by Calculated Risk on 4/11/2017 09:49:00 AM

Tuesday, April 11, 2017

NFIB: Small Business Optimism Index decreased in March

From the National Federation of Independent Business (NFIB): Small Business Optimism Sustained in March

The Index of Small Business Optimism fell 0.6 points to 104.7, sustaining the remarkable surge in optimism that started November 9, 2016, the day after the election.

...

Small business owners reported a seasonally adjusted average employment change per firm of 0.16 workers per firm, a solid showing. ... Sixteen percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem (down 1 point), far more than were concerned with weak sales. Thirty percent of all owners reported job openings they could not fill in the current period, down 2 points but historically high.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 104.7 in March.

Monday, April 10, 2017

Tuesday: Job Openings

by Calculated Risk on 4/10/2017 08:09:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Slightly Higher, But Steady Overall

Mortgage rates rose slightly again today, despite moderate improvement in underlying bond markets. ... All that having been said, mortgage rate movement continues to take place inside an exceptionally narrow range. For the past 3 weeks, most borrowers would be quoted the exact same NOTE rate from most lenders, with the only variation coming in the form of upfront cost. The most prevalent top tier conventional 30yr fixed quote remains 4.125%, though several lenders are on either side of that by 0.125%.Thursday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for March.

• At 10:00 AM, Job Openings and Labor Turnover Survey for February from the BLS. Jobs openings were mostly unchanged in January at 5.626 million compared to 5.539 million in December. The number of job openings were down slightly year-over-year, and Quits were up 11% year-over-year in January.

Leading Index for Commercial Real Estate Increases in March

by Calculated Risk on 4/10/2017 03:25:00 PM

Note: This index is a leading indicator for new non-residential Commercial Real Estate (CRE) investment, except manufacturing.

From Dodge Data Analytics: Dodge Momentum Index Springs Forward in March

The Dodge Momentum Index increased by 0.9% in March to 144.4 (2000=100) from its revised February reading of 143.2. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The Momentum Index has now risen for six consecutive months, with much of the gain being driven by institutional projects entering planning while commercial projects so far in 2017 have receded slightly. The institutional portion of the Momentum Index rose 3.7% in March, and is 23.0% higher than the end of 2016. Commercial planning meanwhile fell 1.2% in March and is down 2.9% from December 2016. However, the overall Momentum Index, as well as the commercial and institutional components, are well above their year-ago levels. This continues to signal the potential for increased construction activity in 2017 despite the short-term setbacks that are inherent in the volatile month-to-month planning data.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 144.4 in March, up from 143.2 in February.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This suggests further increases in CRE spending over the next year.

Philly Fed: State Coincident Indexes increased in 38 states in January

by Calculated Risk on 4/10/2017 11:30:00 AM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for January 2017. Over the past three months, the indexes increased in 46 states, decreased in three, and remained stable in one, for a three-month diffusion index of 86. In the past month, the indexes increased in 38 states, decreased in five, and remained stable in seven, for a one-month diffusion index of 66.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In January 39 states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices. I'm not sure why this index was weak in January.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and almost all green now.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and almost all green now.Source: Philly Fed. Note: For complaints about red / green issues, please contact the Philly Fed.

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 4/10/2017 09:51:00 AM

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices were down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts. This decline in 2015 was also probably related to weakness in China.

Prices in 2017 are up year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through March 2017 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 16% from a year ago, and CME futures are up about 29% year-over-year.

Sunday, April 09, 2017

Sunday Night Futures

by Calculated Risk on 4/09/2017 07:05:00 PM

Weekend:

• Schedule for Week of Apr 9, 2017

Monday:

• At 10:00 AM ET, The Fed will release the monthly Labor Market Conditions Index (LMCI).

• At 4:10 PM, Discussion with Fed Chair Janet Yellen, Discussion with Ford School Dean Susan M. Collins, Gerald R. Ford School of Public Policy: Policy Talk Series, Ann Arbor, Michigan

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $52.52 per barrel and Brent at $55.24 per barrel. A year ago, WTI was at $40, and Brent was at $41 - so oil prices are up about 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.39 per gallon - a year ago prices were at $2.06 per gallon - so gasoline prices are up about 33 cents a gallon year-over-year.

Hotels: Hotel Occupancy Rate increase Year-over-Year

by Calculated Risk on 4/09/2017 12:25:00 PM

After some weakness early in the year, hotel occupancy has picked up in recent weeks.

From HotelNewsNow.com: STR: US hotel results for week ending 1 April

The U.S. hotel industry recorded positive results in the three key performance metrics during the week of 26 March through 1 April 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

STR analysts note that performance was lifted for the second week in a row by an Easter calendar shift (27 March 2016). In comparison with the week of 27 March through 2 April 2016, the industry reported the following in year-over-year comparisons:

• Occupancy: +2.4% to 68.5%

• Average daily rate (ADR): +2.9% to US$126.02

• Revenue per available room (RevPAR): +5.3% to US$86.27

emphasis added

The red line is for 2017, dashed is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2017, dashed is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

For hotels, occupancy will now move mostly sideways until the summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, April 08, 2017

Schedule for Week of Apr 9, 2017

by Calculated Risk on 4/08/2017 08:11:00 AM

The key economic reports this week are Retail Sales and the Consumer Price Index (CPI).

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

4:10 PM: Discussion with Fed Chair Janet Yellen, Discussion with Ford School Dean Susan M. Collins, Gerald R. Ford School of Public Policy: Policy Talk Series, Ann Arbor, Michigan

6:00 AM ET: NFIB Small Business Optimism Index for March.

10:00 AM: Job Openings and Labor Turnover Survey for February from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for February from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings were mostly unchanged in January at 5.626 million compared to 5.539 million in December.

The number of job openings (yellow) were down slightly year-over-year, and Quits were up 11% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 243 thousand initial claims, up from 234 thousand the previous week.

8:30 AM: The Producer Price Index for March from the BLS. The consensus is for no change in PPI, and a 0.2% increase in core PPI.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for April). The consensus is for a reading of 97.0, up from 96.9 in March.

8:30 AM ET: Retail sales for March will be released. The consensus is for no change in retail sales in March.

8:30 AM ET: Retail sales for March will be released. The consensus is for no change in retail sales in March.This graph shows retail sales since 1992 through February 2017.

8:30 AM: The Consumer Price Index for March from the BLS. The consensus is for no change in CPI, and a 0.2% increase in core CPI.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for February. The consensus is for a 0.3% increase in inventories.

Friday, April 07, 2017

AAR: Rail Traffic increased in March

by Calculated Risk on 4/07/2017 05:58:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

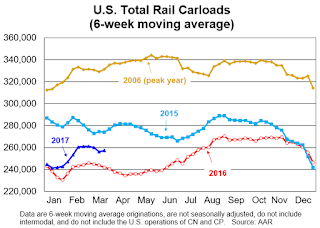

Total carloads on U.S. railroads in March 2017 were up 7.3% (87,183 carloads) over March 2016; excluding coal, carloads in March were up 2.7% (23,337 carloads). Intermodal containers and trailers were up 3.8% (47,180 units) for the month. Year-to-date total carloads through March were up 5.7% (180,665 carloads), while year-to-date intermodal volume was up 1.4% (47,977 units) over last year.

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Dark blue is 2017.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

U.S. railroads originated 1,283,489 total carloads in March 2017, up 87,183 carloads (7.3%) over March 2016. It’s the fifth straight year-over-year carload increase (see the chart below right) and the biggest percentage carload increase in those five months. Total carloads averaged 256,698 per week in March 2017, much better than the 239,261 weekly average in March 2016 but otherwise the lowest weekly average for March since our data begin in 1988. The best March ever was 2006, when carloads averaged 337,465 per week — 31.5% higher than in March 2017. Note that Easter Sunday and the preceding week are included in March 2016 numbers, but will be included in April 2017 numbers. For the first three months of 2017, total U.S. carloads were 3,324,102, up 5.7% (180,665 carloads) over the first three months of 2016 but otherwise the lowest January-March total since sometime prior to 1988 ...

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):U.S. railroads originated 1,298,173 intermodal containers and trailers in March 2017, up 3.8% (47,180 units) over March 2016. Average weekly volume of 259,635 containers and trailers was the second highest for March ever (behind 2015).

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama, Trump

by Calculated Risk on 4/07/2017 01:53:00 PM

Here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term, and President Obama is in the final months of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (just two months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 811,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 396,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,966,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,937,000 more private sector jobs at the end of Mr. Obama's first term. At the end of his second term, there were 11,756,000 more private sector jobs than when Mr. Obama initially took office.

During the first two months of Mr. Trump's term, the economy has added 310,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector declined significantly while Mr. Obama was in office (down 268,000 jobs).

During the first two months of Mr. Trump's term, the economy has added 7,000 public sector jobs.

After two months, the economy has added 317,000 jobs, about 100,000 behind the goal.