by Calculated Risk on 8/03/2017 03:35:00 PM

Thursday, August 03, 2017

Goldman: July Payrolls Preview

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls increased by 190k in July ... Our forecast reflects generally favorable labor market fundamentals and a potential boost from evolving seasonality, as July job growth has been strong in recent years in both the establishment and household surveys.

We believe job growth will be sufficient to bring the unemployment rate back down to 4.3%, and we expect the combination of diminished labor market slack and favorable calendar effects to produce a 0.3% monthly rise in average hourly earnings (or +2.4% year-over-year).

July Employment Preview

by Calculated Risk on 8/03/2017 01:00:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for July. The consensus, according to Bloomberg, is for an increase of 178,000 non-farm payroll jobs in July (with a range of estimates between 144,000 to 220,000), and for the unemployment rate to decline to 4.3%.

The BLS reported 222,000 jobs added in June.

Here is a summary of recent data:

• The ADP employment report showed an increase of 178,000 private sector payroll jobs in July. This was close to consensus expectations of 175,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth close to expectations.

• The ISM manufacturing employment index decreased in July to 55.2%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll increased about 10,000 in July. The ADP report indicated manufacturing jobs decreased 4,000 in July.

The ISM non-manufacturing employment index decreased in July to 53.6%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 175,000 in July.

Combined, the ISM indexes suggests employment gains of about 185,000. This suggests employment growth close to expectations.

• Initial weekly unemployment claims averaged 242,000 in July, mostly unchanged from 243,000 in June. For the BLS reference week (includes the 12th of the month), initial claims were at 234,000, down from 242,000 during the reference week in June.

The decrease during the reference week suggests slightly fewer layoffs during the reference week in July than in June. This suggests a somewhat stronger employment report in July than in June.

• The final July University of Michigan consumer sentiment index decreased to 93.4 from the June reading of 95.1. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Conclusion: None of the indicators alone is very good at predicting the initial BLS employment report. Overall these indicators suggest job growth close to the consensus.

ISM Non-Manufacturing Index decreased to 53.9% in July

by Calculated Risk on 8/03/2017 10:04:00 AM

The July ISM Non-manufacturing index was at 53.9%, down from 57.4% in June. The employment index decreased in July to 53.6%, from 55.8%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: July 2017 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in July for the 91st consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: "The NMI® registered 53.9 percent, which is 3.5 percentage points lower than the June reading of 57.4 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased to 55.9 percent, 4.9 percentage points lower than the June reading of 60.8 percent, reflecting growth for the 96th consecutive month, at a slower rate in July. The New Orders Index registered 55.1 percent, 5.4 percentage points lower than the reading of 60.5 percent in June. The Employment Index decreased 2.2 percentage points in July to 53.6 percent from the June reading of 55.8 percent. The Prices Index increased 3.6 percentage points from the June reading of 52.1 percent to 55.7 percent, indicating prices increased in July for the second consecutive month. According to the NMI®, 15 non-manufacturing industries reported growth. The non-manufacturing sector did not sustain the previous rate of growth and cooled-off in July. The majority of respondents’ comments were mostly positive about business conditions and the state of the economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests slower expansion in July than in June.

Weekly Initial Unemployment Claims decrease to 240,000

by Calculated Risk on 8/03/2017 08:33:00 AM

The DOL reported:

In the week ending July 29, the advance figure for seasonally adjusted initial claims was 240,000, a decrease of 5,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 244,000 to 245,000. The 4-week moving average was 241,750, a decrease of 2,500 from the previous week's revised average. The previous week's average was revised up by 250 from 244,000 to 244,250.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 241,750.

This was lower than the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, August 02, 2017

Thursday: Unemployment Claims, ISM non-Mfg Survey

by Calculated Risk on 8/02/2017 07:05:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Steady at Recent Lows

Mortgage rates held steady today, keeping them in line with the best levels in just over a month. That means the best-qualified borrowers putting more than 20% down are seeing conventional 30yr fixed rates of roughly 4%, depending on the lender. Some are quoting rates in the 3.75-3.875% range, but points and fees may vary.Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 244 thousand initial claims, unchanged from 244 thousand the previous week.

• At 10:00 AM, the ISM non-Manufacturing Index for July. The consensus is for index to decrease to 56.9 from 57.4 in June.

Lawler: Selected Operating Statistics, Large Publicly-Traded Home Builders

by Calculated Risk on 8/02/2017 02:45:00 PM

From housing economist Tom Lawler:

Below is a table showing selected operating statistics for eight large, publicly-traded builders for the quarter ended June 30th.

Sales per active community for these builders as a whole last quarter were up 4.9% from a year earlier, while the order backlog for this builder group as of the end of June was up 5.1% from last June. The relative modest year-over-year gains in average prices was in many cases a “mix” issue, with several builders focusing a bit more on first-time buyers. For D.R. Horton, “Express” Homes, its “entry”-level product, represented 36% of net orders and 33% of settlements last quarter, compared to 28% fo both net orders and settlements in the comparable quarter of 2016. PulteGroup’s “higher than average” YOY increase in average sales prices partly reflected an increase in the share of its settlements in its “move-up/luxury” brand.

| Net Orders | Settlements | Average Closing Price $ (000s) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 6/17 | 6/16 | % Chg | 6/17 | 6/16 | % Chg | 6/17 | 6/16 | % Chg |

| D.R. Horton | 13,040 | 11,714 | 11.3% | 12,497 | 10,739 | 16.4% | 293 | 290 | 0.9% |

| Pulte Group | 6,395 | 5,697 | 12.3% | 5,044 | 4,722 | 6.8% | 390 | 367 | 6.3% |

| NVR | 4,678 | 4,324 | 8.2% | 3,917 | 3,581 | 9.4% | 386 | 379 | 2.0% |

| Cal Atlantic | 4,078 | 3,921 | 4.0% | 3,653 | 3,484 | 4.9% | 444 | 447 | -0.7% |

| Beazer Homes | 1,595 | 1,490 | 7.0% | 1,387 | 1,364 | 1.7% | 341 | 331 | 3.0% |

| Meritage Homes | 2,153 | 2,073 | 3.9% | 1,906 | 1,950 | -2.3% | 419 | 408 | 2.7% |

| MDC Holdings | 1,598 | 1,646 | -2.9% | 1,412 | 1,272 | 11.0% | 459 | 449 | 2.1% |

| M/I Homes | 1,400 | 1,354 | 3.4% | 1,211 | 1,042 | 16.2% | 366 | 362 | 1.1% |

| SubTotal | 34,937 | 32,219 | 8.4% | 31,027 | 28,154 | 10.2% | 359 | 354 | 1.4% |

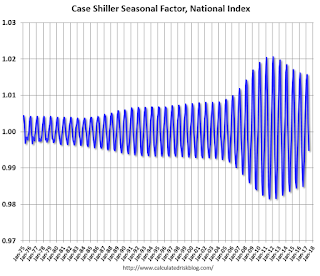

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 8/02/2017 12:56:00 PM

CR Note: This is a repeat of a previous post with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through May 2017). The seasonal pattern was smaller back in the '90s and early '00s, and once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

ADP: Private Employment increased 178,000 in July

by Calculated Risk on 8/02/2017 08:20:00 AM

Private sector employment increased by 178,000 jobs from June to July according to the July ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was close to the consensus forecast for 175,000 private sector jobs added in the ADP report.

...

“Job gains continued to be strong in the month of July,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “However, as the labor market tightens employers may find it more difficult to recruit qualified workers.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The American job machine continues to operate in high gear. Job gains are broad-based across industries and company sizes, with only manufacturers reducing their payrolls. At this pace of job growth, unemployment will continue to quickly decline.”

The BLS report for July will be released Friday, and the consensus is for 180,000 non-farm payroll jobs added in July.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 8/02/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 28, 2017.

... The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier to its lowest level since March 2017. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 9 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) remained unchanged at 4.17 percent, with points decreasing to 0.36 from 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 9% year-over-year.

Tuesday, August 01, 2017

Wednesday: ADP Employment

by Calculated Risk on 8/01/2017 08:58:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 175,000 payroll jobs added in July, up from 158,000 added in June.