by Calculated Risk on 2/01/2018 12:01:00 PM

Thursday, February 01, 2018

January Employment Preview

On Friday at 8:30 AM ET, the BLS will release the employment report for January. The consensus, according to Bloomberg, is for an increase of 175,000 non-farm payroll jobs in January (with a range of estimates between 150,000 to 205,000), and for the unemployment rate to be unchanged at 4.1%.

The BLS reported 148,000 jobs added in December.

Here is a summary of recent data:

• The ADP employment report showed an increase of 234,000 private sector payroll jobs in January. This was well above consensus expectations of 176,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index decreased in January to 54.2%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll increased about 3,000 in January. The ADP report indicated manufacturing jobs increased 12,000 in January.

The ISM non-manufacturing employment index will be released next Monday.

• Initial weekly unemployment claims averaged 234,500 in January, down from 241,750 in December. For the BLS reference week (includes the 12th of the month), initial claims were at 216,000, down from 245,000 during the reference week in December.

The significant decrease during the reference week suggests a stronger employment report in January than in December.

• The final January University of Michigan consumer sentiment index decreased to 94.4 from the December reading of 95.9. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Conclusion: In general, these reports suggest a solid employment report. There was some weather issues early in the month, but mostly before the reference week. My guess - probably influenced by the low number of unemployment claims during the reference week - is that the employment report will be above the consensus in January.

Note from the BLS: "Effective with the release of The Employment Situation for January 2018 on February 2, 2018, the establishment survey will introduce revisions to nonfarm payroll employment, hours, and earnings data to reflect the annual benchmark adjustment for March 2017 and updated seasonal adjustment factors. Not seasonally adjusted data beginning with April 2016 and seasonally adjusted data beginning with January 2013 are subject to revision. Consistent with standard practice, some historical data may be subject to revisions resulting from issues identified during the benchmark process." The preliminary benchmark revision showed an increase of 95,000 jobs.

Construction Spending increased in December

by Calculated Risk on 2/01/2018 11:19:00 AM

Earlier today, the Census Bureau reported that overall construction spending increased in December:

Construction spending during December 2017 was estimated at a seasonally adjusted annual rate of $1,253.3 billion, 0.7 percent above the revised November estimate of $1,245.1 billion. The December figure is 2.6 percent above the December 2016 estimate of $1,221.6 billion.Both private and public spending increased in December:

Spending on private construction was at a seasonally adjusted annual rate of $963.2 billion, 0.8 percent above the revised November estimate of $955.9 billion ...

In December, the estimated seasonally adjusted annual rate of public construction spending was $290.0 billion, 0.3 percent above the revised November estimate of $289.1 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is still 22% below the bubble peak.

Non-residential spending has been declining over the last year, but is 5% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 11% below the peak in March 2009, and 10% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 6%. Non-residential spending is down 3% year-over-year. Public spending is up 4% year-over-year.

This was above the consensus forecast of a 0.5% increase for December, however spending for the previous two months was revised down.

ISM Manufacturing index decreased to 59.1 in January

by Calculated Risk on 2/01/2018 10:04:00 AM

The ISM manufacturing index indicated expansion in January. The PMI was at 59.1% in January, down from 59.3% in December. The employment index was at 54.2%, down from 57.2% last month, and the new orders index was at 65.4%, down from 67.4%.

From the Institute for Supply Management: January 2018 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in January, and the overall economy grew for the 105th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: "The January PMI® registered 59.1 percent, a decrease of 0.2 percentage point from the seasonally adjusted December reading of 59.3 percent. The New Orders Index registered 65.4 percent, a decrease of 2 percentage points from the seasonally adjusted December reading of 67.4 percent. The Production Index registered 64.5 percent, a 0.7 percentage point decrease compared to the seasonally adjusted December reading of 65.2 percent. The Employment Index registered 54.2 percent, a decrease of 3.9 percentage points from the seasonally adjusted December reading of 58.1 percent. The Supplier Deliveries Index registered 59.1 percent, a 1.9 percentage point increase from the seasonally adjusted December reading of 57.2 percent. The Inventories Index registered 52.3 percent, an increase of 3.8 percentage points from the December reading of 48.5 percent. The Prices Index registered 72.7 percent in January, a 4.4 percentage point increase from the December reading of 68.3 percent, indicating higher raw materials prices for the 23rd consecutive month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 58.7%, and suggests manufacturing expanded at a slightly slower pace in January than in December.

A solid report.

Weekly Initial Unemployment Claims decrease to 230,000

by Calculated Risk on 2/01/2018 08:33:00 AM

The DOL reported:

In the week ending January 27, the advance figure for seasonally adjusted initial claims was 230,000, a decrease of 1,000 from the previous week's revised level. The previous week's level was revised down by 2,000 from 233,000 to 231,000. The 4-week moving average was 234,500, a decrease of 5,000 from the previous week's revised average. The previous week's average was revised down by 500 from 240,000 to 239,500.The previous week was revised down.

Claims taking procedures in Puerto Rico and in the Virgin Islands have still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 234,500.

This was lower than the consensus forecast. The low level of claims suggest relatively few layoffs.

Wednesday, January 31, 2018

Thursday: Unemployment Claims, ISM Mfg Index, Construction Spending, Vehicle Sales

by Calculated Risk on 1/31/2018 08:08:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 235 thousand initial claims, up from 233 thousand the previous week.

• At 10:00 AM, ISM Manufacturing Index for January. The consensus is for the ISM to decrease to 58.7. The PMI was at 59.7% in December, the employment index was at 57.0%, and the new orders index was at 69.4%.

• Also at 10:00 AM, Construction Spending for December. The consensus is for a 0.5% increase in construction spending.

• All day, Light vehicle sales for January. The consensus is for light vehicle sales to be 17.3 million SAAR in January, down from 17.8 million in December (Seasonally Adjusted Annual Rate).

Fannie Mae: Mortgage Serious Delinquency rate increased in December due to Hurricanes

by Calculated Risk on 1/31/2018 04:52:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate increased to 1.24% in December, up from 1.12% in November. The serious delinquency rate is up from 1.20% in December 2016.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (4% of portfolio), 3.28% are seriously delinquent. For loans made in 2005 through 2008 (6% of portfolio), 6.55% are seriously delinquent, For recent loans, originated in 2009 through 2017 (90% of portfolio), only 0.53% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

This increase in the delinquency rate was due to the hurricanes - no worries about the overall market - and we might see a further increase over the next month or so (These are serious delinquencies, so it takes three months late to be counted).

After the hurricane bump, maybe the rate will decline to 0.5 to 0.7 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

FOMC Statement: No Change in Policy

by Calculated Risk on 1/31/2018 02:02:00 PM

Information received since the Federal Open Market Committee met in December indicates that the labor market has continued to strengthen and that economic activity has been rising at a solid rate. Gains in employment, household spending, and business fixed investment have been solid, and the unemployment rate has stayed low. On a 12-month basis, both overall inflation and inflation for items other than food and energy have continued to run below 2 percent. Market-based measures of inflation compensation have increased in recent months but remain low; survey-based measures of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with further gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market conditions will remain strong. Inflation on a 12‑month basis is expected to move up this year and to stabilize around the Committee's 2 percent objective over the medium term. Near-term risks to the economic outlook appear roughly balanced, but the Committee is monitoring inflation developments closely.

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1-1/4 to 1‑1/2 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee will carefully monitor actual and expected inflation developments relative to its symmetric inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant further gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

Voting for the FOMC monetary policy action were Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Thomas I. Barkin; Raphael W. Bostic; Lael Brainard; Loretta J. Mester; Jerome H. Powell; Randal K. Quarles; and John C. Williams.

emphasis added

NAR: Pending Home Sales Index Increased 0.5% in December, Up 0.5% Year-over-year

by Calculated Risk on 1/31/2018 10:05:00 AM

From the NAR: Pending Home Sales Tick Up 0.5 Percent in December

Pending home sales were up slightly in December for the third consecutive month, according to the National Association of Realtors®. In 2018, existing-home sales and price growth are forecast to moderate, primarily because of the new tax law's expected impact in high-cost housing markets.This was close to expectations of a 0.4% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in January and February.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, moved higher 0.5 percent to 110.1 in December from an upwardly revised 109.6 in November. With last month's modest increase, the index is now 0.5 percent above a year ago.

...

The PHSI in the Northeast dipped 5.1 percent to 93.9 in December, and is now 2.7 percent below a year ago. In the Midwest the index decreased 0.3 percent to 105.0 in December, but is still 0.3 percent higher than December 2016.

Pending home sales in the South grew 2.6 percent to an index of 126.9 in December and are now 4.0 percent higher than last December. The index in the West rose 1.5 percent in December to 101.7, but is still 3.1 percent below a year ago.

emphasis added

ADP: Private Employment increased 234,000 in January

by Calculated Risk on 1/31/2018 08:19:00 AM

Private sector employment increased by 234,000 jobs from December to January according to the January ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 195,000 private sector jobs added in the ADP report.

...

“We’ve kicked off the year with another month of unyielding job gains,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Service providers were firing on all cylinders, posting their strongest gain in more than a year. We also saw robust hiring from midsize and large companies, while job growth in smaller firms slowed slightly.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market juggernaut marches on. Given the strong January job gain, 2018 is on track to be the eighth consecutive year in which the economy creates over 2 million jobs. If it falls short, it is likely because businesses can’t find workers to fill all the open job positions.”

The BLS report for January will be released Friday, and the consensus is for 176,000 non-farm payroll jobs added in January.

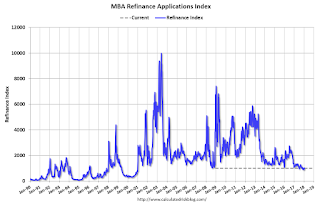

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 1/31/2018 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Surve

Mortgage applications decreased 2.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 26, 2018.

... The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index increased 15 percent compared with the previous week and was 10 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to its highest level since March 2017, 4.41 percent, from 4.36 percent, with points increasing to 0.56 from 0.54 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 10% year-over-year.