by Calculated Risk on 8/21/2018 08:42:00 AM

Tuesday, August 21, 2018

Demographics, Unemployment Rate and Inflation

Update: Here is a paper on this topic by Adam Ozimek using US metro data Population Growth and Inflation

"Overall, these results suggest that slowing population growth can be a headwind for inflation and help explain why inflation has remained stubbornly weak in some places."In early 2015, I wrote about the possible relationship between Demographics, Unemployment Rate and Inflation. An excerpt (at that time the unemployment rate was at 5.7%):

If we look at the annual change in the prime working age population, there is one other period similar to the current situation - the early-to-mid 60s.Recently there has been more research on this topic. From Mikael Juselius and Előd Takáts at the BIS, May 2018: The enduring link between demography and inflation

…

The key is the prime working age population was declining in the early part of this decade and has only started increasing again recently.

This is very similar to what happened in the 60s.

In the early 60s, there was a slow increase in the prime working age population until the baby boomers started pouring into the labor force.

[This] graph shows the unemployment rate and year-over-year change in inflation in the 1960s.

In the 1960s, inflation didn't pickup until the unemployment rate had fallen close to 4%. There could be several demographics reasons for the low inflation (in addition to policy reasons). As an example, maybe older workers were being replaced by younger workers who made less (just like today), and maybe the slow increase in the prime working age population put less pressure on resources.

Demographic shifts, such as population ageing, have been suggested as possible explanations for the past decade’s low inflation. We exploit cross-country variation in a long panel to identify age structure effects in inflation, controlling for standard monetary factors. A robust relationship emerges that accords with the lifecycle hypothesis. That is, inflationary pressure rises when the share of dependants increases and, conversely, subsides when the share of working age population increases. This relationship accounts for the bulk of trend inflation, for instance, about 7 percentage points of US disinflation since the 1980s. It predicts rising inflation over the coming decades.And from Elena Bobeica, Eliza Lis, Christiane Nickel, Yiqiao Sun at the ECB January 2017: Demographics and inflation

emphasis added

Most euro area countries have entered an unprecedented ageing process: life expectancy continues to rise and fertility rates have declined, while retirement age in the last twenty to thirty years hardly increased. This implies an ever smaller fraction of the working age population in total population, leading to changes in consumption and saving behaviours and having an important impact on the macroeconomy. In this paper we focus on the relationship between demographic change and inflation. We find that based on a cointegrated VAR model there is a positive long-run relationship between inflation and the growth rate of working-age population as a share in total population in the euro area countries as a whole, but also in the US and Germany. We also find that this relation is mitigated by the effect of monetary policy, which we account for by including the short-term interest rate in our analysis. One caveat of the analysis could be that the empirical relationship as found does not sufficiently take into account changes in policy settings following the high inflation experiences in the 1970s. Our findings support the view that demographic trends are among the forces that shape the economic environment in which monetary policy operates. This is particularly relevant for countries, like many in Europe, that face an ageing process.Note: For some different views, see the comments in this post by Tyler Cowen at Marginal Revolution: Does demography predict inflation?

Monday, August 20, 2018

Mortgage Rates Continue in Narrow Range

by Calculated Risk on 8/20/2018 05:20:00 PM

Mortgage rates have mostly been moving sideways recently …

From Matthew Graham at Mortgage News Daily: Mortgage Rates Resisting a Move Lower

Mortgage rates were almost perfectly unchanged again today, meaning they haven't really changed in more than a week. All this despite a rather noticeable improvement in underlying bond markets (something that typically goes hand in hand with lower mortgage rates). Granted, the bonds that underlie mortgage rates didn't do quite as well as US Treasuries, but even then, mortgage rates barely budged. [30YR FIXED - 4.625-4.75%]

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from Mortgage News Daily.

Mortgage rates have been in a narrow range between 4.5% and 4.75% since early mid-February.

Hotels: Occupancy Rate Increased Year-over-Year

by Calculated Risk on 8/20/2018 01:06:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 11 August

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 5-11 August 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 6-12 August 2017, the industry recorded the following:

• Occupancy: +2.0% to 75.2%

• Average daily rate (ADR): +3.0% to US$132.02

• Revenue per available room (RevPAR): +5.1% to US$99.22

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The occupancy rate, to date, is close to the record year in 2017. Note: 2017 finished strong due to the impact of the hurricanes.

On a seasonal basis, the 4-week average of the occupancy rate is now at the peak of the summer travel season and will decline into the Fall.

Data Source: STR, Courtesy of HotelNewsNow.com

Phoenix Real Estate in July: Sales up 7% YoY, Active Inventory down 8% YoY

by Calculated Risk on 8/20/2018 11:04:00 AM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report", table below):

1) Overall sales in July were up 6.7% year-over-year.

2) Active inventory is down 8.0% year-over-year. This is the smallest YoY decrease in almost two years. In some cities, it appears the inventory decline might be ending, but not yet in Phoenix.

This is the twenty-first consecutive month with a YoY decrease in inventory in Phoenix.

| July Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||

|---|---|---|---|---|

| Sales | YoY Change | Active Inventory | YoY Change | |

| Jul-13 | 8,216 | --- | 16,803 | --- |

| Jul-14 | 6,775 | -17.5% | 24,462 | 45.6% |

| Jul-15 | 7,914 | 16.8% | 19,596 | -19.9% |

| Jul-16 | 7,630 | -3.6% | 19,530 | -0.3% |

| Jul-17 | 7,853 | 2.9% | 17,433 | -10.7% |

| Jul-18 | 8,380 | 6.7% | 16,035 | -8.0% |

A few comments on the Labor Force Participation Rate

by Calculated Risk on 8/20/2018 08:19:00 AM

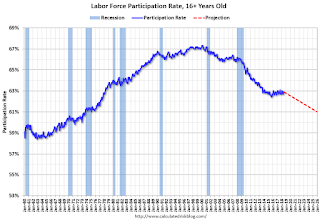

Last week an article misrepresented my writings on the Labor Force Participation Rate (not a big deal, this happens). But this gives me an excuse to post a few graphs and discuss the likely path of the labor force participation rate (LFPR) over time.

Back around 2010 and 2011, when the unemployment rate started falling, following the great recession, a number of observers claimed that the decline in the unemployment rate wasn't a real improvement in the labor market, and that the decline was mainly because of the decline in the participation rate. I had the opposite view. For example, in 2012 I wrote:

"Bottom line: If someone says the "actual" unemployment rate is much higher than reported because of the decline in the participation rate, they are unaware of a key demographic shift."And also in 2012 I wrote:

"Any bounceback in the participation rate as the economy recovers will probably be fairly small, and that the decline in the overall participation rate is mostly due to demographic factors."

Click on graph for larger image.

Click on graph for larger image.This graph show the overall labor force participation rate over time (the red arrow points to approximately when I made the above two comments). The LFPR continued to decline for a couple more years, and then moved mostly sideways over the last 5 years.

A key point: Those expecting the LFPR to bounce back to prerecession highs were mistaken.

Because of the demographics impact, and the impact of some long term trends (more people going to college is an example), I recommended using the LFPR for those "25 to 54 years old". I post this every month after the employment report is released.

Note: The reason everyone uses this age group (aka "Prime age group"), is the BLS puts out data every month for this group. If we looked at say "25 to 59" or "25 to 64", we'd have to do a little more work (I've done this, but mostly I stick with the 25 to 54 group).

Here is the participation rate and employment-population ratio for this key working age group: 25 to 54 years old.

Here is the participation rate and employment-population ratio for this key working age group: 25 to 54 years old.In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

With more younger workers (and fewer 50+ age workers), the prime participation rate might move up some more. The employment population ratio is almost back to the pre-great recession highs.

This is why I've recommended using this graph (not perfect, but more useful than the overall participation rate).

So what will happen to the overall participation rate going forward?

The BLS estimates that the LFPR will decline to around 61% in 2026 from the current level of 62.9%. See T. Alan Lacey, Mitra Toossi, Kevin S. Dubina, and Andrea B. Gensler, "Projections overview and highlights, 2016–26," Monthly Labor Review, U.S. Bureau of Labor Statistics, October 2017. There will probably be an update to these projections soon.

This graph shows the LFPR and a projection to 2026 (some other projections show the LFPR declining even more over the next decade). Note: I drew a straight line from today to the 2026 projection - it is possible that the LFPR will move sideways before starting to decline - but the rate will eventually decline further.

This graph shows the LFPR and a projection to 2026 (some other projections show the LFPR declining even more over the next decade). Note: I drew a straight line from today to the 2026 projection - it is possible that the LFPR will move sideways before starting to decline - but the rate will eventually decline further.I'll post some more details soon. But the bottom line is the overall LFPR has declined due to demographics and some long term trends - and will decline further - and that the "prime age" LFPR is more useful for observing the recovery.

Here are a few of my posts on the LFPR over the years (this is a small sample):

• Why the Prime Labor Force Participation Rate has Declined

• Understanding the Decline in the Participation Rate

• Employment: A decline in the participation rate was expected due to the aging population

• Comments on the Employment-Population Ratio

• Labor Force Participation Rate Projection Update

• The Declining Participation Rate

Sunday, August 19, 2018

Sunday Night Futures

by Calculated Risk on 8/19/2018 07:28:00 PM

Weekend:

• Schedule for Week of Aug 19, 2018

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 3 and DOW futures are up 33 (fair value).

Oil prices were down over the last week with WTI futures at $65.86 per barrel and Brent at $71.75 per barrel. A year ago, WTI was at $49, and Brent was at $51 - so oil prices are up 30% to 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.83 per gallon. A year ago prices were at $2.32 per gallon - so gasoline prices are up 51 cents per gallon year-over-year.

Lawler: A Few “Hot” Markets Home Inventories are Up Sharply

by Calculated Risk on 8/19/2018 08:01:00 AM

CR note: Some data below from housing economist Tom Lawler:

| Active Listings and Closed Sales, Single-Family Homes | ||||||

|---|---|---|---|---|---|---|

| Active Listings | Closed Sales | |||||

| 7/12018 | 7/1/2017 | % Chg | 7/1/2018 | 7/1/2017 | % Chg | |

| King County, WA (includes Seattle) | 4,163 | 2,898 | 43.7% | 2,477 | 2727 | -9.2% |

| Nashville, TN | 8,323 | 6,177 | 34.7% | 3,232 | 3,248 | -0.5% |

| Portland, OR | 6,549 | 5,785 | 13.2% | 2,736 | 2,793 | -2.0% |

Saturday, August 18, 2018

Schedule for Week of August 19, 2018

by Calculated Risk on 8/18/2018 08:11:00 AM

The key economic reports this week are July New and Existing Home Sales.

Fed Chair Jerome Powell will speak on Friday at the Federal Reserve Bank of Kansas City Economic Policy Symposium, at Jackson Hole, Wyo.

No major economic releases scheduled.

No major economic releases scheduled.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 5.43 million SAAR, up from 5.38 million in June.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 5.43 million SAAR, up from 5.38 million in June.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler estimates the NAR will reports sales of 5.40 million SAAR for July and that inventory will be down 1.0% year-over-year.

10:00 AM: The BLS will release the 2018 CES Preliminary Benchmark Revision.

2:00 PM: The Fed will release the FOMC Minutes for the Meeting of July 31-August 1, 2018

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, up from 212 thousand the previous week.

9:00 AM: FHFA House Price Index for June 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: New Home Sales for July from the Census Bureau.

10:00 AM: New Home Sales for July from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 648 thousand SAAR, up from 631 thousand in June.

11:00 AM: the Kansas City Fed manufacturing survey for August.

8:30 AM: Durable Goods Orders for July from the Census Bureau. The consensus is for a 0.2% decrease in durable goods orders.

10:00 AM: Speech by Fed Chair Jerome Powell, "Monetary Policy in a Changing Economy", At the Federal Reserve Bank of Kansas City Economic Policy Symposium, Jackson Hole, Wyo.

Friday, August 17, 2018

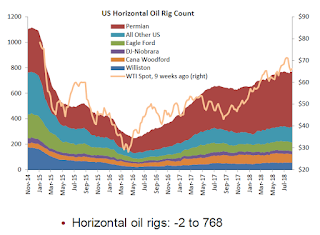

Oil Rigs: "A breather after last week's big gains"

by Calculated Risk on 8/17/2018 07:01:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on August 17, 2018:

• Oil rigs took a breather, consolidating last week’s gains

• Total rigs were flat at 869

• Horizontal oil rigs declined, -2 to 768

...

• Horizontal oil rig counts stand at the level of ten weeks ago in both the Permian and other plays

• This month’s DPR shows US shale oil production was up 150 kbpd in July to 7.2 mbpd.

• Year on year growth in the Permian came in a 0.92 mbpd – almost one million barrels per day of annual growth from just one play!

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Lawler: Early Read on Existing Home Sales in July

by Calculated Risk on 8/17/2018 02:40:00 PM

From housing economist Tom Lawler: Early Read on Existing Home Sales in July

Based on publicly-available local realtor/MLS reports from across the country released through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.40 million in July, up 0.4% from June’s preliminary pace and down 0.4% from last July’s seasonally adjusted pace. Unadjusted sales should show a modest year-over-year gain, with the SA/NSA gap reflecting this July’s higher business day count relative to last July.

Projecting the NAR’s inventory estimate for July using local realtor/MLS data is tricky, as local data for June did not suggest that national inventories were up YOY, as the NAR estimate suggested (the NAR’s estimate for June showed a 0.5% YOY increase). Local realtor/MLS data, as well as other tracking services, suggest that the inventory of existing homes for sale in July were down very slightly from last July, and my “best guess” is that the NAR’s inventory estimate for July will be 1.90 million, down 2.6% from June’s preliminary estimate and down 1.0% from last July’s estimate.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up about 5.7% from last July. Note, however, that of late the NAR’s median existing home sales prices have shown lower YOY gains than local realtor/MLS data would have suggested, for reasons that are not clear.

CR Note: Existing home sales for July are scheduled to be released by the NAR on Wednesday, Aug 22nd.