by Calculated Risk on 5/09/2017 09:20:00 AM

Tuesday, May 09, 2017

NFIB: Small Business Optimism Index decreased in April

From the National Federation of Independent Business (NFIB): April 2017 Report: Small Business Optimism Index

The NFIB Index of Small Business Optimism posted another historically high reading in April, but expectations for future business conditions plunged by eight points ...

...

The Index dipped 0.2 points April, settling at 104.5. ... Small business owners reported a seasonally adjusted average employment change per firm of 0.19 workers per firm ...

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 104.5 in April.

Monday, May 08, 2017

Tuesday: Job Openings, Small Business Optimism

by Calculated Risk on 5/08/2017 06:56:00 PM

Tuesday:

• At 9:00 AM ET, NFIB Small Business Optimism Index for April.

• At 10:00 AM: Job Openings and Labor Turnover Survey for March from the BLS. Jobs openings increased in February to 5.743 million from 5.625 million in January. The number of job openings were up 3% year-over-year, and Quits were up 3% year-over-year.

Leading Index for Commercial Real Estate Decreases in April

by Calculated Risk on 5/08/2017 03:40:00 PM

Note: This index is a leading indicator for new non-residential Commercial Real Estate (CRE) investment, except manufacturing.

From Dodge Data Analytics: Dodge Momentum Index Loses Steam in April

The Dodge Momentum Index fell 5.1% in April to 133.8 (2000=100) from its revised March reading of 140.9. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. April’s decline was due to a 12.0% drop for the institutional component of the Momentum Index, while the commercial component rose a meager 0.1%. Since early 2016, the Momentum Index has gained substantial ground, albeit in a saw-tooth pattern, increasing by over 20% through March this year. Despite April’s decline, the broad upward trend for the Momentum Index remains present, suggesting that construction activity still has further room to grow in 2017. The planning data’s strengthening over the past year stands in stark contrast to the 2014-2015 period, when the Momentum Index saw little improvement, gaining just 4.0% in that 24-month span.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 133.8 in April, down from 140.9 in March.

The index is still up solidly year-over-year.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This suggests further increases in CRE spending over the next year.

Phoenix Real Estate in April: Sales up 5%, Inventory down 11% YoY

by Calculated Risk on 5/08/2017 01:21:00 PM

This is a key housing market to follow since Phoenix saw a large bubble and bust, followed by strong investor buying.

note: Updated

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in April were up 4.5% year-over-year.

2) Cash Sales (frequently investors) were down to 22.5% of total sales.

3) Active inventory is now down 11.0% year-over-year.

More inventory (a theme in most of 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster. Prices were up 6.3% in 2015 according to Case-Shiller.

With flat inventory in 2016, prices were up 4.8%.

This is the sixth consecutive month with a YoY decrease in inventory following eight months with YoY increases.

| April Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash | Percent Cash | Inventory | YoY Change | |

| Apr-08 | 4,8751 | --- | 986 | 20.2% | 55,7261 | --- |

| Apr-09 | 8,564 | 75.7% | 3,464 | 40.4% | 44,165 | -20.7% |

| Apr-10 | 9,261 | 8.1% | 3,641 | 39.3% | 41,756 | -5.5% |

| Apr-11 | 9,328 | 0.7% | 4,489 | 48.1% | 34,515 | -17.3% |

| Apr-12 | 8,438 | -9.5% | 4,013 | 47.6% | 21,125 | -38.8% |

| Apr-13 | 8,744 | 3.6% | 3,670 | 42.0% | 20,083 | -4.9% |

| Apr-14 | 7,656 | -12.4% | 2,469 | 32.2% | 29,889 | 48.8% |

| Apr-15 | 8,368 | 9.3% | 2,120 | 25.3% | 25,950 | -13.2% |

| Apr-16 | 8,437 | 0.8% | 2,008 | 23.8% | 27,232 | 4.9% |

| Apr-17 | 8,819 | 4.5% | 1,980 | 22.5% | 24,230 | -11.0% |

| 1 April 2008 does not include manufactured homes, ~100 more | ||||||

Las Vegas Real Estate in April: Sales up slightly YoY, Inventory down Sharply

by Calculated Risk on 5/08/2017 11:08:00 AM

This is a key distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Local home prices keep rising as Southern Nevada faces a housing shortage, GLVAR Housing Statistics for April 2017

Local home prices continued to climb in April amid what leaders of the Greater Las Vegas Association of REALTORS®(GLVAR) are now calling a housing shortage.1) Overall sales were up slightly year-over-year.

...

... The total number of existing local homes, condos and townhomes sold in April was 3,529, up from 3,518 in April 2016. Compared to one year ago, sales were up 1.7 percent for homes, but down 5.3 percent for condos and townhomes.

According to GLVAR, local home sales in 2017 continue to outpace 2016, when 41,720 total properties were sold in Southern Nevada. That was more than the 38,577 properties sold during 2015. It was also more total sales than in 2014, but fewer than each year from 2009 through 2013.

...

By the end of April, GLVAR reported 5,083 single-family homes listed for sale without any sort of offer. That’s down 30.9 percent from one year ago. For condos and townhomes, the 639 properties listed without offers in April represented a 71.4 percent drop from one year ago.

For several years, GLVAR has been reporting fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. That trend continued in April, when 4.4 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That compares to 4.5 percent of all sales in April 2016. Another 4.0 percent of all April sales were bank-owned, down from 7.1 percent one year ago.

emphasis added

2) Active inventory (single-family and condos) is down sharply from a year ago (A very sharp decline in condo inventory).

3) Fewer distressed sales.

Sunday, May 07, 2017

Sunday Night Futures

by Calculated Risk on 5/07/2017 08:15:00 PM

Weekend:

• Schedule for Week of May 7, 2017

Monday:

• At 10:00 AM ET, the Fed will release the monthly Labor Market Conditions Index (LMCI).

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures and DOW futures are up slightly (fair value).

Oil prices were down over the last week with WTI futures at $46.90 per barrel and Brent at $49.87 per barrel. A year ago, WTI was at $44, and Brent was at $45 - so oil prices are up about 5% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.34 per gallon - a year ago prices were at $2.23 per gallon - so gasoline prices are up about 10 cents a gallon year-over-year.

Hotels: Hotel Occupancy Rate Increases Year-over-Year

by Calculated Risk on 5/07/2017 11:11:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 29 April

The U.S. hotel industry reported positive results in the three key performance metrics during the week of 23-29 April 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 24-30 April 2016, the industry reported the following:

• Occupancy: +3.7% to 70.3%

• Average daily rate (ADR): +5.1% to US$127.50

• Revenue per available room (RevPAR): +8.9% to US$89.65

STR analysts attribute the level of performance growth to a comparison with Passover week last year.

emphasis added

The red line is for 2017, dashed is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2017, dashed is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

For hotels, occupancy will now move mostly sideways until the summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, May 06, 2017

Schedule for Week of May 7, 2017

by Calculated Risk on 5/06/2017 08:11:00 AM

The key economic reports this week are Retail Sales and the Consumer Price Index (CPI).

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

6:00 AM ET: NFIB Small Business Optimism Index for April.

10:00 AM: Job Openings and Labor Turnover Survey for March from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for March from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in February to 5.743 million from 5.625 million in January.

The number of job openings (yellow) were up 3% year-over-year, and Quits were up 3% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 244 thousand initial claims, up from 238 thousand the previous week.

8:30 AM: The Producer Price Index for April from the BLS. The consensus is for 0.2% increase in PPI, and a 0.2% increase in core PPI.

8:30 AM ET: Retail sales for April will be released. The consensus is for a 0.6% increase in retail sales.

8:30 AM ET: Retail sales for April will be released. The consensus is for a 0.6% increase in retail sales.This graph shows retail sales since 1992 through March 2017.

8:30 AM: The Consumer Price Index for April from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.2% increase in core CPI.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for May). The consensus is for a reading of 97.3, up from 97.0 in April.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for March. The consensus is for a 0.1% increase in inventories.

Friday, May 05, 2017

Oil: Slower Growth for Rig Count

by Calculated Risk on 5/05/2017 07:10:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on May 5, 2017:

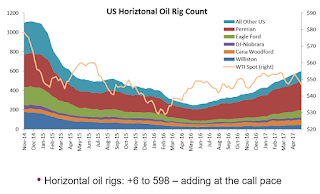

• Total US oil rigs added 6 to 703, all of it in the Permian

• US horizontal oil rigs were up 6 to 598, tied for the second smallest gain since late January

• Morgan Stanley, among other bank and sector analysts, reassures us that OPEC production cuts should finally become visible in the next few weeks

• The market isn’t buying it, though – Art Berman issued a note entitled ‘Oil Prices Plunge to Where They Should Be’. Given the relatively strong performance of the shale operators reporting quarterly results this week, he might be right.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

AAR: Rail Traffic increased in April

by Calculated Risk on 5/05/2017 04:10:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

U.S. rail carloads were 1,023,300 for the month, up 8.4% (78,949 carloads) over April 2016, thanks once again mainly to coal — coal carloads were up 26.7% (65,158 carloads) over last year’s. ... U.S. rail intermodal traffic in April 2017 was 1,052,001 containers and trailers, up 2.3% (23,448 units) over April 2016 — but only the third highest April on record (slightly below 2014 and 2015).

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Dark blue is 2017.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

U.S. railroads originated 1,023,300 total carloads in April 2017, up 8.4%, or 78,949 carloads, over April 2016. It’s the sixth straight year-over-year carload increase. Total originated carloads averaged 255,825 per week in April 2017. The good news is that this is up from a weekly average of 236,088 in April of last year. The bad news is that last year was the only year since sometime prior to 1988, when our data begin, in which average weekly carloads were lower than they were this April.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):U.S. rail intermodal volume in April 2017 was 1,052,001 containers and trailers, up 2.3% (23,448 units) over April 2016. In the first four months of 2017, U.S. intermodal volume was 4,439,681 units, up 1.6%, or 71,425 units, from 2016.