by Calculated Risk on 6/26/2017 11:13:00 AM

Monday, June 26, 2017

Freddie Mac: Mortgage Serious Delinquency rate declined in May, Lowest since May 2008

Freddie Mac reported that the Single-Family serious delinquency rate in May was at 0.87%, down from 0.92% in April. Freddie's rate is down from 1.11% in May 2016.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This is the lowest serious delinquency rate since May 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Although the rate is still declining, the rate of decline has slowed.

Maybe the rate will decline another 0.2 to 0.3 percentage points or so to a cycle bottom, but this is pretty close to normal.

Note: Fannie Mae will report for May soon.

Dallas Fed: "Texas Manufacturing Continues to Expand but at a Slower Pace" in June

by Calculated Risk on 6/26/2017 10:39:00 AM

From the Dallas Fed: Texas Manufacturing Continues to Expand but at a Slower Pace

Texas factory activity increased in June, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell 11 points to 12.3, indicating output grew but at a slower pace than in May.CR note: This suggests solid growth, although at a slower pace than in May. The recent decline in oil prices might impact the Dallas surveys in coming months.

Other measures of current manufacturing activity also indicated that growth moderated. The new orders and growth rate of orders indexes fell several points each, coming in at 9.6 and 4.7, respectively. The capacity utilization index moved down to 12.3, and the shipments index retreated to 8.5 after surging last month.

Perceptions of broader business conditions improved in June, although the indexes were less positive than in May. The general business activity index edged down to 15.0. The company outlook index posted a 10th consecutive positive reading but fell nine points to 10.8.

Labor market measures indicated continued employment gains and longer workweeks this month. The employment index posted a sixth consecutive positive reading and edged up to 9.6. Nineteen percent of firms noted net hiring, compared with 10 percent noting net layoffs. The hours worked index dropped to 8.9, down seven points from a six-year high last month.

emphasis added

Chicago Fed "Index Points to Slower Economic Growth in May"

by Calculated Risk on 6/26/2017 09:11:00 AM

From the Chicago Fed: Chicago Fed National Activity Index Points to Slower Economic Growth in May

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) moved down to –0.26 in May from +0.57 in April. Three of the four broad categories of indicators that make up the index decreased from April, and three of the four categories made negative contributions to the index in May. The index’s three-month moving average, CFNAI-MA3, declined to +0.04 in May from +0.21 in April.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was close to the historical trend in May (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, June 25, 2017

Sunday Night Futures

by Calculated Risk on 6/25/2017 07:56:00 PM

Weekend:

• Schedule for Week of June 25, 2017

Monday:

• At 8:30 AM ET, Durable Goods Orders for May from the Census Bureau. The consensus is for a 0.4% decrease in durable goods orders.

• Also at 8:30 AM, Chicago Fed National Activity Index for May. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for June.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are down 3 and DOW futures are down 10 (fair value).

Oil prices were down over the last week with WTI futures at $43.21 per barrel and Brent at $45.54 per barrel. A year ago, WTI was at $47, and Brent was at $47 - so oil prices are down about 5% to 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.25 per gallon - a year ago prices were at $2.32 per gallon - so gasoline prices are down 7 cents year-over-year.

Goldman on the Next Recession

by Calculated Risk on 6/25/2017 12:13:00 PM

A few brief excerpts from a note by Goldman Sachs economists: The Next Recession: Lessons from History

With the current expansion already the third longest in US history, investors have begun to look ahead to the next recession. ... we find that many pre-WW2 recessions originated in the financial sector, many post-WW2 recessions were caused by oil shocks and monetary policy tightening, and sentiment-driven swings in borrowing and investment led to recessions in both eras. ...CR note: Some day there will be another recession, but I don't see signs of a recession in the next year or more.

Some common contributors to past recessions look less worrisome today. ... the dominant cause of postwar US recessions—rapid rate hikes in response to high inflation, often boosted by oil shocks—is less threatening today due to the anchoring of inflation expectations and the rise of shale.

...

[Our model] now estimates a 1/4 chance of recession over the next two years, somewhat below the unconditional probability over two years of 1/3 since 1980.

Saturday, June 24, 2017

Schedule for Week of June 25, 2017

by Calculated Risk on 6/24/2017 08:11:00 AM

The key economic reports this week are Personal Income and Outlays for May, Case-Shiller house prices, and the third estimate of Q1 GDP.

8:30 AM: Durable Goods Orders for May from the Census Bureau. The consensus is for a 0.4% decrease in durable goods orders.

8:30 AM: Chicago Fed National Activity Index for May. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for June.

Early: Reis Q2 2017 Apartment Survey of rents and vacancy rates.

9:00 AM ET: S&P/Case-Shiller House Price Index for April.

9:00 AM ET: S&P/Case-Shiller House Price Index for April.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the March 2017 report (the Composite 20 was started in January 2000).

The consensus is for a 5.9% year-over-year increase in the Comp 20 index for April.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for June.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

Early: Reis Q2 2017 Mall Survey of rents and vacancy rates.

10:00 AM: Pending Home Sales Index for May. The consensus is for a 0.5% increase in the index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 239 thousand initial claims, down from 241 thousand the previous week.

8:30 AM: Gross Domestic Product, 1st quarter 2017 (Third estimate). The consensus is that real GDP increased 1.2% annualized in Q1, unchanged from the second estimate of 1.2%.

Early: Reis Q2 2017 Office Survey of rents and vacancy rates.

8:30 AM: Personal Income and Outlays for May. The consensus is for a 0.3% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for June. The consensus is for a reading of 58.2, down from 59.4 in May.

10:00 AM: University of Michigan's Consumer sentiment index (final for June). The consensus is for a reading of 94.5, from the preliminary reading 94.5.

Friday, June 23, 2017

Oil Rigs: "Not dead yet!"

by Calculated Risk on 6/23/2017 03:55:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on June 23, 2017:

• Total US oil rigs were up 11 to 756

• Horizontal oil rigs were up a whopping 12 to 648

• Goodness knows the underlying dynamics, but apparently the rig operators have not received the oil price crash memo.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

A few Comments on May New Home Sales

by Calculated Risk on 6/23/2017 11:59:00 AM

New home sales for May were reported at 610,000 on a seasonally adjusted annual rate basis (SAAR). This was above the consensus forecast, and the three previous months combined were revised up. Overall this was a solid report.

Sales were up 8.9% year-over-year in May.

Earlier: New Home Sales increase to 610,000 Annual Rate in May.

This graph shows new home sales for 2016 and 2017 by month (Seasonally Adjusted Annual Rate). Sales were up 8.9% year-over-year in May.

For the first five months of 2017, new home sales are up 12.2% compared to the same period in 2016.

This was a strong year-over-year increase through May, however sales were weak in Q1 last year, so this was a somewhat easy comparison.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increase to 610,000 Annual Rate in May

by Calculated Risk on 6/23/2017 10:15:00 AM

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 610 thousand.

The previous three months combined were revised up.

"Sales of new single-family houses in May 2017 were at a seasonally adjusted annual rate of 610,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 2.9 percent above the revised April rate of 593,000 and is 8.9 percent above the May 2016 estimate of 560,000."

emphasis added

Click on graph for larger image.

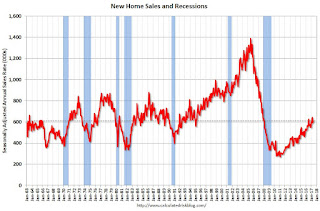

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply was unchanged in May at 5.3 months.

The months of supply was unchanged in May at 5.3 months. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of May was 268,000. This represents a supply of 5.3 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In May 2017 (red column), 58 thousand new homes were sold (NSA). Last year, 53 thousand homes were sold in May.

The all time high for May was 120 thousand in 2005, and the all time low for May was 26 thousand in 2010.

This was above expectations of 590,000 sales SAAR, and the previous months were revised up. A solid report. I'll have more later today.

Thursday, June 22, 2017

Friday: New Home Sales

by Calculated Risk on 6/22/2017 06:50:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Sideways to Slightly Lower

Mortgage rates have been so little-changed in recent days that yesterday's coverage wouldn't need to be changed in order to apply perfectly today.Friday:

...

The absence of change continues to be a good thing given that rates remain very close to their lowest levels in more than 8 months. Only a handful of recent days have been any better. 4.0% is the most prevalently-quoted conventional 30yr fixed rate on top tier scenarios, though a few of the aggressive lenders remain at 3.875%.

• At 8:30 AM ET: New Home Sales for May from the Census Bureau. The consensus is for an increase in sales to 590 thousand Seasonally Adjusted Annual Rate (SAAR) in May from 569 thousand in April.