by Calculated Risk on 7/28/2017 08:35:00 AM

Friday, July 28, 2017

BEA: Real GDP increased at 2.6% Annualized Rate in Q2

From the BEA: Gross Domestic Product: Second Quarter 2017 (Advance Estimate)

Real gross domestic product increased at an annual rate of 2.6 percent in the second quarter of 2017, according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 1.2 percent (revised).The advance Q2 GDP report, with 2.6% annualized growth, was at expectations.

...

The increase in real GDP in the second quarter reflected positive contributions from personal consumption expenditures (PCE), nonresidential fixed investment, exports, and federal government spending that were partly offset by negative contributions from private residential fixed investment, private inventory investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The acceleration in real GDP growth in the second quarter reflected a smaller decrease in private inventory investment, an acceleration in PCE, and an upturn in federal government spending. These movements were partly offset by a downturn in residential fixed investment and decelerations in exports and in nonresidential fixed investment.

emphasis added

Personal consumption expenditures (PCE) increased at 2.8% annualized rate in Q2, up from 1.9% in Q1. Residential investment (RI) decreased at a 6.8% pace. Equipment investment increased at a 8.2% annualized rate, and investment in non-residential structures increased at a 5.2% pace.

I'll have more later ...

Thursday, July 27, 2017

Friday: GDP

by Calculated Risk on 7/27/2017 07:04:00 PM

From Merrill Lynch:

On balance, [inventory] data added 0.3pp to 2Q GDP tracking, bringing us up to 2.4% heading into tomorrow's advance release.From the Altanta Fed: GDPNow

The final GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2017 is 2.8 percent on July 27, up from 2.5 percent on July 19. The forecast of the contribution of inventory investment to second-quarter growth increased from 0.54 percentage points to 0.82 percentage points after this morning's advance reports on durable manufacturing and wholesale and retail inventories from the U.S. Census Bureau.Friday:

• At 8:30 AM ET, Gross Domestic Product, 2nd quarter 2017 (Advance estimate). The consensus is that real GDP increased 2.6% annualized in Q2, up from 1.4% in Q1.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for July). The consensus is for a reading of 93.1, unchanged from the preliminary reading 93.1.

Vehicle Sales Forecast: Fifth consecutive month below 17 million SAAR

by Calculated Risk on 7/27/2017 01:45:00 PM

The automakers will report July vehicle sales on Tuesday, August 1st.

Note: There were 26 selling days in July 2017, the same as in July 2016.

From WardsAuto: Forecast: July U.S. LV Sales Fall Behind Year-Ago

A WardsAuto forecast calls for U.S. light-vehicle sales to reach a 16.9 million-unit seasonally adjusted annual rate in July, following June’s 16.4 million SAAR and resulting in a 5-month streak of sub-17 million figures. July’s SAAR would be significantly lower than the 17.8 million recorded in same-month 2016.Overall sales are down about 3% from the record level in 2016.

...

The industry continues to deal with declining sales and rising inventory ... U.S. dealers entered July with ... 73 days’ supply, while a total in the low 60s is considered healthy for this time of year.

emphasis added

Kansas City Fed: Regional Manufacturing Activity "Expanded Moderately" in July

by Calculated Risk on 7/27/2017 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded Moderately

The Federal Reserve Bank of Kansas City released the July Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded moderately with solid expectations for future activity.The Kansas City region was hit hard by the sharp decline in oil prices, but activity started expanding last year when oil prices increased. Now growth is moderate with oil prices mostly moving sideways.

“We’ve now seen four months of steady gains following more rapid growth in factory activity earlier this year,” said Wilkerson. “Firms overall seem confident that moderate growth will continue.”

...

The month-over-month composite index was 10 in July, down slightly from 11 in June but up from 8 in May. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Factory activity increased moderately at non-durable goods plants, particularly for chemicals and plastics, while durable activity moderated somewhat. Month-over-month indexes were mixed. The production index tumbled from 23 to 4, and the shipments index fell into negative territory for the first time since August 2016. Conversely, the employment index remained solid, while the new orders index rose modestly, and the order backlog index also increased but remained negative.

emphasis added

HVS: Q2 2017 Homeownership and Vacancy Rates

by Calculated Risk on 7/27/2017 10:12:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q1 2017.

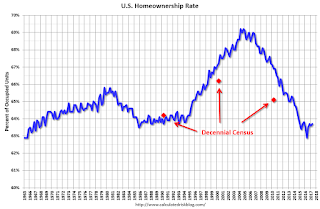

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate increased to 63.7% in Q2, from 63.6% in Q1.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Overall this suggests that vacancies have declined significantly, and my guess is the homeownership rate is probably close to the bottom - and that the rental vacancy rate has bottomed.

Weekly Initial Unemployment Claims increase to 244,000

by Calculated Risk on 7/27/2017 08:33:00 AM

The DOL reported:

In the week ending July 22, the advance figure for seasonally adjusted initial claims was 244,000, an increase of 10,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 233,000 to 234,000. The 4-week moving average was 244,000, unchanged from the previous week's revised average. The previous week's average was revised up by 250 from 243,750 to 244,000.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims was unchanged at 244,000.

This was higher than the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, July 26, 2017

Thursday: Unemployment Claims, Durable Goods, Q2 Housing Vacancies and Homeownership

by Calculated Risk on 7/26/2017 08:25:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Steady to Slightly Lower After Fed

Mortgage rates were steady to slightly lower today, despite fairly substantial movement in underlying bond markets. [30YR FIXED - 4.00%] ... As for today's market motivation, the lion's share of the movement happened after the Fed Announcement.Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 233 thousand the previous week.

• Also at 8:30 AM, Durable Goods Orders for June from the Census Bureau. The consensus is for a 3.2% increase in durable goods orders.

• Also at 8:30 AM, Chicago Fed National Activity Index for June. This is a composite index of other data.

• At 10:00 AM, the Q2 Housing Vacancies and Homeownership from the Census Bureau.

• At 11:00 AM: the Kansas City Fed manufacturing survey for July.

Zillow Forecast: "June Case-Shiller Forecast: Rare Monthly Declines Expected"

by Calculated Risk on 7/26/2017 04:41:00 PM

The Case-Shiller house price indexes for April were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Svenja Gudell at Zillow: June Case-Shiller Forecast: Rare Monthly Declines Expected

Both the 10- and 20-city S&P Case-Shiller indices are expected to fall in June from May on a seasonally adjusted basis, declines that would mark just the third and second months, respectively, in the past five years in which the seasonally adjusted indices have fallen month-over-month.The year-over-year change for the Case-Shiller National index will probably be smaller in June than in May.

All three primary Case-Shiller indices grew at a slower or flat annual pace in May compared to the previous month, and Zillow’s Case-Shiller forecast predicts that slowdown continued into June. The 10- and 20-city indices are each expected to fall 0.1 percent from May (seasonally adjusted), with annual growth falling from 4.9 percent and 5.7 percent to 4.8 percent and 5.5 percent, respectively. Monthly growth in the U.S. National Index is expected to remain flat in June (seasonally adjusted) and grow 5.3 percent year-over-year, down from 5.6 percent annual growth in May.

Zillow’s full forecast for May Case-Shiller data is shown below. These forecasts are based on today’s April Case-Shiller data release and the June 2017 Zillow Home Value Index. The June S&P CoreLogic Case-Shiller Indices will not be officially released until Tuesday, August 29.

FOMC Statement: No Change to Policy, Balance Sheet Change Coming "Relatively Soon"

by Calculated Risk on 7/26/2017 02:02:00 PM

Information received since the Federal Open Market Committee met in June indicates that the labor market has continued to strengthen and that economic activity has been rising moderately so far this year. Job gains have been solid, on average, since the beginning of the year, and the unemployment rate has declined. Household spending and business fixed investment have continued to expand. On a 12-month basis, overall inflation and the measure excluding food and energy prices have declined and are running below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee continues to expect that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace, and labor market conditions will strengthen somewhat further. Inflation on a 12-month basis is expected to remain somewhat below 2 percent in the near term but to stabilize around the Committee's 2 percent objective over the medium term. Near-term risks to the economic outlook appear roughly balanced, but the Committee is monitoring inflation developments closely.

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1 to 1-1/4 percent. The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a sustained return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee will carefully monitor actual and expected inflation developments relative to its symmetric inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

For the time being, the Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. The Committee expects to begin implementing its balance sheet normalization program relatively soon, provided that the economy evolves broadly as anticipated; this program is described in the June 2017 Addendum to the Committee's Policy Normalization Principles and Plans.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Patrick Harker; Robert S. Kaplan; Neel Kashkari; and Jerome H. Powell.

emphasis added

A few Comments on June New Home Sales

by Calculated Risk on 7/26/2017 11:30:00 AM

New home sales for June were reported at 610,000 on a seasonally adjusted annual rate basis (SAAR). This was close to the consensus forecast, however the three previous months were revised down. Still, overall, this was a decent report.

Sales were up 9.1% year-over-year in June.

Earlier: New Home Sales increase to 610,000 Annual Rate in June.

This graph shows new home sales for 2016 and 2017 by month (Seasonally Adjusted Annual Rate). Sales were up 9.1% year-over-year in June.

For the first six months of 2017, new home sales are up 10.9% compared to the same period in 2016.

This was a strong year-over-year increase through June, however sales were weak in Q1 last year, so this was a somewhat easy comparison.

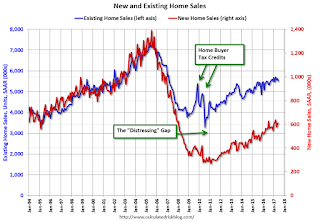

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.