by Calculated Risk on 12/22/2017 06:19:00 PM

Friday, December 22, 2017

Vehicle Forecast: Sales Expected to Exceed 17 million SAAR Again in December

The automakers will report December vehicle sales on Wednesday, Jan 3rd.

Note: There are 26 selling days in December 2017, there were 27 selling days in December 2016.

From WardsAuto: December U.S. Forecast: Market Will Hit 17.5 Million SAAR

The WardsAuto monthly forecast is calling for 1.57 million light vehicles to be delivered over 26 selling days in December.Sales had been below 17 million SAAR (Seasonally Adjusted Annual Rate) for six consecutive months, until September (18.5 million SAAR), October (18.0 million SAAR), and November (17.4 million SAAR) when sales spiked due to buying following Hurricane Harvey.

...

The forecast 17.53 million-unit seasonally adjusted annual rate is above November’s 17.40 million, but below December 2016’s 18.05 million.

emphasis added

Even with the pickup in sales over the last few months, sales were down 1.5% in 2017 through November compared to the same period in 2016.

BLS: Unemployment Rates Lower in 8 states in November; Alabama, California, Hawaii, Mississippi and Texas at New Series Lows

by Calculated Risk on 12/22/2017 04:03:00 PM

First, on migration from Puerto Rico, an except from analysis by Goldman Sachs economist Spencer Hill (this will have impacts on Puerto Rico, and on employment in the U.S. mainland):

A quarter of a million Puerto Ricans have already relocated to the continental United States in the aftermath of Hurricane Maria, and the ultimate scale of migration could be two or three times higher. While press coverage has appropriately focused on the continuing humanitarian crisis, the economic impact of these migration patterns is also significant.From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in November in 8 states, higher in 2 states, and stable in 40 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Twenty-three states had jobless rate decreases from a year earlier, 2 states had increases, and 25 states and the District had little or no change. The national unemployment rate was unchanged from October at 4.1 percent but was 0.5 percentage point lower than in November 2016.

...

Hawaii had the lowest unemployment rate in November, 2.0 percent. The rates in Alabama (3.5 percent), California (4.6 percent), Hawaii (2.0 percent), Mississippi (4.8 percent), and Texas (3.8 percent) set new series lows. ... Alaska had the highest jobless rate, 7.2 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

Fourteen states have reached new all time lows since the end of the 2007 recession. These fourteen states are: Alabama, Arkansas, California, Colorado, Hawaii, Idaho, Maine, Mississippi, North Dakota, Oregon, Tennessee, Texas, Washington, and Wisconsin.

The states are ranked by the highest current unemployment rate. Alaska, at 7.2%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently one state has an unemployment rate at or above 7% (light blue); Only two states and D.C. are at or above 6% (dark blue). The states are Alaska (7.2%) and New Mexico (6.1%). D.C. is at 6.4%.

A few Comments on November New Home Sales

by Calculated Risk on 12/22/2017 12:13:00 PM

New home sales for November were reported at 733,000 on a seasonally adjusted annual rate basis (SAAR). This was well above the consensus forecast, and the highest sales rate since July 2007. However the three previous months were revised down significantly (especially sales for October).

Looking at the regional data, the South saw a 32.5% year-over-year increase that might be related to the hurricanes (some sales might have been delayed).

Sales overall were up 26.6% year-over-year in November.

Earlier: New Home Sales increase to 733,000 Annual Rate in November.

This graph shows new home sales for 2016 and 2017 by month (Seasonally Adjusted Annual Rate).

For the first eleven months of 2017, new home sales are up 9.1% compared to the same period in 2016.

This was a solid year-over-year increase through November.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Kansas City Fed: Regional Manufacturing Activity "Growth Continued at a Solid Pace" in December

by Calculated Risk on 12/22/2017 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Growth Continued at a Solid Pace

The Federal Reserve Bank of Kansas City released the December Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity continued at a solid pace, and optimism remained high.So far, all of the regional Fed surveys have been solid in December.

“Factories in our region remain upbeat about hiring and capital spending as we head into 2018, following strong growth in recent months,” said Wilkerson.

...

The month-over-month composite index was 14 in December, lower than 16 in November and 23 in October. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Growth in factory activity moderated slightly at both durable and non-durable goods plants, particularly for chemicals and plastics products. Month-over-month indexes were mixed but remained generally solid. The shipments, new orders, and order backlog indexes all decreased somewhat. However, the production index edged up from 15 to 21, and the employment and new orders for exports indexes also rose. The finished goods inventory index dropped from 2 to -11, and the raw materials inventory index also decreased.

emphasis added

New Home Sales increase to 733,000 Annual Rate in November

by Calculated Risk on 12/22/2017 10:12:00 AM

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 733 thousand.

The previous three months combined were revised down significantly (October was revised down from 685 thousand to 624 thousand).

"Sales of new single-family houses in November 2017 were at a seasonally adjusted annual rate of 733,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 17.5 percent above the revised October rate of 624,000 and is 26.6 percent above the November 2016 estimate of 579,000. "

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply decreased in November to 4.6 months from 4.9 months in October.

The months of supply decreased in November to 4.6 months from 4.9 months in October. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of November was 283,000. This represents a supply of 4.6 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In November 2017 (red column), 52 thousand new homes were sold (NSA). Last year, 46 thousand homes were sold in November.

The all time high for November was 86 thousand in 2005, and the all time low for November was 20 thousand in 2010.

This was well above expectations of 650,000 sales SAAR, however the previous months were revised down significantly. Some of the recent pickup might be hurricane related (delayed signings). I'll have more later today.

Personal Income increased 0.3% in November, Spending increased 0.6%

by Calculated Risk on 12/22/2017 08:37:00 AM

The BEA released the Personal Income and Outlays report for November:

Personal income increased $54.0 billion (0.3 percent) in November according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $50.9 billion (0.4 percent) and personal consumption expenditures (PCE) increased $87.1 billion (0.6 percent).The November PCE price index increased 1.8 percent year-over-year and the November PCE price index (up from 1.6 percent YoY in October), excluding food and energy, increased 1.5 percent year-over-year (up from 1.4 percent YoY in October).

Real DPI increased 0.1 percent in November and Real PCE increased 0.4 percent. The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through November 2017 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was slightly below expectations, and the increase in PCE was slightly above expectations.

Using the two-month method to estimate Q4 PCE growth, PCE was increasing at a 3.2% annual rate in Q4 2017. (using the mid-month method, PCE was increasing 4.2%). This suggests solid PCE growth in Q4.

Thursday, December 21, 2017

Friday: New Home Sales, Personal Income and Outlays, Durable Goods and More

by Calculated Risk on 12/21/2017 09:08:00 PM

Friday:

• At 8:30 AM ET, Durable Goods Orders for November from the Census Bureau. The consensus is for a 2.0% increase in durable goods orders.

• Also at 8:30 AM, Personal Income and Outlays for November. The consensus is for a 0.4% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 10:00 AM ET: New Home Sales for November from the Census Bureau. The consensus is for 650 thousand SAAR, down from 685 thousand in October.

• Also at 10:00 AM: University of Michigan's Consumer sentiment index (final for December). The consensus is for a reading of 97.0, up from the preliminary reading 96.8.

• Also at 10:00 AM: State Employment and Unemployment (Monthly) for November 2017

• At 11:00 AM: the Kansas City Fed manufacturing survey for December.

Goldman on "Fiscal Boost"

by Calculated Risk on 12/21/2017 04:32:00 PM

A few excerpts from a note by Goldman Sachs economist Alec Phillips:

Overall, the legislation is somewhat more front-loaded than the earlier Senate version, and as a result we expect it will boost growth slightly more in 2018. We estimate a positive impulse from the tax bill of 0.3pp in 2018 and 0.3pp in 2019.

...

We are adjusting our forecasts to reflect the final details of the tax bill, as well as the incremental easing in financial conditions and continued strong economic momentum to end the year. We are increasing our GDP forecasts for 2018 and 2019 by 0.3pp and 0.2pp, respectively, on a Q4/Q4 basis (to 2.6% and 1.7%). We are also lowering our year-end 2018 unemployment rate forecast by two tenths to 3.5%, mainly reflecting a modestly higher expected pace of job growth. We now expect the unemployment rate to bottom in this cycle at 3.3%, at the end of 2019. ...

With more fiscal stimulus comes larger deficits, and we are increasing our deficit projection somewhat to take the recent tax legislation into account, as well as upcoming spending legislation. We expect the deficit to rise to 3.7% of GDP in FY2018 and to 5% of GDP in 2019 ...

Black Knight: National Mortgage Delinquency Rate increased in November due to Hurricanes

by Calculated Risk on 12/21/2017 12:46:00 PM

From Black Knight: Black Knight’s First Look at November 2017 Mortgage Data: Continued Hurricane-Driven Effects Lead to Largest 90-Day Delinquency Increase in Nine Years

• 90-day delinquent mortgage inventory spiked 13 percent in November, the largest monthly increase since 2008 as the financial crisis began to unfoldAccording to Black Knight's First Look report for November, the percent of loans delinquent increased 2.5% in November compared to October, and increased 2.0% year-over-year.

• While 90-day delinquency increases are common in November, the volumes seen this year are noteworthy

• Over 85 percent -- approximately 66,000 -- of the month’s 77,000 new severely delinquent loans can be attributed to hurricanes Harvey and Irma

• As a result, the current estimate of 90-day delinquencies resulting from Harvey and Irma totals over 85,000

The percent of loans in the foreclosure process declined 3.2% in November and were down 33% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.55% in November, up from 4.44% in October.

The percent of loans in the foreclosure process declined in November to 0.66%.

The number of delinquent properties, but not in foreclosure, is up 61,000 properties year-over-year, and the number of properties in the foreclosure process is down 161,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Nov 2017 | Oct 2017 | Nov 2016 | Nov 2015 | |

| Delinquent | 4.55% | 4.44% | 4.46% | 4.92% |

| In Foreclosure | 0.66% | 0.68% | 0.98% | 1.38% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,324,000 | 2,262,000 | 2,263,000 | 2,491,000 |

| Number of properties in foreclosure pre-sale inventory: | 337,000 | 348,000 | 498,000 | 698,000 |

| Total Properties | 2,661,000 | 2,610,000 | 2,761,000 | 3,189,000 |

Earlier: Philly Fed Manufacturing Survey showed "Solid Growth" in December

by Calculated Risk on 12/21/2017 11:15:00 AM

Earlier from the Philly Fed: December 2017 Manufacturing Business Outlook Survey

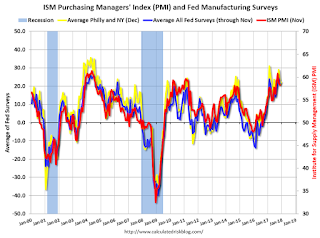

Results from the December Manufacturing Business Outlook Survey suggest that regional manufacturing conditions continued to improve. Indexes for general activity, new orders, and shipments were all positive this month and increased from their readings last month. The firms also reported continued expansion of employment. Most indicators reflecting expectations for the next six months suggest continued optimism.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

...

The diffusion index for current general activity increased from a reading of 22.7 in November to 26.2 this month ... The firms continued to report increases in employment. The current employment index fell 5 points but remained in positive territory, where it has been for 13 consecutive months. More than 29 percent of the responding firms reported increases in employment, while 11 percent of the firms reported decreases this month. The average workweek index declined 3 points after being in positive territory for 14 consecutive months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through December), and five Fed surveys are averaged (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through November (right axis).

This suggests the ISM manufacturing index night increase slightly in December, and show solid expansion again.