by Calculated Risk on 6/27/2018 11:28:00 AM

Wednesday, June 27, 2018

Reis: Apartment Vacancy Rate increased in Q2 to 4.8%

Reis reported that the apartment vacancy rate was at 4.8% in Q2 2018, up from 4.7% in Q1, and up from 4.3% in Q2 2017. This is the highest vacancy rate since Q3 2012. The vacancy rate peaked at 8.0% at the end of 2009, and bottomed at 4.1% in 2016.

From Reis:

Once again, the apartment vacancy rate increased in the quarter to 4.8% from 4.7% last quarter and 4.3% in the second quarter of 2017. The vacancy rate has now increased 70 basis points from a low of 4.1% in Q3 2016.

The national average asking rent increased 1.3% in the first quarter while effective rents, which net out landlord concessions, increased 1.2%. At $1,404 per unit (market) and $1,337 per unit (effective), the average rents have increased 4.4% and 4.0%, respectively, from the second quarter of 2017.

Net absorption was 37,265 units, slightly above last quarter’s absorption of 36,124 units but below the average quarterly absorption of 2017 of 46,031 units. Construction was 50,360 units, higher than the first quarter’s 50,244 units but below the 2017 quarterly average of 60,514 units. We still expect total construction for 2018 to surpass that of 2017.

...

The apartment market had slowed at the end of 2017 and early 2018 as the housing market started to accelerate. Momentum in the housing market, however, recently slowed as indicated by recent existing home sales results. These shifts are likely due to the Tax Reform and Jobs Act that doubled the standard deduction and cut the deductibility of state, local and property taxes which lowered the incentive to buy a home.

We expect construction to remain robust for the rest of 2018 and in early 2019 before completions drop off in subsequent periods. Occupancy is expected to remain positive, although vacancy rates are expected to continue to increase as new supply will outpace demand growth. Still, as long as job growth remains positive, we expect rent growth to remain positive over the next few quarters.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate had mostly moved sideways for the last several years. However, the vacancy rate has bottomed and is now increasing. With more supply coming on line - and less favorable demographics - the vacancy rate will probably continue to increase over the next year.

Apartment vacancy data courtesy of Reis.

NAR: Pending Home Sales Index Decreased 0.5% in May

by Calculated Risk on 6/27/2018 10:03:00 AM

From the NAR: Pending Home Sales Inch Back 0.5 Percent in May

Pending home sales decreased modestly in May and have now fallen on an annualized basis for the fifth straight month, according to the National Association of Realtors®. A larger decline in contract activity in the South offset gains in the Northeast, Midwest and West.This was well below expectations of a 0.7% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in June and July.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 0.5 percent to 105.9 in May from 106.4 in April.

...

The PHSI in the Northeast increased 2.0 percent to 92.4 in May, but is still 4.8 percent below a year ago. In the Midwest the index rose 2.9 percent to 101.4 in May, but is still 2.5 percent lower than May 2017.

Pending home sales in the South declined 3.5 percent to an index of 122.9 in May (unchanged from a year ago). The index in the West inched forward 0.6 percent in May to 94.7, but is 4.1 percent below a year ago.

emphasis added

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 6/27/2018 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 4.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 22, 2018.

... The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 6 percent from one week earlier. The unadjusted Purchase Index decreased 7 percent compared with the previous week and was 1 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to 4.84 percent from 4.83 percent, with points decreasing to 0.42 from 0.48 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 1% year-over-year.

Tuesday, June 26, 2018

Wednesday: Durable Goods, Pending Home Sales, Q2 Apartment Vacancy Survey

by Calculated Risk on 6/26/2018 09:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• Early, Reis Q2 2018 Apartment Survey of rents and vacancy rates.

• At 8:30 AM, Durable Goods Orders for May from the Census Bureau. The consensus is for a 0.6% decrease in durable goods orders.

• At 10:00 AM, Pending Home Sales Index for May. The consensus is for a 0.7% increase in the index.

Freddie Mac: Mortgage Serious Delinquency Rate Decreased in May

by Calculated Risk on 6/26/2018 05:43:00 PM

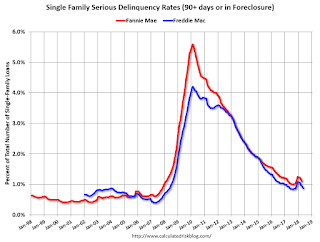

Freddie Mac reported that the Single-Family serious delinquency rate in May was 0.87%, down from 0.94% in April. Freddie's rate is unchanged from 0.87% in May 2017.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The increase in the delinquency rate late last year was due to the hurricanes - no worries about the overall market (These are serious delinquencies, so it took three months late to be counted).

After the hurricane bump, maybe the rate will decline to a cycle bottom in the 0.5% to 0.8% range.

Note: Fannie Mae will report for May soon.

Real House Prices and Price-to-Rent Ratio in April

by Calculated Risk on 6/26/2018 02:31:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 6.4% year-over-year in April

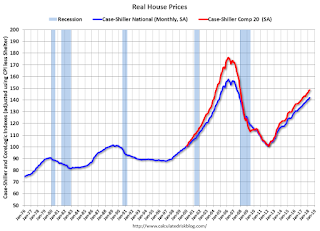

It has been over eleven years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 9.1% above the previous bubble peak. However, in real terms, the National index (SA) is still about 9.9% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 15.8% below the bubble peak.

The year-over-year increase in prices is mostly moving sideways now around 6%. In April, the index was up 6.4% YoY.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $284,000 today adjusted for inflation (42%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA)and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to December 2004 levels, and the Composite 20 index is back to June 2004.

In real terms, house prices are at 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to February 2004 levels, and the Composite 20 index is back to December 2003 levels.

In real terms, prices are back to mid 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 6/26/2018 12:09:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through April 2018). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Case-Shiller: National House Price Index increased 6.4% year-over-year in April

by Calculated Risk on 6/26/2018 09:24:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for April ("April" is a 3 month average of February, March and April prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

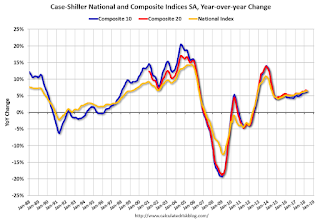

From S&P: Home Prices Continue Their Upward Trend According to S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.4% annual gain in April, down from 6.5% in the previous month. The 10-City Composite annual increase came in at 6.2%, down from 6.4% in the previous month. The 20-City Composite posted a 6.6% year-over-year gain, down from 6.7% in the previous month.

Seattle, Las Vegas, and San Francisco continue to report the highest year-over-year gains among the 20 cities. In April, Seattle led the way with a 13.1% year-over-year price increase, followed by Las Vegas with a 12.7% increase and San Francisco with a 10.9% increase. Nine of the 20 cities reported greater price increases in the year ending April 2018 versus the year ending March 2018

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 1.0% in April. The 10-City and 20-City Composites reported increases of 0.6% and 0.8%, respectively. After seasonal adjustment, the National Index recorded a 0.3% month-over-month increase in April. The 10-City and 20-City Composites posted 0.1% and 0.2% month-over-month increases, respectively. Nineteen of 20 cities reported increases in April before seasonal adjustment, while 17 of 20 cities reported increases after seasonal adjustment.

“Home prices continued their climb with the S&P CoreLogic Case-Shiller National Index up 6.4% in the past 12 months,” says David M. Blitzer Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “Cities west of the Rocky Mountains continue to lead price increases with Seattle, Las Vegas and San Francisco ranking 1-2-3 based on price movements in the trailing 12 months. The favorable economy and moderate mortgage rates both support recent gains in housing. One factor pushing prices up is the continued low supply of homes for sale. The months-supply is currently 4.3 months, up from levels below 4 months earlier in the year, but still low.

“Looking back to the peak of the boom in 2006, 10 of the 20 cities tracked by the indices are higher than their peaks; the other ten are below their high points. The National Index is also above its previous all-time high, the 20-city index slightly up versus its peak, and the 10-city is a bit below. However, if one adjusts the price movements for inflation since 2006, a very different picture emerges. Only three cities – Dallas, Denver and Seattle – are ahead in real, or inflation-adjusted, terms. The National Index is 14% below its boom-time peak and Las Vegas, the city with the longest road to a new high, is 47% below its peak when inflation is factored in.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 1.1% from the peak, and up 0.1% in April (SA).

The Composite 20 index is 1.9% above the bubble peak, and up 0.2% (SA) in April.

The National index is 9.1% above the bubble peak (SA), and up 0.3% (SA) in April. The National index is up 47.5% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 6.2% compared to April 2017. The Composite 20 SA is up 6.5% year-over-year.

The National index SA is up 6.4% year-over-year.

Note: According to the data, prices increased in 17 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, June 25, 2018

Tuesday: Case-Shiller House Prices

by Calculated Risk on 6/25/2018 07:01:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Relatively Unchanged Despite Stock Losses

Conventional wisdom holds that interest rates tend to move in the same direction as stocks. This makes logical sense from a classical investment portfolio standpoint. If investors are selling stocks to buy bonds, the prices of stocks would fall and the price of bonds would rise. When bond prices rise, rates fall. But even with today's heavy losses in stocks, mortgage rates barely budged today. [30YR FIXED - 4.625% - 4.75%]Tuesday:

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for April. The consensus is for a 6.8% year-over-year increase in the Comp 20 index for April.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for June.

Oil Rigs: Total US oil rigs fell 1 to 862 last week

by Calculated Risk on 6/25/2018 05:10:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on June 22, 2018:

• Total US oil rigs fell 1 to 862 last week

• Horizontal oil rigs added 2 to 767

...

• The appetite to add rigs seems to be waning, as we noted last week, and a new interim peak may be forming.

• This in turn suggests the breakeven price to add oil rigs is rising to about $60 / barrel WTI, up from around $48 / barrel a year ago.

• Oil prices recovered on the OPEC deal – no surprise – but seem weak again today.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.