by Calculated Risk on 8/29/2017 03:41:00 PM

Tuesday, August 29, 2017

The Impact of Harvey on Unemployment Claims

My thoughts are with the people of south Texas.

There will be some economic impacts from Hurricane Harvey (housing, oil, etc).

On housing, my initial expectations is that new home sales and housing starts will decline in the September report. Houston and south Texas are a major portion of starts and new home sales, and it will take some time to recover. We will probably also see a decline in existing home sales. We can't look back at Hurricane Katrina for guidance on housing because Katrina happened just after the housing bubble peaked - so starts and sales were already declining.

We can look back at Katrina (and Rita) for the impact on unemployment claims.

The following graph shows the 4-week moving average of weekly claims since 2000.

The dashed line on the graph is the current 4-week average.

Hurricane Katrina made landfall on Aug 29, 2005. Unemployment claims moved higher over the next month, and stayed elevated for a couple of months.

Note that claims also spiked following 9/11 and after Hurricane Sandy in late October 2012. The increase following Sandy was significant, but only lasted a few weeks (so the 4-week average didn't increase as much as for Katrina).

My expectation is the 4-week average of claims will increase from the current level of 238,000 to over 300,000 over the next month.

Real House Prices and Price-to-Rent Ratio in June

by Calculated Risk on 8/29/2017 11:12:00 AM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.8% year-over-year in June

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 3.2% above the previous bubble peak. However, in real terms, the National index (SA) is still about 13.3% below the bubble peak.

The year-over-year increase in prices is mostly moving sideways now just over 5%. In June, the index was up 5.8% YoY.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $278,000 today adjusted for inflation (39%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is at a new peak, and the Case-Shiller Composite 20 Index (SA) is back to October 2005 levels.

Real House Prices

In real terms, the National index is back to July 2004 levels, and the Composite 20 index is back to March 2004.

In real terms, house prices are back to early-to-mid 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to November 2003 levels, and the Composite 20 index is back to August 2003 levels.

In real terms, prices are back to early-to-mid 2004 levels, and the price-to-rent ratio is back to 2003 - and the price-to-rent ratio maybe moving a little more sideways now.

Case-Shiller: National House Price Index increased 5.8% year-over-year in June

by Calculated Risk on 8/29/2017 09:14:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for June ("June" is a 3 month average of April, May and June prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: The S&P Corelogic Case-Shiller National Home Price Rises Again to All Time High

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.8% annual gain in June, up from 5.7% the previous month. The 10-City Composite posted a 4.9% annual increase, down from 5.0% the previous month. The 20-City Composite reported a 5.7% year-over-year gain, the same as the previous month.

Seattle, Portland, and Dallas reported the highest year-over-year gains among the 20 cities. In June, Seattle led the way with a 13.4% year-over-year price increase, followed by Portland with 8.2%, and Dallas with a 7.7% increase. Nine cities reported greater price increases in the year ending June 2017 versus the year ending May 2017.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.9% in June. The 10-City and 20-City Composites both reported a 0.7% increase in June. After seasonal adjustment, the National Index recorded a 0.4% month-over-month increase. The 10-City Composite remained stagnant with no month-over-month increase. The 20-City Composite posted a 0.1% month-over-month increase. All 20 cities reported increases in June before seasonal adjustment; after seasonal adjustment, 14 cities saw prices rise.

“The trend of increasing home prices is continuing,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “Price increases are supported by a tight housing market. Both the number of homes for sale and the number of days a house is on the market have declined for four to five years. Currently the months-supply of existing homes for sale is low, at 4.2 months. In addition, housing starts remain below their pre-financial crisis peak as new home sales have not recovered as fast as existing home sales.”

“Rising prices are the principal factor driving affordability down. However, other drivers of affordability are more favorable: the national unemployment rate is down, and the number of jobs created continues to grow at a robust pace, rising to close to 200,000 per month. Wages and salaries are increasing, maintaining a growth rate a bit ahead of inflation. Mortgage rates, up slightly since the end of 2016, are under 4%. Given current economic conditions and the tight housing market, an immediate reversal in home price trends appears unlikely.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 6.7% from the peak, and up slightly in June (SA).

The Composite 20 index is off 3.9% from the peak, and up 0.1% (SA) in June.

The National index is 3.2% above the bubble peak (SA), and up 0.4% (SA) in June. The National index is up 39.5% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.9% compared to June 2016. The Composite 20 SA is up 5.7% year-over-year.

The National index SA is up 5.8% year-over-year.

Note: According to the data, prices increased in 16 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, August 28, 2017

Tuesday: Case-Shiller House Prices

by Calculated Risk on 8/28/2017 06:41:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Still at 2017 Lows

Mortgage rates held steady today, as the news cycle was dominated by Hurricane Harvey. That's not to say that natural disasters prevent movement in mortgage rates, but in today's case, there simply wasn't much else to talk about. An auction of 5yr Treasury notes helped bond markets improve slightly in the afternoon. When bonds improve, rates tend to move lower, but only a few lenders adjusted mortgage rates lower in the afternoon.Tuesday:

The lack of movement continues to be just fine for the average borrower, considering rates are at their lowest levels since November 2016. The most prevalent conventional 30yr fixed rate for to tier scenarios remains 3.875%.

• At 9:00 AM ET, 9:00 AM ET: S&P/Case-Shiller House Price Index for June. The consensus is for a 5.7% year-over-year increase in the Comp 20 index for June.

Hotels: Occupancy Rate up Year-over-Year

by Calculated Risk on 8/28/2017 03:05:00 PM

Note: Hotel occupancy rates increased noticeably following Hurricanes Katrina and Rita in 2005. I expect the overall occupancy rate will also increase following Hurricane Harvey - and stay elevated for several months. This might even push 2017 into record territory.

From HotelNewsNow.com: STR: US hotel results for week ending 19 August

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 13-19 August 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 14-20 August 2016, the industry recorded the following:

• Occupancy: +1.4% to 72.3%

• Average daily rate (ADR): +2.1% to US$127.12

• Revenue per available room (RevPAR): +3.5% to US$91.85

emphasis added

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate is tracking close to last year, and behind the record year in 2015.

Seasonally, the occupancy rate has peaked and will decline into the Fall.

Data Source: STR, Courtesy of HotelNewsNow.com

Dallas Fed: "Texas Manufacturing Activity Expands Again" in August

by Calculated Risk on 8/28/2017 10:37:00 AM

From the Dallas Fed: Texas Manufacturing Activity Expands Again

Texas factory activity continued to increase in August, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, edged down to 20.3, indicating output grew but at a slightly slower pace than in July.This was the last of the regional Fed surveys for August.

Other measures of current manufacturing activity also indicated continued growth. The new orders and the growth rate of orders indexes ticked down but stayed solidly positive, coming in at 14.3 and 11.7, respectively. The capacity utilization index fell six points to 12.2, while the shipments index increased seven points to 18.1.

Perceptions of broader business conditions remained positive in August. The general business activity index was largely unchanged at a robust 17.0. The company outlook index posted its 12th consecutive positive reading but slipped 10 points to 16.3 after surging to a multiyear high last month.

Labor market measures suggested continued employment gains and longer workweeks this month. The employment index came in at 9.9, slightly below the July reading, extending this year’s string of positive readings. Eighteen percent of firms noted net hiring, compared with eight percent noting net layoffs. The hours worked index rose five points to 14.5.

emphasis added

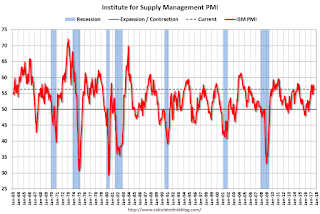

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through August), and five Fed surveys are averaged (blue, through August) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through July (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index will increase in August compared to July (to be released Friday, Sept 1st). The consensus is for the ISM index to increase to 56.6 in August from 56.3 in July.

Black Knight: House Price Index up 0.9% in June, Up 6.2% year-over-year

by Calculated Risk on 8/28/2017 08:30:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight Home Price Index Report: U.S. Home Prices Hit Another New High with 0.9 Percent Gain in June, Up 6.2 Percent Year-Over-Year

• After 62 consecutive months of annual home price appreciation, U.S. home prices hit yet another new peak in JuneThe year-over-year increase in this index has been about the same for the last year (in the 5% and 6% range).

• Prices rose 0.9% from May, for a total of 5.5% growth since the start of the year

• The national level HPI now stands at $281K, and the rate of annual growth continues to accelerate (+6.2% Y/Y in June as compared to +6.1% in May)

• 12 of the 20 largest states and 21 of the 40 largest metros hit new home price peaks in June

Note that house prices are above the bubble peak in nominal terms, but not in real terms (adjusted for inflation). Case-Shiller for June will be released tomorrow.

Sunday, August 27, 2017

Sunday Night Futures

by Calculated Risk on 8/27/2017 06:49:00 PM

My thoughts are with the people of south Texas. I was hoping the forecasts were wrong - and the rain and damage wouldn't be this severe - but once again the NHC forecasts were correct.

There will be some significant economic impacts from Hurricane Harvey (housing, oil, etc). I'll try to address some of these later this week after the deluge. Best wishes to all.

Weekend:

• Schedule for Week of Aug 27, 2017

Monday:

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for August.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were mixed over the last week with WTI futures at $48.03 per barrel and Brent at $52.83 per barrel. A year ago, WTI was at $47, and Brent was at $50 - so oil prices are up slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.36 per gallon - a year ago prices were at $2.22 per gallon - so gasoline prices are up 14 cents per gallon year-over-year.

August 2017: Unofficial Problem Bank list declines to 123 Institutions

by Calculated Risk on 8/27/2017 08:15:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for August 2017.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for August 2017. The list shrank by a net 11 banks to 123 after twelve removals and one addition. Aggregate assets dropped by $4½ billion to $32.8 billion. A year ago, the list held 184 institutions with assets of $56½ billion.

Actions were terminated against Lone Star National Bank, Pharr, TX ($2.2 billion); State Bank of India (California), Los Angeles, CA ($633 million); Intercredit Bank, National Association, Miami, FL ($360 million); Central Federal Savings and Loan Association, Cicero, IL ($175 million); Alliance Bank & Trust Company, Gastonia, NC ($142 million Ticker: ABTO); Anthem Bank & Trust, Plaquemine, LA ($132 million); Community 1st Bank Las Vegas, Las Vegas, NM ($123 million); Hometown Bank of The Hudson Valley, Walden, NY ($118 million Ticker: HTWC); People's Bank and Trust Company of Pickett County, Byrdstown, TN ($116 million); Valley Bank of Nevada, North Las Vegas, NV ($111 million); Signature Bank of Georgia, Sandy Springs, GA ($100 million); and Columbia Savings and Loan Association, Milwaukee, WI ($25 million).

The addition this month was the Farmers and Merchants State Bank of Argonia, Argonia, KS ($34 million). In addition, the Federal Reserve issued a Prompt Corrective Action order against Heartland Bank, Little Rock, AR ($199 million), which has been on the list since December 2016.

This week the FDIC released their official Problem Bank figures for the end of the second quarter of 2017, with their list holding 105 institutions with assets of $17.2 billion, which equates to an average asset size of about $164 million. Last quarter, the FDIC said the official list had 112 institutions with assets of $23.7 billion, which equated to an average asset size of $212 million. Thus, during the second quarter of 2017, the FDIC removed a net seven institutions and $6.5 billion of assets from the official list. The average asset size of the seven institutions the FDIC removed from the official list was about $929 million. Currently, the unofficial list only has five institutions larger than $950 million; therefore, it seems a bit of a stretch for the aggregate assets on the official list to decline by $6.5 billion during the second quarter. We know the FDIC does not like publishing the official figures, so it is unlikely they would provide us readers/analysts with an average or median asset figure to improve our understanding of the characteristics of the institutions on the official list.

Saturday, August 26, 2017

Schedule for Week of Aug 27, 2017

by Calculated Risk on 8/26/2017 08:11:00 AM

The key report this week is the August employment report on Friday.

Other key indicators include the second estimate of Q2 GDP, the August ISM manufacturing index, August auto sales and the June Case-Shiller house prices.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for August.

9:00 AM ET: S&P/Case-Shiller House Price Index for June.

9:00 AM ET: S&P/Case-Shiller House Price Index for June.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the May 2017 report (the Composite 20 was started in January 2000).

The consensus is for a 5.7% year-over-year increase in the Comp 20 index for June.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for August. This report is for private payrolls only (no government). The consensus is for 182,000 payroll jobs added in August, up from 178,000 added in July.

8:30 AM: Gross Domestic Product, 2nd quarter 2017 (Second estimate). The consensus is that real GDP increased 2.8% annualized in Q2, up from advance estimate of 2.6%.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 237 thousand initial claims, up from 234 thousand the previous week.

8:30 AM: Personal Income and Outlays for July. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for August. The consensus is for a reading of 58.0, down from 58.9 in July.

10:00 AM: Pending Home Sales Index for June. The consensus is for a 0.8% increase in the index.

8:30 AM: Employment Report for August. The consensus is for an increase of 180,000 non-farm payroll jobs added in August, down from the 209,000 non-farm payroll jobs added in July.

The consensus is for the unemployment rate to be unchanged at 4.3%.

The consensus is for the unemployment rate to be unchanged at 4.3%.This graph shows the year-over-year change in total non-farm employment since 1968.

In July, the year-over-year change was 2.16 million jobs.

A key will be the change in wages.

10:00 AM: ISM Manufacturing Index for August. The consensus is for the ISM to be at 56.6, up from 56.3 in August.

10:00 AM: ISM Manufacturing Index for August. The consensus is for the ISM to be at 56.6, up from 56.3 in August.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in July. The PMI was at 56.3% in July, the employment index was at 55.2%, and the new orders index was at 60.4%.

10:00 AM: Construction Spending for July. The consensus is for a 0.6% increase in construction spending.

All day: Light vehicle sales for August. The consensus is for light vehicle sales to be 16.7 million SAAR in August, unchanged from 16.7 million in July (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for August. The consensus is for light vehicle sales to be 16.7 million SAAR in August, unchanged from 16.7 million in July (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the July sales rate.

10:00 AM: University of Michigan's Consumer sentiment index (final for July). The consensus is for a reading of 97.2, unchanged from the preliminary reading 97.6.