by Calculated Risk on 1/04/2018 08:36:00 AM

Thursday, January 04, 2018

Weekly Initial Unemployment Claims increase to 250,000

The DOL reported:

In the week ending December 30, the advance figure for seasonally adjusted initial claims was 250,000, an increase of 3,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 245,000 to 247,000. The 4-week moving average was 241,750, an increase of 3,500 from the previous week's revised average. The previous week's average was revised up by 500 from 237,750 to 238,250.The previous week was revised up.

Claims taking procedures continue to be disrupted in the Virgin Islands. The claims taking process in Puerto Rico has still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 241,750.

This was higher than the consensus forecast. The low level of claims suggest relatively few layoffs.

ADP: Private Employment increased 250,000 in December

by Calculated Risk on 1/04/2018 08:20:00 AM

Private sector employment increased by 250,000 jobs from November to December according to the December ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was well above the consensus forecast for 185,000 private sector jobs added in the ADP report.

...

“We’ve seen yet another month where the labor market has shown no signs of slowing,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Throughout the year there was significant growth in services except for an overall loss of jobs in the shrinking information sector. Looking at company size, small businesses finished out 2017 on a high note adding more than double their monthly average for the past six months.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market ended the year strongly. Robust Christmas sales prompted retailers and delivery services to add to their payrolls. The tight labor market will get even tighter, raising the specter that it will overheat.”

The BLS report for December will be released Friday, and the consensus is for 190,000 non-farm payroll jobs added in December.

Wednesday, January 03, 2018

Thursday: Unemployment Claims, ADP Employment

by Calculated Risk on 1/03/2018 07:02:00 PM

A brief excerpt from a note by Goldman Sachs economists Daan Struyven and Marty Young:

Without consideration of tax reform, we would be constructive on US house prices. Taking tax reform into account, we expect house price appreciation to decelerate from last year’s strong 6%. We still look for homeownership rates and single-family starts to grow but see some modest downside risk from tax reform.Thursday:

• At 8:15 AM, The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 185,000 payroll jobs added in December, down from 190,000 added in November.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, down from 245 thousand the previous week.

• Early, Reis Q4 2017 Mall Survey of rents and vacancy rates.

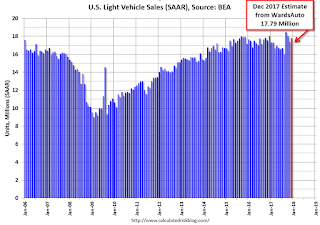

U.S. Light Vehicle Sales at 17.79 million annual rate in December

by Calculated Risk on 1/03/2018 03:19:00 PM

Based on a preliminary estimate from WardsAuto, light vehicle sales were at a 17.79 million SAAR in December.

That is down 1.5% from December 2016, and up 2.2% from last month.

This puts annual sales 17.14 million, down from 17.46 million in 2016.

The top five years for auto sales are (2017 is fourth overall).

| Top 5 Year Light Vehicle Sales | ||

|---|---|---|

| Year | Sales (000s) | |

| 2016 | 17,464.8 | |

| 2015 | 17,396.3 | |

| 2000 | 17,349.7 | |

| 20171 | 17,135.4 | |

| 2001 | 17,122.4 | |

| 1Includes estimate for Dec 2017 | ||

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for December (red, light vehicle sales of 17.79 million SAAR from WardsAuto).

This was above the consensus forecast of 17.5 million for December.

Still - even with the bump in sales following the hurricanes - vehicle sales were down year-over-year in 2017, following two consecutive years of record sales.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.Note: dashed line is current estimated sales rate.

FOMC Minutes: New Tax Law "would likely provide a modest boost to capital spending"

by Calculated Risk on 1/03/2018 02:08:00 PM

A couple of excerpts, the first on the economic impact of the new tax law, and the second on the yield curve.

From the Fed: Minutes of the Federal Open Market Committee, December 12-13, 2017:

Many participants judged that the proposed changes in business taxes, if enacted, would likely provide a modest boost to capital spending, although the magnitude of the effects was uncertain. The resulting increase in the capital stock could contribute to positive supply-side effects, including an expansion of potential output over the next few years. However, some business contacts and respondents to business surveys suggested that firms were cautious about expanding capital spending in response to the proposed tax changes or noted that the increase in cash flow that would result from corporate tax cuts was more likely to be used for mergers and acquisitions or for debt reduction and stock buybacks.

...

Meeting participants also discussed the recent narrowing of the gap between the yields on long- and short-maturity nominal Treasury securities, which had resulted in a flatter profile of the term structure of interest rates. Among the factors contributing to the flattening, participants pointed to recent increases in the target range for the federal funds rate, reductions in investors' estimates of the longer-run neutral real interest rate, lower longer-term inflation expectations, and lower term premiums. They generally agreed that the current degree of flatness of the yield curve was not unusual by historical standards. However, several participants thought that it would be important to continue to monitor the slope of the yield curve. Some expressed concern that a possible future inversion of the yield curve, with short-term yields rising above those on longer-term Treasury securities, could portend an economic slowdown, noting that inversions have preceded recessions over the past several decades, or that a protracted yield curve inversion could adversely affect the financial condition of banks and other financial institutions and pose risks to financial stability. A couple of other participants viewed the flattening of the yield curve as an expected consequence of increases in the Committee's target range for the federal funds rate, and judged that a yield curve inversion under such circumstances would not necessarily foreshadow or cause an economic downturn. It was also noted that contacts in the financial sector generally did not express concern about the recent flattening of the term structure.

emphasis added

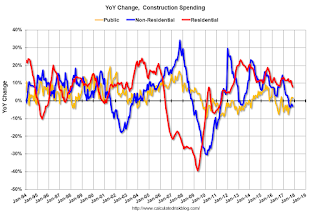

Construction Spending increased in November

by Calculated Risk on 1/03/2018 11:59:00 AM

Earlier today, the Census Bureau reported that overall construction spending increased in November:

Construction spending during November 2017 was estimated at a seasonally adjusted annual rate of $1,257.0 billion, 0.8 percent above the revised October estimate of $1,247.1 billion. The November figure is 2.4 percent above the November 2016 estimate of $1,227.0 billion.Both private and public spending increased in November:

Spending on private construction was at a seasonally adjusted annual rate of $964.3 billion, 1.0 percent above the revised October estimate of $955.1 billion. ...

In November, the estimated seasonally adjusted annual rate of public construction spending was $292.7 billion, 0.2 percent above the revised October estimate of $292.0 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is still 22% below the bubble peak.

Non-residential spending has been declining over the last year, but is 5% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 10% below the peak in March 2009, and 11% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 8%. Non-residential spending is down 3% year-over-year. Public spending is up 2% year-over-year.

This was above the consensus forecast of a 0.6% increase for November.

ISM Manufacturing index increased to 59.7 in December

by Calculated Risk on 1/03/2018 10:04:00 AM

The ISM manufacturing index indicated expansion in December. The PMI was at 59.7% in December, up from 58.2% in November. The employment index was at 57.0%, down from 59.7% last month, and the new orders index was at 69.4%, up from 64.0%.

From the Institute for Supply Management: December 2017 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in December, and the overall economy grew for the 103rd consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report on Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The December PMI® registered 59.7 percent, an increase of 1.5 percentage points from the November reading of 58.2 percent. The New Orders Index registered 69.4 percent, an increase of 5.4 percentage points from the November reading of 64 percent. The Production Index registered 65.8 percent, a 1.9 percentage point increase compared to the November reading of 63.9 percent. The Employment Index registered 57 percent, a decrease of 2.7 percentage points from the November reading of 59.7 percent. The Supplier Deliveries Index registered 57.9 percent, a 1.4 percentage point increase from the November reading of 56.5 percent. The Inventories Index registered 48.5 percent, an increase of 1.5 percentage points from the November reading of 47 percent. The Prices Index registered 69 percent in December, a 3.5 percentage point increase from the November reading of 65.5 percent, indicating higher raw materials prices for the 22nd consecutive month. Comments from the panel reflect expanding business conditions, with new orders and production leading gains; employment expanding at a slower rate; order backlogs expanding at a faster rate; and export orders and imports continuing to grow in December. Supplier deliveries continued to slow (improving) at a faster rate, and inventories continued to contract at a slower rate during the period. Price increases continued at a faster rate. The Customers’ Inventories Index declined and remains at low levels.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 58.0%, and suggests manufacturing expanded at a faster pace in December than in November.

A strong report.

Reis: Office Vacancy Rate unchanged in Q4 at 16.3%

by Calculated Risk on 1/03/2018 09:32:00 AM

Reis released their Q4 2017 Office Vacancy survey this morning. Reis reported that the office vacancy rate was unchanged at 16.3% in Q4, from 16.3% in Q3. This is up from 16.1% in Q4 2016, and down from the cycle peak of 17.6%.

From Reis Economist Barbara Denham:

Maintaining a steady balance between added supply and positive net absorption, the office market recorded no change in vacancy for the third quarter in a row. Currently at 16.3%, the national office vacancy rate has held steady most of the year climbing from a low of 16.1% at year-end 2016. Construction fell to 7.0 million square feet from 8.3 million last quarter and 10.7 million in the fourth quarter of 2016. Net absorption, or occupancy growth, was in line with construction at 5.2 million. Last quarter’s net absorption was 5.3 million square feet, while the fourth quarter of 2016 saw net absorption of 12.9 million square feet. Indeed, the fourth quarter generally sees the highest completion and net absorption numbers in the year; thus, this quarter’s lackluster results were especially noteworthy.

...

The sluggish occupancy growth numbers have kept a lid on rent growth. Although office rents increased 0.6% in the quarter – higher than previous quarters growth rates of 0.4% – asking and effective rents have both only increased 1.8% since the fourth quarter of 2016. This is the third straight quarter that saw a year-over-year effective rent growth rate below 2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.3% in Q4. The office vacancy rate is moving sideways at an elevated level.

Office vacancy data courtesy of Reis.

MBA: Mortgage Applications Decrease over Previous Two Weeks

by Calculated Risk on 1/03/2018 07:00:00 AM

From the MBA: Mortgage Applications Decrease Over Two Week Period in Latest MBA Survey

Mortgage applications decreased 2.8 percent from two weeks earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 29, 2017. The results include adjustments to account for the Christmas holiday.

... The Refinance Index decreased 7 percent from two weeks ago. The seasonally adjusted Purchase Index increased 1 percent from two weeks earlier. The unadjusted Purchase Index decreased 40 percent compared with two weeks ago and was 3 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to 4.16 percent from 4.20 percent, with points decreasing to 0.35 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 3% year-over-year.

Tuesday, January 02, 2018

Wednesday: ISM Mfg, Construciton Spending, Vehicle Sales, FOMC Minutes and More

by Calculated Risk on 1/02/2018 07:29:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Begin New Year Under Pressure

Bond markets weakened somewhat quickly, thus raising the risk that early 2018 would indeed follow-through on the promise that's been broken time and again when the average 30yr fixed rate has attempted to move up from the 4% level. [30YR FIXED - 4.0%-4.125%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• Early, Reis Q4 2017 Office Survey of rents and vacancy rates.

• At 10:00 AM, ISM Manufacturing Index for December. The consensus is for the ISM to be at 58.0. The ISM manufacturing index was at 58.2% in November, the employment index was at 59.7%, and the new orders index was at 64.0%.

• At 10:00 AM, Construction Spending for November. The consensus is for a 0.6% increase in construction spending.

• All day, Light vehicle sales for December. The consensus is for light vehicle sales to be 17.5 million SAAR in December, up from 17.4 million in November (Seasonally Adjusted Annual Rate).

• At 2:00 PM, FOMC Minutes, Meeting of December 12 - 13, 2017