by Calculated Risk on 10/01/2019 10:05:00 AM

Tuesday, October 01, 2019

ISM Manufacturing index Decreased to 47.8 in September

The ISM manufacturing index indicated contraction in September. The PMI was at 47.8% in September, down from 49.1% in August. The employment index was at 46.3%, down from 47.4% last month, and the new orders index was at 47.3%, up from 47.2%.

From the Institute for Supply Management: September 2019 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in September, and the overall economy grew for the 125th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The September PMI® registered 47.8 percent, a decrease of 1.3 percentage points from the August reading of 49.1 percent. The New Orders Index registered 47.3 percent, an increase of 0.1 percentage point from the August reading of 47.2 percent. The Production Index registered 47.3 percent, a 2.2-percentage point decrease compared to the August reading of 49.5 percent. The Employment Index registered 46.3 percent, a decrease of 1.1 percentage points from the August reading of 47.4 percent. The Supplier Deliveries Index registered 51.1 percent, a 0.3-percentage point decrease from the August reading of 51.4 percent. The Inventories Index registered 46.9 percent, a decrease of 3 percentage points from the August reading of 49.9 percent. The Prices Index registered 49.7 percent, a 3.7-percentage point increase from the August reading of 46 percent. The New Export Orders Index registered 41 percent, a 2.3-percentage point decrease from the August reading of 43.3 percent. The Imports Index registered 48.1 percent, a 2.1-percentage point increase from the August reading of 46 percent.

“Comments from the panel reflect a continuing decrease in business confidence. September was the second consecutive month of PMI® contraction, at a faster rate compared to August. Demand contracted, with the New Orders Index contracting at August levels, the Customers’ Inventories Index moving toward ‘about right’ territory and the Backlog of Orders Index contracting for the fifth straight month (and at a faster rate). The New Export Orders Index continued to contract strongly, a negative impact on the New Orders Index. Consumption (measured by the Production and Employment indexes) contracted at faster rates, again primarily driven by a lack of demand, contributing negative numbers (a combined 3.3-percentage point decrease) to the PMI® calculation. Inputs — expressed as supplier deliveries, inventories and imports — were again lower in September, due to inventory tightening for the fourth straight month. This resulted in a combined 3.3-percentage point decline in the Supplier Deliveries and Inventories indexes. Imports contraction slowed. Overall, inputs indicate (1) supply chains are meeting demand and (2) companies are continuing to closely match inventories to new orders. Prices decreased for the fourth consecutive month, but at a slower rate.

“Global trade remains the most significant issue, as demonstrated by the contraction in new export orders that began in July 2019. Overall, sentiment this month remains cautious regarding near-term growth,” says Fiore.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was well below expectations of 50.0%, and suggests manufacturing contracted further in September.

CoreLogic: House Prices up 3.6% Year-over-year in August

by Calculated Risk on 10/01/2019 08:37:00 AM

Notes: This CoreLogic House Price Index report is for August. The recent Case-Shiller index release was for July. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports August Home Prices Increased by 3.6% Year Over Year

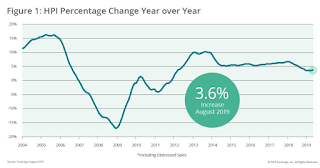

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for August 2019, which shows home prices rose both year over year and month over month. Home prices increased nationally by 3.6% from August 2018. On a month-over-month basis, prices increased by 0.4% in August 2019. (July 2019 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)

Home prices continue to increase on an annual basis with the CoreLogic HPI Forecast indicating annual price growth will increase 5.8% by August 2020. On a month-over-month basis, the forecast calls for home prices to increase by 0.3% from August 2019 to September 2019. The CoreLogic HPI Forecast is a projection of home prices calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“The 3.6% increase in annual home price growth this August marked a big slowdown from a year earlier when the U.S. index was up 5.5%,” said Dr. Frank Nothaft, chief economist at CoreLogic. “While the slowdown in appreciation occurred across the country at all price points, it was most pronounced at the lower end of the market. Prices for the lowest-priced homes increased by 5.5%, compared with August 2018, when prices increased by 8.4%. This moderation in home-price growth should be welcome news to entry-level buyers.”

emphasis added

This graph is from CoreLogic and shows the YoY change in their index.

This graph is from CoreLogic and shows the YoY change in their index.CR Note: The YoY change in the CoreLogic index decreased over the last year, but is now moving sideways.

Monday, September 30, 2019

Tuesday: ISM Mfg, Construction Spending

by Calculated Risk on 9/30/2019 09:25:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Lowest in Weeks

Over the past few business days, the sideways momentum gradually began to give way to modest improvements. Lenders have been slow to adjust their rate sheet offerings, but as of today, the average lender is back in line with its lowest rates since September 9th. More than a few lenders offered mid-day improvements today. [Most Prevalent Rates 30YR FIXED - 3.75%]Tuesday:

emphasis added

• At 10:00 AM, ISM Manufacturing Index for September. The consensus is for a reading of 50.0, up from 49.1 in August. The employment index was at 47.4%, and the new orders index was at 47.2%.

• Also at 10:00 AM, Construction Spending for August. The consensus is for a 0.3% increase.

• Early, Reis Q3 2019 Office Survey of rents and vacancy rates.

Fannie Mae: Mortgage Serious Delinquency Rate Unchanged in August

by Calculated Risk on 9/30/2019 04:26:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency was unchanged at 0.67% in August, from 0.67% in July. The serious delinquency rate is down from 0.82% in August 2018.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

This matches last month as the lowest serious delinquency rate for Fannie Mae since June 2007.

By vintage, for loans made in 2004 or earlier (2% of portfolio), 2.50% are seriously delinquent. For loans made in 2005 through 2008 (4% of portfolio), 4.20% are seriously delinquent, For recent loans, originated in 2009 through 2018 (94% of portfolio), only 0.32% are seriously delinquent. So Fannie is still working through a few poor performing loans from the bubble years.

The increase in the delinquency rate in late 2017 was due to the hurricanes - there were no worries about the overall market.

I expect the serious delinquency rate will probably decline to 0.4 to 0.6 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Chicago PMI "Drifts to 47.1 in September", Lowest Quarter since 2009

by Calculated Risk on 9/30/2019 12:41:00 PM

From the Chicago PMI: Chicago Business Barometer™ – Drifts to 47.1 in September

The Chicago Business BarometerTM, produced with MNI, fell 3.3 points to 47.1 in September, following August’s rebound to 50.4.CR Note: This was below the consensus forecast, and is another weak reading.

Business confidence dropped below the 50-mark to 47.3 in Q3, leaving the index at the lowest level on a quarterly basis since Q3 2009. The index fell 4.9 points compared to the previous quarter.

...

Labor demand improved slightly to 45.6 in September, but the quarterly average fell to 44.1, recording the weakest quarter since Q4 2009. br /> emphasis added

Dallas Fed: "Texas Manufacturing Expansion Continues"

by Calculated Risk on 9/30/2019 10:36:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Continues

Texas factory activity continued to expand in September, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell four points to 13.9, suggesting output growth continued but at a slightly slower pace than in August.This was the last of the regional Fed surveys for September.

Other measures of manufacturing activity also suggested slightly slower expansion in September. The new orders index edged down two points to 7.1, while the shipments index fell three points to 14.7. Similarly, the capacity utilization index fell four points to 12.0. A bright spot this month was the growth rate of orders index, which edged up to 4.4, a five-month high.

Perceptions of broader business conditions remained positive in September. The general business activity index came in at 1.5, a second positive reading in a row after three months in negative territory. The company outlook index inched up to 7.4, its highest reading since February. The index measuring uncertainty regarding companies’ outlooks remained elevated at 13.3.

Labor market measures suggested stronger growth in employment and work hours in September. The employment index jumped 13 points to 18.8, its highest reading in nearly a year.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through September), and five Fed surveys are averaged (blue, through September) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through August (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index for September will be weak again.

September Vehicle Sales Forecast: 16.8 Million SAAR

by Calculated Risk on 9/30/2019 09:27:00 AM

From JD Power: Record Q3 Spending Accelerates Auto Sales After Year's Slow Start

New-vehicle retail sales in September are expected to fall from a year ago, according to a forecast developed jointly by J.D. Power and LMC Automotive. Retail sales are projected to reach 1,007,000 units, a 15.2% decrease compared with September 2018. Controlling for the number of selling days, this translates to a decline of 7.8% from last year on two fewer selling days. (Note: This year excludes the Labor Day holiday and has one fewer weekend than September 2018.)This forecast is for sales be solid in September, but down from 17.0 million SAAR in August, and down from 17.3 million SAAR in September 2018.

...

Total sales in September are projected to reach 1,244,000 units, a 13.3% decrease compared with September 2018. Adjusting the results for two fewer selling days results in a decline of 5.8%. The seasonally adjusted annualized rate (SAAR) for total sales, which normalizes sales for the exclusion of the Labor Day holiday and one fewer weekend this year, is expected to be 16.8 million units.

…

“After delivering record sales results in August, when retail sales rose 6.2% on a selling-day adjusted basis, the decline in September sales was expected and reflects a quirk in how the industry reports sales. The large decline in sales this month is driven primarily by the timing of the Labor Day holiday. Unlike most years, sales from the Labor Day holiday weekend were included in August sales reporting instead of September. With close to 250,000 new vehicles sold during the holiday weekend, the exclusion from September reporting is significant.”

emphasis added

Sunday, September 29, 2019

Sunday Night Futures

by Calculated Risk on 9/29/2019 08:43:00 PM

Weekend:

• Schedule for Week of September 29, 2019

• Sept 2019: Unofficial Problem Bank list decreased to 74 Institutions, Q3 2019 Transition Matrix

Monday:

• At 9:45 AM ET, Chicago Purchasing Managers Index for September. The consensus is for a reading of 50.4, unchanged from 50.4 in August.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for September. This is the last of the Fed regional manufacturing surveys for September.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 8 and DOW futures are up 64 (fair value).

Oil prices were down over the last week with WTI futures at $56.07 per barrel and Brent at $62.12 barrel. A year ago, WTI was at $73, and Brent was at $83 - so oil prices are down about 25% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.64 per gallon. A year ago prices were at $2.87 per gallon, so gasoline prices are down 23 cents year-over-year.

Sept 2019: Unofficial Problem Bank list decreased to 74 Institutions, Q3 2019 Transition Matrix

by Calculated Risk on 9/29/2019 08:19:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources. DISCLAIMER: This is an unofficial list, the information is from public sources and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here is the unofficial problem bank list for September 2019.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for September 2019. During the month, the list decreased by two to 74 institutions after four removals and two additions. Assets increased by $1.1 billion to $55.7 billion. A year ago, the list held 79 institutions with assets of $56.9 billion.

This month, actions were terminated against Interamerican Bank, A FSB, Miami, FL ($200 million); First Covenant Bank, Commerce, GA ($136 million); Homestead Savings Bank, Albion, MI ($66 million); and The First National Bank of Lacon, Lacon, IL ($65 million). Added this month was Metropolitan Capital Bank & Trust, Chicago, IL ($230 million). We give thanks to a reader that identified that Carver Federal Savings Bank, New York, NY ($575 million) should be added to the list, which we did this month based on an action issued in May 2016.

With the conclusion of the third quarter, we bring an updated transition matrix to detail how banks are transitioning off the Unofficial Problem Bank List. Since the Unofficial Problem Bank List was first published on August 7, 2009 with 389 institutions, 1,753 institutions have appeared on a weekly or monthly list since the start of publication. Only 4.2 percent of the banks that have appeared on a list remain today as 1,679 institutions have transitioned through the list. Departure methods include 992 action terminations, 406 failures, 262 mergers, and 19 voluntary liquidations. Of the 389 institutions on the first published list, only 5 or 1.3 percent, are still designated as being in a troubled status more than ten years later. The 406 failures represent 23.2 percent of the 1,753 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 180 | (68,469,804) | |

| Unassisted Merger | 41 | (10,072,112) | |

| Voluntary Liquidation | 5 | (10,672,586) | |

| Failures | 158 | (186,397,337) | |

| Asset Change | 511,796 | ||

| Still on List at 9/30/2019 | 5 | 1,213,386 | |

| Additions after 8/7/2009 | 69 | 54,532,883 | |

| End (9/30/2019) | 74 | 55,746,269 | |

| Intraperiod Removals1 | |||

| Action Terminated | 812 | 326,376,223 | |

| Unassisted Merger | 221 | 82,691,403 | |

| Voluntary Liquidation | 14 | 2,558,186 | |

| Failures | 248 | 125,152,210 | |

| Total | 1,295 | 536,778,022 | |

| 1Institution not on 8/7/2009 or 9/30/2019 list but appeared on a weekly list. | |||

Saturday, September 28, 2019

Schedule for Week of September 29, 2019

by Calculated Risk on 9/28/2019 08:11:00 AM

The key report this week is the September employment report on Friday.

Other key indicators include the September ISM manufacturing and non-manufacturing indexes, September auto sales, and the August trade deficit.

9:45 AM: Chicago Purchasing Managers Index for September. The consensus is for a reading of 50.4, unchanged from 50.4 in August.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for September.

10:00 AM: ISM Manufacturing Index for September. The consensus is for a reading of 50.0, up from 49.1 in August.

10:00 AM: ISM Manufacturing Index for September. The consensus is for a reading of 50.0, up from 49.1 in August.Here is a long term graph of the ISM manufacturing index.

The PMI was at 49.1% in August, the employment index was at 47.4%, and the new orders index was at 47.2%.

10:00 AM: Construction Spending for August. The consensus is for a 0.3% increase.

Early: Reis Q3 2019 Office Survey of rents and vacancy rates.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 152,000 jobs added, down from 195,000 in August.

All day: Light vehicle sales for September.

All day: Light vehicle sales for September.The consensus is for sales of 17.0 million SAAR, unchanged from 17.0 million SAAR in August (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215,000 initial claims, up from 213,000 last week.

10:00 AM: the ISM non-Manufacturing Index for September.

Early: Reis Q3 2019 Mall Survey of rents and vacancy rates.

8:30 AM: Employment Report for September.

8:30 AM: Employment Report for September. The consensus is for 145,000 jobs added, up from 130,000 in August (including temporary Census hires). The consensus is the unemployment rate will be unchanged at 3.7%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In August, the year-over-year change was 2.074 million jobs.

A key will be the change in wages.

8:30 AM: Trade Balance report for August from the Census Bureau. The consensus is for the deficit to be $54.5 billion in August, from $54.0 billion in July.

8:30 AM: Trade Balance report for August from the Census Bureau. The consensus is for the deficit to be $54.5 billion in August, from $54.0 billion in July.This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

2:00 PM: Speech, Fed Chair Jerome Powell, Opening Remarks, At Fed Listens: Perspectives on Maximum Employment and Price Stability, Federal Reserve Board, Washington, D.C.