by Calculated Risk on 5/10/2018 11:09:00 AM

Thursday, May 10, 2018

Key Measures Show Inflation increased YoY in April

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.9% annualized rate) in April. The 16% trimmed-mean Consumer Price Index also rose 0.2% (1.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for April here. Motor fuel was up 43% annualized in April.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (2.7% annualized rate) in April. The CPI less food and energy rose 0.1% (1.2% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.6%, the trimmed-mean CPI rose 2.0%, and the CPI less food and energy rose 2.1%. Core PCE is for February and increased 1.9% year-over-year.

On a monthly basis, median CPI was at 2.9% annualized, trimmed-mean CPI was at 1.9% annualized, and core CPI was at 1.2% annualized.

Using these measures, inflation increased year-over-year in April. Overall, these measures are close to the Fed's 2% target.

Weekly Initial Unemployment Claims at 211,000, 4-week average lowest since 1969

by Calculated Risk on 5/10/2018 08:35:00 AM

The DOL reported:

In the week ending May 5, the advance figure for seasonally adjusted initial claims was 211,000, unchanged from the previous week's unrevised level of 211,000. The 4-week moving average was 216,000, a decrease of 5,500 from the previous week's unrevised average of 221,500. This is the lowest level for this average since December 20, 1969 when it was 214,500.The previous week was unrevised.

Claims taking procedures in Puerto Rico and in the Virgin Islands have still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 216,000.

This was lower than the consensus forecast. The low level of claims suggest few layoffs.

BLS: CPI increased 0.2% in April, Core CPI increased 0.1%

by Calculated Risk on 5/10/2018 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in April on a seasonally adjusted basis after falling 0.1 percent in March, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 2.5 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was slightly lower than the consensus forecast of a 0.3% for CPI, and a 0.2% increase in core CPI.

The indexes for gasoline and shelter were the largest factors in the seasonally adjusted increase in the all items index, although the food index increased as well. The gasoline index increased 3.0 percent, more than offsetting declines in other energy component indexes and led to a 1.4-percent rise in the energy index. The food index rose 0.3 percent, with the food at home index rising 0.3 percent and the index for food away from home increasing 0.2 percent.

The index for all items less food and energy rose 0.1 percent in April. ... The all items index rose 2.5 percent for the 12 months ending April; this figure has been mostly trending upward since it was 1.6 percent for the period ending June 2017. The index for all items less food and energy rose 2.1 percent for the 12 months ending April.

emphasis added

Wednesday, May 09, 2018

"Mortgage Rates Back at 4-Year Highs Ahead of Inflation Data"

by Calculated Risk on 5/09/2018 06:03:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Back at 4-Year Highs Ahead of Inflation Data

Mortgage rates moved higher today as bond markets braced for impact from several upcoming events. ... [T]omorrow's Consumer Price Index--a key inflation report that can have an immediate impact on the bond market. If inflation is lower than expected, rates could recover. But if it's as strong as expected (or higher), rates could easily continue higher. That would be unfortunate as today's rate sheets are very close to being the worst in more than 4 years, depending on the lender. [30YR FIXED - 4.625%-4.75%]Thursday:

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 211 thousand the previous week.

• Also at 8:30 AM, The Consumer Price Index for April from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.2% increase in core CPI.

Las Vegas: Convention Attendance Sluggish in Q1 2018, Visitor Traffic off Slightly

by Calculated Risk on 5/09/2018 02:31:00 PM

During the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic recovered to new record highs.

However, in 2017, visitor traffic declined 1.7% compared to 2016, but was still 8% above the pre-recession peak.

Convention attendance set a new record in 2017, but is off to a sluggish start in 2018. Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

Convention attendance was down 7.5% in Q1 2018 compared to Q1 2017.

Visitor traffic was down 1.6% in Q1 2018 compared to Q1 2017.

Historically, declines in Las Vegas visitor traffic have been associated with economic weakness, so the sluggish start to 2018 is a little concerning for the Vegas area.

Trends in Educational Attainment in the U.S. Labor Force

by Calculated Risk on 5/09/2018 10:39:00 AM

The first graph shows the unemployment rate by four levels of education (all groups are 25 years and older) through April 2018.

Unfortunately this data only goes back to 1992 and includes only two recessions (the stock / tech bust in 2001, and the housing bust/financial crisis). Clearly education matters with regards to the unemployment rate - and all four groups are generally trending down.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

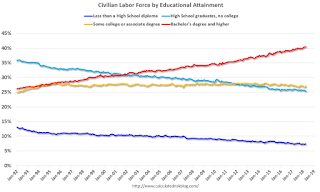

This brings up an interesting question: What is the composition of the labor force by educational attainment, and how has that been changing over time?

Note: Thanks to Tim Duy, Economics Professor at the University of Oregon, and Josh Lehner, at the Oregon Office of Economic Analysis.

Here is some data on the U.S. labor force by educational attainment since 1992.

This is the only category trending up. "Some college" has been steady, and both "high school" and "less than high school" have been trending down.

Based on current trends, probably more than half the labor force will have at least a bachelor's degree sometime in the next decade (2020s).

Some thoughts: Since workers with bachelor's degrees typically have a lower unemployment rate, this is probably a factor in pushing down the overall unemployment rate over time.

Also, I'd guess more education would mean less labor turnover, and that education is a factor in fewer weekly claims (I haven't seen data on unemployment claims by education).

A more educated labor force is one of the reasons I remain optimistic about the future.

MBA: Mortgage Applications Decrease Slightly in Latest Weekly Survey, Refi Index lowest since 2008

by Calculated Risk on 5/09/2018 07:00:00 AM

From the MBA: Mortgage Applications Slightly Decrease in Latest MBA Weekly Survey

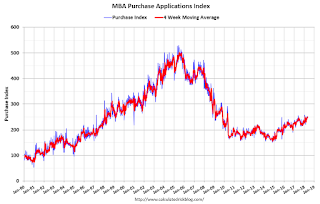

Mortgage applications decreased 0.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 4, 2018.

... The Refinance Index decreased 1 percent from the previous week to its lowest level since October 2008. The seasonally adjusted Purchase Index decreased 0.2 percent from one week earlier. The unadjusted Purchase Index increased 0.4 percent compared with the previous week and was 3 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 4.78 percent from 4.80 percent, with points decreasing to 0.50 from 0.53 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 3% year-over-year.

Tuesday, May 08, 2018

Four Years Ago: Housing Doom and Gloom

by Calculated Risk on 5/08/2018 06:35:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Producer Price Index for April from the BLS. The consensus is a 0.3% increase in PPI, and a 0.2% increase in core PPI.

Four years ago, there were numerous "doom and gloom" stories about housing. I responded with What's Right with Housing? written on May 6, 2014. I wrote:

The first mistake these writers make is they are asking the wrong question. Of course housing is lagging the recovery because of the residual effects of the housing bust and financial crisis (this lag was predicted on this blog and elsewhere for years - it should not be a surprise).What has happened since?

The correct question is: What's right with housing? And there is plenty.

...

Housing is a slow moving market - and the recovery will not be smooth or fast with all the residual problems. But overall housing is clearly improving and the outlook remains positive for the next few years.

Housing starts are up 32% from March 2014 to March 2018.

New home sales are up 69% from March 2014 to March 2018.

Existing home sales are up 20%.

House prices are up 22% (Case-Shiller National Index February 2014 to February 2018).

When I started this blog in 2005, I was very bearish on example. (For example, see: Housing: Speculation is the Key written in April 2005)

Some day I'll be bearish again on housing, but not now. Clearly those bearish on housing in 2014 were wrong.

Update: Housing Inventory Tracking

by Calculated Risk on 5/08/2018 01:50:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

The graph below shows the year-over-year change for non-contingent inventory in Las Vegas (through April), Phoenix and Sacramento (through March), and also total existing home inventory as reported by the NAR (also through March 2018).

This shows the year-over-year change in inventory for Phoenix, Sacramento, and Las Vegas. The black line if the year-over-year change in inventory as reported by the NAR.

Note that inventory in Sacramento was up 19% year-over-year in March (inventory was still very low), and has increased year-over-year for six consecutive months.

Also note the inventory is still down 19.5% in Las Vegas (red), but the YoY decline has been getting smaller - and it is very possible that inventory will up year-over-year in Las Vegas later this year.

I'll try to add a few other markets.

Inventory is a key for the housing market, and I will be watching inventory for the impact of the new tax law and higher mortgage rates on housing.

Las Vegas Real Estate in April: Sales Up Slightly YoY, Inventory down 19%

by Calculated Risk on 5/08/2018 12:11:00 PM

This is a key distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Southern Nevada home prices keep climbing while supply keeps shrinking; GLVAR housing statistics for April 2018

Local home prices kept climbing through April as the local housing supply continued contracting, according to a report released today by the Greater Las Vegas Association of REALTORS®(GLVAR).1) Overall sales were up slightly year-over-year from 3,529 in April 2017 to 3,571 in April 2018.

...

The low supply may also be slowing down local home sales, which have been running roughly even with last year’s sales pace so far this year after increasing in recent years. The total number of existing local homes, condos and townhomes sold during April was 3,571. Compared to one year ago, April sales were up 0.4 percent for homes and up 4.5 percent for condos and townhomes.

...

By the end of April, GLVAR reported 3,816 single-family homes listed for sale without any sort of offer. That’s down 24.9 percent from one year ago. For condos and townhomes, the 790 properties listed without offers in April represented a 23.6 percent increase from one year ago.

...

Meanwhile, the number of so-called distressed sales continues to decline. GLVAR reported that short sales and foreclosures combined accounted for 2.5 percent of all existing local home sales in April, down from 8.4 percent of all sales one year ago.

emphasis added

2) Active inventory (single-family and condos) is down sharply from a year ago, from a total of 5,722 in April 2017 to 4,606 in April 2018. Note: Total inventory was down 19.5% year-over-year - a large decline - but the smallest year-over-year decline in inventory since November 2016.

Watch inventory. Last year, inventory declined almost 500 homes from March to April, this year inventory was up slightly from March to April. The inventory decline might be nearing an end in Las Vegas (and elsewhere).

3) Fewer distressed sales.