by Calculated Risk on 5/30/2018 08:35:00 AM

Wednesday, May 30, 2018

Q1 GDP Revised down to 2.2% Annual Rate

From the BEA: National Income and Product Accounts Gross Domestic Product: First Quarter 2018 (Second Estimate)

Real gross domestic product (GDP) increased at an annual rate of 2.2 percent in the first quarter of 2018, according to the "second" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2017, real GDP increased 2.9 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised down from 1.1% to 1.0%. Residential investment was revised down from no change to -2.0%. Most revisions were small. This was slightly below the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 2.3 percent. With this second estimate for the first quarter, the general picture of economic growth remains the same; downward revisions to private inventory investment, residential fixed investment, and exports were partly offset by an upward revision to nonresidential fixed investment.

emphasis added

ADP: Private Employment increased 178,000 in May

by Calculated Risk on 5/30/2018 08:24:00 AM

Private sector employment increased by 178,000 jobs from April to May according to the May ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was slightly below the consensus forecast for 186,000 private sector jobs added in the ADP report.

...

“The hot job market has cooled slightly as the labor market continues to tighten,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Healthcare and professional services remain a model of consistency and continue to serve as the main drivers of growth in the services sector and the broader labor market as well.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth is strong, but slowing, as businesses are unable to fill a record number of open positions. Wage growth is accelerating in response, most notably for young, new entrants and those changing jobs. Finding workers is increasingly becoming businesses number one problem.”

The BLS report for May will be released Friday, and the consensus is for 185,000 non-farm payroll jobs added in May.

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Refi Index lowest since December 2000

by Calculated Risk on 5/30/2018 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 25, 2018.

... The Refinance Index decreased 5 percent from the previous week to its lowest level since December 2000. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 2 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 4.77 percent from 4.78 percent, with points remaining unchanged at 0.50 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity is at the lowest level since December 2000.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 2% year-over-year.

Tuesday, May 29, 2018

Wednesday: GDP, ADP Employment, Beige Book

by Calculated Risk on 5/29/2018 06:55:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 186,000 payroll jobs added in May, down from 204,000 added in April.

• At 8:30 AM, Gross Domestic Product, 1st quarter 2018 (Second estimate). The consensus is that real GDP increased 2.2% annualized in Q1, down from the advance estimate of 2.3% in Q1.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Real House Prices and Price-to-Rent Ratio in March

by Calculated Risk on 5/29/2018 04:14:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 6.5% year-over-year in March

It has been eleven years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 8.8% above the previous bubble peak. However, in real terms, the National index (SA) is still about 10.0% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 15.7% below the bubble peak.

The year-over-year increase in prices is mostly moving sideways now around 6%. In March, the index was up 6.5% YoY.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $284,000 today adjusted for inflation (42%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA)and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to December 2004 levels, and the Composite 20 index is back to June 2004.

In real terms, house prices are at 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to February 2004 levels, and the Composite 20 index is back to December 2003 levels.

In real terms, prices are back to mid 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 5/29/2018 01:31:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

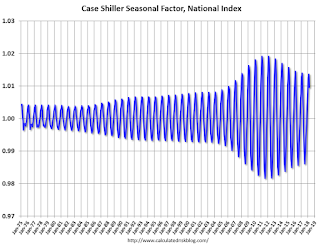

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

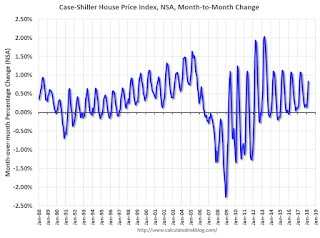

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through March 2018). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Dallas Fed: "Texas Manufacturing Expansion Accelerates Notably"

by Calculated Risk on 5/29/2018 10:37:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Accelerates Notably

Texas factory activity rose markedly in May, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, increased 10 points to a 12-year high of 35.2, signaling further acceleration in output growth.This was the last of the regional Fed surveys for May.

Most other indexes of manufacturing activity also indicated a sharp acceleration in May. The capacity utilization index rose notably from 18.7 to 32.2, and the shipments index jumped 20 points to 39.5. Demand growth picked up as the growth rate of orders index increased eight points to 26.5. All three measures reached their highest readings since 2006. Meanwhile, the new orders index held steady at 27.7.

Perceptions of broader business conditions were even more positive in May than in April. The general business activity index rose five points to 26.8, and the company outlook index rose four points to 28.0. These readings are far above their respective averages.

Labor market measures suggested stronger growth in employment and notably longer work hours in May. The employment index pushed up six points to 23.4, its highest reading in six years. Twenty-nine percent of firms noted net hiring, compared with 5 percent that noted net layoffs. The hours worked index shot up nine points to 23.2.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through May), and five Fed surveys are averaged (blue, through May) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

Based on these regional surveys, it is possible the ISM manufacturing index will be close to 60 in May (to be released on Friday, June 1st).

Case-Shiller: National House Price Index increased 6.5% year-over-year in March

by Calculated Risk on 5/29/2018 09:13:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3 month average of January, February and March prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Not Slowing Down According to S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.5% annual gain in March, the same as the previous month. The 10-City Composite annual increase came in at 6.5%, up from 6.4% in the previous month. The 20-City Composite posted a 6.8% year-over-year gain, no change from the previous month.

Seattle, Las Vegas, and San Francisco continue to report the highest year-over-year gains among the 20 cities. In March, Seattle led the way with a 13.0% year-over-year price increase, followed by Las Vegas with a 12.4% increase and San Francisco with an 11.3% increase. Twelve of the 20 cities reported greater price increases in the year ending March 2018 versus the year ending February 2018.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.8% in March. The 10-City and 20-City Composites reported increases of 0.9% and 1.0%, respectively. After seasonal adjustment, the National Index recorded a 0.4% month-over-month increase in March. The 10-City and 20-City Composites posted 0.4% and 0.5% month-over-month increases, respectively. All 20 cities reported increases in March before seasonal adjustment, while 19 of 20 cities reported increases after seasonal adjustment.

“The home price increases continue with the National Index rising at 6.5% per year,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “Seattle continues to report the fastest rising prices at 13% per year, double the National Index pace. While Seattle has been the city with the largest gains for 19 months, the ranking among other cities varies. Las Vegas and San Francisco saw the second and third largest annual gains of 12.4% and 11.3%. A year ago, they ranked 10th and 16th. Any doubts that real, or inflation-adjusted, home prices are climbing rapidly are eliminated by considering Chicago; the city reported the lowest 12-month gain among all cities in the index of 2.8%, almost a percentage point ahead of the inflation rate.

“Looking across various national statistics on sales of new or existing homes, permits for new construction, and financing terms, two figures that stand out are rapidly rising home prices and low inventories of existing homes for sale. Months-supply, which combines inventory levels and sales, is currently at 3.8 months, lower than the levels of the 1990s, before the housing boom and bust. Until inventories increase faster than sales, or the economy slows significantly, home prices are likely to continue rising. Compared to the price gains of the last boom in the early 2000s, things are calmer today. Gains in the National Index peaked at 14.5% in September 2005, more quickly than Seattle is rising now.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 1.1% from the peak, and up 0.4% in March (SA).

The Composite 20 index is 1.8% above the bubble peak, and up 0.5% (SA) in March.

The National index is 8.8% above the bubble peak (SA), and up 0.4% (SA) in March. The National index is up 47.1% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 6.4% compared to March 2017. The Composite 20 SA is up 6.7% year-over-year.

The National index SA is up 6.5% year-over-year.

Note: According to the data, prices increased in 19 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, May 28, 2018

Tuesday: Case-Shiller House Prices, Dallas Fed Mfg

by Calculated Risk on 5/28/2018 09:39:00 PM

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for March. The consensus is for a 6.4% year-over-year increase in the Comp 20 index for March.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for May. This is the last of the regional Fed surveys for May.

Hotels: Occupancy Rate decreases Year-over-Year, Close to Record Annual Pace

by Calculated Risk on 5/28/2018 10:44:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 19 May

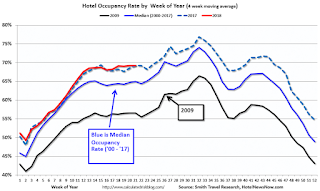

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 13-19 May 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 14-20 May 2017, the industry recorded the following:

• Occupancy: -0.5% to 70.2%

• Average daily rate (ADR): +3.5% to US$132.36

• Revenue per available room (RevPAR): +3.0% to US$92.92

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The occupancy rate, to date, is slightly ahead of the record year in 2017 (2017 finished strong due to the impact of the hurricanes).

On a seasonal basis, the occupancy rate will pick up soon when the summer travel season starts.

Data Source: STR, Courtesy of HotelNewsNow.com