by Calculated Risk on 11/13/2017 01:20:00 PM

Monday, November 13, 2017

A few comments on the Seasonal Pattern for House Prices

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

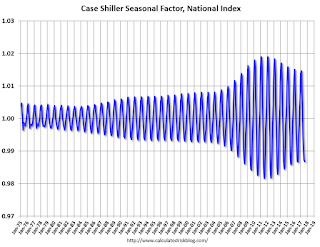

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through August 2017). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

U.S. Heavy Truck Sales up Year-over-year in October

by Calculated Risk on 11/13/2017 09:27:00 AM

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the October 2017 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 181 thousand in April and May 2009, on a seasonally adjusted annual rate basis (SAAR). Then sales increased more than 2 1/2 times, and hit 480 thousand SAAR in June 2015.

Heavy truck sales declined again - probably mostly due to the weakness in the oil sector - and bottomed at 364 thousand SAAR in October 2016.

Click on graph for larger image.

With the increase in oil prices over the last year, heavy truck sales increased too.

Heavy truck sales were at 411 thousand SAAR in October 2017, down from 440 thousand in September, and up from 364 thousand in October 2016.

Sunday, November 12, 2017

Sunday Night Futures

by Calculated Risk on 11/12/2017 07:19:00 PM

Weekend:

• Schedule for Week of Nov 12, 2017

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 4, and DOW futures are up 44 (fair value).

Oil prices were up over the last week with WTI futures at $56.88 per barrel and Brent at $64.65 per barrel. A year ago, WTI was at $43, and Brent was at $42 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.56 per gallon. A year ago prices were at $2.17 per gallon - so gasoline prices are up 39 cents per gallon year-over-year.

Port of Long Beach: Another Record Month in October

by Calculated Risk on 11/12/2017 08:09:00 AM

From the Port of Long Beach: Port Sets Record for October Cargo, Long Beach on pace for highest-ever volumes in 2017

A year of records continues at the Port of Long Beach, where this October was the busiest in history, as container volumes surged 15 percent compared to the same month a year ago.CR Note: I'll have more on port traffic soon.

Trade has been growing so rapidly in 2017 that the record-setting October — at 669,218 twenty-foot-equivalent units (TEUs), one of the Port’s strongest all-time results — was only the fourth-busiest month of the year behind July, September and August.

“October used to be the industry’s busiest month of the year, with retailers preparing for Christmas,” said Port of Long Beach Executive Director Mario Cordero. “Now, with other popular shopping seasons like back-to-school, Halloween and Black Friday, ocean carriers are spreading shipments across more months to maximize the services we have developed to serve them.”

Inbound containers destined for retailers jumped 14.3 percent to 339,013 TEUs. Export boxes decreased slightly, 0.5 percent, to 126,150 containers. Empty containers sent overseas to be refilled with goods increased 28.9 percent, to 204,055 TEUs.

...

Through the first 10 months of the year, 6,234,930 TEUs have been moved through the Port, a 9.5 percent increase over the same period in 2016.

Saturday, November 11, 2017

Schedule for Week of Nov 12, 2017

by Calculated Risk on 11/11/2017 08:11:00 AM

The key economic reports this week are October housing starts, retail sales and the Consumer Price Index (CPI).

For manufacturing, October industrial production, and the November New York Fed, Philly Fed and Kansas City Fed manufacturing surveys, will be released this week.

No economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for October.

8:30 AM: The Producer Price Index for October from the BLS. The consensus is a 0.1% increase in PPI, and a 0.2% increase in core PPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for October from the BLS. The consensus is for a 0.1% increase in CPI, and a 0.2% increase in core CPI.

8:30 AM ET: Retail sales for October be released. The consensus is for a 0.1% increase in retail sales.

8:30 AM ET: Retail sales for October be released. The consensus is for a 0.1% increase in retail sales.This graph shows retail sales since 1992 through September 2017.

8:30 AM: The New York Fed Empire State manufacturing survey for November. The consensus is for a reading of 26.0, down from 30.2.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for September. The consensus is for a 0.1% increase in inventories.

During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 235 thousand initial claims, down from 239 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for November. The consensus is for a reading of 25.0, down from 27.9.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.This graph shows industrial production since 1967.

The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 76.2%.

10:00 AM: The November NAHB homebuilder survey. The consensus is for a reading of 67, down from 68 in October. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for October. The consensus is for 1.188 million SAAR, up from the September rate of 1.127 million.

8:30 AM: Housing Starts for October. The consensus is for 1.188 million SAAR, up from the September rate of 1.127 million.This graph shows total and single unit starts since 1968.

The graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering.

10:00 AM: State Employment and Unemployment (Monthly) for October 2017

11:00 AM: the Kansas City Fed manufacturing survey for November.

Friday, November 10, 2017

Oil Rigs "A Sharp Rebound in the Rig Count"

by Calculated Risk on 11/10/2017 04:01:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Nov 10, 2017:

• Rigs counts rebounded sharply this week, essentially reversing last week’s losses

• Total US oil rigs were up +9 to 738

• Horizontal oil rigs rose, +11 to 637, the highest in a the last month

...

• The gap between Brent and WTI continues above $6 / barrel, with WTI now near $57 / barrel

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Employment: October Diffusion Indexes

by Calculated Risk on 11/10/2017 01:21:00 PM

I haven't posted this in some time. Here is some more positive news in the employment report.

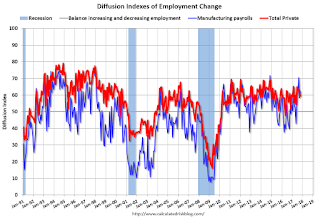

The BLS diffusion index for total private employment was at 59.6 in October, down from 61.1 in September.

For manufacturing, the diffusion index was at 62.2, up from 58.3 in September.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. Above 60 is very good. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.

Overall both total private and manufacturing job growth was widespread in October.

Overall both total private and manufacturing job growth was widespread in October.

Preliminary November Consumer Sentiment declines to 97.8

by Calculated Risk on 11/10/2017 10:09:00 AM

The preliminary University of Michigan consumer sentiment index for November was at 97.8, down from 100.7 in October.

Consumer sentiment declined slightly in early November due to widespread losses across current and expected economic conditions. The losses were quite small as the Sentiment Index remained at its second highest level since January. Overall, the Sentiment Index has remained trendless since the start of the year, varying by less that 4.0 Index-points around its 2017 average of 96.8. Consumers (and policy makers) have four key concerns: prospective trends in jobs, wages, inflation, and interest rates.

emphasis added

Click on graph for larger image.

This was below the consensus forecast.

Consumer sentiment is a concurrent indicator (not a leading indicator).

Prime Working-Age Population nears 2007 Peak

by Calculated Risk on 11/10/2017 08:01:00 AM

The prime working age population peaked in 2007, and bottomed at the end of 2012. As of October 2017, according to the BLS, there were still fewer people in the 25 to 54 age group than in 2007.

At the beginning of this year - based on demographics - it looked like the prime working age (25 to 54) would probably hit a new peak in 2017.

However, since the end of last year, the prime working age population has declined slightly.

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story. Here is a graph of the prime working age population (25 to 54 years old) from 1948 through October 2017.

Note: This is population, not work force.

There was a huge surge in the prime working age population in the '70s, '80s and '90s.

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

The good news is the prime working age group should start growing at 0.5% per year - and this should boost economic activity.

Thursday, November 09, 2017

Hotel Occupancy Rate decreases YoY

by Calculated Risk on 11/09/2017 01:55:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 4 November

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 29 October through 4 November 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 30 October through 5 November 2016, the industry recorded the following:

• Occupancy: -0.9% to 63.3%

• Average daily rate (ADR): +0.4% to US$124.08

• Revenue per available room (RevPAR): -0.4% to US$78.57

Among the Top 25 Markets, Houston, Texas, reported the largest increase in RevPAR (+40.4% to US$90.28), due primarily to the only double-digit increase in occupancy (+28.2% to 79.1%). Post-Hurricane Harvey demand continues to drive performance levels in the market.

emphasis added

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate, to date, is ahead of the record year in 2015. The hurricanes will probably push the annual occupancy rate to a new record in 2017.

Data Source: STR, Courtesy of HotelNewsNow.com