by Calculated Risk on 11/01/2017 02:02:00 PM

Wednesday, November 01, 2017

FOMC Statement: No Change to Policy

Information received since the Federal Open Market Committee met in September indicates that the labor market has continued to strengthen and that economic activity has been rising at a solid rate despite hurricane-related disruptions. Although the hurricanes caused a drop in payroll employment in September, the unemployment rate declined further. Household spending has been expanding at a moderate rate, and growth in business fixed investment has picked up in recent quarters. Gasoline prices rose in the aftermath of the hurricanes, boosting overall inflation in September; however, inflation for items other than food and energy remained soft. On a 12-month basis, both inflation measures have declined this year and are running below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. Hurricane-related disruptions and rebuilding will continue to affect economic activity, employment, and inflation in the near term, but past experience suggests that the storms are unlikely to materially alter the course of the national economy over the medium term. Consequently, the Committee continues to expect that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace, and labor market conditions will strengthen somewhat further. Inflation on a 12-month basis is expected to remain somewhat below 2 percent in the near term but to stabilize around the Committee's 2 percent objective over the medium term. Near-term risks to the economic outlook appear roughly balanced, but the Committee is monitoring inflation developments closely.

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1 to 1-1/4 percent. The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a sustained return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee will carefully monitor actual and expected inflation developments relative to its symmetric inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The balance sheet normalization program initiated in October 2017 is proceeding.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Patrick Harker; Robert S. Kaplan; Neel Kashkari; Jerome H. Powell; and Randal K. Quarles.

emphasis added

Construction Spending increased in September

by Calculated Risk on 11/01/2017 11:24:00 AM

Earlier today, the Census Bureau reported that overall construction spending increased in September:

Construction spending during September 2017 was estimated at a seasonally adjusted annual rate of $1,219.5 billion, 0.3 percent above the revised August estimate of $1,216.0 billion. The September figure is 2.0 percent above the September 2016 estimate of $1,195.6 billion.Private spending decreased, and public spending increased, in September:

Spending on private construction was at a seasonally adjusted annual rate of $942.7 billion, 0.4 percent below the revised August estimate of $946.2 billion. ...

In September, the estimated seasonally adjusted annual rate of public construction spending was $276.8 billion, 2.6 percent above the revised August estimate of $269.8 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is still 24% below the bubble peak.

Non-residential spending is now 3% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 15% below the peak in March 2009, and 5% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 10%. Non-residential spending is down 4% year-over-year. Public spending is down 2% year-over-year.

This was above the consensus forecast of a 0.1% increase for September, however private spending for previous months was revised down slightly - and public spending revised up.

ISM Manufacturing index decreased to 58.7 in October

by Calculated Risk on 11/01/2017 10:04:00 AM

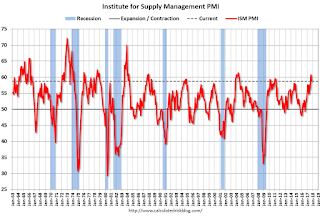

The ISM manufacturing index indicated expansion in October. The PMI was at 58.7% in October, down from 60.8% in September. The employment index was at 59.8%, down from 60.3% last month, and the new orders index was at 63.4%, down from 64.6%.

From the Institute for Supply Management: October 2017 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in October, and the overall economy grew for the 101st consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: "The October PMI® registered 58.7 percent, a decrease of 2.1 percentage points from the September reading of 60.8 percent. The New Orders Index registered 63.4 percent, a decrease of 1.2 percentage points from the September reading of 64.6 percent. The Production Index registered 61 percent, a 1.2 percentage point decrease compared to the September reading of 62.2 percent. The Employment Index registered 59.8 percent, a decrease of 0.5 percentage point from the September reading of 60.3 percent. The Supplier Deliveries Index registered 61.4 percent, a 3 percentage point decrease from the September reading of 64.4 percent. The Inventories Index registered 48 percent, a decrease of 4.5 percentage points from the September reading of 52.5 percent. The Prices Index registered 68.5 percent in October, a 3 percentage point decrease from the September level of 71.5, indicating higher raw materials prices for the 20th consecutive month. Comments from the panel reflect expanding business conditions, with new orders, production, employment, order backlogs and export orders all continuing to grow in October, supplier deliveries continuing to slow (improving) and inventories contracting during the period. Prices continue to remain under pressure. The Customers’ Inventories Index remains at low levels."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 59.5%, and suggests manufacturing expanded at a slower pace in October than in September.

Still a strong report.

ADP: Private Employment increased 235,000 in October

by Calculated Risk on 11/01/2017 08:21:00 AM

Private sector employment increased by 235,000 jobs from September to October according to the October ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 210,000 private sector jobs added in the ADP report.

...

“The job market remains healthy and hiring bounced back with one of the best performances we’ve seen all year,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Although the service providing sector was hard hit last month due to the weather, we saw significant growth in professional services, especially in the higher paid professional technical jobs. Additionally, small businesses rebounded well from the impact of Hurricanes Harvey and Irma, posting very strong gains.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market rebounded strongly from the hit it took from Hurricanes Harvey and Irma. Resurgence in construction jobs shows the rebuilding is already in full swing. Looking through the hurricane-created volatility, job growth is robust.”

The BLS report for October will be released Friday, and the consensus is for 323,000 non-farm payroll jobs added in September.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 11/01/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 27, 2017.

... The Refinance Index decreased 5 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 10 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) increased to its highest level since July 2017, 4.22 percent, from 4.18 percent, with points increasing to 0.43 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 10% year-over-year.

Tuesday, October 31, 2017

Wednesday: FOMC Annoucement, ADP Employment, Vehicle Sales, ISM Mfg, Construction Spending

by Calculated Risk on 10/31/2017 08:08:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 210,000 payroll jobs added in October, up from 135,000 added in September.

• At 10:00 AM, ISM Manufacturing Index for October. The consensus is for the ISM to be at 59.5, down from 60.8 in September. The PMI was at 60.8% in September, the employment index was at 60.3%, and the new orders index was at 64.6%.

• Also at 10:00 AM, Construction Spending for September. The consensus is for a 0.1% increase in construction spending.

• All Day, Light vehicle sales for October. The consensus is for light vehicle sales to be 17.5 million SAAR in October, down from 18.6 million in September (Seasonally Adjusted Annual Rate).

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to announce no change to policy at this meeting.

Zillow Case-Shiller Forecast: More Solid House Price Gains in September

by Calculated Risk on 10/31/2017 05:52:00 PM

The Case-Shiller house price indexes for August were released this morning. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Svenja Gudell at Zillow: Case-Shiller August Results and September Forecast: Gains to the Horizon

The U.S. housing market has settled into a predictable rhythm that shows very few signs of changing. There is incredibly strong demand, driven by a largely healthy overall economy and aging millennials entering their home buying prime, and there is too-low inventory, driven by limited home building activity. Together, those two factors continue to push housing prices up.The year-over-year change for the Case-Shiller National index will be about the same in September as in August.

...

Our home-price forecast for September, which Case-Shiller will not release until Nov. 28, is for more of the same: We expect the national index to maintain its 0.5 percent month-over-month trend, with both city composites climbing 0.4 percent month-over-month, which is slightly slower than they have been.

Real House Prices and Price-to-Rent Ratio in August

by Calculated Risk on 10/31/2017 01:23:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 6.1% year-over-year in August

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 4.3% above the previous bubble peak. However, in real terms, the National index (SA) is still about 13.3% below the bubble peak (and historically there has been an upward slope to real house prices).

The year-over-year increase in prices is mostly moving sideways now around 5% to 6%. In August, the index was up 6.1% YoY.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $278,000 today adjusted for inflation (39%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is at a new peak, and the Case-Shiller Composite 20 Index (SA) is back to November 2005 levels.

Real House Prices

In real terms, the National index is back to August 2004 levels, and the Composite 20 index is back to March 2004.

In real terms, house prices are back to mid 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to November 2003 levels, and the Composite 20 index is back to September 2003 levels.

In real terms, prices are back to mid 2004 levels, and the price-to-rent ratio is back to 2003 - and the price-to-rent ratio has been increasing slowly.

HVS: Q3 2017 Homeownership and Vacancy Rates

by Calculated Risk on 10/31/2017 10:11:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q3 2017.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate increased to 63.9% in Q3, from 63.7% in Q2.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate has probably bottomed.

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Overall this suggests that vacancies have declined significantly, and my guess is the homeownership rate has bottomed - and that the rental vacancy rate has bottomed for this cycle.

Case-Shiller: National House Price Index increased 6.1% year-over-year in August

by Calculated Risk on 10/31/2017 09:14:00 AM

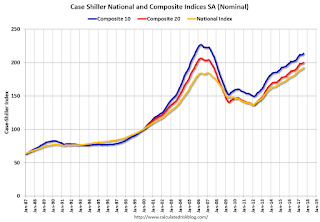

S&P/Case-Shiller released the monthly Home Price Indices for August ("August" is a 3 month average of June, July and August prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: The S&P Corelogic Case-Shiller National Home Price NSA Index Reaches New High as Momentum Continues

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.1% annual gain in August, up from 5.9% in the previous month. The 10-City Composite annual increase came in at 5.3%, up from 5.2% the previous month. The 20-City Composite posted a 5.9% year-over-year gain, up from 5.8% the previous month.

Seattle, Las Vegas, and San Diego reported the highest year-over-year gains among the 20 cities. In August, Seattle led the way with a 13.2% year-over-year price increase, followed by Las Vegas with an 8.6% increase, and San Diego with a 7.8% increase. Nine cities reported greater price increases in the year ending August 2017 versus the year ending July 2017.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.5% in August. The 10-City and 20-City Composites reported increases of 0.5% and 0.4% respectively. After seasonal adjustment, the National Index recorded a 0.5% month-over-month increase in August. The 10-City Composite and 20-City Composite both posted 0.5% month-over-month increases. Nineteen of 20 cities reported increases in August both before and after seasonal adjustment.

“Home price increases appear to be unstoppable,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “August saw the National Index annual rate tick up to 6.1%; all 20 cities followed in the report were up year-over-year while one, Atlanta, saw the seasonally adjusted monthly number slip 0.2%. Most prices across the rest of the economy are barely moving compared to housing. Over the last year the consumer price index rose 2.2%, driven largely by energy costs. Aside from oil, the only other major item with price gains close to housing was hospital services, which were up 4.6%. Wages climbed 3.6% in the year to August.

“The ongoing rise in home prices poses questions of why prices are climbing and whether they will continue to outpace most of the economy. Currently, low mortgage rates combined with an improving economy are supporting home prices. Low interest rates raise the value of both real and financial longlived assets. The price gains are not simply a rebound from the financial crisis; nationally and in nine of the 20 cities in the report, home prices have reached new all-time highs. However, home prices will not rise forever. Measures of affordability are beginning to slide, indicating that the pool of buyers is shrinking. The Federal Reserve is pushing short term interest rates upward and mortgage rates are likely to follow over time, removing a key factor supporting rising home prices.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 5.8% from the peak, and up 0.5% in August (SA).

The Composite 20 index is off 3.1% from the peak, and up 0.4% (SA) in August.

The National index is 4.3% above the bubble peak (SA), and up 0.5% (SA) in August. The National index is up 41.0% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 5.4% compared to August 2016. The Composite 20 SA is up 6.0% year-over-year.

The National index SA is up 6.1% year-over-year.

Note: According to the data, prices increased in 19 of 20 cities month-over-month seasonally adjusted.

I'll have more later.