by Calculated Risk on 10/23/2017 02:05:00 PM

Monday, October 23, 2017

Duy's FedWatch: In Defense of the conventional Wisdom

From Tim Duy at FedWatch: In Defense of the conventional Wisdom. Excerpt:

Altogether, looking at the history of the past sixty years or so, I think it is reasonable for a policymaker to conclude that while they may not yet have a perfect model to guide policy, they have a reasonable approximation to a perfect model that delivers outcomes that are generally consistent with their mandates. Moreover, are the potential gains of adopting a new framework such as, for example a nominal GDP target, worth the potential costs of abandoning the conventional wisdom? I think that is a reasonable question.

In short, while many, including myself, have criticized the Fed for living in the past and continuously re-fighting the inflation wars of the 1970s, I can argue that those criticisms fail to acknowledge the improvement of outcomes since the 1970s. We argue about 50bp of inflation, for example, when the real gains were made in the first 500bp. This issue is worth considering before dismissing the validity of the conventional wisdom among monetary policymakers. They have good reasons for maintaining that wisdom.

Update: For Fun, Stock Market as Barometer of Policy Success

by Calculated Risk on 10/23/2017 11:48:00 AM

Note: This is a repeat of a June post with updated statistics and graph.

There are a number of observers who think the stock market is the key barometer of policy success. My view is there are many measures of success - and that the economy needs to work well for a majority of the people - not just stock investors.

However, for example, Treasury Secretary Steven Mnuchin was on CNBC on Feb 22, 2017, and was asked if the stock market rally was a vote of confidence in the new administration, he replied: "Absolutely, this is a mark-to-market business, and you see what the market thinks."

And Larry Kudlow wrote in 2007: A Stock Market Vote of Confidence for Bush: "I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."

Note: Kudlow's comments were made a few months before the market started selling off in the Great Recession. For more on Kudlow, see: Larry Kudlow is usually wrong

For fun, here is a graph comparing S&P500 returns (ex-dividends) under Presidents Trump and Obama:

Blue is for Mr. Obama, Orange is for Mr. Trump.

At this point, the S&P500 is up 13.3% under Mr. Trump compared to up 34.3% under Mr. Obama for the same number of market days.

Chicago Fed "Index Points to a Pickup in Economic Growth in September"

by Calculated Risk on 10/23/2017 09:04:00 AM

From the Chicago Fed: Index Points to a Pickup in Economic Growth in September

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) moved up to +0.17 in September from –0.37 in August. All four broad categories of indicators that make up the index increased from August, and three of the four categories made positive contributions to the index in September. The index’s three-month moving average, CFNAI-MA3, was unchanged at –0.16 in September.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was close to the historical trend in September (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, October 22, 2017

Sunday Night Futures

by Calculated Risk on 10/22/2017 07:48:00 PM

Weekend:

• Schedule for Week of Oct 22, 2017

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for September. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 future are up 3 and DOW futures are up 22 (fair value).

Oil prices were up over the last week with WTI futures at $52.15 per barrel and Brent at $58.01 per barrel. A year ago, WTI was at $50, and Brent was at $50 - so oil prices are up year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.44 per gallon. A year ago prices were at $2.22 per gallon - so gasoline prices are up 22 cents per gallon year-over-year.

Hotel Occupancy Rate increases YoY, Just behind Record Year

by Calculated Risk on 10/22/2017 09:53:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 14 October

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 8-14 October 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 9-15 October 2016, the industry recorded the following:

• Occupancy: +2.4% to 72.3%

• Average daily rate (ADR): +5.3% to US$130.83

• Revenue per available room (RevPAR): +7.8% to US$94.58

STR analysts note that U.S. performance growth was lifted due to a comparison with a Jewish holiday time period last year.

Among the Top 25 Markets, Houston, Texas, reported the largest year-over-year increases in occupancy (+37.3% to 85.2%) and RevPAR (+57.0% to US$99.76).

emphasis added

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate, to date, is ahead of last year, and just behind the record year in 2015. The hurricanes might push the annual occupancy rate to a new record.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, October 21, 2017

Schedule for Week of Oct 22, 2017

by Calculated Risk on 10/21/2017 08:11:00 AM

The key economic reports this week are the advance estimate of Q3 GDP, and New Home sales for September.

8:30 AM ET: Chicago Fed National Activity Index for September. This is a composite index of other data.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for September from the Census Bureau. The consensus is for a 1.0% increase in durable goods orders.

9:00 AM ET: FHFA House Price Index for August 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM ET: New Home Sales for September from the Census Bureau.

10:00 AM ET: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the August sales rate.

The consensus is for 555 thousand SAAR, down from 560 thousand in August.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 235 thousand initial claims, up from 222 thousand the previous week.

10:00 AM: Pending Home Sales Index for September. The consensus is for a 0.5% increase in the index.

8:30 AM: Gross Domestic Product, 3rd quarter 2017 (Advance estimate). The consensus is that real GDP increased 2.5% annualized in Q3.

10:00 AM: University of Michigan's Consumer sentiment index (final for October). The consensus is for a reading of 101.1, unchanged from the preliminary reading 101.1.

Friday, October 20, 2017

Yellen: "A Challenging Decade and a Question for the Future"

by Calculated Risk on 10/20/2017 08:00:00 PM

From Fed Chair Janet Yellen: A Challenging Decade and a Question for the Future. Excerpt:

A Key Question for the Future

As the financial crisis and Great Recession fade into the past and the stance of monetary policy gradually returns to normal, a natural question concerns the possible future role of the unconventional policy tools we deployed after the onset of the crisis. My colleagues on the FOMC and I believe that, whenever possible, influencing short-term interest rates by targeting the federal funds rate should be our primary tool. As I have already noted, we have a long track record using this tool to pursue our statutory goals. In contrast, we have much more limited experience with using our securities holdings for that purpose.

Where does this assessment leave our unconventional policy tools? I believe their deployment should be considered again if our conventional tool reaches its limit--that is, when the federal funds rate has reached its effective lower bound and the U.S. economy still needs further monetary policy accommodation.

Does this mean that it will take another Great Recession for our unconventional tools to be used again? Not necessarily. Recent studies suggest that the neutral level of the federal funds rate appears to be much lower than it was in previous decades. Indeed, most FOMC participants now assess the longer-run value of the neutral federal funds rate as only 2-3/4 percent or so, compared with around 4-1/4 percent just a few years ago. With a low neutral federal funds rate, there will typically be less scope for the FOMC to reduce short-term interest rates in response to an economic downturn, raising the possibility that we may need to resort again to enhanced forward rate guidance and asset purchases to provide needed accommodation.

Of course, substantial uncertainty surrounds any estimates of the neutral level of short-term interest rates. In this regard, there is an important asymmetry to consider. If the neutral rate turns out to be significantly higher than we currently estimate, it is less likely that we will have to deploy our unconventional tools again. In contrast, if the neutral rate is as low as we estimate or even lower, we will be glad to have our unconventional tools in our toolkit.

The bottom line is that we must recognize that our unconventional tools might have to be used again. If we are indeed living in a low-neutral-rate world, a significantly less severe economic downturn than the Great Recession might be sufficient to drive short-term interest rates back to their effective lower bound.

Oil Rigs "The US oil rig count was crushed this week"

by Calculated Risk on 10/20/2017 05:23:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Oct 20, 2017:

• The US oil rig count was crushed this week

• Total US oil rigs were down 7 to 736

• Horizontal oil rigs were down 10 to 638, the worst week for horizontal rigs since March 2016

...

• The loss of rigs is consistent with our lagged WTI model (below), but the scale of the decline this week was stunning.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Q3 GDP Forecasts

by Calculated Risk on 10/20/2017 02:52:00 PM

From the Altanta Fed: GDPNow

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2017 is 2.7 percent on October 18, unchanged from October 13. The forecast of third-quarter real residential investment growth inched down from -4.1 percent to -4.3 percent after this morning's new residential construction release from the U.S. Census Bureau.From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.5% for 2017:Q3 and 2.6% for 2017:Q4From Merrill Lynch:

We revise up our 3Q GDP forecast to 3.0% marking to market with our tracking estimate.CR Note: The BEA is scheduled to release the advance estimate for Q3 GDP next week. Based on the August report, PCE looks sluggish in Q3 (mid-month method at 1.7%).

A Few Comments on September Existing Home Sales

by Calculated Risk on 10/20/2017 12:35:00 PM

Earlier: NAR: "Existing-Home Sales Inch 0.7 Percent Higher in September"

First, as usual, housing economist Tom Lawler's estimate was much closer to the NAR report than the consensus. So the slight month-to-month increase in reported sales, in September, was no surprise for CR readers.

My view is a sales rate of 5.39 million is solid. In fact, I'd consider any existing home sales rate in the 5 to 5.5 million range solid based on the normal historical turnover of the existing stock. As always, it is important to remember that new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc. - but overall the economic impact is small compared to a new home sale.

Inventory is still very low and falling year-over-year (down 6.4% year-over-year in September). Inventory has declined year-over-year for 28 consecutive months. I started the year expecting inventory would be increasing year-over-year by the end of 2017. That now seems unlikely.

However this was the lowest year-over-year decline this year, and inventory could bottom this year. Inventory is a key metric to watch. More inventory would probably mean smaller price increases, and less inventory somewhat larger price increases.

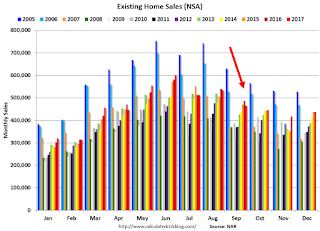

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in September (465,000, red column) were below sales in September 2016 (486,000, NSA) and sales in September 2015 (471,000).

Sales NSA are now slowing seasonally, and sales NSA will be lower in Q4.