by Calculated Risk on 8/31/2017 11:53:00 AM

Thursday, August 31, 2017

August Employment Preview

On Friday at 8:30 AM ET, the BLS will release the employment report for August. The consensus, according to Bloomberg, is for an increase of 180,000 non-farm payroll jobs in August (with a range of estimates between 140,000 to 200,000), and for the unemployment rate to be unchanged at 4.3%.

The BLS reported 209,000 jobs added in July.

Here is a summary of recent data:

• The ADP employment report showed an increase of 237,000 private sector payroll jobs in August. This was well above consensus expectations of 182,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations. However, the ADP number has frequently been above the BLS number for August.

• The ISM manufacturing and non-manufacturing indexes have not been released yet.

• Initial weekly unemployment claims averaged 237,000 in August, down from 242,000 in July. For the BLS reference week (includes the 12th of the month), initial claims were at 232,000, down from 234,000 during the reference week in July.

The decrease during the reference week suggests slightly fewer layoffs during the reference week in August than in July. This suggests a similar employment report in August as in July.

• The final August University of Michigan consumer sentiment index increased to 97.6 from the July reading of 93.4. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Conclusion: Unfortunately the ISM reports will be released after the employment report this month, and those reports are helpful. Also August tends to be below the ADP report (and frequently below consensus). My sense (mostly based on history) is that job gains will be below consensus in August.

NAR: Pending Home Sales Index decreased 0.8% in July, down 1.3% year-over-year

by Calculated Risk on 8/31/2017 10:03:00 AM

From the NAR: Pending Home Sales Lessen 0.8 Percent in July

Pending homes sales stumbled in July for the fourth time in five months as only the West saw an increase in contract activity, according to the National Association of Realtors®.This was below expectations of a 0.8% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in August and September.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 0.8 percent to 109.1 in July from a downwardly revised 110.0 in June. After last month’s decline, the index is now 1.3 percent below a year ago and has fallen on an annual basis in three of the past four months.

...

The PHSI in the Northeast inched backward 0.3 percent to 97.7 in July, but is still 2.4 percent above a year ago. In the Midwest the index decreased 0.7 percent to 103.3 in July, and is now 2.8 percent lower than July 2016.

Pending home sales in the South declined 1.7 percent to an index of 123.1 in July and are now 0.2 percent below last July. The index in the West expanded 0.6 percent in July to 102.3, but is still 4.0 percent below a year ago.

emphasis added

Personal Income increased 0.4% in July, Spending increased 0.3%

by Calculated Risk on 8/31/2017 08:39:00 AM

The BEA released the Personal Income and Outlays report for July:

Personal income increased $65.6 billion (0.4 percent) in July according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $39.6 billion (0.3 percent) and personal consumption expenditures (PCE) increased $44.7 billion (0.3 percent).The July PCE price index increased 1.4 percent year-over-year and the July PCE price index, excluding food and energy, also increased 1.4 percent year-over-year.

...

Real PCE increased 0.2 percent. The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through July 2017 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was at expectations, and the increase in PCE was slightly below expectations.

Weekly Initial Unemployment Claims increase to 236,000

by Calculated Risk on 8/31/2017 08:33:00 AM

The DOL reported:

In the week ending August 26, the advance figure for seasonally adjusted initial claims was 236,000, an increase of 1,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 234,000 to 235,000. The 4-week moving average was 236,750, a decrease of 1,250 from the previous week's revised average. The previous week's average was revised up by 250 from 237,750 to 238,000.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 236,750.

This was close to the consensus forecast.

The low level of claims suggests relatively few layoffs.

Note: Claims will increase over the next few weeks due to Hurricane Harvey.

Wednesday, August 30, 2017

Thursday: Unemployment Claims, Personal Income and Outlays, Chicago PMI, Pending Home Sales

by Calculated Risk on 8/30/2017 07:46:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 237 thousand initial claims, up from 234 thousand the previous week. Note: The report tomorrow will be for the week ending Aug 26th. Unemployment claims will increase over the next few weeks due to Hurricane Harvey.

• Also at 8:30 AM, Personal Income and Outlays for July. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:45 AM, Chicago Purchasing Managers Index for August. The consensus is for a reading of 58.0, down from 58.9 in July.

• At 10:00 AM, Pending Home Sales Index for June. The consensus is for a 0.8% increase in the index.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 8/30/2017 04:05:00 PM

CR Note: This is a repeat of a previous post with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through June 2017). The seasonal pattern was smaller back in the '90s and early '00s, and once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Zillow Forecast: "July Case-Shiller Forecast: Slowdown Coming in Home Prices"

by Calculated Risk on 8/30/2017 12:13:00 PM

The Case-Shiller house price indexes for June were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Svenja Gudell at Zillow: July Case-Shiller Forecast: Slowdown Coming in Home Prices

Following months of record highs in the Case-Shiller U.S. National Index for home prices, July is expected to bring a slowdown — to 5.6 percent from June’s 5.8 percent year-over-year, non-seasonally adjusted gain. The monthly gain for July is forecast at 0.2 percent, which is half the 0.4 percent growth that index posted for June.The year-over-year change for the Case-Shiller National index will probably be smaller in July than in June.

The 10- and 20-month indices are expected to drop 0.1 percent from June to July, with the 10-city index gaining 4.8 percent in July over the previous year, down from June’s 4.9 percent annual growth, and the 20-city index climbing 5.4 percent annually, down from 5.7 percent in June.

Zillow’s full forecast for July Case-Shiller data is shown below. These forecasts are based on today’s June Case-Shiller data release and the July 2017 Zillow Home Value Index. The July S&P CoreLogic Case-Shiller Indices will not be released officially until Tuesday, September 26.

Q2 GDP Revised up to 3.0% Annual Rate

by Calculated Risk on 8/30/2017 08:33:00 AM

From the BEA: Gross Domestic Product: Second Quarter 2017 (Second Estimate)

Real gross domestic product (GDP) increased at an annual rate of 3.0 percent in the second quarter of 2017, according to the "second" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 1.2 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised up from 2.8% to 3.3%. (solid PCE). Residential investment was revised up slightly from -6.8% to -6.5%. This was above the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 2.6 percent. With this second estimate for the second quarter, the general picture of economic growth remains the same; increases in personal consumption expenditures (PCE) and in nonresidential fixed investment were larger than previously estimated. These increases were partly offset by a larger decrease in state and local government spending ...

emphasis added

ADP: Private Employment increased 237,000 in August

by Calculated Risk on 8/30/2017 08:19:00 AM

Private sector employment increased by 237,000 jobs from July to August according to the August ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 182,000 private sector jobs added in the ADP report.

...

“In August, the goods-producing sector saw the best performance in months with solid increases in both construction and manufacturing,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Additionally, the trade industry pulled ahead to lead job gains across all industries, adding the most jobs it has seen since the end of 2016. This could be an industry to watch as consumer spending and wage growth improves.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market continues to power forward. Job creation is strong across nearly all industries, company sizes. Mounting labor shortages are set to get much worse. The initial BLS employment estimate is often very weak in August due to measurement problems, and is subsequently revised higher. The ADP number is not impacted by those problems.”

The BLS report for August will be released Friday, and the consensus is for 180,000 non-farm payroll jobs added in August.

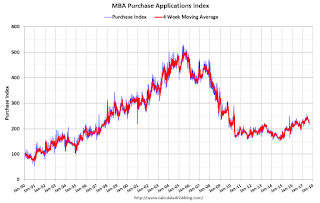

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 8/30/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 25, 2017.

... The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 5 percent compared with the previous week and was 4 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to its lowest level since November 2016, 4.11 percent, from 4.12 percent, with points increasing to 0.43 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 4% year-over-year.