by Calculated Risk on 10/10/2019 08:36:00 AM

Thursday, October 10, 2019

Weekly Initial Unemployment Claims decreased to 210,000

The DOL reported:

In the week ending October 5, the advance figure for seasonally adjusted initial claims was 210,000, a decrease of 10,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 219,000 to 220,000. The 4-week moving average was 213,750, an increase of 1,000 from the previous week's revised average. The previous week's average was revised up by 250 from 212,500 to 212,750.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 213,750.

This was lower than the consensus forecast.

BLS: CPI unchanged in September, Core CPI increased 0.1%

by Calculated Risk on 10/10/2019 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in September on a seasonally adjusted basis after rising 0.1 percent in August, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.7 percent before seasonal adjustment.Core inflation was below expectations in September. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

...

The index for all items less food and energy rose 0.1 percent in September after increasing 0.3 percent in each of the last 3 months.

...

The all items index increased 1.7 percent for the 12 months ending September, the same increase as for the 12 months ending August. The index for all items less food and energy rose 2.4 percent over the last 12 months, also the same increase as the period ending August.

emphasis added

Wednesday, October 09, 2019

Thursday: CPI, Unemployment Claims

by Calculated Risk on 10/09/2019 08:35:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 216,000 initial claims, down from 219,000 last week.

• Also at 8:30 AM, The Consumer Price Index for September from the BLS. The consensus is for a 0.1% increase in CPI, and a 0.2% increase in core CPI.

FOMC Minutes: "More concerned about risks associated with trade tensions and adverse geopolitical developments"

by Calculated Risk on 10/09/2019 02:25:00 PM

From the Fed: Minutes of the Federal Open Market Committee, September 17-18, 2019. A few excerpts:

Participants generally viewed the baseline economic outlook as positive and indicated that their views of the most likely outcomes for economic activity and inflation had changed little since the July meeting. However, for most participants, that economic outlook was premised on a somewhat more accommodative path for policy than in July. Participants generally had become more concerned about risks associated with trade tensions and adverse developments in the geopolitical and global economic spheres. In addition, inflation pressures continued to be muted. Many participants expected that real GDP growth would moderate to around its potential rate in the second half of the year.

...

Participants generally judged that downside risks to the outlook for economic activity had increased somewhat since their July meeting, particularly those stemming from trade policy uncertainty and conditions abroad. In addition, although readings on the labor market and the overall economy continued to be strong, a clearer picture of protracted weakness in investment spending, manufacturing production, and exports had emerged. Participants also noted that there continued to be a significant probability of a no-deal Brexit, and that geopolitical tensions had increased in Hong Kong and the Middle East. Several participants commented that, in the wake of this increase in downside risk, the weakness in business spending, manufacturing, and exports could give rise to slower hiring, a development that would likely weigh on consumption and the overall economic outlook.

...

Participants judged that conditions in the labor market remained strong, with the unemployment rate near historical lows and continued solid job gains, on average, in recent months. The labor force participation rate of prime-age individuals, especially of prime-age women, moved up in August, continuing its upward trajectory, and the unemployment rate of African Americans fell to its lowest rate on record. However, a number of participants noted that, although the labor market was clearly in a strong position, the preliminary benchmark revision by the Bureau of Labor Statistics indicated that payroll employment gains would likely show less momentum coming into this year when the revisions are incorporated in published data early next year. A few participants observed that it would be important to be vigilant in monitoring incoming data for any sign of softening in labor market conditions.

emphasis added

BLS: Job Openings "Little Changed" at 7.1 Million in August

by Calculated Risk on 10/09/2019 10:05:00 AM

Notes: In August there were 7.051 million job openings, and, according to the August Employment report, there were 6,044 million unemployed. So, for the eighteenth consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015 (almost 5 years).

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 7.1 million on the last business day of August, the U.S. Bureau of Labor Statistics reported today. Over the month, hires edged down to 5.8 million and separations were little changed at 5.6 million. Within separations, the quits rate was little changed at 2.3 percent, and the layoffs and discharges rate was unchanged at 1.2 percent. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits decreased in August to 3.5 million (-142,000). The quits rate was 2.3 percent. The quits level decreased for total private (-144,000) and was little changed for government. Quits decreased in professional and business services (-76,000) and in other services (-67,000).

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for August, the most recent employment report was for September.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in August to 7.051 million from 7.174 million in July.

The number of job openings (yellow) are down 4% year-over-year.

Quits are up 1.5% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings remain at a high level, and quits are still increasing year-over-year. This was a solid report.

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 10/09/2019 07:00:00 AM

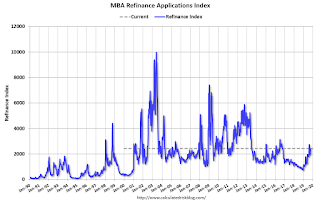

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 5.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 4, 2019.

... The Refinance Index increased 10 percent from the previous week and was 163 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 10 percent higher than the same week one year ago.

...

“U.S. Treasury rates moved sharply lower last week, as data showing weakness in the services sector was a sign that slowing economic growth is not confined to the manufacturing sector. This in turn caused a flight to safety by investors, resulting in mortgage rates dropping across the board, with the 30-year fixed rate decreasing nine basis points to 3.9 percent – the lowest level in a month,” said Joel Kan, Associate Vice President of Economic and Industry Forecasting. “As seen a few times this year, the large drop in rates caused another surge in refinance applications. The refinance index increased 10 percent to its highest level since late August, with both conventional and government refinances experiencing an upswing.”

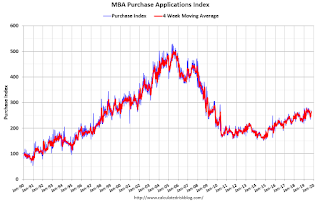

Added Kan, “Purchase activity was muted, declining almost 1 percent, but was still 10 percent higher than a year ago. Despite low rates, the cloudier economic outlook and ongoing market uncertainty may be keeping some potential homebuyers away from the market this fall.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 3.90 percent from 3.99 percent, with points decreasing to 0.37 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity. Mortgage rates would have to decline further to see a huge refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 10% year-over-year.

Tuesday, October 08, 2019

Wednesday: Job Openings, FOMC Minutes

by Calculated Risk on 10/08/2019 09:28:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Job Openings and Labor Turnover Survey for August from the BLS.

• At 2:00 PM, FOMC Minutes, Meeting of September 17-18, 2019• At 6:00 AM, NFIB Small Business Optimism Index for September.

Seattle Real Estate in September: Sales up 12.3% YoY, Inventory down Slightly YoY

by Calculated Risk on 10/08/2019 04:09:00 PM

The Northwest Multiple Listing Service reported Northwest MLS Brokers Say Transition to Fall Creating Opportunities for Buyers

Northwest Multiple Listing Service brokers reported year-over-year gains in pending sales, closed sales and prices, but its report summarizing September activity also showed an 18% drop in inventory compared to a year ago.The press release is for the Northwest. In King County, sales were up 7.5% year-over-year, and active inventory was down 17.5% year-over-year.

At the end of September, MLS brokers reported 15,982 total active listings, down more than 18% from the same month a year ago when the selection totaled 19,526 listings.

emphasis added

In Seattle, sales were up 12.3% year-over-year, and inventory was down slightly year-over-year.. The year-over-year increase in inventory has ended, and the months of supply is still low in Seattle (2.6 months). In many areas it appears the inventory build that started last year is ending.

Fed Chair Powell: "Data-Dependent Monetary Policy in an Evolving Economy"

by Calculated Risk on 10/08/2019 02:34:00 PM

Excerpt from Fed Chair Powell: Data-Dependent Monetary Policy in an Evolving Economy

What Does Data Dependence Mean at Present?

In summary, data dependence is, and always has been, at the heart of policymaking at the Federal Reserve. We are always seeking out new and better sources of information and refining our analysis of that information to keep us abreast of conditions as our economy constantly reinvents itself. Before wrapping up, I will discuss recent developments in money markets and the current stance of monetary policy.

Our influence on the financial conditions that affect employment and inflation is indirect. The Federal Reserve sets two overnight interest rates: the interest rate paid on banks' reserve balances and the rate on our reverse repurchase agreements. We use these two administered rates to keep a market-determined rate, the federal funds rate, within a target range set by the FOMC. We rely on financial markets to transmit these rates through a variety of channels to the rates paid by households and businesses—and to financial conditions more broadly.

In mid-September, an important channel in the transmission process—wholesale funding markets—exhibited unexpectedly intense volatility. Payments to meet corporate tax obligations and to purchase Treasury securities triggered notable liquidity pressures in money markets. Overnight interest rates spiked, and the effective federal funds rate briefly moved above the FOMC's target range. To counter these pressures, we began conducting temporary open market operations. These operations have kept the federal funds rate in the target range and alleviated money market strains more generally.

While a range of factors may have contributed to these developments, it is clear that without a sufficient quantity of reserves in the banking system, even routine increases in funding pressures can lead to outsized movements in money market interest rates. This volatility can impede the effective implementation of monetary policy, and we are addressing it. Indeed, my colleagues and I will soon announce measures to add to the supply of reserves over time. Consistent with a decision we made in January, our goal is to provide an ample supply of reserves to ensure that control of the federal funds rate and other short-term interest rates is exercised primarily by setting our administered rates and not through frequent market interventions. Of course, we will not hesitate to conduct temporary operations if needed to foster trading in the federal funds market at rates within the target range.

Reserve balances are one among several items on the liability side of the Federal Reserve's balance sheet, and demand for these liabilities—notably, currency in circulation—grows over time. Hence, increasing the supply of reserves or even maintaining a given level over time requires us to increase the size of our balance sheet. As we indicated in our March statement on balance sheet normalization, at some point, we will begin increasing our securities holdings to maintain an appropriate level of reserves.18 That time is now upon us.

I want to emphasize that growth of our balance sheet for reserve management purposes should in no way be confused with the large-scale asset purchase programs that we deployed after the financial crisis. Neither the recent technical issues nor the purchases of Treasury bills we are contemplating to resolve them should materially affect the stance of monetary policy, to which I now turn.

Our goal in monetary policy is to promote maximum employment and stable prices, which we interpret as inflation running closely around our symmetric 2 percent objective. At present, the jobs and inflation pictures are favorable. Many indicators show a historically strong labor market, with solid job gains, the unemployment rate at half-century lows, and rising prime-age labor force participation. Wages are rising, especially for those with lower-paying jobs. Inflation is somewhat below our symmetric 2 percent objective but has been gradually firming over the past few months. FOMC participants continue to see a sustained expansion of economic activity, strong labor market conditions, and inflation near our symmetric 2 percent objective as most likely. Many outside forecasters agree.

But there are risks to this favorable outlook, principally from global developments. Growth around much of the world has weakened over the past year and a half, and uncertainties around trade, Brexit, and other issues pose risks to the outlook. As those factors have evolved, my colleagues and I have shifted our views about appropriate monetary policy toward a lower path for the federal funds rate and have lowered its target range by 50 basis points. We believe that our policy actions are providing support for the outlook. Looking ahead, policy is not on a preset course. The next FOMC meeting is several weeks away, and we will be carefully monitoring incoming information. We will be data dependent, assessing the outlook and risks to the outlook on a meeting-by-meeting basis. Taking all that into account, we will act as appropriate to support continued growth, a strong job market, and inflation moving back to our symmetric 2 percent objective.

emphasis added

2020 Economic Forecast featuring the UCI Paul Merage School of Business

by Calculated Risk on 10/08/2019 01:58:00 PM

This is almost sold out!

On October 23rd, I will be one of three speakers at the "2020 Economic Forecast featuring the UCI Paul Merage School of Business" in Newport Beach, California, sponsored by the Newport Beach Chamber of Commerce.

UCI Finance Professor Christopher Schwarz and I will be discussing the 2020 economic outlook, and Dr. Richard Afable will be discussing "The Future of the Healthcare System".

This is a lunch time event (from 11:15 am to 1:30 pm) at the Balboa Bay Resort.

Click here for more information and tickets. Tickets are $65 for members, and $75 for non-members and includes lunch. (I'm speaking for free).

Or click on the banner below.