by Calculated Risk on 6/21/2018 03:06:00 PM

Thursday, June 21, 2018

Housing Inventory Tracking

It appears existing home inventory has bottomed in some areas, and might be close to bottoming nationally. For example, in May, inventory was up 8.3% year-over-year (YoY) in California. However inventory nationally was still down 6.1% YoY in May.

But this isn't like in late 2005, when inventory started increasing sharply indicating the end of the housing bubble. Currently lending standards have been reasonably solid (some loosening with FHA standards), and in some areas inventory is increasing - but from a very low level. As example, inventory was up almost 30% YoY in Sacramento in May, but the months-of-supply was just 1.5 months. Inventory in Sacramento could double or even triple, and house prices wouldn't decline (months-of-supply in the 5 to 6 month range is somewhat normal).

If inventory starts to increase, then house price growth will probably slow. But it would take a significant increase in inventory to see price declines.

The graph below shows the year-over-year (YoY) change for non-contingent inventory in Houston, Las Vegas, Phoenix and Sacramento (through May 2018), and total existing home inventory as reported by the NAR (also through May 2018).

This shows the YoY change in inventory for Houston, Las Vegas, Phoenix, and Sacramento. The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory in Sacramento was up 30% year-over-year in May (inventory was still very low), and has increased YoY for eight consecutive months.

Also note that inventory is still down 12% YoY in Las Vegas (red), but the YoY decline has been getting smaller - and inventory in Vegas will probably be up YoY very soon.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY recently as oil prices increased.

Inventory is a key for the housing market, and I will be watching inventory for the impact of the new tax law and higher mortgage rates on housing. Currently I expect national inventory to be up YoY by the end of 2018 (but still be low).

This is not comparable to late 2005 when inventory increased sharply signaling the end of the housing bubble, but it does appear that inventory is bottoming nationally (and has already bottomed in some areas like California).

Hotels: Occupancy Rate decreased Year-over-Year

by Calculated Risk on 6/21/2018 01:41:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 16 June

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 10-16 June 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 11-17 June 2017, the industry recorded the following:

• Occupancy: -0.3% to 74.2%

• Average daily rate (ADR): +2.0% to US$131.72

• Revenue per available room (RevPAR): +1.8% to US$97.70

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The occupancy rate, to date, is slightly ahead of the record year in 2017. Note: 2017 finished strong due to the impact of the hurricanes.

On a seasonal basis, the occupancy rate will be solid for the next couple of months during the summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Earlier: Philly Fed Manufacturing Survey "Suggest Continuing Growth" in June

by Calculated Risk on 6/21/2018 10:21:00 AM

From the Philly Fed: June 2018 Manufacturing Business Outlook Survey

Results from the June Manufacturing Business Outlook Survey suggest continued expansion of the region’s manufacturing sector. All the broad indicators remained positive, although the indicators for general activity and new orders fell notably. The firms continued to report higher prices for purchased inputs and their own manufactured goods. Expectations for the next six months continued to moderate but remain positive overall.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The diffusion index for current general activity remained positive but decreased 15 points this month. Almost 37 percent of the manufacturers reported increases in overall activity this month, while 17 percent reported decreases. ... The firms continued to report overall increases in employment. Nearly 34 percent of the responding firms reported increases in employment this month, while 3 percent reported decreases. The current employment index, at 30.4, was virtually unchanged from May. The current average workweek index, however, decreased 10 points.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through June), and five Fed surveys are averaged (blue, through May) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through May (right axis).

This suggests the ISM manufacturing index will show solid expansion again in June, but probably weaker than in May.

Weekly Initial Unemployment Claims at 218,000

by Calculated Risk on 6/21/2018 08:33:00 AM

The DOL reported:

In the week ending June 16, the advance figure for seasonally adjusted initial claims was 218,000, a decrease of 3,000 from the previous week's revised level. The previous week's level was revised up by 3,000 from 218,000 to 221,000. The 4-week moving average was 221,000, a decrease of 4,000 from the previous week's revised average. The previous week's average was revised up by 750 from 224,250 to 225,000.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 221,000.

This was lower than the consensus forecast. The low level of claims suggest few layoffs.

Black Knight: National Mortgage Delinquency Rate Decreased in May, Foreclosure Inventory Close to Pre-Recession Average

by Calculated Risk on 6/21/2018 07:00:00 AM

From Black Knight: Black Knight’s First Look: May 2018 Sees Second Fewest Foreclosure Starts in 17 Years; Active Foreclosure Inventory on Pace to Hit Pre-Recession Average in Early Q3 2018

• At 44,900, May 2018 saw the second lowest monthly foreclosure starts in more than 17 yearsAccording to Black Knight's First Look report for May, the percent of loans delinquent decreased 0.8% in May compared to April, and decreased 4.1% year-over-year.

• Just 303,000 mortgages remain in active foreclosure; at 0.59 percent, the national foreclosure rate is now at its lowest point in 15 years

• At the current rate of decline, national foreclosure inventories are on pace to hit the pre-recession average (2000-2005) in early Q3 2018

• May marked five consecutive months of declining delinquencies, as post-hurricane improvement continues

• Delinquency improvements in hurricane-affected areas more than offset slight increases in non-impacted markets in May, dropping the national delinquency rate to its lowest level in 15 months

The percent of loans in the foreclosure process decreased 3.3% in May and were down 28.7% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.64% in May, down from 3.67% in April.

The percent of loans in the foreclosure process decreased in May to 0.59%.

The number of delinquent properties, but not in foreclosure, is down 60,000 properties year-over-year, and the number of properties in the foreclosure process is down 118,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| May 2018 | Apr 2018 | May 2017 | May 2016 | |

| Delinquent | 3.64% | 3.67% | 3.79% | 4.25% |

| In Foreclosure | 0.59% | 0.61% | 0.83% | 1.13% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,867,000 | 1,885,000 | 1,927,000 | 2,153,000 |

| Number of properties in foreclosure pre-sale inventory: | 303,000 | 314,000 | 421,000 | 574,000 |

| Total Properties | 2,171,000 | 2,199,000 | 2,348,000 | 2,727,000 |

Wednesday, June 20, 2018

Thursday: Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 6/20/2018 07:05:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 218 thousand the previous week.

• At 8:30 AM, the Philly Fed manufacturing survey for June. The consensus is for a reading of 26.0, down from 34.4.

• At 9:00 AM, FHFA House Price Index for April 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

AIA: "Architecture firm billings strengthen in May"

by Calculated Risk on 6/20/2018 02:31:00 PM

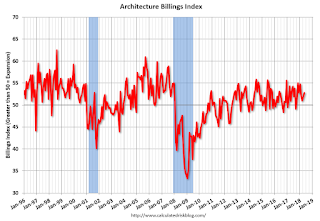

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture firm billings strengthen in May

Architecture firm billings grew in May, marking the eighth consecutive month of solid growth, according to a new report today from The American Institute of Architects (AIA).

Overall, the AIA’s Architecture Billings Index (ABI) score for May was 52.8 (any score over 50 is billings growth), which shows that demand for services from architecture firms continues to be healthy. The ABI also indicated that business conditions remain strong at firms located in the South and West, while growth in billings was modest at firms in the Northeast and Midwest.

“Architecture firms continue to have plenty of work as they enter the busiest part of the design and construction season,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “This is especially true for firms serving the institutional building sector, which reported their strongest growth in billings in several years.”

...

• Regional averages: West (51.9), Midwest (50.2), South (55.0), Northeast (50.6)

• Sector index breakdown: multi-family residential (52.1), institutional (54.3), commercial/industrial (53.6), mixed practice (47.9)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.8 in May, up from 52.0 in April. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 11 of the last 12 months, suggesting a further increase in CRE investment in 2018.

A Few Comments on May Existing Home Sales

by Calculated Risk on 6/20/2018 11:59:00 AM

Earlier: NAR: "Existing-Home Sales Backpedal, Decrease 0.4 Percent in May"

A few key points:

1) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus. See: Lawler: Early Read on Existing Home Sales in April. The consensus was for sales of 5.56 million SAAR, Lawler estimated the NAR would report 5.47 million SAAR in May, and the NAR actually reported 5.43 million.

2) Inventory is still very low and falling year-over-year (YoY) with inventory down 6.1% year-over-year in May. This was the 36th consecutive month with a year-over-year decline in inventory, however the YoY declines have been getting smaller.

And some areas of the country are now reporting YoY increases in inventory. As an example, the CAR reported yesterday that inventory in California was up 8.3% YoY in May. More inventory would probably mean smaller price increases.

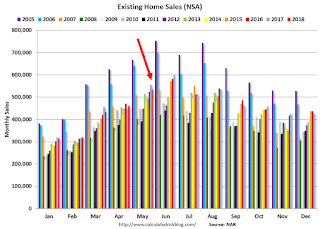

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in May (536,000, red column) were below sales in May 2017 (555,000, NSA).

Sales NSA through May(first five months) are down about 1.4% from the same period in 2017.

This is a small decline - and it is too early to tell if there is an impact from higher interest rates and / or the changes to the tax law on home sales.

NAR: "Existing-Home Sales Backpedal, Decrease 0.4 Percent in May"

by Calculated Risk on 6/20/2018 10:10:00 AM

From the NAR: Existing-Home Sales Backpedal, Decrease 0.4 Percent in May

Existing-home sales fell back for the second straight month in May, as only the Northeast region saw an uptick in activity, according to the National Association of Realtors®.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, decreased 0.4 percent to a seasonally adjusted annual rate of 5.43 million in May from downwardly revised 5.45 million in April. With last month’s decline, sales are now 3.0 percent below a year ago and have fallen year-over-year for three straight months.

...

Total housing inventory at the end of May climbed 2.8 percent to 1.85 million existing homes available for sale, but is still 6.1 percent lower than a year ago (1.97 million) and has fallen year-over-year for 36 consecutive months. Unsold inventory is at a 4.1-month supply at the current sales pace (4.2 months a year ago).

emphasis added

Click on graph for larger image.

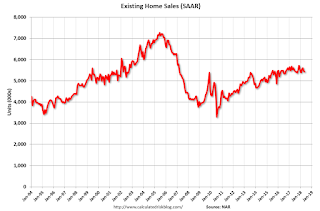

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in May (5.43 million SAAR) were 0.4% lower than last month, and were 3.0% below the May 2017 rate.

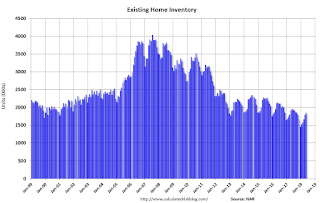

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.85 million in May from 1.80 million in April. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

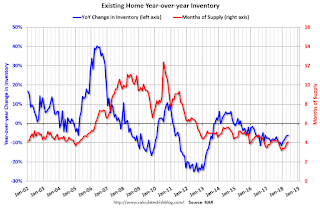

According to the NAR, inventory increased to 1.85 million in May from 1.80 million in April. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 6.1% year-over-year in May compared to May 2017.

Inventory decreased 6.1% year-over-year in May compared to May 2017. Months of supply was at 4.1 months in May.

Sales were below the consensus view. For existing home sales, a key number is inventory - and inventory is still low, but appears to be bottoming in some areas. I'll have more later ...

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 6/20/2018 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 5.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 15, 2018.

... The Refinance Index increased 6 percent from the previous week. The seasonally adjusted Purchase Index increased 4 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 3 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) remained unchanged at 4.83 percent, with points decreasing to 0.48 from 0.53 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

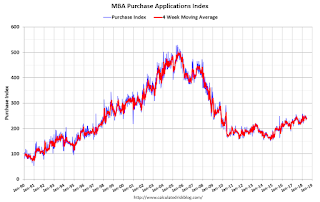

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 3% year-over-year.