by Calculated Risk on 3/15/2017 10:17:00 AM

Wednesday, March 15, 2017

NAHB: Builder Confidence increased to 71 in March, Highest in 12 Years

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 71 in March, up from 65 in February. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Hits 12-Year High

Builder confidence in the market for newly-built single-family homes jumped six points to a level of 71 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). This is the highest reading since June 2005.

...

“While builders are clearly confident, we expect some moderation in the index moving forward,” said NAHB Chief Economist Robert Dietz. “Builders continue to face a number of challenges, including rising material prices, higher mortgage rates, and shortages of lots and labor.”

All three HMI components posted robust gains in March. The component gauging current sales conditions increased seven points to 78 while the index charting sales expectations in the next six months rose five points to 78. Meanwhile, the component measuring buyer traffic jumped eight points to 54.

Looking at the three-month moving averages for regional HMI scores, the Midwest increased three points to 68 and the South rose one point to 68. The West dipped three points to 76 and the Northeast edged one point lower to 48.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast and another solid reading.

Retail Sales increased 0.1% in February

by Calculated Risk on 3/15/2017 08:45:00 AM

On a monthly basis, retail sales increased 0.1 percent from January to February (seasonally adjusted), and sales were up 5.7 percent from February 2016.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for February 2017, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $474.0 billion, an increase of 0.1 percent from the previous month, and 5.7 percent above February 2016. ... The December 2016 to January 2017 percent change was revised from up 0.4 percent to up 0.6 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.1% in February.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.5% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 4.5% on a YoY basis.The increase in February was close to expectations, and sales for January were revised up. A solid report.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 3/15/2017 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 3.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 10, 2017.

... The Refinance Index increased 4 percent from the previous week. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 3 percent compared with the previous week and was 6 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) increased to its highest level since April 2014, 4.46 percent, from 4.36 percent, with points decreasing to 0.37 from 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance is up over the last three weeks, but it seems like activity will decline again as interest rates increase.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the increase in mortgage rates over the last few months, purchase activity is still holding up.

However refinance activity has declined significantly since rates increased.

Tuesday, March 14, 2017

Wednesday: FOMC Meeting, Retail Sales, CPI, Homebuilder Survey and More

by Calculated Risk on 3/14/2017 07:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for February will be released. The consensus is for 0.2% increase in retail sales in February.

• Also at 8:30 AM, The Consumer Price Index for February from the BLS. The consensus is for 0.1% increase in CPI, and a 0.2% increase in core CPI.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for March. The consensus is for a reading of 15.7, down from 18.7.

• At 10:00 AM, The March NAHB homebuilder survey. The consensus is for a reading of 66, up from 65 in February. Any number above 50 indicates that more builders view sales conditions as good than poor.

• Also at 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for January. The consensus is for a 0.3% increase in inventories.

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to increase the Fed Funds rate 25 bps at this meeting.

• Also at 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Janet Yellen holds a press briefing following the FOMC announcement

Duy on FOMC Meeting: Shifting Dots

by Calculated Risk on 3/14/2017 03:18:00 PM

From Tim Duy at Fed Watch: Shifting Dots

The Federal Reserve begins its two-day meeting today. The outcome of the meeting is no longer in debate. A 25bp rate hike is widely expected after a round of Fedspeak in the week prior to the blackout period and the February employment report. More important now is what signal the Fed sends with the statement, the press conference, and the dots. I anticipate the overall message to signal general confidence in the economic outlook while reinforcing the idea that the Fed is neither behind the curve nor intends to fall behind the curve. The combination will give the Fed room to tighten policy at a gradual pace. I think that four hikes this year would still be considered gradual from the Fed's perspective. After all, the expectation of four hikes a year was considered gradual at the beginning of 2016. Not sure why it shouldn't be considered gradual now.

...

Bottom Line: I see more reasons tha[n] not that the Fed will push up its 2017 rate hike projections. Lots of different factors - external, data flow, fiscal stimulus, and financial conditions - to say that with the economy hovering near potential output, the time is right to make a slightly faster move toward the neutral rate. Indeed, I have a hard time seeing why they would pull forward a rate hike if they weren't trying to create room for an additional hike this year. Note that this would really be just moving the ball down the field a bit quicker, not changing the goal posts - the estimate of the neutral rate. A higher estimate of the neutral rate would be much more hawkish than just quickening the pace slightly to that rate.

emphasis added

Mortgage Equity Withdrawal Positive in Q4

by Calculated Risk on 3/14/2017 11:29:00 AM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released today) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q4 2016, the Net Equity Extraction was a positive $14 billion, or a positive 0.4% of Disposable Personal Income (DPI) . This is only the third positive MEW since Q1 2008.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $63 billion in Q4.

The Flow of Funds report also showed that Mortgage debt has declined by $1.21 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance.

With a slower rate of debt cancellation, MEW will likely stay positive.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

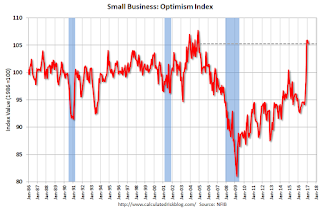

NFIB: Small Business Optimism Index decreased slightly in February

by Calculated Risk on 3/14/2017 10:08:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Remains Near Record High

Small business optimism remained at one of its highest readings in 43 years, as small business awaits a new healthcare law, tax reform, and regulatory relief from Washington, according to the February National Federation of Independent Business (NFIB) Small Business Optimism Index, released today.

...

The Index fell 0.6 points in February to 105.3 yet remains a very high reading. The slight decline follows the largest month-over-month increase in the survey’s history in December and another uptick in January.

...

The job openings component reached its highest level since December 2000, but more owners reported difficulty finding qualified workers to fill open positions.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 105.3 in February.

Monday, March 13, 2017

"Mortgage Rates Approach 3-Year Highs Ahead of Fed"

by Calculated Risk on 3/13/2017 08:23:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Approach 3-Year Highs Ahead of Fed

Mortgage rates rose for the 10th time in the past 11 days today, bringing them very close to highest levels in 3 years. You'd have to go back to April 30th, 2014 to see the average lender offering higher rates. The most common conventional 30yr fixed quote is easily up to 4.375% on top tier scenarios with a growing number of lenders moving up to 4.5%.Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for February.

• At 8:30 AM, The Producer Price Index for February from the BLS. The consensus is for 0.1% increase in PPI, and a 0.2% increase in core PPI.

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 3/13/2017 05:20:00 PM

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices were down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts. This decline in 2015 was also probably related to weakness in China.

Prices in 2017 are up year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through early March 2017 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 26% from a year ago, and CME futures are up about 33% year-over-year.

Long Beach: Port Traffic down in February due to Chinese New Year

by Calculated Risk on 3/13/2017 03:01:00 PM

Note: I mentioned earlier that the timing of the Chinese New Year increased the trade deficit with China in January. In February, the deficit with China will likely decline.

From the Port of Long Beach: Cargo Declines During Lunar New Year

Reduced economic activity in Asia associated with the Lunar New Year contributed to lower February container volumes at the Port of Long Beach.

Overall, traffic totaled 498,311 twenty-foot equivalent units (TEUs), a decline of 11.2 percent compared to the same month last year, the highest-volume February in Port history. Cargo in February 2016 ballooned 35.9 percent year-over-year.

The Lunar New Year holiday began Jan. 28, almost two weeks earlier than in 2016. The Lunar New Year typically results in slower trade since businesses in China — the world’s No. 2 economy and the Port’s primary trading partner — close for a week or more to observe the holiday. The impact on the Port is seen two weeks afterwards, accounting for the time it takes vessels to cross the Pacific.