by Calculated Risk on 3/28/2017 09:18:00 AM

Tuesday, March 28, 2017

Case-Shiller: National House Price Index increased 5.9% year-over-year in January

S&P/Case-Shiller released the monthly Home Price Indices for January ("January" is a 3 month average of November, December and January prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: S&P Corelogic Case-Shiller National Index Annual Return Sets 31-Month High

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.9% annual gain in January, up from 5.7% last month and setting a 31-month high. The 10-City Composite posted a 5.1% annual increase, up from 4.8% the previous month. The 20-City Composite reported a year-over-year gain of 5.7%, up from 5.5% in December

Seattle, Portland, and Denver reported the highest year-over-year gains among the 20 cities over each of the last 12 months. In January, Seattle led the way with an 11.3% year-over-year price increase, followed by Portland with 9.7%, and Denver with a 9.2% increase. Twelve cities reported greater price increases in the year ending January 2017 versus the year ending December 2016.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.2% in January. The 10-City Composite posted a 0.3% increase and the 20-City Composite reported a 0.2% increase in January. After seasonal adjustment, the National Index recorded a 0.6% month-over-month increase, while both the 10-City and 20-City Composites each reported a 0.9% month-over-month increase. Thirteen of 20 cities reported increases in January before seasonal adjustment; after seasonal adjustment, 19 cities saw prices rise.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 7.7% from the peak, and up 0.9% in January (SA).

The Composite 20 index is off 5.4% from the peak, and up 0.9% (SA) in January.

The National index is 1.9% above the bubble peak (SA), and up 0.6% (SA) in January. The National index is up 37.7% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 5.1% compared to January 2015.

The Composite 20 SA is up 5.7% year-over-year.

The National index SA is up 5.9% year-over-year.

Note: According to the data, prices increased in all 19 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, March 27, 2017

Tuesday: Case-Shiller House Prices

by Calculated Risk on 3/27/2017 07:09:00 PM

Here is the Zillow forecast (They've been very close each month):

The January Case-Shiller national index is expected to grow 6 percent year-over-year and 0.5 percent from December, up from 5.8 percent annual growth recorded in November but down somewhat from 0.7 percent monthly growth in December. The smaller 10- and 20-city indices are both expected to grow by 0.7 percent month-over-month (SA), slower than the 0.9 percent monthly growth recorded in December. On an annual basis, the 10- and 20-city indices are expected to grow by 5.1 percent and 5.7 percent in January, respectively, up from 4.9 percent and 5.6 percent in November.Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January prices. The consensus is for a 5.7% year-over-year increase in the Comp 20 index for January.

• At 10:00 AM: Richmond Fed Survey of Manufacturing Activity for March. This is the last of the regional Fed surveys for March.

• At 12:50 PM: Speech by Fed Chair Janet Yellen, Addressing Workforce Development Challenges in Low-Income Communities, At the National Community Reinvestment Coalition Annual Conference, Washington, D.C.

Freddie Mac: Mortgage Serious Delinquency rate declines in February, Lowest since June 2008

by Calculated Risk on 3/27/2017 12:42:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in February was at 0.98%, down from 0.99% in January. Freddie's rate is down from 1.26% in February 2016.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This is the lowest serious delinquency rate since June 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Although the rate is still declining, the rate of decline has slowed.

Maybe the rate will decline another 0.25 percentage points or so to a cycle bottom, but this is pretty close to normal.

Note: Fannie Mae will report soon.

Dallas Fed: "Texas Manufacturing Activity Strengthens" in March

by Calculated Risk on 3/27/2017 10:44:00 AM

From the Dallas Fed: Texas Manufacturing Activity Strengthens

Texas factory activity increased for the ninth consecutive month in March, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose two points to 18.6, suggesting output growth picked up pace this month. ...The Richmond Fed manufacturing survey for March will be released tomorrow. Based on the surveys released so far, it appears the ISM index will be strong again in March.

...

The general business activity index fell eight points but remained positive at 16.9, and the company outlook index was largely unchanged at 17.9. The March figures represent the sixth and seventh positive readings in a row for general business activity and company outlook indexes, respectively.

...

Labor market measures indicated employment gains and longer workweeks in March. The employment index posted a third consecutive positive reading and edged down from 9.6 to 8.4. Nineteen percent of firms noted net hiring, compared with 10 percent noting net layoffs. The hours worked index moved up one point to 8.7. ...

emphasis added

Black Knight: House Price Index up 0.1% in January, Up 5.4% year-over-year

by Calculated Risk on 3/27/2017 07:01:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight Home Price Index Report - January 2017 Transactions: U.S. Home Prices Up 0.1 Percent for the Month; Up 5.4 Percent Year-Over-Year

• U.S. home prices at the start of 2017 continued the trend of incremental monthly gains, rising 0.1 percent from DecemberThe year-over-year increase in this index has been about the same for the last year.

• January marks 57 consecutive months of annual national home price appreciation

• Home prices in three of the nation’s 20 largest states and nine of the 40 largest metros hit new peaks

Note that house prices are close to the bubble peak in nominal terms (just 0.3% below), but not in real terms (adjusted for inflation). Case-Shiller for January will be released tomorrow.

Sunday, March 26, 2017

Sunday Night Futures

by Calculated Risk on 3/26/2017 09:30:00 PM

Weekend:

• Schedule for Week of Mar 26, 2017

Monday:

• 10:30 AM: Dallas Fed Survey of Manufacturing Activity for March.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are down 13 and DOW futures are down 90 (fair value).

Oil prices were down over the last week with WTI futures at $47.93 per barrel and Brent at $50.80 per barrel. A year ago, WTI was at $40, and Brent was at $40 - so oil prices are up about 25% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.28 per gallon - a year ago prices were at $2.05 per gallon - so gasoline prices are up about 23 cents a gallon year-over-year.

Fed: Q4 Household Debt Service Ratio Very Low

by Calculated Risk on 3/26/2017 12:59:00 PM

The Fed's Household Debt Service ratio through Q4 2016 was released on Friday: Household Debt Service and Financial Obligations Ratios. I used to track this quarterly back in 2005 and 2006 to point out that households were taking on excessive financial obligations.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households. Note: The Fed changed the release in Q3 2013.

The household Debt Service Ratio (DSR) is the ratio of total required household debt payments to total disposable income.This data has limited value in terms of absolute numbers, but is useful in looking at trends. Here is a discussion from the Fed:

The DSR is divided into two parts. The Mortgage DSR is total quarterly required mortgage payments divided by total quarterly disposable personal income. The Consumer DSR is total quarterly scheduled consumer debt payments divided by total quarterly disposable personal income. The Mortgage DSR and the Consumer DSR sum to the DSR.

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only an approximation of the debt service ratio faced by households. Nonetheless, this approximation is useful to the extent that, by using the same method and data series over time, it generates a time series that captures the important changes in the household debt service burden.

Click on graph for larger image.

Click on graph for larger image.The graph shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).

The overall Debt Service Ratio decreased slightly in Q4, and has been moving sideways and is near a record low. Note: The financial obligation ratio (FOR) was decreased slightly in Q4 and is also near a record low (not shown)

The DSR for mortgages (blue) are near the low for the last 35 years. This ratio increased rapidly during the housing bubble, and continued to increase until 2007. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined significantly.

The consumer debt DSR (yellow) has been increasing for the last four years.

This data suggests aggregate household cash flow has improved.

Saturday, March 25, 2017

Schedule for Week of Mar 26, 2017

by Calculated Risk on 3/25/2017 08:11:00 AM

The key economic reports this week are the third estimate of Q4 GDP, Personal Income and Outlays for February, and the Case-Shiller house price index.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for March.

9:00 AM ET: S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January prices.

9:00 AM ET: S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the December 2016 report (the Composite 20 was started in January 2000).

The consensus is for a 5.7% year-over-year increase in the Comp 20 index for January.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for March. This is the last of the regional Fed surveys for March.

12:50 PM: Speech by Fed Chair Janet Yellen, Addressing Workforce Development Challenges in Low-Income Communities, At the National Community Reinvestment Coalition Annual Conference, Washington, D.C.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Pending Home Sales Index for February. The consensus is for a 1.8% increase in the index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 247 thousand initial claims, down from 258 thousand the previous week.

8:30 AM: Gross Domestic Product, 4th quarter 2016 (third estimate). The consensus is that real GDP increased 2.0% annualized in Q4, up from the second estimate of 1.9%.

8:30 AM: Personal Income and Outlays for February. The consensus is for a 0.4% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a reading of 57.1, down from 57.4 in February.

10:00 AM: University of Michigan's Consumer sentiment index (final for March). The consensus is for a reading of 97.6, unchanged from the preliminary reading 95.7.

Friday, March 24, 2017

Oil: "Incredible strength in rig additions"

by Calculated Risk on 3/24/2017 07:08:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Mar 24, 2017:

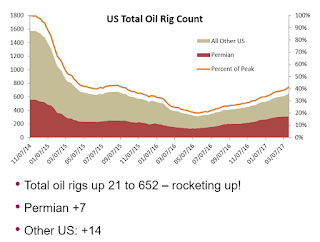

• US oil rig count was up an eye-popping 21 this week to 652

• US horizontal oil rigs were up by 13 to 543

...

• Despite a major correction in oil prices, rig additions continue at a rapid pace.

Click on graph for larger image.

Click on graph for larger image.Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

CoreLogic: "Between 2007–2016, Nearly 7.8 Million Homes Lost to Foreclosure"

by Calculated Risk on 3/24/2017 04:22:00 PM

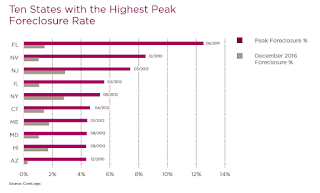

Here is a report from CoreLogic: US Residential Foreclosure Crisis: 10 Years Later. There are several interesting graphs in the report, including foreclosures completed by year.

This graph for CoreLogic the Ten States with the highest peak foreclosure rate during the crisis, and the current foreclosure rate.

Here is a table based on data from the CoreLogic report showing completed foreclosure per year.

| Completed foreclosure by Year Source: CoreLogic | |

|---|---|

| Year | Completed Foreclosures |

| 2000 | 191,295 |

| 2001 | 183,437 |

| 2002 | 232,330 |

| 2003 | 255,010 |

| 2004 | 275,900 |

| 2005 | 293,541 |

| 2006 | 383,037 |

| 2007 | 592,622 |

| 2008 | 983,881 |

| 2009 | 1,035,033 |

| 2010 | 1,178,234 |

| 2011 | 958,957 |

| 2012 | 853,358 |

| 2013 | 679,923 |

| 2014 | 608,321 |

| 2015 | 506,609 |

| 2016 | 385,748 |