by Calculated Risk on 3/23/2017 07:00:00 AM

Thursday, March 23, 2017

Black Knight: Mortgage Delinquencies Declined in February

From Black Knight: Black Knight Financial Services’ First Look at February Mortgage Data: Prepayment Activity Continues to Decline, Down 40 Percent So Far in 2017

• Prepayment speeds (historically a good indicator of refinance activity) declined 15 percent in February, marking a 40 percent overall year-to-date decline and the lowest monthly rate in three yearsAccording to Black Knight's First Look report for February, the percent of loans delinquent decreased 1.0% in February compared to January, and declined 5.5% year-over-year.

• Delinquencies continued their seasonal decline, ticking down .98 percent from January

• Foreclosure starts fell 18 percent from last month to 31 percent below last year’s levels

• Active foreclosure inventory now stands at 470,000, the lowest such level since June 2007

The percent of loans in the foreclosure process declined 1.9% in February and were down 28.5% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.21% in February, down from 4.25% in January.

The percent of loans in the foreclosure process declined in February to 0.93%.

The number of delinquent properties, but not in foreclosure, is down 117,000 properties year-over-year, and the number of properties in the foreclosure process is down 185,000 properties year-over-year.

Still improving, but the improvement has slowed.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Feb 2017 | Jan 2017 | Feb 2016 | Feb 2015 | |

| Delinquent | 4.21% | 4.25% | 4.45% | 5.30% |

| In Foreclosure | 0.93% | 0.94% | 1.30% | 1.72% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,135,000 | 2,162,000 | 2,252,000 | 2,671,000 |

| Number of properties in foreclosure pre-sale inventory: | 470,000 | 481,000 | 655,000 | 866,000 |

| Total Properties | 2,605,000 | 2,643,000 | 2,907,000 | 3,537,000 |

Wednesday, March 22, 2017

Thursday: New Home Sales, Unemployment Claims

by Calculated Risk on 3/22/2017 06:32:00 PM

The warmer weather probably didn't impact February existing home sales, because existing home sales are counted when the contract closes. However the warm February may have boosted New Home sales since new home sales are counted when contracts are signed - and there were probably more people out looking in some parts of the country with the warmer weather.

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, down from 241 thousand the previous week.

• At 8:45 AM, Speech by Fed Chair Janet L. Yellen, Opening Remarks, At the 2017 Federal Reserve System Community Development Research Conference, Washington, D.C.

• At 10:00 AM, New Home Sales for February from the Census Bureau. The consensus is for an increase in sales to 565 thousand Seasonally Adjusted Annual Rate (SAAR) in February from 555 thousand in January.

• At 11:00 AM, the Kansas City Fed manufacturing survey for March.

A Few Comments on February Existing Home Sales

by Calculated Risk on 3/22/2017 02:39:00 PM

Earlier: NAR: "Existing-Home Sales Stumble in February"

A few key points:

1) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus. See: Existing Home Sales: Take the Under

2) The warmer weather probably had no impact on February sales (existing home sales are reported at closing). Warmer weather in February might have boosted sales for March and early April.

3) The contracts for February existing home sales were entered after the recent increase in mortgage rates (rates started increasing after the election).

With the recent increase in rates, I'd expect some decline in sales volume as happened following the "taper tantrum" in 2013. This is the first month with softer sales (and it is just one month), so maybe sales will hold up.

4) Inventory is still very low and falling year-over-year (down 6.4% year-over-year in January). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases.

To repeat: Two of the key reasons inventory is low: 1) A large number of single family home and condos were converted to rental units. In 2015, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors, and rents have increased substantially, and the investors are not selling (even though prices have increased too). Most of these rental conversions were at the lower end, and that is limiting the supply for first time buyers. 2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80, in another 10 to 20 years for the boomers). Instead we are seeing a surge in home improvement spending, and this is also limiting supply.

Of course low inventory keeps potential move-up buyers from selling too. If someone looks around for another home, and inventory is lean, they may decide to just stay and upgrade.

I expect inventory will be increasing year-over-year by the end of 2017.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in February (red column) were the highest for February since 2007 (NSA).

Note that sales NSA are in the slow seasonal period, and will increase sharply (NSA) in March.

AIA: Architecture Billings Index increased in February

by Calculated Risk on 3/22/2017 12:24:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index rebounds into positive territory

The Architecture Billings Index (ABI) returned to growth mode in February, after a weak showing in January. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the February ABI score was 50.7, up from a score of 49.5 in the previous month. This score reflects a minor increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 61.5, up from a reading of 60.0 the previous month, while the new design contracts index climbed from 52.1 to 54.7.

“The sluggish start to the year in architecture firm billings should give way to stronger design activity as the year progresses,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “New project inquiries have been very strong through the first two months of the year, and in February new design contracts at architecture firms posted their largest monthly gain in over two years.”

...

• Regional averages: Midwest (52.4), South (50.5), Northeast (50.0), West (47.5)

• Sector index breakdown: institutional (51.8), multi-family residential (49.3), mixed practice (49.2), commercial / industrial (48.9)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.7 in February, up from 49.5 in January. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 9 of the last 12 months, suggesting a further increase in CRE investment in 2017.

NAR: "Existing-Home Sales Stumble in February"

by Calculated Risk on 3/22/2017 10:12:00 AM

From the NAR: Existing-Home Sales Stumble in February

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, retreated 3.7 percent to a seasonally adjusted annual rate of 5.48 million in February from 5.69 million in January. Despite last month's decline, February's sales pace is still 5.4 percent above a year ago.

Total housing inventory 3 at the end of February increased 4.2 percent to 1.75 million existing homes available for sale, but is still 6.4 percent lower than a year ago (1.87 million) and has fallen year-over-year for 21 straight months. Unsold inventory is at a 3.8-month supply at the current sales pace (3.5 months in January).

emphasis added

Click on graph for larger image.

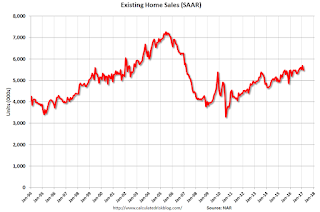

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in January (5.48 million SAAR) were 3.7% lower than last month, but were 5.4% above the February 2016 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.75 million in February from 1.68 million in January. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 1.75 million in February from 1.68 million in January. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 6.4% year-over-year in February compared to February 2016.

Inventory decreased 6.4% year-over-year in February compared to February 2016. Months of supply was at 3.8 months in February.

This was below consensus expectations. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 3/22/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 17, 2017.

... The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 5 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) remained unchanged at 4.46 percent, with points increasing to 0.41 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity remains low - and would not increase significantly unless rates fall sharply.

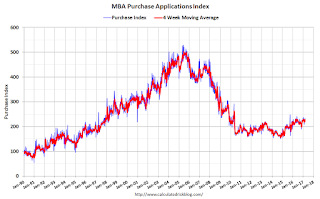

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the increase in mortgage rates over the last few months, purchase activity is still holding up.

However refinance activity has declined significantly since rates increased.

Tuesday, March 21, 2017

Wednesday: Existing Home Sales

by Calculated Risk on 3/21/2017 05:41:00 PM

First, I expect existing home sales to be below consensus tomorrow. See: Existing Home Sales: Take the Under

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:00 AM, FHFA House Price Index for January 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 5.55 million SAAR, down from 5.69 million in January. Housing economist Tom Lawler expects the NAR to report sales of 5.41 million SAAR in February.

• During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

Here is a graph (click on graph for larger image) from Doug Short and shows the S&P 500 since the 2007 high. Today is that little blip at the end.

More graphs here: S&P 500 Snapshot: Biggest Loss in Five Months

Chemical Activity Barometer increases in March

by Calculated Risk on 3/21/2017 11:52:00 AM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Consumer, Business Confidence Reach Levels Not Seen in Decades; Optimism Reflected in Increased Chemical Industry Activity

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), posted its strongest year-over-year gain in nearly seven years. The 5.5 percent increase over this time last year reflects elevated consumer and business confidence and an overall rising optimism in the U.S. economy. Speaking last week, Federal Reserve Chairwoman Janet Yellen also referenced a “confidence in the robustness of the economy” as a reason to move forward with an interest rate hike.

The barometer posted a 0.5 percent gain in March, following a 0.5 percent gain in February and 0.4 percent gain in January. All data is measured on a three-month moving average (3MMA). Coupled with consecutive monthly gains in the fourth quarter of 2016, the pattern shows consistent, accelerating activity. On an unadjusted basis the CAB climbed 0.4 percent in March, following a 0.4 percent gain in February and a 0.6 percent increase in January.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

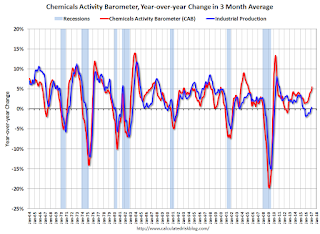

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

CAB has increased solidly over the last several months, and this suggests an increase in Industrial Production in 2017.

"Mortgage Rates at 2 Week Lows"

by Calculated Risk on 3/21/2017 10:03:00 AM

From Matthew Graham at Mortgage News Daily: Mortgage Rates at 2 Week Lows Amid Political Uncertainty

Mortgage rates were steady-to-slightly lower today, keeping them in line with the lowest levels in 2 weeks and very close to the lowest levels of the month. For most lenders, that means conventional 30yr fixed rate quotes of 4.25% on top tier scenarios. Some lenders are still up at 4.375% and an aggressive few are back down to 4.125%.Here is a table from Mortgage News Daily:

Last week, we discussed the motivations for the rate improvements in detail. To recap: longer-term rates like mortgages had already risen in anticipation of the Fed rate hike. It wasn't a surprise. Instead, markets were focused on the Fed's forward-looking rate hike forecasts, which came out slightly slower than markets expected. Thus, rates were overly-prepared for a fast rate hike timeline and had some room to return to early March levels.

From there, attention has turned to fiscal uncertainty as several policy objectives of the Trump administration have run into roadblocks. Specifically, investors are concerned that tax cuts will be significantly delayed as the health care debate seems to be front and center. The expectation of tax cuts (and other fiscal measures) was a major contributor to the move higher in rates and stocks after the election. To whatever extent those measures are delayed, investors can easily question if rates and stocks are higher than they should be.

emphasis added

Monday, March 20, 2017

Hotels: Hotel Occupancy Solid in early March

by Calculated Risk on 3/20/2017 03:11:00 PM

Hotel occupancy has picked up in recent weeks and is now close to the record year (2015 was the record).

From HotelNewsNow.com: STR: US hotel results for week ending 11 March

The U.S. hotel industry reported positive results in the three key performance metrics during the week of 5-11 March 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In a year-over-year comparison with the week of 6-12 March 2016:

• Occupancy: +0.8% to 67.4%

• Average daily rate (ADR): +3.9% to US$128.61

• Revenue per available room (RevPAR): +4.8% to US$86.72

emphasis added

The red line is for 2017, dashed is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2017, dashed is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

For hotels, occupancy will now move mostly sideways until the summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com