by Calculated Risk on 7/28/2017 05:10:00 PM

Friday, July 28, 2017

Oil Rigs "Back in action"

A few comments from Steven Kopits of Princeton Energy Advisors LLC on July 28, 2017:

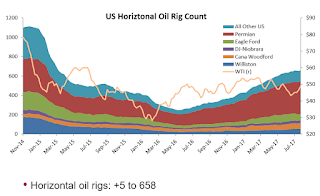

• Total US oil rigs were up 2 to 766

• Horizontal oil rigs were up 5 to 658

...

• With oil prices now over $49, operators are both above breakeven and in a position to hedge future production. Expect a return to rig additions at these prices.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Freddie Mac: Mortgage Serious Delinquency rate declined in June, Lowest since April 2008

by Calculated Risk on 7/28/2017 02:09:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in June was at 0.85%, down from 0.87% in May. Freddie's rate is down from 1.08% in June 2016.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This is the lowest serious delinquency rate since April 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Although the rate is still declining, the rate of decline has slowed.

Maybe the rate will decline another 0.2 to 0.3 percentage points or so to a cycle bottom, but this is pretty close to normal.

Note: Fannie Mae will report for June soon.

Q2 GDP: Investment

by Calculated Risk on 7/28/2017 11:12:00 AM

First, the BEA released revisions of GDP data from 2014 through Q1 2017. In general, GDP was revised up slightly, although residential investment was revised down a little. Not a significant change.

The first graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Residential investment (RI) decreased at a 6.8% annual rate in Q1. Equipment investment increased at a 8.2% annual rate, and investment in non-residential structures increased at a 4.9% annual rate.

On a 3 quarter trailing average basis, RI (red), equipment (green), and nonresidential structures (blue) are all positive.

I'll post more on the components of non-residential investment once the supplemental data is released.

I expect investment to be solid going forward, and for the economy to continue to grow.

The second graph shows residential investment as a percent of GDP.

Residential Investment as a percent of GDP decreased in Q2, but has generally been increasing. RI as a percent of GDP is only just above the bottom of the previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Still no worries.

BEA: Real GDP increased at 2.6% Annualized Rate in Q2

by Calculated Risk on 7/28/2017 08:35:00 AM

From the BEA: Gross Domestic Product: Second Quarter 2017 (Advance Estimate)

Real gross domestic product increased at an annual rate of 2.6 percent in the second quarter of 2017, according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 1.2 percent (revised).The advance Q2 GDP report, with 2.6% annualized growth, was at expectations.

...

The increase in real GDP in the second quarter reflected positive contributions from personal consumption expenditures (PCE), nonresidential fixed investment, exports, and federal government spending that were partly offset by negative contributions from private residential fixed investment, private inventory investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The acceleration in real GDP growth in the second quarter reflected a smaller decrease in private inventory investment, an acceleration in PCE, and an upturn in federal government spending. These movements were partly offset by a downturn in residential fixed investment and decelerations in exports and in nonresidential fixed investment.

emphasis added

Personal consumption expenditures (PCE) increased at 2.8% annualized rate in Q2, up from 1.9% in Q1. Residential investment (RI) decreased at a 6.8% pace. Equipment investment increased at a 8.2% annualized rate, and investment in non-residential structures increased at a 5.2% pace.

I'll have more later ...

Thursday, July 27, 2017

Friday: GDP

by Calculated Risk on 7/27/2017 07:04:00 PM

From Merrill Lynch:

On balance, [inventory] data added 0.3pp to 2Q GDP tracking, bringing us up to 2.4% heading into tomorrow's advance release.From the Altanta Fed: GDPNow

The final GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2017 is 2.8 percent on July 27, up from 2.5 percent on July 19. The forecast of the contribution of inventory investment to second-quarter growth increased from 0.54 percentage points to 0.82 percentage points after this morning's advance reports on durable manufacturing and wholesale and retail inventories from the U.S. Census Bureau.Friday:

• At 8:30 AM ET, Gross Domestic Product, 2nd quarter 2017 (Advance estimate). The consensus is that real GDP increased 2.6% annualized in Q2, up from 1.4% in Q1.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for July). The consensus is for a reading of 93.1, unchanged from the preliminary reading 93.1.

Vehicle Sales Forecast: Fifth consecutive month below 17 million SAAR

by Calculated Risk on 7/27/2017 01:45:00 PM

The automakers will report July vehicle sales on Tuesday, August 1st.

Note: There were 26 selling days in July 2017, the same as in July 2016.

From WardsAuto: Forecast: July U.S. LV Sales Fall Behind Year-Ago

A WardsAuto forecast calls for U.S. light-vehicle sales to reach a 16.9 million-unit seasonally adjusted annual rate in July, following June’s 16.4 million SAAR and resulting in a 5-month streak of sub-17 million figures. July’s SAAR would be significantly lower than the 17.8 million recorded in same-month 2016.Overall sales are down about 3% from the record level in 2016.

...

The industry continues to deal with declining sales and rising inventory ... U.S. dealers entered July with ... 73 days’ supply, while a total in the low 60s is considered healthy for this time of year.

emphasis added

Kansas City Fed: Regional Manufacturing Activity "Expanded Moderately" in July

by Calculated Risk on 7/27/2017 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded Moderately

The Federal Reserve Bank of Kansas City released the July Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded moderately with solid expectations for future activity.The Kansas City region was hit hard by the sharp decline in oil prices, but activity started expanding last year when oil prices increased. Now growth is moderate with oil prices mostly moving sideways.

“We’ve now seen four months of steady gains following more rapid growth in factory activity earlier this year,” said Wilkerson. “Firms overall seem confident that moderate growth will continue.”

...

The month-over-month composite index was 10 in July, down slightly from 11 in June but up from 8 in May. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Factory activity increased moderately at non-durable goods plants, particularly for chemicals and plastics, while durable activity moderated somewhat. Month-over-month indexes were mixed. The production index tumbled from 23 to 4, and the shipments index fell into negative territory for the first time since August 2016. Conversely, the employment index remained solid, while the new orders index rose modestly, and the order backlog index also increased but remained negative.

emphasis added

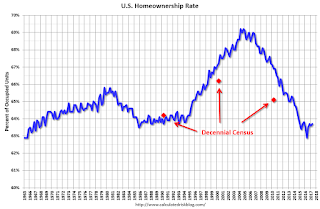

HVS: Q2 2017 Homeownership and Vacancy Rates

by Calculated Risk on 7/27/2017 10:12:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q1 2017.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate increased to 63.7% in Q2, from 63.6% in Q1.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Overall this suggests that vacancies have declined significantly, and my guess is the homeownership rate is probably close to the bottom - and that the rental vacancy rate has bottomed.

Weekly Initial Unemployment Claims increase to 244,000

by Calculated Risk on 7/27/2017 08:33:00 AM

The DOL reported:

In the week ending July 22, the advance figure for seasonally adjusted initial claims was 244,000, an increase of 10,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 233,000 to 234,000. The 4-week moving average was 244,000, unchanged from the previous week's revised average. The previous week's average was revised up by 250 from 243,750 to 244,000.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims was unchanged at 244,000.

This was higher than the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, July 26, 2017

Thursday: Unemployment Claims, Durable Goods, Q2 Housing Vacancies and Homeownership

by Calculated Risk on 7/26/2017 08:25:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Steady to Slightly Lower After Fed

Mortgage rates were steady to slightly lower today, despite fairly substantial movement in underlying bond markets. [30YR FIXED - 4.00%] ... As for today's market motivation, the lion's share of the movement happened after the Fed Announcement.Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 233 thousand the previous week.

• Also at 8:30 AM, Durable Goods Orders for June from the Census Bureau. The consensus is for a 3.2% increase in durable goods orders.

• Also at 8:30 AM, Chicago Fed National Activity Index for June. This is a composite index of other data.

• At 10:00 AM, the Q2 Housing Vacancies and Homeownership from the Census Bureau.

• At 11:00 AM: the Kansas City Fed manufacturing survey for July.