by Calculated Risk on 9/12/2018 01:40:00 PM

Wednesday, September 12, 2018

Houston Real Estate in August: YoY Sales Distorted by Hurricane Harvey

From the HAR: Hurricane Harvey Distorts Houston Housing Analysis

Thousands of people are still haunted by Hurricane Harvey’s devastating effects as they continue to rebuild their homes and lives. Even now, the storm is affecting the way housing numbers compare August 2018 to August 2017. The traditional year-over-year measurements that the Houston Association of Realtors® (HAR) uses to track market trends have been thrown out of whack because Harvey halted most real estate activity across the greater Houston market during the final week of August 2017 and beyond. …Sales were impacted significantly by Hurricane Harvey. The impact on active listings was probably less significant.

According to the traditional, full-month numbers, Houston single-family home sales rose 37.2 percent year-over-year, with 8,358 homes sold in August versus 6,090 one year earlier when Harvey struck the region. HAR isolated single-family home sales for the period of August 1 - 24 since Harvey’s effects began to take a toll on the market on August 25, 2017. That analysis showed sales up 7.6 percent in August 2018, with 5,844 homes sold through August 24 of this year compared to 5,433 during the same time frame last year.

...

Total active listings, or the total number of available properties, were up 0.3 percent to 41,991.

emphasis added

"Income, Poverty and Health Insurance Coverage in the United States: 2017"

by Calculated Risk on 9/12/2018 10:45:00 AM

Note: Changes to health insurance policy will probably start showing up in the 2018 report.

From the Census Bureau: Income, Poverty and Health Insurance Coverage in the United States: 2017

The U.S. Census Bureau announced today that real median household income increased by 1.8 percent between 2016 and 2017, while the official poverty rate decreased 0.4 percentage points. At the same time, the number of people without health insurance coverage and the uninsured rate were not statistically different from 2016.

Median household income in the United States in 2017 was $61,372, an increase in real terms of 1.8 percent from the 2016 median income of $60,309. This is the third consecutive annual increase in median household income.

The nation’s official poverty rate in 2017 was 12.3 percent, with 39.7 million people in poverty. The number of people in poverty in 2017 was not statistically different from the number in poverty in 2016. The 0.4 percentage-point decrease in the poverty rate from 2016 (12.7 percent) to 2017 represents the third consecutive annual decline in poverty. Since 2014, the poverty rate has fallen 2.5 percentage points, from 14.8 percent to 12.3 percent.

The percentage of people without health insurance coverage for the entire 2017 calendar year was 8.8 percent, or 28.5 million, not statistically different from 2016 (8.8 percent or 28.1 million people). Between 2016 and 2017, the number of people with health insurance coverage increased by 2.3 million, up to 294.6 million.

emphasis added

Regulatory Capture

by Calculated Risk on 9/12/2018 09:08:00 AM

Caroline Baum writes at MarketWatch: Opinion: An overlooked element of the financial crisis: To err is human

There’s a name for what happened. It’s called regulatory capture, and it means just what the name implies. Regulators become sympathetic to those they are supposed to be regulating, losing sight of their actual function.This happened, but not at the field level. Here is an excerpt I wrote from the WaMu hearing:

Granted, some of the financial chicanery was going on in the accounting department, but regulators have access to the information they need to fulfill their supervisory and regulatory responsibilities. All they have to do is ask.

"My opinion is the OTS examiner in charge during the period of time I was there did an excellent job of finding and raising issues. Likewise, I found good performance from the FDIC examiner in charge. What I can't explain is why the superior in the agencies didn't take a tougher tone with banks, given the degree of negative findings. … seemed to be a tolerance there or political influence of senior management of those agencies that prevented them from taking more active stances …" James Vanasek, who was the former chief risk and credit officer of WaMu from 1999 to 2005.I noted:

We have seen this over and over. Every time the inspector general's office issues a report on a failed bank, the field examiners had correctly identified the problems - usually going back to 2003 or so - but no further action was taken.And from the Financial Crisis Inquiry Commission report Crisis

Vanasek is arguing this was possibly because of "political influence of senior management of those agencies" - the political appointees in charge. I've heard the same thing from examiners.

• We conclude this financial crisis was avoidable. …And I noted:

Despite the expressed view of many on Wall Street and in Washington that the crisis could not have been foreseen or avoided, there were warning signs. ... Yet there was pervasive permissiveness; little meaningful action was taken to quell the threats in a timely manner.

The prime example is the Federal Reserve’s pivotal failure to stem the flow of toxic mortgages, which it could have done by setting prudent mortgage-lending standards. The Federal Reserve was the one entity empowered to do so and it did not.

This is absolutely correct. In 2005 I was calling regulators and I was told they were very concerned - and several people told me confidentially that the political appointees were blocking all efforts to tighten standards - and one person told me "Greenspan is throwing his body in front of all efforts to tighten standards".

MBA: Mortgage Applications Decreased in Latest Weekly Survey, Refi Lowest Since 2000

by Calculated Risk on 9/12/2018 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 7, 2018. This week’s results include an adjustment for the Labor Day holiday.

... The Refinance Index decreased 6 percent from the previous week to the lowest level since December 2000. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index decreased 11 percent compared with the previous week and was 4 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to 4.84 percent from 4.80 percent, with points increasing to 0.46 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 4% year-over-year.

Tuesday, September 11, 2018

Wednesday: PPI, Beige Book

by Calculated Risk on 9/11/2018 08:21:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Producer Price Index for August from the BLS. The consensus is a 0.2% increase in PPI, and a 0.2% increase in core PPI.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Hurricanes and Economic Data

by Calculated Risk on 9/11/2018 04:25:00 PM

For everyone in North and South Carolina - stay safe!

Frequently there is a temporary slowdown in several major growth indicators following a large natural disaster. And usually there is a pretty rapid bounce back following the disaster.

It seems likely Hurricane Florence will negatively impact Q3 GDP, September employment and housing.

On employment: This week is the BLS reference week (includes the 12th). Hurricane Irma made landfall during the BLS reference week last year, and the BLS noted:

Hurricane Irma made landfall in Florida on September 10--during the reference period for both the establishment and household surveys--causing severe damage in Florida and other parts of the Southeast. Hurricane Harvey made landfall in Texas on August 25--prior to the September reference periods--resulting in severe damage in Texas and other areas of the Gulf Coast.Initially the BLS reported 33,000 jobs lost in September 2017, however this was eventually revised up to a gain of 14,000 jobs - keeping the job streak alive.

Our analysis suggests that the net effect of these hurricanes was to reduce the estimate of total nonfarm payroll employment for September. There was no discernible effect on the national unemployment rate.

Something similar might happen this year, with employment being depressed in September - then eventually being revised up, with a bounce back in October.

The first economic indicator to be impacted by the hurricane will probably be weekly unemployment claims. Last year, weekly claims jumped from 238,000 to 293,000 following hurricane Harvey. The size of the jump in claims for next week will give an idea of the impact on employment.

Another early indicator is usually car sales, with car sales falling to 16.45 million SAAR last August (the weakest month of 2017). Since so many cars were damaged from the flooding in Texas last year, sales bounced back sharply.

Stay safe. And expect any impacted indicator to rebound fairly quickly.

Leading Index for Commercial Real Estate "Falters" in August

by Calculated Risk on 9/11/2018 01:44:00 PM

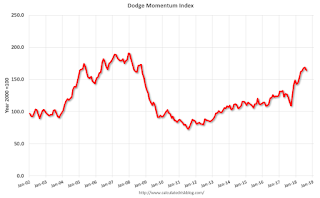

From Dodge Data Analytics: Dodge Momentum Index Falters in August

The Dodge Momentum Index fell 2.9% in August to 164.1 (2000=100) from the revised July reading of 169.0. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 164.1 in August, down from 169.0 in July.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests further growth into 2019.

BLS: Job Openings "Little Changed" in July

by Calculated Risk on 9/11/2018 10:08:00 AM

Notes: In July there were 6.939 million job openings, and, according to the July Employment report, there were 6.234 million unemployed. So, for the fourth consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015.

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 6.9 million on the last business day of July, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were little changed at 5.7 million and 5.5 million, respectively. Within separations, the quits rate was little changed at 2.4 percent and the layoffs and discharges rate was unchanged at 1.1 percent. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed in July at 3.6 million. The quits rate was 2.4 percent. The number of quits edged up for total private (+109,000) and was little changed for government. Quits increased in accommodation and food services (+61,000), other services (+49,000), and educational services (+12,000).

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for July, the most recent employment report was for August.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in July to 6.939 million from 6.822 million in June.

The number of job openings (yellow) are up 12% year-over-year.

Quits are up 1% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings are at a record level, and quits are increasing year-over-year. This was a strong report.

Small Business Optimism Index increased in August

by Calculated Risk on 9/11/2018 08:33:00 AM

From the National Federation of Independent Business (NFIB): August 2018 Report: Small Business Optimism Index

The NFIB Small Business Optimism Index soared to 108.8 in August, a new record in the survey’s 45-year history, topping the July 1983 highwater mark of 108.

..

After posting significant gains in employment in July, job creation slowed among small firms in August, perhaps because there were fewer workers available to hire because job openings hit a 45 year record high. Fifteen percent (down 2 points) reported increasing employment an average of 3.2 workers per firm and 10 percent (down 1 point) reported reducing employment an average of 2.4 workers per firm (seasonally adjusted). Sixty-two percent reported hiring or trying to hire (up 3 points), but 55 percent (up 3 points and 89 percent of those hiring or trying to hire) reported few or no qualified applicants for the positions they were trying to fill. A record 25 percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem (up 2 points). Thirty-eight percent of all owners reported job openings they could not fill in the current period, a new survey record high.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 108.8 in August.

Note: Usually small business owners complain about taxes and regulations. However, during the recession, "poor sales" was the top problem.

Now the difficulty of finding qualified workers is the top problem.

Monday, September 10, 2018

Tuesday: Job Openings

by Calculated Risk on 9/10/2018 07:16:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Highest in Over a Month

Mortgage rates were slightly higher today, depending on the lender. Many lenders ended up raising rates last Friday afternoon as underlying bond markets weakened. The remaining lenders had more distance to cover in terms of getting caught up with market movements. The average lender is just slightly worse off. Unfortunately, that puts rates at the highest levels in more than a month. [30YR FIXED - 4.625% - 4.75%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for August.

• At 10:00 AM, Job Openings and Labor Turnover Survey for July from the BLS.