by Calculated Risk on 7/26/2017 04:41:00 PM

Wednesday, July 26, 2017

Zillow Forecast: "June Case-Shiller Forecast: Rare Monthly Declines Expected"

The Case-Shiller house price indexes for April were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Svenja Gudell at Zillow: June Case-Shiller Forecast: Rare Monthly Declines Expected

Both the 10- and 20-city S&P Case-Shiller indices are expected to fall in June from May on a seasonally adjusted basis, declines that would mark just the third and second months, respectively, in the past five years in which the seasonally adjusted indices have fallen month-over-month.The year-over-year change for the Case-Shiller National index will probably be smaller in June than in May.

All three primary Case-Shiller indices grew at a slower or flat annual pace in May compared to the previous month, and Zillow’s Case-Shiller forecast predicts that slowdown continued into June. The 10- and 20-city indices are each expected to fall 0.1 percent from May (seasonally adjusted), with annual growth falling from 4.9 percent and 5.7 percent to 4.8 percent and 5.5 percent, respectively. Monthly growth in the U.S. National Index is expected to remain flat in June (seasonally adjusted) and grow 5.3 percent year-over-year, down from 5.6 percent annual growth in May.

Zillow’s full forecast for May Case-Shiller data is shown below. These forecasts are based on today’s April Case-Shiller data release and the June 2017 Zillow Home Value Index. The June S&P CoreLogic Case-Shiller Indices will not be officially released until Tuesday, August 29.

FOMC Statement: No Change to Policy, Balance Sheet Change Coming "Relatively Soon"

by Calculated Risk on 7/26/2017 02:02:00 PM

Information received since the Federal Open Market Committee met in June indicates that the labor market has continued to strengthen and that economic activity has been rising moderately so far this year. Job gains have been solid, on average, since the beginning of the year, and the unemployment rate has declined. Household spending and business fixed investment have continued to expand. On a 12-month basis, overall inflation and the measure excluding food and energy prices have declined and are running below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee continues to expect that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace, and labor market conditions will strengthen somewhat further. Inflation on a 12-month basis is expected to remain somewhat below 2 percent in the near term but to stabilize around the Committee's 2 percent objective over the medium term. Near-term risks to the economic outlook appear roughly balanced, but the Committee is monitoring inflation developments closely.

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1 to 1-1/4 percent. The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a sustained return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee will carefully monitor actual and expected inflation developments relative to its symmetric inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

For the time being, the Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. The Committee expects to begin implementing its balance sheet normalization program relatively soon, provided that the economy evolves broadly as anticipated; this program is described in the June 2017 Addendum to the Committee's Policy Normalization Principles and Plans.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Patrick Harker; Robert S. Kaplan; Neel Kashkari; and Jerome H. Powell.

emphasis added

A few Comments on June New Home Sales

by Calculated Risk on 7/26/2017 11:30:00 AM

New home sales for June were reported at 610,000 on a seasonally adjusted annual rate basis (SAAR). This was close to the consensus forecast, however the three previous months were revised down. Still, overall, this was a decent report.

Sales were up 9.1% year-over-year in June.

Earlier: New Home Sales increase to 610,000 Annual Rate in June.

This graph shows new home sales for 2016 and 2017 by month (Seasonally Adjusted Annual Rate). Sales were up 9.1% year-over-year in June.

For the first six months of 2017, new home sales are up 10.9% compared to the same period in 2016.

This was a strong year-over-year increase through June, however sales were weak in Q1 last year, so this was a somewhat easy comparison.

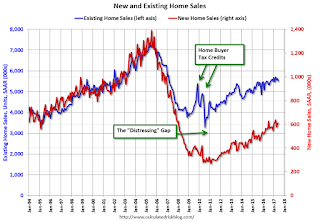

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increase to 610,000 Annual Rate in June

by Calculated Risk on 7/26/2017 10:12:00 AM

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 610 thousand.

The previous three months combined were revised up.

"Sales of new single-family houses in June 2017 were at a seasonally adjusted annual rate of 610,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 0.8 percent above the revised May rate of 605,000 and is 9.1 percent above the June 2016 estimate of 559,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in June to 5.4 months from 5.3 month in May.

The months of supply increased in June to 5.4 months from 5.3 month in May. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of June was 272,000. This represents a supply of 5.4 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

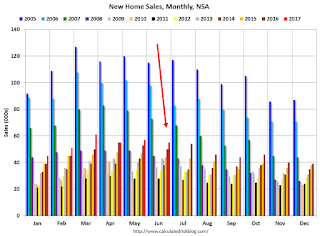

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In June 2017 (red column), 55 thousand new homes were sold (NSA). Last year, 50 thousand homes were sold in June.

The all time high for June was 115 thousand in 2005, and the all time low for June was 28 thousand in both 2010 and 2011.

This was close to expectations of 612,000 sales SAAR, however the previous months were revised down. I'll have more later today.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 7/26/2017 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

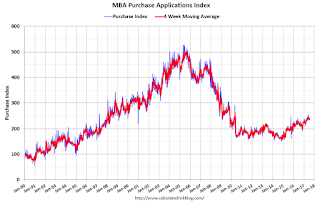

Mortgage applications increased 0.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 21, 2017.

... The Refinance Index increased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier to the lowest level since May 2017. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 8 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to 4.17 percent from 4.22 percent, with points increasing to 0.40 from 0.31 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 8% year-over-year.

Tuesday, July 25, 2017

Wednesday: FOMC Announcement, New Home Sales

by Calculated Risk on 7/25/2017 09:18:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, New Home Sales for June from the Census Bureau. The consensus is for 612 thousand SAAR, up from 610 thousand in May.

• At 2:00 PM, FOMC Meeting Announcement. No change to policy is expected at this meeting.

Real House Prices and Price-to-Rent Ratio in May

by Calculated Risk on 7/25/2017 05:06:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.6% year-over-year in May

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 2.7% above the previous bubble peak. However, in real terms, the National index (SA) is still about 13.3% below the bubble peak.

The year-over-year increase in prices is mostly moving sideways now just over 5%. In May, the index was up 5.6% YoY.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $278,000 today adjusted for inflation (39%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is at a new peak, and the Case-Shiller Composite 20 Index (SA) is back to October 2005 levels.

Real House Prices

In real terms, the National index is back to June 2004 levels, and the Composite 20 index is back to March 2004.

In real terms, house prices are back to early 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to November 2003 levels, and the Composite 20 index is back to August 2003 levels.

In real terms, prices are back to early 2004 levels, and the price-to-rent ratio is back to 2003 - and the price-to-rent ratio maybe moving a little more sideways now.

Chemical Activity Barometer increased slightly in July

by Calculated Risk on 7/25/2017 02:57:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Notches Gain

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), ticked up 0.1 percent in July following a flat reading in June and a 0.2 percent gain in May. Gains during the second quarter averaged 0.2 percent following average gains of 0.5 percent during the first quarter. Compared to a year earlier, the CAB is up 3.6 percent year-over-year, an easing from recent year-over-year gains. All data is measured on a three-month moving average (3MMA).

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

CAB increased solidly in early 2017 suggesting an increase in Industrial Production, however, the year-over-year increase in the CAB has slowed recently.

Case-Shiller: National House Price Index increased 5.6% year-over-year in May

by Calculated Risk on 7/25/2017 09:13:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for May ("May" is a 3 month average of March, April and May prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: The S&P Corelogic Case-Shiller National Home Price NSA Index Sets Record for Sixth Consecutive Months

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.6% annual gain in May, the same as the prior month. The 10-City Composite annual increase came in at 4.9%, down from 5.0% the previous month. The 20-City Composite posted a 5.7% year-over-year gain, down from 5.8% in April.I'll have more later.

Seattle, Portland, and Denver reported the highest year-over-year gains among the 20 cities. In May, Seattle led the way with a 13.3% year-over-year price increase, followed by Portland with 8.9%, and Denver overtaking Dallas with a 7.9% increase. Nine cities reported greater price increases in the year ending May 2017 versus the year ending April 2017.

...

Before seasonal adjustment, the National Index posted a month -over-month gain of 1.0% in May. The 10-City Composite posted a 0.7% increase and 20-City Composite reported a 0.8% increase in May. After seasonal adjustment, the National Index recorded a 0. 2% month-over-month increase. The 10- City Composite remained stagnant with no month-over-month increase. The 20-City Composite posted a 0.1% month-over-month increase. All 20 cities reported increases in May before seasonal adjustment; after seasonal adjustment, 14 cities saw prices rise.

“Home prices continue to climb and outpace both inflation and wages,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “Housing is not repeating the bubble period of 2000-2006: price increases vary across the country unlike the earlier period when rising prices were almost universal; the number of homes sold annually is 20% less today than in the earlier period and the months’ supply is declining, not surging. The small supply of homes for sale, at only about four months’ worth, is one cause of rising prices. New home construction, higher than during the recession but still low, is another factor in rising prices.

“For the last 19 months, either Seattle or Portland OR was the city with fastest rising home prices based on 12-month gains. Since the national index bottomed in February 2012, San Francisco has the largest gain. Using Census Bureau data for 2011 to 2015, it is possible to compare these three cities to national averages. The proportion of owner-occupied homes is lower than the national average in all three cities with San Francisco being the lowest at 36%, Seattle at 46%, and Portland at 52%. Nationally, the figure is 64%. The key factor for the rise in home prices is population growth from 2010 to 2016: the national increase is 4.7%, but for these cities, it is 8.2% in San Francisco, 9.6% in Portland and 15.7% in Seattle. A larger population combined with more people working leads to higher home prices.”

emphasis added

Monday, July 24, 2017

Tuesday: Case-Shiller House Prices

by Calculated Risk on 7/24/2017 07:49:00 PM

From Matthew Graham at Mortgage News Daily: Rates Begin Week Unchanged at July's Lows

Mortgage rates held steady today, which leaves them in line with the lowest levels in July. [30YR FIXED - 4.00%] ... The most obvious calendar item is the Fed Announcement on Wednesday.Tuesday:

• At 9:00 AM ET, FHFA House Price Index for May 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 9:00 AM, S&P/Case-Shiller House Price Index for May. The consensus is for a 5.8% year-over-year increase in the Comp 20 index for May.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for July.