by Calculated Risk on 8/03/2017 10:04:00 AM

Thursday, August 03, 2017

ISM Non-Manufacturing Index decreased to 53.9% in July

The July ISM Non-manufacturing index was at 53.9%, down from 57.4% in June. The employment index decreased in July to 53.6%, from 55.8%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: July 2017 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in July for the 91st consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: "The NMI® registered 53.9 percent, which is 3.5 percentage points lower than the June reading of 57.4 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased to 55.9 percent, 4.9 percentage points lower than the June reading of 60.8 percent, reflecting growth for the 96th consecutive month, at a slower rate in July. The New Orders Index registered 55.1 percent, 5.4 percentage points lower than the reading of 60.5 percent in June. The Employment Index decreased 2.2 percentage points in July to 53.6 percent from the June reading of 55.8 percent. The Prices Index increased 3.6 percentage points from the June reading of 52.1 percent to 55.7 percent, indicating prices increased in July for the second consecutive month. According to the NMI®, 15 non-manufacturing industries reported growth. The non-manufacturing sector did not sustain the previous rate of growth and cooled-off in July. The majority of respondents’ comments were mostly positive about business conditions and the state of the economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests slower expansion in July than in June.

Weekly Initial Unemployment Claims decrease to 240,000

by Calculated Risk on 8/03/2017 08:33:00 AM

The DOL reported:

In the week ending July 29, the advance figure for seasonally adjusted initial claims was 240,000, a decrease of 5,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 244,000 to 245,000. The 4-week moving average was 241,750, a decrease of 2,500 from the previous week's revised average. The previous week's average was revised up by 250 from 244,000 to 244,250.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 241,750.

This was lower than the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, August 02, 2017

Thursday: Unemployment Claims, ISM non-Mfg Survey

by Calculated Risk on 8/02/2017 07:05:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Steady at Recent Lows

Mortgage rates held steady today, keeping them in line with the best levels in just over a month. That means the best-qualified borrowers putting more than 20% down are seeing conventional 30yr fixed rates of roughly 4%, depending on the lender. Some are quoting rates in the 3.75-3.875% range, but points and fees may vary.Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 244 thousand initial claims, unchanged from 244 thousand the previous week.

• At 10:00 AM, the ISM non-Manufacturing Index for July. The consensus is for index to decrease to 56.9 from 57.4 in June.

Lawler: Selected Operating Statistics, Large Publicly-Traded Home Builders

by Calculated Risk on 8/02/2017 02:45:00 PM

From housing economist Tom Lawler:

Below is a table showing selected operating statistics for eight large, publicly-traded builders for the quarter ended June 30th.

Sales per active community for these builders as a whole last quarter were up 4.9% from a year earlier, while the order backlog for this builder group as of the end of June was up 5.1% from last June. The relative modest year-over-year gains in average prices was in many cases a “mix” issue, with several builders focusing a bit more on first-time buyers. For D.R. Horton, “Express” Homes, its “entry”-level product, represented 36% of net orders and 33% of settlements last quarter, compared to 28% fo both net orders and settlements in the comparable quarter of 2016. PulteGroup’s “higher than average” YOY increase in average sales prices partly reflected an increase in the share of its settlements in its “move-up/luxury” brand.

| Net Orders | Settlements | Average Closing Price $ (000s) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 6/17 | 6/16 | % Chg | 6/17 | 6/16 | % Chg | 6/17 | 6/16 | % Chg |

| D.R. Horton | 13,040 | 11,714 | 11.3% | 12,497 | 10,739 | 16.4% | 293 | 290 | 0.9% |

| Pulte Group | 6,395 | 5,697 | 12.3% | 5,044 | 4,722 | 6.8% | 390 | 367 | 6.3% |

| NVR | 4,678 | 4,324 | 8.2% | 3,917 | 3,581 | 9.4% | 386 | 379 | 2.0% |

| Cal Atlantic | 4,078 | 3,921 | 4.0% | 3,653 | 3,484 | 4.9% | 444 | 447 | -0.7% |

| Beazer Homes | 1,595 | 1,490 | 7.0% | 1,387 | 1,364 | 1.7% | 341 | 331 | 3.0% |

| Meritage Homes | 2,153 | 2,073 | 3.9% | 1,906 | 1,950 | -2.3% | 419 | 408 | 2.7% |

| MDC Holdings | 1,598 | 1,646 | -2.9% | 1,412 | 1,272 | 11.0% | 459 | 449 | 2.1% |

| M/I Homes | 1,400 | 1,354 | 3.4% | 1,211 | 1,042 | 16.2% | 366 | 362 | 1.1% |

| SubTotal | 34,937 | 32,219 | 8.4% | 31,027 | 28,154 | 10.2% | 359 | 354 | 1.4% |

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 8/02/2017 12:56:00 PM

CR Note: This is a repeat of a previous post with updated graphs.

A few key points:

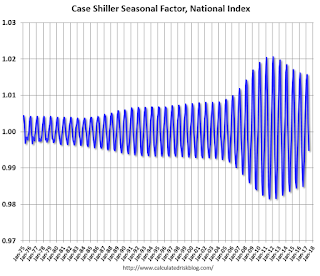

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through May 2017). The seasonal pattern was smaller back in the '90s and early '00s, and once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

ADP: Private Employment increased 178,000 in July

by Calculated Risk on 8/02/2017 08:20:00 AM

Private sector employment increased by 178,000 jobs from June to July according to the July ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was close to the consensus forecast for 175,000 private sector jobs added in the ADP report.

...

“Job gains continued to be strong in the month of July,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “However, as the labor market tightens employers may find it more difficult to recruit qualified workers.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The American job machine continues to operate in high gear. Job gains are broad-based across industries and company sizes, with only manufacturers reducing their payrolls. At this pace of job growth, unemployment will continue to quickly decline.”

The BLS report for July will be released Friday, and the consensus is for 180,000 non-farm payroll jobs added in July.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 8/02/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 28, 2017.

... The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier to its lowest level since March 2017. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 9 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) remained unchanged at 4.17 percent, with points decreasing to 0.36 from 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 9% year-over-year.

Tuesday, August 01, 2017

Wednesday: ADP Employment

by Calculated Risk on 8/01/2017 08:58:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 175,000 payroll jobs added in July, up from 158,000 added in June.

U.S. Light Vehicle Sales at 16.76 million annual rate in July

by Calculated Risk on 8/01/2017 02:47:00 PM

Based on an estimate from WardsAuto, light vehicle sales were at a 16.76 million SAAR in July.

That is down 6% from July 2016, and up 1% from last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for July (red, light vehicle sales of 16.76 million SAAR mostly from WardsAuto).

This was close to the consensus forecast of 16.8 million for July.

After two consecutive years of record sales, vehicle sales will be down in 2017.

Note: dashed line is current estimated sales rate.

Construction Spending decreased in June

by Calculated Risk on 8/01/2017 11:57:00 AM

Earlier today, the Census Bureau reported that overall construction spending decreased in June:

Construction spending during June 2017 was estimated at a seasonally adjusted annual rate of $1,205.8 billion, 1.3 percent below the revised May estimate of $1,221.6 billion. The June figure is 1.6 percent above the June 2016 estimate of $1,186.4 billion.Private and public spending both decreased in June:

Spending on private construction was at a seasonally adjusted annual rate of $940.7 billion, 0.1 percent below the revised May estimate of $941.3 billion. ...

In June, the estimated seasonally adjusted annual rate of public construction spending was $265.1 billion, 5.4 percent below the revised May estimate of $280.3 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is still 26% below the bubble peak.

Non-residential spending is now 6% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 19% below the peak in March 2009, and only slightly above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 9%. Non-residential spending is up 1% year-over-year. Public spending is down 9% year-over-year.

This was well below the consensus forecast of a 0.5% increase for June, and spending for previous months were revised down. A weak report.