10 November 2018, the industry recorded the following:

• Occupancy: +0.1% to 69.0%

• Average daily rate (ADR): +1.9% to US$132.66

• Revenue per available room (RevPAR): +1.9% to US$91.53

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, and close to-date compared to the previous 4 years.

However occupancy will be lower this year than in 2018 (the record year).

Seasonally, the 4-week average of the occupancy rate will decline into the winter.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, November 16, 2019

Schedule for Week of November 17, 2019

by Calculated Risk on 11/16/2019 08:11:00 AM

The key economic reports this week are October Housing Starts and Existing Home Sales.

For manufacturing, the November Philly and Kansas City Fed surveys, will be released this week.

10:00 AM: The November NAHB homebuilder survey. The consensus is for a reading of 71, unchanged from 71. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for October.

8:30 AM: Housing Starts for October. This graph shows single and total housing starts since 1968.

The consensus is for 1.320 million SAAR, up from 1.256 million SAAR.

10:00 AM: State Employment and Unemployment (Monthly) for October 2019

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes, Meeting of October 29-30, 2019

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 219,000 initial claims, down from 225,000 last week.

8:30 AM: the Philly Fed manufacturing survey for November. The consensus is for a reading of 7.5, up from 5.6.

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 5.49 million SAAR, up from 5.38 million in September.

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 5.49 million SAAR, up from 5.38 million in September.The graph shows existing home sales from 1994 through the report last month.

10:00 AM: University of Michigan's Consumer sentiment index (Final for November). The consensus is for a reading of 95.7.

11:00 AM: the Kansas City Fed manufacturing survey for November.

Friday, November 15, 2019

Q4 GDP Forecasts: 0.3% to 1.5%

by Calculated Risk on 11/15/2019 12:45:00 PM

From Merrill Lynch:

We continue to track 1.9% for 3Q GDP tracking. 4Q tracking is at 1.5%. [Nov 15 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 0.4% for 2019:Q4. [Nov 15 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2019 is 0.3 percent on November 15, down from 1.0 percent on November 8. [Nov 15 estimate]CR Note: These early estimates suggest real GDP growth will be between 0.3% and 1.5% annualized in Q4.

NY Fed: Manufacturing "Business activity was little changed in New York State"

by Calculated Risk on 11/15/2019 10:58:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity was little changed in New York State, according to firms responding to the November 2019 Empire State Manufacturing Survey. The headline general business conditions index came in at 2.9, roughly in line with its level in October.This was slightly lower than the consensus forecast.

...

The index for number of employees edged up to 10.4, indicating that employment expanded for the third consecutive month. The average workweek index came in at 2.3, indicating a slightly longer workweek.

…

Indexes assessing the six-month outlook suggested that optimism about future conditions remained subdued.

emphasis added

Industrial Production Decreased in October

by Calculated Risk on 11/15/2019 09:22:00 AM

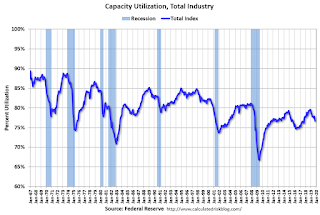

From the Fed: Industrial Production and Capacity Utilization

Industrial production fell 0.8 percent in October after declining 0.3 percent in September. Manufacturing production decreased 0.6 percent in October. Much of this decline was due to a drop of 7.1 percent in the output of motor vehicles and parts that resulted from a strike at a major manufacturer of motor vehicles. The decreases for total industrial production, manufacturing, and motor vehicles and parts were their largest since May 2018, April 2019, and January 2019, respectively.

Excluding motor vehicles and parts, the index for total industrial production moved down 0.5 percent, and the index for manufacturing edged down 0.1 percent. Mining production decreased 0.7 percent, while utilities output fell 2.6 percent.

At 108.7 percent of its 2012 average, total industrial production was 1.1 percent lower in October than it was a year earlier. Capacity utilization for the industrial sector decreased 0.8 percentage point in October to 76.7 percent, a rate that is 3.1 percentage points below its long-run (1972–2018) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.0 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.7% is 3.1% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in October to 108.7. This is 25% above the recession low, and 3.2% above the pre-recession peak.

The change in industrial production and increase in capacity utilization were below consensus expectations.

Retail Sales increased 0.3% in October

by Calculated Risk on 11/15/2019 08:50:00 AM

On a monthly basis, retail sales increased 0.3 percent from September to October (seasonally adjusted), and sales were up 3.1 percent from October 2018.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for October 2019, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $526.5 billion, an increase of 0.3 percent from the previous month, and 3.1 percent above October 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.2% in October.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 3.9% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 3.9% on a YoY basis.The increase in October was slightly above expectations, however sales in August and September were revised down.

Thursday, November 14, 2019

Friday: Retail Sales, NY Fed Mfg, Industrial Production

by Calculated Risk on 11/14/2019 05:12:00 PM

Friday:

• At 8:30 AM ET, Retail sales for October will be released. The consensus is for a 0.2% increase in retail sales.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for November. The consensus is for a reading of 5.0, up from 4.0.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for October. The consensus is for a 0.4% decrease in Industrial Production, and for Capacity Utilization to decrease to 77.2%.

Looking back: "The Cupboard is Full"

by Calculated Risk on 11/14/2019 02:09:00 PM

Three years ago I wrote The Cupboard is Full

"The bottom line is the cupboard is full. The expansion should continue for some time."This is one in a series of post in late 2016 - post election - explaining why I thought the expansion should continue, even though I was extremely disappointed about the outcome of the election.

I'm still not on recession watch, but the cupboard isn't quite as full (I'll have more to say on this in the coming weeks).

MBA: "Mortgage Delinquencies Fall to Lowest Level in Nearly 25 Years"

by Calculated Risk on 11/14/2019 10:34:00 AM

From the MBA: Mortgage Delinquencies Fall to Lowest Level in Nearly 25 Years

The delinquency rate for mortgage loans on one-to-four unit residential properties decreased to a seasonally adjusted rate of 3.97 percent of all loans outstanding at the end of the third quarter of 2019, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey.

The delinquency rate was down 56 basis points from the second quarter of 2019 and down 50 basis points from one year ago. The percentage of loans on which foreclosure actions were started in the third quarter fell by four basis points to 0.21 percent.

"Mortgage delinquencies decreased in the third quarter across all loan types - conventional, VA, and in particular, FHA," said Marina Walsh, MBA's Vice President of Industry Analysis. "The FHA delinquency rate dropped 100 basis points, as weather-related disruptions from the spring waned. The labor market remains healthy and economic growth has been stronger than anticipated. These two factors have contributed to the lowest level of overall delinquencies in almost 25 years."

Added Walsh, "Looking ahead, we do continue to monitor the credit profile of new FHA loans, as changes to this profile can have a noticeable impact on future delinquency rates."

...

Compared to last quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding to the lowest level since the first quarter of 1995. By stage, the 30-day delinquency rate decreased 42 basis points to 2.20 percent, the 60-day delinquency rate decreased six basis points to 0.75 percent, and the 90-day delinquency bucket decreased 8 basis points to 1.02 percent.

...

The delinquency rate includes loans that are at least one payment past due, but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 0.84 percent, down six basis points from the second quarter of 2019 and 15 basis points lower than one year ago. This is the lowest foreclosure inventory rate since the fourth quarter of 1985.

...

The seriously delinquent rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 1.81 percent - a decrease of 14 basis points from last quarter - and a decrease of 32 basis points from last year. This the lowest seriously delinquent rate since the third quarter of 2000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. Delinquencies decreased in Q3.

The percent of loans in the foreclosure process continues to decline, and is now at the lowest level since 1985.

Weekly Initial Unemployment Claims increased to 225,000

by Calculated Risk on 11/14/2019 08:36:00 AM

The DOL reported:

In the week ending November 9, the advance figure for seasonally adjusted initial claims was 225,000, an increase of 14,000 from the previous week's unrevised level of 211,000. The 4-week moving average was 217,000, an increase of 1,750 from the previous week's unrevised average of 215,250.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 217,000.

This was above the consensus forecast.