by Calculated Risk on 9/07/2017 04:15:00 PM

Thursday, September 07, 2017

AAR: Rail Traffic decreased slightly in August

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

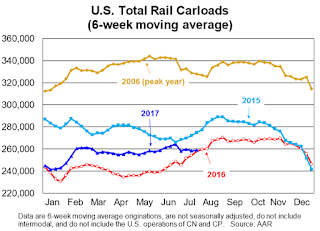

August 2017 U.S. rail traffic was like a glass that’s either half full or half empty, depending on your point of view. Total U.S. rail carloads were down 0.3% (4,571 carloads) from August 2016, thanks mainly to big declines in carloads of grain (down 24,565 carloads, or 20.4%), motor vehicles and parts (down 10,321 carloads, or 11.2%), and petroleum and petroleum products (down 8,362 carloads, or 15.8%). ... On the other hand, carloads of coal were up 25,926 (5.8%) in August, and carloads of crushed stone, gravel, and sand had their best month ever, with carloads up 14,506, or 12.1%, over last August, thanks mainly to booming frac sand shipments. August 2017 was also the best month ever for intermodal: U.S. railroads originated an average of 280,216 containers and trailers per week, more than in any month in history. Year-to-date total U.S. rail carloads were up 4.5% through August; year-to-date intermodal volume was up 3.4% through August.

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Dark blue is 2017.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

U.S. railroads originated 1,343,405 carloads in August 2017, down 4,571 carloads (0.3%) from August 2016 and the second straight small year-over year monthly decline. (Carloads fell 0.6% in July — see the top right chart below). Average weekly total carloads in August 2017 were 268,681, the fewest for August since sometime prior to 1988, when our records begin, but the most for any month since August 2016

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):U.S. railroads originated 1,401,081 intermodal containers and trailers in August 2017, up 5.6%, or 73,790 units, over August 2016. Weekly average intermodal originations of 280,216 in August 2017 were the highest for any month in history for U.S. railroads, breaking the previous record set in June 2015

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 9/07/2017 11:36:00 AM

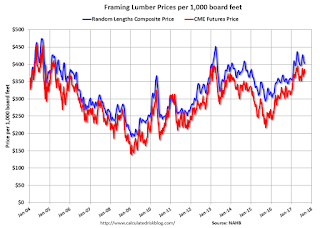

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs - and prices are once again near the bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices were down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts. This decline in 2015 was also probably related to weakness in China.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through early Sept 2017 (via NAHB), and 2) CME framing futures.

Prices in 2017 are up solidly year-over-year and might approach or exceed the housing bubble highs in the Spring of 2018.

Right now Random Lengths prices are up 15% from a year ago, and CME futures are up about 25% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

Goldman: Demographics and Inflation

by Calculated Risk on 9/07/2017 11:17:00 AM

I've been writing about the possible impact of demographics on inflation. As an example, in Demographics, Unemployment Rate and Inflation, I noted that in a period with somewhat similar demographics as today, inflation didn't pick up until the unemployment rate fell below 4%.

However, Goldman Sachs economists think the demographic impact is minimal. Here are a few excerpts from a research piece by Goldman Sachs economist David Mericle: Inflation and Demographics

The combination of low unemployment and low inflation has led many market participants to search for disinflationary structural forces that might be at work. Today’s note explores one often-cited explanation: demographics.

Demographic trends could influence inflation via their impact on growth, the dependency ratio, or inflation expectations. Other researchers have found that faster population growth is associated with higher inflation in cross-country studies; using US city data, we find a very small positive effect that arises only via the shelter component. Researchers have found mixed results on the effect of the dependency ratio, and we do not find a statistically significant effect.

Overall, our results imply a small and very gradual drag from demographics of about 0.05pp relative to the effect in 1980. While demographic effects via lower inflation expectations are intriguing and more difficult to test, any such effect would be very gradual and—with the expectations of all age groups still above 2%—not inconsistent with returning inflation to target.

Weekly Initial Unemployment Claims increase to 298,000

by Calculated Risk on 9/07/2017 08:34:00 AM

The DOL reported:

In the week ending September 2, the advance figure for seasonally adjusted initial claims was 298,000, an increase of 62,000 from the previous week's unrevised level of 236,000. This is the highest level for initial claims since April 18, 2015 when it was 298,000. The 4-week moving average was 250,250, an increase of 13,500 from the previous week's unrevised average of 236,750.The previous week was unrevised.

Hurricane Harvey impacted this week's initial claims.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 250,250.

This was above the consensus forecast, but an increase was expected due to Hurricane Harvey.

Note: Claims will probably increase further over the next few weeks due to Hurricane Harvey and possibly due to Hurricane Irma.

Wednesday, September 06, 2017

Thursday: Unemployment Claims

by Calculated Risk on 9/06/2017 07:46:00 PM

From Noah Smith at Bloomberg: Don't Believe What Jeff Sessions Said About Jobs

While announcing President Donald Trump’s decision to end the Deferred Action for Child Arrivals program, which protects undocumented immigrants from deportation if they arrived as children, Attorney General Jeff Sessions made a startling and blatantly incorrect claim:The Lump of Labor fallacy is frequently heard. I wrote this in 2010: Older Workers and the Lump of Labor Fallacy

"[The DACA program] denied jobs to hundreds of thousands of Americans by allowing those same jobs to go to illegal aliens."Hundreds of thousands? How did Sessions arrive at this number? It appears that he simply counted the number of adult Dreamers (as the program’s beneficiaries are known) and assumed that each one of them had denied a job to an American.

That’s terrible economics. It’s a classic application of a well-known fallacy called the Lump of Labor -- the idea that there are a fixed number of jobs in the world, and those jobs get divvied up among people.

Unfortunately Span concluded:Thursday:

So to that Wisconsin reader who grumped, “Too many older people (professors, Morley Safer, etc.) continue to work for selfish reasons, thereby taking jobs from the young and unemployed” — I’m afraid you ain’t seen nothin’ yet.That is a classic lump of labor fallacy. This is a common error people make with immigration - that immigrants displace other workers, when in fact immigration increases the size of the economy. I suspect we will see more and more of this age related "lump of labor" fallacy. The number of jobs in the economy is not fixed, and people staying in the work force just means the economy will be larger.

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 239 thousand initial claims, up from 236 thousand the previous week.

• At 10:00 AM, The Q2 Quarterly Services Report from the Census Bureau.

Fed's Beige Book: "Modest to moderate"expansion, Labor markets "Tight"

by Calculated Risk on 9/06/2017 02:57:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Chicago based on information collected on or before August 28, 2017. The information included in the District reports was primarily collected before Hurricane Harvey made landfall on the Gulf Coast. However, some Districts received preliminary information from business contacts regarding the impact of the storm, which is compiled in a special paragraph in the national summary. "

Economic activity expanded at a modest to moderate pace across all twelve Federal Reserve Districts in July and August. Consumer spending increased in most Districts, with gains reported for nonauto retail sales and tourism, but mixed results for vehicle sales. Capital spending also increased in several Districts. Manufacturing activity expanded modestly on balance. That said, reports were mixed regarding auto production, and contacts in many Districts expressed concerns about a prolonged slowdown in the auto industry. Both residential and commercial construction increased slightly overall. Low inventories of homes for sale continued to weigh on residential real estate activity across the country, while commercial real estate activity increased slightly. Activity in the energy and natural resources sector was generally positive prior to shutdowns arising from Hurricane Harvey. Agricultural conditions were mixed overall, with drought conditions reported in multiple Districts. Business and consumer loan demand grew at a modest pace in most Districts, with a number of banks reporting rising competition from both other banks and non-bank lenders.And on Hurricane Harvey:

...

Employment growth slowed some on balance, ranging from a slight to a modest rate in most Districts. Labor markets were widely characterized as tight. There were reports of worker shortages in numerous industries, most notably in manufacturing and construction. Firms in the Atlanta, St. Louis, and Minneapolis Districts said that they had turned down business because they could not find the necessary workers. Many Districts indicated that businesses were having difficulty filling openings at all skill levels. In spite of the tight labor market, the majority of Districts reported limited wage pressures and modest to moderate wage growth. That said, there were reports from firms in the Dallas and San Francisco Districts that labor shortages were pushing up wages.

emphasis added

Hurricane Harvey created broad disruptions to economic activity along the Gulf Coast in the Dallas and Atlanta Districts, although it was too soon to gauge the full extent of the impact. Many firms and organizations in the affected areas closed due to flooding. A fifth of the oil and natural gas production in the Gulf of Mexico was offline, and many onshore producers in the Eagle Ford region temporarily stopped production. Harvey also affected fuel and petrochemical production, forcing fifteen refineries in the region to shut down temporarily and several others to operate at reduced capacity. Some areas experienced gasoline shortages, and supply was expected to remain tight in the Southeastern United States because of pipeline disruptions. Contacts in the Richmond District indicated that spot freight prices jumped after the storm, as freight was being redirected around the country. The Port of Charleston expected increased volumes in coming weeks as freight traffic is routed away from the Port of Houston.

Las Vegas Real Estate in August: Sales up 6% YoY, Inventory down Sharply

by Calculated Risk on 9/06/2017 02:19:00 PM

This is a key distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Local Home Sales Keep Increasing While Prices Level Off in August, GLVAR Housing Statistics for August 2017

The Greater Las Vegas Association of REALTORS® (GLVAR) reported today that local home sales continued to rise while home prices started to level off in August.1) Overall sales were up 6% year-over-year.

...

By the end of August, GLVAR reported 5,157 single-family homes listed for sale without any sort of offer. That’s down 32.1 percent from one year ago. For condos and townhomes, the 683 properties listed without offers in August represented a 45.1 percent drop from one year ago. If there’s a bright spot in the housing supply, Tina explained, it’s that “at least we had more homes available for sale in August than we did the previous month.”

Meanwhile, more homes are selling each month. The total number of existing local homes, condos and townhomes sold during August was 4,012, up from 3,789 in August 2016. Compared to one year ago, sales were up 5.9 percent for homes and up 6.0 percent for condos and townhomes.

According to GLVAR, total sales so far in 2017 continue to outpace 2016, when 41,720 total properties were sold in Southern Nevada. At this rate, GLVAR statistics show that 2017 is on pace to be the best year for local home sales since at least 2012.

...

In recent years, GLVAR has been reporting fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. That trend continued in August, when 3.7 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 4.1 percent of all sales in August 2016. Another 2.4 percent of all August sales were bank-owned, down from 5.5 percent one year ago.

emphasis added

2) Active inventory (single-family and condos) is down sharply from a year ago.

3) Fewer distressed sales.

Employment: Preliminary annual benchmark revision shows upward adjustment of 95,000 jobs

by Calculated Risk on 9/06/2017 10:13:00 AM

The BLS released the preliminary annual benchmark revision showing 95,000 additional payroll jobs as of March 2017. The final revision will be published when the January 2018 employment report is released in February 2018. Usually the preliminary estimate is pretty close to the final benchmark estimate.

The annual revision is benchmarked to state tax records. From the BLS:

In accordance with usual practice, the Bureau of Labor Statistics (BLS) is announcing the preliminary estimate of the upcoming annual benchmark revision to the establishment survey employment series. The final benchmark revision will be issued in February 2018 with the publication of the January 2018 Employment Situation news release.Using the preliminary benchmark estimate, this means that payroll employment in March 2017 was 95,000 higher than originally estimated. In February 2018, the payroll numbers will be revised up to reflect the final estimate. The number is then "wedged back" to the previous revision (March 2016).

Each year, the Current Employment Statistics (CES) survey employment estimates are benchmarked to comprehensive counts of employment for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. For National CES employment series, the annual benchmark revisions over the last 10 years have averaged plus or minus two-tenths of one percent of total nonfarm employment. The preliminary estimate of the benchmark revision indicates an upward adjustment to March 2017 total nonfarm employment of 95,000 (0.1 percent).

emphasis added

Construction was revised up by 50,000 jobs, and manufacturing revised up by 23,000 jobs.

This preliminary estimate showed 98,000 more private sector jobs, and 3,000 fewer government jobs (as of March 2017).

ISM Non-Manufacturing Index increased to 55.3% in August

by Calculated Risk on 9/06/2017 10:05:00 AM

The August ISM Non-manufacturing index was at 55.3%, up from 53.9% in July. The employment index increased in August to 56.2%, from 53.6%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: August 2017 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in August for the 92nd consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: "The NMI® registered 55.3 percent, which is 1.4 percentage points higher than the July reading of 53.9 percent. This represents continued growth in the non-manufacturing sector at a faster rate. The Non-Manufacturing Business Activity Index increased to 57.5 percent, 1.6 percentage points higher than the July reading of 55.9 percent, reflecting growth for the 97th consecutive month, at a faster rate in August. The New Orders Index registered 57.1 percent, 2 percentage points higher than the reading of 55.1 percent in July. The Employment Index increased 2.6 percentage points in August to 56.2 percent from the July reading of 53.6 percent. The Prices Index increased 2.2 percentage points from the July reading of 55.7 percent to 57.9 percent, indicating prices increased in August for the third consecutive month. According to the NMI®, 15 non-manufacturing industries reported growth. The non-manufacturing sector has rebounded from the prior month’s cooling-off period. The majority of respondents are optimistic about business conditions going forward."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests faster expansion in August than in July.

Trade Deficit at $43.7 Billion in July

by Calculated Risk on 9/06/2017 08:43:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $43.7 billion in July, up $0.1 billion from $43.5 billion in June, revised. July exports were $194.4 billion, $0.6 billion less than June exports. July imports were $238.1 billion, $0.4 billion less than June imports.

Click on graph for larger image.

Click on graph for larger image.Imports and exports decreased in June.

Exports are 18% above the pre-recession peak and up 5% compared to July 2016; imports are 3% above the pre-recession peak, and up 5% compared to June 2016.

In general, trade has been picking up.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $43.20 in July, down from $44.68 in June, and up from $41.02 in July 2016. The petroleum deficit had been declining for years - and is the major reason the overall deficit has mostly moved sideways since early 2012.

The trade deficit with China increased to $35.6 billion in July, from $30.3 billion in July 2016.