by Calculated Risk on 8/28/2017 03:05:00 PM

Monday, August 28, 2017

Hotels: Occupancy Rate up Year-over-Year

Note: Hotel occupancy rates increased noticeably following Hurricanes Katrina and Rita in 2005. I expect the overall occupancy rate will also increase following Hurricane Harvey - and stay elevated for several months. This might even push 2017 into record territory.

From HotelNewsNow.com: STR: US hotel results for week ending 19 August

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 13-19 August 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 14-20 August 2016, the industry recorded the following:

• Occupancy: +1.4% to 72.3%

• Average daily rate (ADR): +2.1% to US$127.12

• Revenue per available room (RevPAR): +3.5% to US$91.85

emphasis added

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate is tracking close to last year, and behind the record year in 2015.

Seasonally, the occupancy rate has peaked and will decline into the Fall.

Data Source: STR, Courtesy of HotelNewsNow.com

Dallas Fed: "Texas Manufacturing Activity Expands Again" in August

by Calculated Risk on 8/28/2017 10:37:00 AM

From the Dallas Fed: Texas Manufacturing Activity Expands Again

Texas factory activity continued to increase in August, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, edged down to 20.3, indicating output grew but at a slightly slower pace than in July.This was the last of the regional Fed surveys for August.

Other measures of current manufacturing activity also indicated continued growth. The new orders and the growth rate of orders indexes ticked down but stayed solidly positive, coming in at 14.3 and 11.7, respectively. The capacity utilization index fell six points to 12.2, while the shipments index increased seven points to 18.1.

Perceptions of broader business conditions remained positive in August. The general business activity index was largely unchanged at a robust 17.0. The company outlook index posted its 12th consecutive positive reading but slipped 10 points to 16.3 after surging to a multiyear high last month.

Labor market measures suggested continued employment gains and longer workweeks this month. The employment index came in at 9.9, slightly below the July reading, extending this year’s string of positive readings. Eighteen percent of firms noted net hiring, compared with eight percent noting net layoffs. The hours worked index rose five points to 14.5.

emphasis added

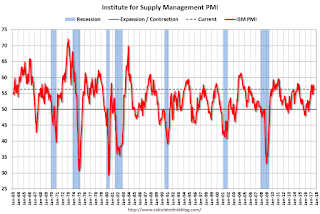

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through August), and five Fed surveys are averaged (blue, through August) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through July (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index will increase in August compared to July (to be released Friday, Sept 1st). The consensus is for the ISM index to increase to 56.6 in August from 56.3 in July.

Black Knight: House Price Index up 0.9% in June, Up 6.2% year-over-year

by Calculated Risk on 8/28/2017 08:30:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight Home Price Index Report: U.S. Home Prices Hit Another New High with 0.9 Percent Gain in June, Up 6.2 Percent Year-Over-Year

• After 62 consecutive months of annual home price appreciation, U.S. home prices hit yet another new peak in JuneThe year-over-year increase in this index has been about the same for the last year (in the 5% and 6% range).

• Prices rose 0.9% from May, for a total of 5.5% growth since the start of the year

• The national level HPI now stands at $281K, and the rate of annual growth continues to accelerate (+6.2% Y/Y in June as compared to +6.1% in May)

• 12 of the 20 largest states and 21 of the 40 largest metros hit new home price peaks in June

Note that house prices are above the bubble peak in nominal terms, but not in real terms (adjusted for inflation). Case-Shiller for June will be released tomorrow.

Sunday, August 27, 2017

Sunday Night Futures

by Calculated Risk on 8/27/2017 06:49:00 PM

My thoughts are with the people of south Texas. I was hoping the forecasts were wrong - and the rain and damage wouldn't be this severe - but once again the NHC forecasts were correct.

There will be some significant economic impacts from Hurricane Harvey (housing, oil, etc). I'll try to address some of these later this week after the deluge. Best wishes to all.

Weekend:

• Schedule for Week of Aug 27, 2017

Monday:

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for August.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were mixed over the last week with WTI futures at $48.03 per barrel and Brent at $52.83 per barrel. A year ago, WTI was at $47, and Brent was at $50 - so oil prices are up slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.36 per gallon - a year ago prices were at $2.22 per gallon - so gasoline prices are up 14 cents per gallon year-over-year.

August 2017: Unofficial Problem Bank list declines to 123 Institutions

by Calculated Risk on 8/27/2017 08:15:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for August 2017.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for August 2017. The list shrank by a net 11 banks to 123 after twelve removals and one addition. Aggregate assets dropped by $4½ billion to $32.8 billion. A year ago, the list held 184 institutions with assets of $56½ billion.

Actions were terminated against Lone Star National Bank, Pharr, TX ($2.2 billion); State Bank of India (California), Los Angeles, CA ($633 million); Intercredit Bank, National Association, Miami, FL ($360 million); Central Federal Savings and Loan Association, Cicero, IL ($175 million); Alliance Bank & Trust Company, Gastonia, NC ($142 million Ticker: ABTO); Anthem Bank & Trust, Plaquemine, LA ($132 million); Community 1st Bank Las Vegas, Las Vegas, NM ($123 million); Hometown Bank of The Hudson Valley, Walden, NY ($118 million Ticker: HTWC); People's Bank and Trust Company of Pickett County, Byrdstown, TN ($116 million); Valley Bank of Nevada, North Las Vegas, NV ($111 million); Signature Bank of Georgia, Sandy Springs, GA ($100 million); and Columbia Savings and Loan Association, Milwaukee, WI ($25 million).

The addition this month was the Farmers and Merchants State Bank of Argonia, Argonia, KS ($34 million). In addition, the Federal Reserve issued a Prompt Corrective Action order against Heartland Bank, Little Rock, AR ($199 million), which has been on the list since December 2016.

This week the FDIC released their official Problem Bank figures for the end of the second quarter of 2017, with their list holding 105 institutions with assets of $17.2 billion, which equates to an average asset size of about $164 million. Last quarter, the FDIC said the official list had 112 institutions with assets of $23.7 billion, which equated to an average asset size of $212 million. Thus, during the second quarter of 2017, the FDIC removed a net seven institutions and $6.5 billion of assets from the official list. The average asset size of the seven institutions the FDIC removed from the official list was about $929 million. Currently, the unofficial list only has five institutions larger than $950 million; therefore, it seems a bit of a stretch for the aggregate assets on the official list to decline by $6.5 billion during the second quarter. We know the FDIC does not like publishing the official figures, so it is unlikely they would provide us readers/analysts with an average or median asset figure to improve our understanding of the characteristics of the institutions on the official list.

Saturday, August 26, 2017

Schedule for Week of Aug 27, 2017

by Calculated Risk on 8/26/2017 08:11:00 AM

The key report this week is the August employment report on Friday.

Other key indicators include the second estimate of Q2 GDP, the August ISM manufacturing index, August auto sales and the June Case-Shiller house prices.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for August.

9:00 AM ET: S&P/Case-Shiller House Price Index for June.

9:00 AM ET: S&P/Case-Shiller House Price Index for June.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the May 2017 report (the Composite 20 was started in January 2000).

The consensus is for a 5.7% year-over-year increase in the Comp 20 index for June.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for August. This report is for private payrolls only (no government). The consensus is for 182,000 payroll jobs added in August, up from 178,000 added in July.

8:30 AM: Gross Domestic Product, 2nd quarter 2017 (Second estimate). The consensus is that real GDP increased 2.8% annualized in Q2, up from advance estimate of 2.6%.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 237 thousand initial claims, up from 234 thousand the previous week.

8:30 AM: Personal Income and Outlays for July. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for August. The consensus is for a reading of 58.0, down from 58.9 in July.

10:00 AM: Pending Home Sales Index for June. The consensus is for a 0.8% increase in the index.

8:30 AM: Employment Report for August. The consensus is for an increase of 180,000 non-farm payroll jobs added in August, down from the 209,000 non-farm payroll jobs added in July.

The consensus is for the unemployment rate to be unchanged at 4.3%.

The consensus is for the unemployment rate to be unchanged at 4.3%.This graph shows the year-over-year change in total non-farm employment since 1968.

In July, the year-over-year change was 2.16 million jobs.

A key will be the change in wages.

10:00 AM: ISM Manufacturing Index for August. The consensus is for the ISM to be at 56.6, up from 56.3 in August.

10:00 AM: ISM Manufacturing Index for August. The consensus is for the ISM to be at 56.6, up from 56.3 in August.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in July. The PMI was at 56.3% in July, the employment index was at 55.2%, and the new orders index was at 60.4%.

10:00 AM: Construction Spending for July. The consensus is for a 0.6% increase in construction spending.

All day: Light vehicle sales for August. The consensus is for light vehicle sales to be 16.7 million SAAR in August, unchanged from 16.7 million in July (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for August. The consensus is for light vehicle sales to be 16.7 million SAAR in August, unchanged from 16.7 million in July (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the July sales rate.

10:00 AM: University of Michigan's Consumer sentiment index (final for July). The consensus is for a reading of 97.2, unchanged from the preliminary reading 97.6.

Friday, August 25, 2017

Oil Rigs "Rig counts rolling off"

by Calculated Risk on 8/25/2017 04:53:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Aug 25, 2017:

• Continued decline in rig counts

• Total US oil rigs were down 4 to 759

• Horizontal oil rigs were down 3 at 647

...

• Drilling Info is showing more optimistic rig numbers than Baker Hughes

• Thesis is unchanged: Expect rigs counts to roll off for the next three months or so, with oil prices languishing in the $46-49 range typically

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Vehicle Sales Forecast: Sixth consecutive month below 17 million SAAR

by Calculated Risk on 8/25/2017 01:41:00 PM

The automakers will report July vehicle sales on Friday, September 1st.

Note: There were 27 selling days in August 2017, there were 26 in August 2016.

From WardsAuto: Forecast: U.S. Auto Market Continues Downward Trend in August

A WardsAuto forecast calls for U.S. automakers to deliver 1.51 million light vehicles in August. ... The report puts the seasonally adjusted annual rate of sales for August at 16.5 million units, below the 17.1 million SAAR in same-month 2016 and 16.7 million in prior-month 2017.Overall sales through July are down about 3% from the record level in 2016.

...

Light-vehicle inventory stood at 3.86 million units at the end of July, up 9.4% from year-ago and about 15% higher than necessary with current sales rates. The streak of record-high stock is expected to continue with 3.8 million units at the end of August, 7.5% greater than same-month 2016. This will leave automakers with a 69 days’ supply, same as prior-month, but well above year-ago’s 62. Slowdowns in production and higher sales incentives through September are expected to narrow the gap between supply and demand.

emphasis added

Freddie Mac: Mortgage Serious Delinquency rate unchanged in July

by Calculated Risk on 8/25/2017 11:30:00 AM

Freddie Mac reported that the Single-Family serious delinquency rate in July was at 0.85%, unchanged from 0.85% in June. Freddie's rate is down from 1.08% in July 2016.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This ties last month as the lowest serious delinquency rate since April 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Although the rate is still generally declining, the rate of decline has slowed.

Maybe the rate will decline another 0.2 to 0.3 percentage points or so to a cycle bottom, but this is pretty close to normal.

Note: Fannie Mae will report for July soon.

Yellen: "Financial Stability a Decade after the Onset of the Crisis"

by Calculated Risk on 8/25/2017 10:08:00 AM

From Fed Chair Janet Yellen: Financial Stability a Decade after the Onset of the Crisis. A few excerpts (here Dr. Yellen argues for keeping most of existing regulations put in place after the financial crisis):

Is This Safer System Supporting Growth?

I suspect many in this audience would agree with the narrative of my remarks so far: The events of the crisis demanded action, needed reforms were implemented, and these reforms have made the system safer. Now--a decade from the onset of the crisis and nearly seven years since the passage of the Dodd-Frank Act and international agreement on the key banking reforms--a new question is being asked: Have reforms gone too far, resulting in a financial system that is too burdened to support prudent risk-taking and economic growth?

The Federal Reserve is committed individually, and in coordination with other U.S. government agencies through forums such as the FSOC and internationally through bodies such as the Basel Committee on Banking Supervision and the FSB, to evaluating the effects of financial market regulations and considering appropriate adjustments. Furthermore, the Federal Reserve has independently taken steps to evaluate potential adjustments to its regulatory and supervisory practices. For example, the Federal Reserve initiated a review of its stress tests following the 2015 cycle, and this review suggested changes to reduce the burden on participating institutions, especially smaller institutions, and to better align the supervisory stress tests with regulatory capital requirements. In addition, a broader set of changes to the new financial regulatory framework may deserve consideration. Such changes include adjustments that may simplify regulations applying to small and medium-sized banks and enhance resolution planning.

More broadly, we continue to monitor economic conditions, and to review and conduct research, to better understand the effect of regulatory reforms and possible implications for regulation. I will briefly summarize the current state of play in two areas: the effect of regulation on credit availability and on changes in market liquidity.

The effects of capital regulation on credit availability have been investigated extensively. Some studies suggest that higher capital weighs on banks' lending, while others suggest that higher capital supports lending. Such conflicting results in academic research are not altogether surprising. It is difficult to identify the effects of regulatory capital requirements on lending because material changes to capital requirements are rare and are often precipitated, as in the recent case, by financial crises that also have large effects on lending.

Given the uncertainty regarding the effect of capital regulation on lending, rulemakings of the Federal Reserve and other agencies were informed by analyses that balanced the possible stability gains from greater loss-absorbing capacity against the possible adverse effects on lending and economic growth. This ex ante assessment pointed to sizable net benefits to economic growth from higher capital standards--and subsequent research supports this assessment. The steps to improve the capital positions of banks promptly and significantly following the crisis, beginning with the 2009 Supervisory Capital Assessment Program, have resulted in a return of lending growth and profitability among U.S. banks more quickly than among their global peers.

While material adverse effects of capital regulation on broad measures of lending are not readily apparent, credit may be less available to some borrowers, especially homebuyers with less-than-perfect credit histories and, perhaps, small businesses. In retrospect, mortgage borrowing was clearly too easy for some households in the mid-2000s, resulting in debt burdens that were unsustainable and ultimately damaging to the financial system. Currently, many factors are likely affecting mortgage lending, including changes in market perceptions of the risk associated with mortgage lending; changes in practices at the government-sponsored enterprises and the Federal Housing Administration; changes in technology that may be contributing to entry by nonbank lenders; changes in consumer protection regulations; and, perhaps to a limited degree, changes in capital and liquidity regulations within the banking sector. These issues are complex and interact with a broader set of challenges related to the domestic housing finance system.

Credit appears broadly available to small businesses with solid credit histories, although indicators point to some difficulties facing firms with weak credit scores and insufficient credit histories. Small business formation is critical to economic dynamism and growth. Smaller firms rely disproportionately on lending from smaller banks, and the Federal Reserve has been taking steps and examining additional steps to reduce unnecessary complexity in regulations affecting smaller banks.

Finally, many financial market participants have expressed concerns about the ability to transact in volume at low cost--that is, about market liquidity, particularly in certain fixed-income markets such as that for corporate bonds. Market liquidity for corporate bonds remains robust overall, and the healthy condition of the market is apparent in low bid-ask spreads and the large volume of corporate bond issuance in recent years. That said, liquidity conditions are clearly evolving. Large dealers appear to devote less of their balance sheets to holding inventories of securities to facilitate trades and instead increasingly facilitate trades by directly matching buyers and sellers. In addition, algorithmic traders and institutional investors are a larger presence in various markets than previously, and the willingness of these institutions to support liquidity in stressful conditions is uncertain. While no single factor appears to be the predominant cause of the evolution of market liquidity, some regulations may be affecting market liquidity somewhat. There may be benefits to simplifying aspects of the Volcker rule, which limits proprietary trading by banking firms, and to reviewing the interaction of the enhanced supplementary leverage ratio with risk-based capital requirements. At the same time, the new regulatory framework overall has made dealers more resilient to shocks, and, in the past, distress at dealers following adverse shocks has been an important factor driving market illiquidity. As a result, any adjustments to the regulatory framework should be modest and preserve the increase in resilience at large dealers and banks associated with the reforms put in place in recent years.

emphasis added