by Calculated Risk on 8/23/2017 11:47:00 AM

Wednesday, August 23, 2017

AIA: Architecture Billings Index "growth moderates" in July

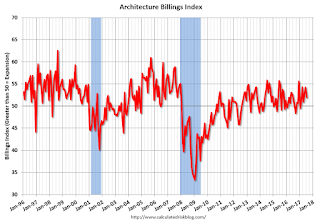

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index growth moderates

For the sixth consecutive month, architecture firms reported increasing demand for design services as reflected in the July Architecture Billings Index (ABI). As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the July ABI score was 51.9, down from a score of 54.2 in the previous month. This score still reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 59.5, up from a reading of 58.6 the previous month, while the new design contracts index increased from 53.7 to 56.4.

“The July figures show the continuation of healthy trends in the construction sector of our economy,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “In addition to the balanced increases in design billings across all major regions and construction sectors, the strong gains in new project work coming into architecture firms points to future growth in design and construction activity over coming quarters.”

...

• Regional averages: South (53.8), Midwest (53.8), Northeast (53.6), West (50.9)

• Sector index breakdown: multi-family residential (55.8), commercial / industrial (55.4), institutional (52.0), mixed practice (48.4)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.9 in July, up from 54.2 the previous month. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 9 of the last 12 months, suggesting a further increase in CRE investment in 2017 and early 2018.

New Home Sales decrease to 571,000 Annual Rate in July

by Calculated Risk on 8/23/2017 10:12:00 AM

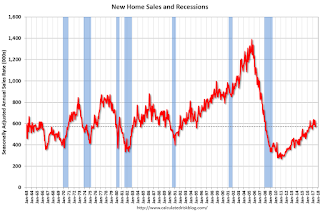

The Census Bureau reports New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 571 thousand.

The previous three months were revised up solidly.

"Sales of new single-family houses in July 2017 were at a seasonally adjusted annual rate of 571,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 9.4 percent below the revised June rate of 630,000 and is 8.9 percent below the July 2016 estimate of 627,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in July to 5.8 months from 5.2 month in June.

The months of supply increased in July to 5.8 months from 5.2 month in June. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of July was 276,000. This represents a supply of 5.8 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In July 2017 (red column), 49 thousand new homes were sold (NSA). Last year, 54 thousand homes were sold in July.

The all time high for July was 117 thousand in 2005, and the all time low for June was 26 thousand in 2010.

This was below expectations of 610,000 sales SAAR, however the previous months were revised up solidly. I'll have more later today.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 8/23/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

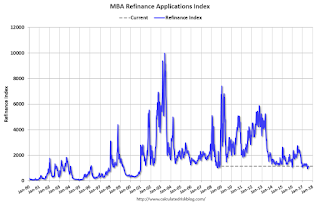

Mortgage applications decreased 0.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 18, 2017.

... The Refinance Index increased 0.3 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 9 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) remained unchanged from the week prior at 4.12 percent, with points increasing to 0.39 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 9% year-over-year.

Tuesday, August 22, 2017

Wednesday: New Home Sales

by Calculated Risk on 8/22/2017 05:39:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, New Home Sales for July from the Census Bureau. The consensus is for 610 thousand SAAR, unchanged from 610 thousand in June.

• During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

Chemical Activity Barometer Shows Modest Slowing in August

by Calculated Risk on 8/22/2017 11:45:00 AM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Shows Modest Slowing

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), remained unchanged from July, continuing a modest deceleration of growth. The flat reading follows a 0.1 percent increase in July and a flat reading in June. Compared to a year earlier, the CAB is up 3.2 percent year-over-year, an easing from recent year-over-year gains. All data is measured on a three-month moving average (3MMA).

On a year-over-year basis, the unadjusted CAB is up 3.0 percent, also an easing from the previous six months.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

CAB increased solidly in early 2017 suggesting an increase in Industrial Production, however, the year-over-year increase in the CAB has slowed recently.

Richmond Fed: "Manufacturing Activity in August Remained Little Changed from July"

by Calculated Risk on 8/22/2017 10:04:00 AM

From the Richmond Fed: Reports on Fifth District Manufacturing Activity in August Remained Little Changed from July

Reports on Fifth District manufacturing activity were largely unchanged in August, according to the latest survey by the Federal Reserve Bank of Richmond. The composite index remained at 14 in August, with an increase in the employment index offsetting a decrease in the shipments index and a very slight decline in the new orders metric. Although the employment index rose from 10 to 17 in August, other measures of labor market activity — wages and average workweek — were largely unchanged.This suggests solid growth in August.

emphasis added

Monday, August 21, 2017

"Mortgage Rates Steady at 2017 Lows"

by Calculated Risk on 8/21/2017 05:11:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Steady at 2017 Lows

Mortgage rates held steady to start the new week. This keeps them in line with the best levels since November 2016. There were no interesting developments in financial markets or in terms of economic data today. ...Tuesday:

3.875% remains the most prevalently-quoted conventional 30yr fixed rate for top tier scenarios, although quite a few lenders remain at 4.00%.

• At 9:00 AM ET, FHFA House Price Index for June 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for August.

• Also expected at 10:00 AM (not confirmed), Q2 MBA National Delinquency Survey.

Existing Home Sales: Take the Under on Thursday

by Calculated Risk on 8/21/2017 11:55:00 AM

The NAR is scheduled to report July Existing Home Sales on Thursday, August 24th at 10:00 AM ET.

The consensus, according to Bloomberg, is that the NAR will report sales of 5.57 million. Housing economist Tom Lawler estimates the NAR will report sales of 5.38 million on a seasonally adjusted annual rate (SAAR) basis, down from 5.52 million SAAR in June.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for over 7 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last seven years, the consensus average miss was 145 thousand, and Lawler's average miss was 70 thousand.

Many analysts now change their "forecast" after Lawler's estimate is posted, so the consensus has improved a little recently!

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | --- |

| 1NAR initially reported before revisions. | |||

Chicago Fed "Index Points to Growth near Historical Trend in July"

by Calculated Risk on 8/21/2017 09:50:00 AM

From the Chicago Fed: Index Points to Growth near Historical Trend in July

The Chicago Fed National Activity Index (CFNAI) moved down to –0.01 in July from +0.16 in June. Three of the four broad categories of indicators that make up the index decreased from June, and three of the four categories made negative contributions to the index in July. The index’s three-month moving average, CFNAI-MA3, moved down to –0.05 in July from +0.09 in June.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was close to the historical trend in July (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, August 20, 2017

Sunday Night Futures

by Calculated Risk on 8/20/2017 08:59:00 PM

Weekend:

• Schedule for Week of Aug 20, 2017

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for July. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 futures are up 2, and DOW futures are up 32 (fair value).

Oil prices were mixed over the last week with WTI futures at $48.48 per barrel and Brent at $52.66 per barrel. A year ago, WTI was at $47, and Brent was at $48 - so oil prices are up slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.32 per gallon - a year ago prices were at $2.16 per gallon - so gasoline prices are up 16 cents per gallon year-over-year.