by Calculated Risk on 3/25/2019 06:27:00 PM

Monday, March 25, 2019

Tuesday: Housing Starts, Case-Shiller House Prices, and More

From Matthew Graham at Mortgage News Daily: Mortgage Rates Still Moving Lower After Last Week's Stellar Drop

Mortgage rates continued deeper into long-term lows today as the underlying bond market experiences its most impressive rally of the year. In a rally, bond prices are moving higher and rates are moving lower. [30YR FIXED - 4.00 - 4.125]Tuesday:

emphasis added

• At 8:30 AM ET: Housing Starts for February. The consensus is for 1.201 million SAAR, down from 1.230 million SAAR in January.

• At 9:00 AM: FHFA House Price Index for January 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 9:00 AM: S&P/Case-Shiller House Price Index for January. The consensus is for a 4.2% year-over-year increase in the Comp 20 index for December.

• At 10:00 AM: Richmond Fed Survey of Manufacturing Activity for March.

Freddie Mac: Mortgage Serious Delinquency Rate Decreased Slightly in February

by Calculated Risk on 3/25/2019 05:22:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in February was 0.69%, down slightly from 0.70% in January. Freddie's rate is down from 1.06% in February 2018.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This matches the lowest serious delinquency rate for Freddie Mac since December 2007.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The increase in the delinquency rate in late 2017 and early 2018 was due to the hurricanes (These are serious delinquencies, so it took three months late to be counted).

I expect the delinquency rate to decline to a cycle bottom in the 0.5% to 0.7% range - but this is close to a bottom.

Note: Fannie Mae will report for February soon.

Housing Inventory Tracking

by Calculated Risk on 3/25/2019 01:39:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Inventory, on a national basis, was up 4.6% year-over-year (YoY) in January, this was the sixth consecutive month with a YoY increase, following over three years of YoY declines.

The graph below shows the YoY change for non-contingent inventory in Houston, Las Vegas, and Sacramento and Phoenix, and total existing home inventory as reported by the NAR (through February). (I'll be adding more areas).

The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory was up 105% YoY in Las Vegas in February (red), the eight consecutive month with a YoY increase.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY recently as oil prices increased. Inventory was up 17% year-over-year in Houston in February.

Inventory is a key for the housing market. I expect a further increase in inventory in 2019, but overall I think inventory will still be fairly low.

Also note that inventory in Seattle was up 164% year-over-year in February (not graphed)!

Dallas Fed: "Texas Manufacturing Activity Continues to Grow"

by Calculated Risk on 3/25/2019 10:32:00 AM

From the Dallas Fed: Texas Manufacturing Activity Continues to Grow

Texas factory activity continued to expand in March, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, held fairly steady at 11.5, indicating output growth continued at about the same pace as last month.So far the regional surveys have been somewhat positive for March.

Other measures of manufacturing activity also suggested continued expansion in March, although demand growth slowed. The new orders index fell from 6.9 to 2.4, and the growth rate of orders index slipped into negative territory for the first time since December 2016. The shipments index declined five points to 5.8, while the capacity utilization index moved up four points to 10.9.

Perceptions of broader business conditions continued to improve in March, although outlooks were less optimistic than in February. The general business activity index remained positive but fell five points to 8.3. Similarly, the company outlook index stayed in positive territory but fell from 14.2 to 6.0. The index measuring uncertainty regarding companies’ outlooks was largely unchanged at a 10-month low of 3.4.

Labor market measures suggested continued employment growth and longer workweeks in March. The employment index held steady at 13.1, a reading well above average. Twenty-two percent of firms noted net hiring, compared with 9 percent noting net layoffs. The hours worked index came in at 4.6, up slightly from February.

emphasis added

Chicago Fed "Index points to little change in economic growth in February"

by Calculated Risk on 3/25/2019 09:13:00 AM

From the Chicago Fed: Index points to little change in economic growth in February

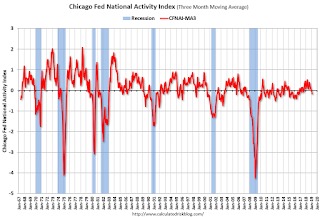

The Chicago Fed National Activity Index (CFNAI) edged down to –0.29 in February from –0.25 in January. Two of the four broad categories of indicators that make up the index decreased from January, and three of the four categories made negative contributions to the index in February. The index’s three-month moving average, CFNAI-MA3, moved down to –0.18 in February from a neutral reading in January.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in February (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, March 24, 2019

Sunday Night Futures

by Calculated Risk on 3/24/2019 08:01:00 PM

Weekend:

• Schedule for Week of March 24, 2019

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for February. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for March.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 5 and DOW futures are up 55 (fair value).

Oil prices were mixed over the last week with WTI futures at $58.79 per barrel and Brent at $66.85 per barrel. A year ago, WTI was at $66, and Brent was at $69 - so oil prices are down about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.63 per gallon. A year ago prices were at $2.63 per gallon, so gasoline prices are unchanged year-over-year.

Hotels: Occupancy Rate Decreased Year-over-year

by Calculated Risk on 3/24/2019 12:31:00 PM

From HotelNewsNow.com: STR: U.S. hotel results for week ending 16 March

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 10-16 March 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 11-17 March 2018, the industry recorded the following:

• Occupancy: -0.9% to 70.2%

• Average daily rate (ADR): +0.6% to US$134.50

• Revenue per available room (RevPAR): -0.3% to US$94.40

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

A decent start for 2019 - close, but slightly lower occupancy rate, to-date, compared to the previous 4 years.

Seasonally, the occupancy rate will mostly move sideways during the Spring travel season, and then increase during the Summer.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, March 23, 2019

Schedule for Week of March 24, 2019

by Calculated Risk on 3/23/2019 08:11:00 AM

The key reports this week are the third estimate of Q4 GDP, February Housing Starts and New Home Sales.

Other key reports include Case-Shiller house prices, and Personal Income for February, and Personal Outlays for January.

For manufacturing, the March Dallas, Richmond and Kansas City manufacturing surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for March.

8:30 AM ET: Housing Starts for February.

8:30 AM ET: Housing Starts for February. This graph shows single and total housing starts since 1968.

The consensus is for 1.201 million SAAR, down from 1.230 million SAAR in January.

9:00 AM: FHFA House Price Index for January 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM: S&P/Case-Shiller House Price Index for January.

9:00 AM: S&P/Case-Shiller House Price Index for January.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 4.2% year-over-year increase in the Comp 20 index for December.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Trade Balance report for January from the Census Bureau.

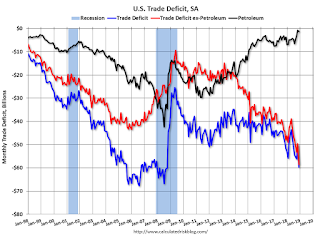

8:30 AM: Trade Balance report for January from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $57.4 billion. The U.S. trade deficit was at $59.8 billion in December.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, up from 221 thousand the previous week.

8:30 AM: Gross Domestic Product, 4th quarter 2018 (Third estimate). The consensus is that real GDP increased 2.2% annualized in Q4, down from the initial estimate of 2.6%.

10:00 AM: Pending Home Sales Index for February. The consensus is for a 1.0% decrease in the index.

11:00 AM: the Kansas City Fed manufacturing survey for March. This is the last of regional manufacturing surveys for March.

8:30 AM ET: Personal Income, February 2019; Personal Outlays, January 2019. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a reading of 60.3, down from 64.7 in February.

10:00 AM: New Home Sales for February from the Census Bureau.

10:00 AM: New Home Sales for February from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 616 thousand SAAR, up from 607 thousand in January.

10:00 AM: University of Michigan's Consumer sentiment index (Final for March). The consensus is for a reading of 97.8.

Friday, March 22, 2019

Q1 GDP Forecasts: Around 1%

by Calculated Risk on 3/22/2019 03:27:00 PM

From Goldman Sachs:

We boosted our Q1 GDP tracking estimate by three tenths to +0.7% (qoq ar). However ... we lowered our past-quarter GDP tracking estimate for Q4 by two tenths to +2.1%. [March 22 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.3% for 2019:Q1 and 1.7% for 2019:Q2. [Mar 22 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2019 is 1.2 percent on March 22, up from 0.4 percent on March 13. [Mar 13 estimate]CR Note: These early estimates suggest real GDP growth will be around 1% annualized in Q1.

BLS: Unemployment Rates at New Series Lows in Alabama, North Dakota, Tennesse and Vermont

by Calculated Risk on 3/22/2019 03:01:00 PM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in February in 4 states and stable in 46 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today.

...

Iowa, New Hampshire, North Dakota, and Vermont had the lowest unemployment rates in February, 2.4 percent each. The rates in Alabama (3.7 percent), North Dakota (2.4 percent), Tennessee (3.2 percent), and Vermont (2.4 percent) set new series lows.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

At the worst of the great recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 6% (dark blue). Note that the series low for Alaska is above 6%. Four states and the D.C. have unemployment rates above 5%; Alaska, Arizona, New Mexico and West Virginia.

A total of nine states are at the series low.