by Calculated Risk on 6/01/2017 06:02:00 PM

Thursday, June 01, 2017

Goldman: May Payrolls Preview

A few excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls increased by 170k in May ... somewhat below consensus of +180k. Our forecast reflects some softening in service sector employment surveys, a return to normal weather, and a modestly slower pace of hiring in May, reflecting labor supply constraints in an economy near full employment.CR Note: My employment preview is here.

We estimate the unemployment rate remained stable at 4.4%, based on our expectation that household employment will hold on to its sharp year-to-date gains. Finally, we expect average hourly earnings to increase 0.2% month over month and 2.5% year-over-year in tomorrow’s report, reflecting the interaction of firming wage growth with unfavorable calendar effects.

U.S. Light Vehicle Sales at 16.6 million annual rate in May

by Calculated Risk on 6/01/2017 04:00:00 PM

Based on a preliminary estimate from WardsAuto, light vehicle sales were at a 16.60 million SAAR in May.

That is down 3% from May 2016, and up 1% from last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for May (red, light vehicle sales of 16.60 million SAAR mostly from WardsAuto).

This was below the consensus forecast of 16.9 million for May.

After two consecutive years of record sales, it looks like sales will be down in 2017.

Note: dashed line is current estimated sales rate.

May Employment Preview

by Calculated Risk on 6/01/2017 12:59:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for May. The consensus, according to Bloomberg, is for an increase of 185,000 non-farm payroll jobs in May (with a range of estimates between 140,000 to 231,000), and for the unemployment rate to be unchanged at 4.4%.

The BLS reported 211,000 jobs added in April.

Here is a summary of recent data:

• The ADP employment report showed an increase of 253,000 private sector payroll jobs in May. This was well above expectations of 170,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index increased in May to 53.5%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll was unchanged in May. The ADP report indicated 8,000 manufacturing jobs added in May.

The ISM non-manufacturing employment index for May hasn't been released yet.

• Initial weekly unemployment claims averaged 238,000 in May, down from 243,000 in April. For the BLS reference week (includes the 12th of the month), initial claims were at 233,000, down from 243,000 during the reference week in April.

The decrease during the reference week suggests fewer layoffs during the reference week in May than in April. This suggests a somewhat stronger employment report in May than in April.

• The final May University of Michigan consumer sentiment index increased slightly to 97.1 from the April reading of 97.0. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Conclusion: None of the indicators alone is very good at predicting the initial BLS employment report. The ADP report and weekly unemployment claims suggest stronger job growth in May.

Construction Spending decreased in April

by Calculated Risk on 6/01/2017 11:59:00 AM

Earlier today, the Census Bureau reported that overall construction spending decreased in April:

Construction spending during April 2017 was estimated at a seasonally adjusted annual rate of $1,218.5 billion, 1.4 percent below the revised March estimate of $1,235.5 billion.Both private and public spending decreased in April:

Spending on private construction was at a seasonally adjusted annual rate of $943.3 billion, 0.7 percent below the revised March estimate of $949.7 billion. ...

In April, the estimated seasonally adjusted annual rate of public construction spending was $275.3 billion, 3.7 percent below the revised March estimate of $285.9 billion.

emphasis added

Click on graph for larger image.

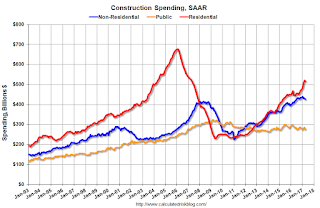

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been generally increasing, and is still 24% below the bubble peak.

Non-residential spending is now 3% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 15% below the peak in March 2009, and only 4% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 16%. Non-residential spending is up 4% year-over-year. Public spending is down 4% year-over-year.

Looking forward, all categories of construction spending should increase in 2017 (maybe not public spending).

This was below the consensus forecast of a 0.5% increase for April, however spending for March was revised up sharply.

ISM Manufacturing index increased to 54.9 in May

by Calculated Risk on 6/01/2017 10:05:00 AM

The ISM manufacturing index indicated expansion in May. The PMI was at 54.9% in May, up from 54.8% in April. The employment index was at 53.5%, up from 52.0% last month, and the new orders index was at 59.5%, up from 57.5%.

From the Institute for Supply Management: May 2017 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in May, and the overall economy grew for the 96th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: "The May PMI® registered 54.9 percent, an increase of 0.1 percentage point from the April reading of 54.8 percent. The New Orders Index registered 59.5 percent, an increase of 2 percentage points from the April reading of 57.5 percent. The Production Index registered 57.1 percent, a 1.5 percentage points decrease compared to the April reading of 58.6 percent. The Employment Index registered 53.5 percent, an increase of 1.5 percentage points from the April reading of 52 percent. The Inventories Index registered 51.5 percent, an increase of 0.5 percentage point from the April reading of 51 percent. The Prices Index registered 60.5 percent in May, a decrease of 8 percentage points from the April reading of 68.5 percent, indicating higher raw materials prices for the 15th consecutive month, but at a noticeably slower rate of increase in May compared with April. Comments from the panel generally reflect stable to growing business conditions, with new orders, employment and inventories of raw materials all growing in May compared to April. The slowing of pricing pressure, especially in basic commodities, should have a positive impact on margins and buying policies as this moderation moves up the value chain."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 54.6%, and suggests manufacturing expanded at a slightly faster pace in May than in April.

A solid report.

Weekly Initial Unemployment Claims increase to 248,000

by Calculated Risk on 6/01/2017 08:33:00 AM

The DOL reported:

In the week ending May 27, the advance figure for seasonally adjusted initial claims was 248,000, an increase of 13,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 234,000 to 235,000. The 4-week moving average was 238,000, an increase of 2,500 from the previous week's revised average. The previous week's average was revised up by 250 from 235,250 to 235,500.The previous week was revised up by 1,000.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 238,000.

This was above the consensus forecast.

The low level of claims suggests relatively few layoffs.

ADP: Private Employment increased 253,000 in May

by Calculated Risk on 6/01/2017 08:20:00 AM

Private sector employment increased by 253,000 jobs from April to May according to the May ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was well above the consensus forecast for 170,000 private sector jobs added in the ADP report.

...

“May proved to be a very strong month for job growth,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Professional and business services had the strongest monthly increase since 2014. This may be an indicator of broader strength in the workforce since these services are relied on by many industries.”

Mark Zandi, chief economist of Moody’s Analytics said, “Job growth is rip-roaring. The current pace of job growth is nearly three times the rate necessary to absorb growth in the labor force. Increasingly, businesses’ number one challenge will be a shortage of labor.”

The BLS report for May will be released Friday, and the consensus is for 185,000 non-farm payroll jobs added in May.

Wednesday, May 31, 2017

Thursday: Unemployment Claims, ADP Employment, ISM Mfg, Construction Spending, Auto Sales

by Calculated Risk on 5/31/2017 07:29:00 PM

Thursday:

• At 8:15 AM ET, The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in May, down from 177,000 added in April.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 239 thousand initial claims, up from 234 thousand the previous week.

• At 10:00 AM, ISM Manufacturing Index for May. The consensus is for the ISM to be at 54.6, down from 54.8 in April. The employment index was at 52.0% in April, and the new orders index was at 54.8%.

• Also at 10:00 AM, Construction Spending for April. The consensus is for a 0.5% increase in construction spending.

• All day: Light vehicle sales for May. The consensus is for light vehicle sales to be at 16.9 million SAAR in May, mostly unchanged from 16.9 million in April (Seasonally Adjusted Annual Rate).

Fannie Mae: Mortgage Serious Delinquency rate declined in April, Lowest since January 2008

by Calculated Risk on 5/31/2017 04:29:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined to 1.07% in April, from 1.12% in March. The serious delinquency rate is down from 1.40% in April 2016.

This is the lowest serious delinquency rate since January 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The Fannie Mae serious delinquency rate has fallen 0.33 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until this Summer.

Note: Freddie Mac reported earlier.

Fed's Beige Book: Modest to Moderate expansion, Labor markets "Tighten"

by Calculated Risk on 5/31/2017 02:08:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Philadelphia based on information collected on or before May 22, 2017."

Most of the twelve Federal Reserve Districts reported that their economies continued to expand at a modest or moderate pace from early April through late May. Boston and Chicago signaled that growth in their Districts had slowed somewhat to a modest pace since the prior Beige Book period, while New York indicated that activity had flattened out. Consumer spending softened with many Districts noting little or no change in nonauto retail sales, while auto sales have edged down from last year's record highs in several Districts; tourism activity has continued to keep pace with the general economy. Meanwhile, the majority of Districts continued to report moderate growth in manufacturing activity and in most nonfinancial service sectors. Construction of new homes and nonresidential structures also continued to grow at modest to moderate rates, as did sales of existing homes; nonresidential leasing picked up a bit. Lending volume trends tended to mirror (and support) the general activity of the economy. Agricultural conditions remained mixed with some regions negatively affected by unusually wet weather. Most energy sectors tended to modestly improve. A majority of Districts reported that firms expressed positive near-term outlooks; however, optimism waned somewhat in a few Districts.And a few excerpts on real estate:

...

Labor markets continued to tighten, with most Districts citing shortages across a broadening range of occupations and regions. Despite supply constraints impeding the ability of firms to attract and retain qualified workers, most Districts reported that employment continued to grow at a modest to moderate pace. Similarly, most firms across the Districts noted little change to the recent trend of modest to moderate wage growth, although many firms reported offering higher wages to attract workers where shortages were most severe.

emphasis added

New York: Housing markets across the District have been mixed but, on balance, steady since the last report. New York City's rental market has remained mostly steady, though increased landlord concessions have further lowered effective rents and spurred some pickup in leasing, especially at the high end. In contrast, rents continued to rise across northern New Jersey, the Lower Hudson Valley, southwestern Connecticut and upstate New York.

The sales market for homes has strengthened in northern New Jersey and across upstate New York but has been essentially flat in New York City...

San Franciso: Real estate market activity continued to grow at a strong pace, but activity varied by region. Residential construction activity remained strong in urban centers but slowed to a moderate pace in some rural regions, due in part to especially wet ground conditions in areas of the Mountain West. Permits for single and multi-family units edged up, but contacts noted that construction was somewhat hampered by shortages of available land in some areas. Supply shortages and strong demand continued to fuel rapid home price growth in most parts of the District; contacts in urban centers reported that bids routinely came in significantly above the asking prices. Demand for commercial real estate loans in California remained strong.