by Calculated Risk on 10/10/2017 12:23:00 PM

Tuesday, October 10, 2017

Off-topic: The Art of Negotiation

Recently I’ve spoken to a few Trump supporters who think Mr. Trump has extensive negotiating experience. They are wrong.

In general, there are two types of negotiations. There is the “win-lose” type (or Distributive negotiation) where one party receives more and the other party receives less. This is the common approach when buying a car or real estate, or haggling at a street market.

The other type of negotiation is “win-win” (or Integrative negotiation). This type is used when negotiating between a company and a worker’s union, with long term suppliers, negotiating agreements between international allies – and even with adversaries.

The tactics for the two types of negotiations are very different. In the first type (win-lose), bluffing, threats (like threatening to walk away), even lying are commonly used. (Sound familiar?)

The approach to an integrative negotiation includes building trust, understanding the other party’s concerns, and knowing the details of the agreement – with the goal to reach a mutually beneficial agreement.

It is important to understand when each approach is appropriate. A used car buyer could use the Integrative negotiation approach, but they probably wouldn’t get a very good deal.

A company could use the “win-lose” tactics with a worker’s union, but they would probably face an extended strike followed by a long period of ill-will.

This brings me to Mr. Trump. He has experience in “win-lose” negotiations (buying and selling real estate), but apparently little or no experience in Integrative negotiations.

Mr. Trump keeps using the tactics of “win-lose” in negotiating with Congress, allies and adversaries. Not only has this been ineffective (members of Congress have repeatedly called his bluffs), but it is damaging to long term relationships. Mr. Trump’s use of “win-lose” techniques with North Korea have made him look weak and ineffective (a “dotard”), and have increased the risks of a major misunderstanding and possibly a war.

So, what can Mr. Trump do to be effective? First, he needs to realize he lacks the negotiating experience that is required for these types of negotiations. He needs to stop with the empty threats, bluffs, and lying. And he either needs to learn the integrative negotiation approach (and become a student of the details), or hire people with relevant negotiating experience (and remove himself from the process). All of this seems unlikely, and I expect Mr. Trump to continue using inappropriate tactics - that betray his lack of negotiating experience.

CoreLogic: House Prices up 6.9% Year-over-year in August

by Calculated Risk on 10/10/2017 10:00:00 AM

Notes: This CoreLogic House Price Index report is for August. The recent Case-Shiller index release was for July. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Prices Up 6.9 Percent in August 2017

August National Home Prices Home prices nationwide, including distressed sales, increased year over year by 6.9 percent in August 2017 compared with August 2016 and increased month over month by 0.9 percent in August 2017 compared with July 2017. ...The CoreLogic HPI Forecast indicates that home prices will increase by 4.7 percent on a year-over-year basis from August 2017 to August 2018, and on a month-over-month basis home prices are expected to increase by 0.1 percent from August 2017 to September 2017.CR Note: The YoY increase has been in the 5% to 7% range for the last couple of years.

emphasis added

The year-over-year comparison has been positive for over five consecutive years since turning positive year-over-year in February 2012.

NFIB: Small Business Optimism Index decreased in September

by Calculated Risk on 10/10/2017 08:43:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Slides in September, Expected business conditions tumble in NFIB Optimism Index

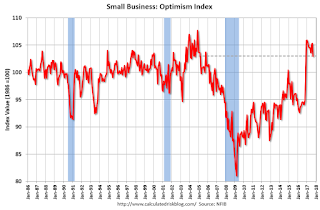

The NFIB Index of Small Business Optimism tumbled in September from 105.3 to 103 led by a steep drop in sales expectations, not just in hurricane-affected states, but across the country.

“The temptation is to blame the decline on the hurricanes in Texas and Florida, but that is not consistent with our data,” said Juanita Duggan, NFIB President and CEO. “Small business owners across the country were measurably less enthusiastic last month.”

...

Job creation weakened in the small business sector as business owners reported an adjusted average employment change per firm of -0.17 workers. Decreases were reported by owners in six of the nine Census regions, so it wasn’t just a hurricane effect. ... Nineteen percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem (unchanged), second only to taxes. This is the top ranked problem for those in construction (30 percent) and manufacturing (28 percent), getting more votes than taxes and regulations.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 103.0 in September.

Monday, October 09, 2017

Duy: "On Track For a December Rate Hike"

by Calculated Risk on 10/09/2017 05:30:00 PM

From Tim Duy at Fed Watch: On Track For a December Rate Hike

The headline figure on nonfarm payrolls report came in well below already withered expectations, but the disappointment was more than compensated for in the details of both the establishment and household survey. The Fed is looking for data that allows them to overlook the weak inflation data. This was just that sort of data.

...

An unemployment rate at 4.2% will rattle Fed officials already worried about pushing too far below full employment under the current projections. This will go a long way toward offsetting their nagging worries about low inflation.

...

The data calendar is a bit slower this week. Look for the JOLTS report (Wednesday), inflation indicator reports PPI (Thursday) and CPI (Friday), and readings on the demand side of the economy from retail sales and business inventories (both on Friday).

In addition, we have plenty of Fed speakers, including regional Presidents Kashkari (Tuesday), Evans (Wednesday), Bostic (Thursday), and Rosengren and Kaplan (Friday). I don’t think we will see anything new from these speakers regarding monetary policy. Federal Reserve Governor Jerome Powell speaks Thursday (keynote address on emerging markets) and Friday (“Are Rules Made to be Broken? Discretion and Monetary Policy,” an event for which I foolishly forgot to make an effort to attend). Neither speech will likely give direct policy guidance, but with Powell rumored to be a contender for the top spot at the Fed, they will offer additional opportunity to explore his thinking.

Bottom Line: December rate hike still a go; low unemployment outweighs low inflation for now. That will change next year if job growth slows further and unemployment stabilizes.

Update: Framing Lumber Prices Up 20% Year-over-year

by Calculated Risk on 10/09/2017 12:11:00 PM

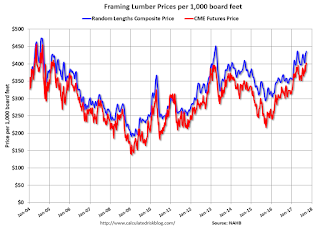

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs - and prices are once again near the bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices were down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts. This decline in 2015 was also probably related to weakness in China.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through early Sept 2017 (via NAHB), and 2) CME framing futures.

Prices in 2017 are up solidly year-over-year and might approach or exceed the housing bubble highs in the Spring of 2018.

Right now Random Lengths prices are up 22% from a year ago, and CME futures are up about 19% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

Oil Rigs "Steady as she goes"

by Calculated Risk on 10/09/2017 10:02:00 AM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Oct 6, 2017:

• The US oil rig count is largely stable

• Total US oil rigs were down 2 to 748

• Horizontal oil rigs were down 1 to 641

...

• Overall, the rig count looks like it’s moving sideways.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Leading Index for Commercial Real Estate Declines in September

by Calculated Risk on 10/09/2017 08:11:00 AM

Note: This index is possibly a leading indicator for new non-residential Commercial Real Estate (CRE) investment, except manufacturing.

From Dodge Data Analytics: Dodge Momentum Index Declines In September

The Dodge Momentum Index fell in September, moving 8.4% lower to 116.4 (2000=100) from the revised August reading of 127.1. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. Both components of the Momentum Index declined in September. The institutional building component fell 11.5% from August, while the commercial building component fell 6.1%. While the overall Momentum Index has lost ground for four consecutive months, this should not be seen, in and of itself, as a predictor of a turn in building markets. Prior to the previous peak of the Momentum Index in January 2008 it had suffered similar significant declines, only to rebound and post strong gains in subsequent months in line with overall economic growth. Similarly, the Momentum Index posted healthy gains from late-2016 through early 2017. Economic growth remains solid, and building market fundamentals are supportive of further growth in construction activity.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 116.4 in September, down from 127.1 in August.

The index is down 4.6% year-over-year.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This suggests some softness in CRE spending next year.

Sunday, October 08, 2017

Sunday Night Futures

by Calculated Risk on 10/08/2017 08:30:00 PM

Weekend:

• Schedule for Week of Oct 8, 2017

• The Record Job Streak: A couple of Comments

Monday:

• Columbus Day Holiday: Banks will be closed in observance of Columbus Day. The stock market will be open. No economic releases are scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $49.42 per barrel and Brent at $55.62 per barrel. A year ago, WTI was at $50, and Brent was at $51 - so oil prices are unchanged to up 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.47 per gallon - up sharply in September due to Hurricane Harvey, but now declining back towards pre-hurricane levels - a year ago prices were at $2.26 per gallon - so gasoline prices are up 21 cents per gallon year-over-year.

The Record Job Streak: A couple of Comments

by Calculated Risk on 10/08/2017 08:09:00 AM

On Friday, the BLS reported that the U.S. economy lost 33,000 nonfarm payroll jobs in September (the decline was mostly related to the impact of the hurricanes).

This negative headline jobs report followed a record 83 consecutive months of positive jobs reports.

A couple of comments:

1) If we adjust for the 2010 Census hiring and firing (data here) the streak of consecutive positive jobs reports was actually 90 months long. It makes sense to adjust for the Census hiring and firing since that was preplanned and unrelated to the business cycle.

This graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

The previous longest streak was 48 months ending in 1990. If we adjust for the 1990 Decennial Census, that streak was actually 45 months - making the streak ending in 2007 at 46 months the second longest.

2) There is a reasonable chance that the recent streak isn't over - and that the September jobs data will be revised up.

In September 2005 - following Hurricane Katrina - the BLS reported 35,000 jobs lost in September. This was revised up to only 8,000 jobs lost in the October report, and revised up again to a gain of 17,000 in the November report. After annual revisions, the gain in September, following Katrina, is now reported as 67,000.

If something similar happens, the streak would still be alive!

Saturday, October 07, 2017

Schedule for Week of Oct 8, 2017

by Calculated Risk on 10/07/2017 08:09:00 AM

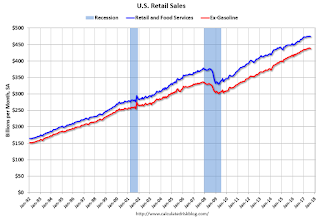

The key economic reports this week are September retail sales and the Consumer Price Index (CPI).

Columbus Day Holiday: Banks will be closed in observance of Columbus Day. The stock market will be open. No economic releases are scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in July to 6.170 million from 6.116 in June. This was the highest number of job openings since this series started in December 2000.

The number of job openings (yellow) were up 3% year-over-year, and Quits were up 4% year-over-year.

2:00 PM: FOMC Minutes, Meeting of September 19 - 20, 2017

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 252 thousand initial claims, down from 260 thousand the previous week.

8:30 AM: The Producer Price Index for September from the BLS. The consensus is a 0.4% increase in PPI, and a 0.2% increase in core PPI.

8:30 AM: The Consumer Price Index for September from the BLS. The consensus is for a 0.6% increase in CPI, and a 0.2% increase in core CPI.

8:30 AM ET: Retail sales for September be released. The consensus is for a 1.9% increase in retail sales.

8:30 AM ET: Retail sales for September be released. The consensus is for a 1.9% increase in retail sales.This graph shows retail sales since 1992 through August 2017.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for August. The consensus is for a 0.6% increase in inventories.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for October). The consensus is for a reading of 95.5, up from 95.1 in September.

At 9:00 AM ET, Speech by Fed Chair Janet Yellen, The Economy and Monetary Policy, At the 32nd Annual G30 International Banking Seminar, Washington, D.C