by Calculated Risk on 6/25/2018 03:33:00 PM

Monday, June 25, 2018

Earlier from Dallas Fed: "Texas Manufacturing Continues to Expand, Outlook Improves"

From the Dallas Fed: Texas Manufacturing Continues to Expand, Outlook Improves

The expansion in Texas factory activity continued in June, albeit at a slower pace than in May, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, declined 12 points to 23.3, signaling a deceleration in output growth.

Some other indexes of manufacturing activity also indicated slower growth in June. The capacity utilization and shipments indexes posted double-digit declines, falling to 21.7 and 25.5, respectively. However, demand improved further in June as the new orders index edged up to 29.6, its highest level this year.

Perceptions of broader business conditions were even more positive in June than in May. The general business activity index rose 10 points to 36.5, and the company outlook index rose five points to 33.2, its highest reading since 2006.

Labor market measures suggested robust growth in employment and longer work hours in June. The employment index stayed near last month’s six-year high at 23.9. Thirty-one percent of firms noted net hiring, compared with 7 percent noting net layoffs. The hours worked index remained highly positive but edged down to 20.2.

emphasis added

A few Comments on May New Home Sales

by Calculated Risk on 6/25/2018 12:34:00 PM

New home sales for May were reported at 689,000 on a seasonally adjusted annual rate basis (SAAR). This was above the consensus forecast, however the three previous months. combined, were revised down.

Sales in May were up 14.1% year-over-year compared to May 2017. This was strong YoY growth, however, this was also a fairly easy comparison since new home sales were soft in mid-year 2017.

Earlier: New Home Sales increase to 689,000 Annual Rate in May.

This graph shows new home sales for 2017 and 2018 by month (Seasonally Adjusted Annual Rate).

Sales are up 8.8% through May compared to the same period in 2017. Decent growth so far, and the next three months will also be an easy comparison to 2017.

This is on track to be close to my forecast for 2018 of 650 thousand new home sales for the year; an increase of about 6% over 2017. There are downside risks to that forecast, such as higher mortgage rates, higher costs (labor and material), and possible policy errors.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increase to 689,000 Annual Rate in May

by Calculated Risk on 6/25/2018 10:12:00 AM

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 689 thousand.

The previous three months were revised down, combined.

"Sales of new single-family houses in May 2018 were at a seasonally adjusted annual rate of 689,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 6.7 percent above the revised April rate of 646,000 and is 14.1 percent above the May 2017 estimate of 604,000. "

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply decreased in May to 5.2 months from 5.5 months in April.

The months of supply decreased in May to 5.2 months from 5.5 months in April. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of May was 299,000. This represents a supply of 5.2 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is also somewhat low.

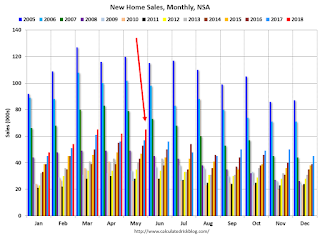

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In May 2018 (red column), 64 thousand new homes were sold (NSA). Last year, 57 thousand homes were sold in May.

The all time high for May was 120 thousand in 2005, and the all time low for May was 26 thousand in 2010.

This was above expectations of 665,000 sales SAAR, however the previous months were revised down, combined. I'll have more later today.

Chicago Fed "Index Points to Slower Economic Growth in May "

by Calculated Risk on 6/25/2018 08:37:00 AM

From the Chicago Fed: Index Points to Slower Economic Growth in May

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) fell to –0.15 in May from +0.42 in April. Two of the four broad categories of indicators that make up the index decreased from April, and two of the four categories made negative contributions to the index in May. The index’s three-month moving average, CFNAI-MA3, decreased to +0.18 in May from +0.48 in April.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was above the historical trend in May (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, June 24, 2018

Monday: New Home Sales

by Calculated Risk on 6/24/2018 08:47:00 PM

Weekend:

• Schedule for Week of June 24, 2018

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for May. This is a composite index of other data.

• At 10:00 AM, New Home Sales for May from the Census Bureau. The consensus is for 665 thousand SAAR, up from 662 thousand in April.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for June.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 10, and DOW futures are down 82 (fair value).

Oil prices were up over the last week with WTI futures at $68.43 per barrel and Brent at $73.95 per barrel. A year ago, WTI was at $45, and Brent was at $46 - so oil prices are up about 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.83 per gallon. A year ago prices were at $2.25 per gallon - so gasoline prices are up 58 cents per gallon year-over-year.

Update: For Fun, Stock Market as Barometer of Policy Success

by Calculated Risk on 6/24/2018 10:03:00 AM

By request, here is an update to the chart showing market performance under Presidents Trump and Obama.

Note: I don't think the stock market is a great measure of policy performance, but some people do - and I'm having a little fun with them.

There are some observers who think the stock market is the key barometer of policy success. My view is there are many measures of success - and that the economy needs to work well for a majority of the people - not just stock investors.

However, for example, Treasury Secretary Steven Mnuchin was on CNBC on Feb 22, 2017, and was asked if the stock market rally was a vote of confidence in the new administration, he replied: "Absolutely, this is a mark-to-market business, and you see what the market thinks."

And Larry Kudlow wrote in 2007: A Stock Market Vote of Confidence for Bush: "I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."

Note: Kudlow's comments were made a few months before the market started selling off in the Great Recession. For more on Kudlow, see: Larry Kudlow is usually wrong

Update: And from White House chief economic advisor Gary Cohn on December 20, 2017:

"I think there is a lot more momentum in the stock market. ... "The stock market is reflecting the reality of what's going in the business environment today," said Cohn, director of the National Economic Council. "There is going to be a continuation [of the] rally in the equity markets based on real underlying fundamentals of the U.S. economy ... as well as companies having more earnings power because of lower tax rates."For fun, here is a graph comparing S&P500 returns (ex-dividends) under Presidents Trump and Obama:

Click on graph for larger image.

Click on graph for larger image.Blue is for Mr. Obama, Orange is for Mr. Trump.

At this point, the S&P500 is up 21.3% under Mr. Trump - compared to up 36.0% under Mr. Obama for the same number of market days.

Saturday, June 23, 2018

Schedule for Week of June 24, 2018

by Calculated Risk on 6/23/2018 08:11:00 AM

The key economic reports this week are May New Home Sales and the third estimate of Q1 GDP.

Other key indicators include Personal Income and Outlays for May, and Case-Shiller house prices for April.

For manufacturing, the Dallas, Richmond, and Kansas City Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for May. This is a composite index of other data.

10:00 AM: New Home Sales for May from the Census Bureau.

10:00 AM: New Home Sales for May from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the April sales rate.

The consensus is for 665 thousand SAAR, up from 662 thousand in April.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for June.

9:00 AM ET: S&P/Case-Shiller House Price Index for April.

9:00 AM ET: S&P/Case-Shiller House Price Index for April.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the January 2018 report (the Composite 20 was started in January 2000).

The consensus is for a 6.8% year-over-year increase in the Comp 20 index for April.

10:00 AM ET: Richmond Fed Survey of Manufacturing Activity for June.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

Early: Reis Q2 2018 Apartment Survey of rents and vacancy rates.

8:30 AM: Durable Goods Orders for May from the Census Bureau. The consensus is for a 0.6% decrease in durable goods orders.

10:00 AM: Pending Home Sales Index for May. The consensus is for a 0.7% increase in the index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 218 thousand the previous week.

8:30 AM: Gross Domestic Product, 1st quarter 2018 (Third estimate). The consensus is that real GDP increased 2.2% annualized in Q1, unchanged from the second estimate of 2.2% in Q1.

11:00 AM: the Kansas City Fed manufacturing survey for June. This is the last of the regional surveys for June.

8:30 AM: Personal Income and Outlays for May. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for June. The consensus is for a reading of 60.1, down from 62.7 in May.

10:00 AM: University of Michigan's Consumer sentiment index (Final for June). The consensus is for a reading of 99.2, down from 99.3.

Friday, June 22, 2018

Duy: "No, A Recession Is Not Likely In The Next Twelve Months"

by Calculated Risk on 6/22/2018 12:33:00 PM

A few excerpts from Professor Tim Duy at Fed Watch: No, A Recession Is Not Likely In The Next Twelve Months. Why Do You Ask?

Headlines blared the latest recession warning today, this time from David Rosenberg of Gluskin Sheff & Associates. The culprit will be the Fed:CR Notes: I agree completely with Duy. I don't see a recession starting any time soon.

“Cycles die, and you know how they die?” Rosenberg told the Inside ETFs Canada conference in Montreal on Thursday. “Because the Fed puts a bullet in its forehead.”I get this. I buy the story that the Fed is likely to have a large role in causing the next recession. Either via overtightening or failing to loosen quickly enough in response to a negative shock.

And I truly get the frustration of being a business cycle economist in the midst of what will almost certainly be a record-breaking expansion. Imagine a business cycle economist going year after year without a recession to ride. It’s like Tinkerbell without her wings.

But the timeline here is wrong. And timing is everything when it comes to the recession call. Recessions don’t happen out of thin air. Data starts shifting ahead of a recession. Manufacturing activity sags. Housing starts tumble. Jobless claims start rising. You know the drill, and we are seeing any of it yet.

For a recession to start in the next twelve months, the data has to make a hard turn now. Maybe yesterday. And you would have to believe that turn would be happening in the midst of a substantial fiscal stimulus adding a tailwind to the economy through 2019. I just don’t see it happening.

...

Bottom Line: The business cycle is not dead. The future holds another recession. But many, many things have to start going wrong in fairly short order to bring about a recession in the next twelve months. It would probably have to be an extraordinary set of events outside of the typical business cycle dynamics. A much better bet is to expect this expansion will be a record breaker.

According to NBER, the four longest expansions in U.S. history are:

1) From a trough in March 1991 to a peak in March 2001 (120 months).

2) From a trough in June 2009 to today, June 2018 (108 months and counting).

3) From a trough in February 1961 to a peak in December 1969 (106 months).

4) From a trough in November 1982 to a peak in July 1990 (92 months).

So the current expansion is the second longest in U.S. history, and it seems very likely that the current expansion will surpass the '90s expansion in the Summer of 2019.

As I noted last year in Is a Recession Imminent? (one of the five questions I'm frequently asked)

Expansions don't die of old age! There is a very good chance this will become the longest expansion in history.A key reason the current expansion has been so long is that housing didn't contribute for the first few years of the expansion. Also the housing recovery was sluggish for a few more years after the bottom in 2011. This was because of the huge overhang of foreclosed properties coming on the market. Single family housing starts and new home sales both bottomed in 2011 - so this is just the seventh year of expansion - and I expect further increases in starts and sales over the next couple of years.

Recently the story has changed, but I still think the current expansion will end up being the longest in U.S. history.

Q2 GDP Forecasts

by Calculated Risk on 6/22/2018 11:19:00 AM

From Merrill Lynch:

We continue to track 3.7% for 2Q GDP growth [June 22 estimate].And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2018 is 4.7 percent on June 19, down from 4.8 percent on June 14. [June 19 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.9% for 2018:Q2 and 2.6% for 2018:Q3. [June 22 estimate]CR Note: This is still quite a range. These estimates suggest real annualized GDP in the 2.9% to 4.7% range in Q2.

Merrill: "The cost of a trade war"

by Calculated Risk on 6/22/2018 08:53:00 AM

A few excerpts from a research note by Merrill Lynch economists: The cost of a trade war

Early this week, trade tensions ratcheted up another notch. President Trump announced that he has directed the US Trade Representative to prepare another round of tariffs on $200bn in Chinese imports at a tax rate of 10%. This comes after China announced that it would retaliate dollar for dollar against the initial round of tariffs that are set to go into effect on July 6. While the actual amount of tariffs that have been imposed by the US to date remain modest at just over $100bn worth of goods imports (only 4.2% of total goods imports), the latest announcement shows that trade tensions are likely to get worse before it gets better. Although we remain of the view that the likelihood of a full blown global trade war remains low, below we try to put some numbers on how a major trade confrontation could potentially impact the US economy.

…

The good news is that we are still many steps away from a full blown global trade war. The bad news is that the tail risks are rising and our work and the literature suggest a major global trade confrontation would likely push the US and the rest of the world to the brink of a recession. So far, the trade actions taken by the Trump White House and trading partners have been relatively modest and in turn have had a limited impact on the economy and financial markets. The next round of $100-$200bn of tariff between US and China may prove more substantial. Further escalation like auto tariffs would lead us to reassess the US economic outlook.