by Calculated Risk on 5/01/2018 10:06:00 AM

Tuesday, May 01, 2018

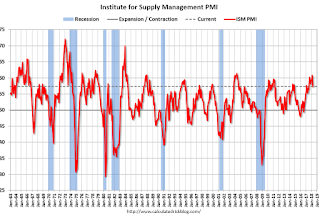

ISM Manufacturing index decreased to 57.3 in April

The ISM manufacturing index indicated expansion in April. The PMI was at 57.3% in April, down from 59.3% in March. The employment index was at 54.2%, down from 57.3% last month, and the new orders index was at 61.2%, down from 61.9%.

From the Institute for Supply Management: April 2018 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in April, and the overall economy grew for the 108th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The April PMI® registered 57.3 percent, a decrease of 2 percentage points from the March reading of 59.3 percent. The New Orders Index registered 61.2 percent, a decrease of 0.7 percentage point from the March reading of 61.9 percent. The Production Index registered 57.2 percent, a 3.8 percentage point decrease compared to the March reading of 61 percent. The Employment Index registered 54.2 percent, a decrease of 3.1 percentage points from the March reading of 57.3 percent. The Supplier Deliveries Index registered 61.1 percent, a 0.5 percentage point increase from the March reading of 60.6 percent. The Inventories Index registered 52.9 percent, a decrease of 2.6 percentage points from the March reading of 55.5 percent. The Prices Index registered 79.3 percent in April, a 1.2 percentage point increase from the March reading of 78.1 percent, indicating higher raw materials prices for the 26th consecutive month. Comments from the panel reflect continued expanding business strength. Demand remains strong, with the New Orders Index at 60 or above for the 12th straight month, and the Customers’ Inventories Index remaining at low levels. The Backlog of Orders Index continued expanding, with its highest reading since May 2004, when it registered 63 percent. Consumption, described as production and employment, continues to expand, but has been restrained by labor and skill shortages. Inputs, expressed as supplier deliveries, inventories and imports, declined overall, due primarily to inventory reductions likely led by supplier performance restrictions. Lead time extensions, steel and aluminum disruptions, supplier labor issues, and transportation difficulties continue. Export orders remained strong. The Prices Index is at its highest level since April 2011, when it registered 82.6 percent. In April, price increases occurred across 17 of 18 industry sectors. Demand remains robust, but the nation’s employment resources and supply chains continue to struggle.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 58.7%, and suggests manufacturing expanded at a slower pace in April than in March.

Still a solid report.

CoreLogic: House Prices up 7.0% Year-over-year in March

by Calculated Risk on 5/01/2018 08:52:00 AM

Notes: This CoreLogic House Price Index report is for March. The recent Case-Shiller index release was for February. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Up Again in March, This Time by 7 Percent

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for March 2018, which shows home prices rose both year over year and month over month. Home prices increased nationally by 7 percent year over year from March 2017 to March 2018, while on a month-over-month basis, prices increased by 1.4 percent in March 2018 – compared with February 2018 – according to the CoreLogic HPI.CR Note: The CoreLogic YoY increase has been in the 5% to 7% range for the last couple of years. This is towards the top end of that range. The year-over-year comparison has been positive for six consecutive years since turning positive year-over-year in February 2012.

Looking ahead, the CoreLogic HPI Forecast indicates that the national home-price index is projected to continue to increase by 5.2 percent on a year-over-year basis from March 2018 to March 2019. On a month-over-month basis, home prices are expected to rise 0.1 percent in April 2018. The CoreLogic HPI Forecast is a projection of home prices that is calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“Home prices grew briskly in the first quarter of 2018,” said Dr. Frank Nothaft, chief economist for CoreLogic. “High demand and limited supply have pushed home prices above where they were in early 2006. New construction still lags historically normal levels, keeping upward pressure on prices.”

emphasis added

Monday, April 30, 2018

Tuesday: ISM Manufacturing, Construction Spending, Auto Sales

by Calculated Risk on 4/30/2018 07:52:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Mostly Sideways to Begin Busy Week

Mortgage rates didn't move much today, which keeps them right in line with last week's lowest levels. That sounds pretty good! Unfortunately, any time prior to last week, those "lowest levels" would have been the highest in more than 4 years. [30YR FIXED - 4.625%-4.75%]Tuesday:

emphasis added

• At 10:00 AM ET, ISM Manufacturing Index for April. The consensus is for the ISM to be at 58.7, down from 59.3 in March. The PMI was at 59.3% in March, the employment index was at 57.3%, and the new orders index was at 61.9%.

• Also at 10:00 AM, Construction Spending for March. The consensus is for a 0.5% increase in construction spending.

• All day, Light vehicle sales for April. The consensus is for light vehicle sales to be 17.2 million SAAR in March, down from 17.4 million in March (Seasonally Adjusted Annual Rate).

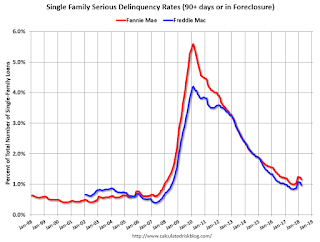

Fannie Mae: Mortgage Serious Delinquency rate decreased in March

by Calculated Risk on 4/30/2018 04:21:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate decreased to 1.16% in March, down from 1.22% in January. The serious delinquency rate is up from 1.12% in March 2017.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (3% of portfolio), 3.24% are seriously delinquent. For loans made in 2005 through 2008 (6% of portfolio), 6.22% are seriously delinquent, For recent loans, originated in 2009 through 2018 (91% of portfolio), only 0.51% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

The recent increase in the delinquency rate was due to the hurricanes - no worries about the overall market (These are serious delinquencies, so it took three months late to be counted).

After the hurricane bump, the rate will probably decline to 0.5 to 0.7 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Energy expenditures as a percentage of PCE

by Calculated Risk on 4/30/2018 02:09:00 PM

Note: Back in early 2016, I noted that energy expenditures as a percentage of PCE had hit an all time low. Here is an update through the March 2018 PCE report released this morning.

Below is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through March 2018.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA Table 2.3.5U.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

In March 2018, energy expenditures as a percentage of PCE increased to 4.05% of PCE, up from the all time low two years ago of 3.6%.

Historically this is still a low percentage of PCE for energy expenditures, even though oil prices are up sharply over the last two years (WTI was at $37.55 per barrel in March 2016 and has risen to almost $69 per barrel today).

Earlier: Chicago PMI Increased Slightly in April

by Calculated Risk on 4/30/2018 01:10:00 PM

From the Chicago PMI: Chicago Business Barometer Rises to 57.6 in April

The MNI Chicago Business Barometer rose 0.2 points to 57.6 in April, up from 57.4 in March, snapping a three-month downward trend.This was slightly below the consensus forecast of 57.8, but still a decent reading.

Business activity continued to rise at a solid pace in April, with growth in firms’ operations up for the first time this year, albeit marginally. Three of the five Barometer components fell on the month, with only Production and Supplier Deliveries finding room to grow.

...

“While the MNI Chicago Business Barometer ended a threemonth falling streak in April, supply constraints faced by firms intensified and continue to weigh on activity. Longer delivery times are proving attritive, while dearer materials bite further into margins” said Jamie Satchi, Economist at MNI Indicators.

“Uncertainty among suppliers appears to be assisting the upward march in prices, but the majority of firms were optimistic any negative impact stemming directly from recently implemented tariffs would be minimal,” he added.

emphasis added

Dallas Fed: "Growth in Texas Manufacturing Rebounds Strongly"

by Calculated Risk on 4/30/2018 10:37:00 AM

From the Dallas Fed: Growth in Texas Manufacturing Rebounds Strongly

Texas factory activity rose markedly in April after posting slower growth in March, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, increased 11 points to 25.3.This was the last of the regional Fed surveys for April.

Other indexes of manufacturing activity also rose sharply in April. The new orders and growth rate of orders indexes jumped to their highest readings this year, 27.9 and 18.9, respectively. The capacity utilization index climbed eight points to 18.7, and the shipments index rose nine points to 19.3.

Perceptions of broader business conditions remained highly positive on net in April. The general business activity index was largely unchanged at 21.8, and the company outlook index edged up four points to 23.6. Both indexes remained far above their average levels.

Labor market measures suggested stronger growth in employment and work hours in April. The employment index came in at 17.8, up six points from March. Twenty-four percent of firms noted net hiring, compared with 6 percent noting net layoffs. The hours worked index moved up four points to 14.3.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through April), and five Fed surveys are averaged (blue, through April) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through March (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index will be solid again in April, but probably lower than in March (to be released tomorrow, Tuesday, May 1st).

NAR: Pending Home Sales Index Increased 0.4% in March, Down 3.0% Year-over-year

by Calculated Risk on 4/30/2018 10:05:00 AM

From the NAR: Pending Home Sales Move Up 0.4 Percent in March

Pending home sales inched higher for the second consecutive month in March, but unrelenting inventory constraints once again kept overall activity below year ago levels, according to the National Association of Realtors®.This was below expectations of a 1.0% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in April and May.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, inched up 0.4 percent to 107.6 in March from a downwardly revised 107.2 in February. Even with last month's increase in activity, the index declined on an annualized basis (3.0 percent) for the third straight month.

...

The PHSI in the Northeast fell 5.6 percent to 90.6 in March, and is now 8.1 percent below a year ago. In the Midwest the index rose 2.4 percent to 101.3 in March, but is 6.0 percent lower than March 2017. Pending home sales in the South climbed 2.5 percent to an index of 128.6 in March, and are 0.3 percent higher than last March. The index in the West declined 1.1 percent in March to 94.7, and is 2.2 percent below a year ago.

emphasis added

Personal Income increased 0.3% in March, Spending increased 0.4%

by Calculated Risk on 4/30/2018 08:36:00 AM

The BEA released the Personal Income and Outlays report for March:

Personal income increased $47.8 billion (0.3 percent) in March according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $39.8 billion (0.3 percent) and personal consumption expenditures (PCE) increased $61.7 billion (0.4 percent).The March PCE price index increased 2.0 percent year-over-year and the March PCE price index, excluding food and energy, increased 1.9 percent year-over-year.

...

Real PCE increased 0.4 percent. The PCE price index increased less than 0.1 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through March 2018 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was slightly below expectations, and the increase in PCE was at expectations.

PCE growth was weak in Q1, however inflation is now near the Fed's target.

Sunday, April 29, 2018

Monday: Personal Income, Chicago PMI, Pending Home Sales

by Calculated Risk on 4/29/2018 10:01:00 PM

Weekend:

• Schedule for Week of Apr 29, 2018

Monday:

• At 8:30 AM ET, Personal Income and Outlays for March. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:45 AM, Chicago Purchasing Managers Index for April. The consensus is for a reading of 57.8, up from 57.4 in March.

• At 10:00 AM, Pending Home Sales Index for March. The consensus is for a 1.0% increase in the index.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for April. This is the last of the regional Fed surveys for April.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 7, and DOW futures are up 50 (fair value).

Oil prices were mixed over the last week with WTI futures at $67.93 per barrel and Brent at $74.22 per barrel. A year ago, WTI was at $49, and Brent was at $50 - so oil prices are up about 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.81 per gallon. A year ago prices were at $2.39 per gallon - so gasoline prices are up 42 cents per gallon year-over-year.