by Calculated Risk on 2/10/2017 04:35:00 PM

Friday, February 10, 2017

Update: The Inland Empire Bust and Recovery

Way back in 2006 I disagreed with some analysts on the outlook for the Inland Empire in California. I wrote:

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.And sure enough, the economies of housing dependent areas like the Inland Empire were devastated during the housing bust. The good news is the Inland Empire is expanding solidly now.

So I think some pundits have it backwards: Instead of a strong local economy keeping housing afloat, I think the bursting housing bubble will significantly impact housing dependent local economies.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate for the Inland Empire (using MSA: Riverside, San Bernardino, Ontario), and also the number of construction jobs as a percent of total employment.

The unemployment rate is falling, and is down to 5.2% (down from 14.4% in 2010). And construction employment is up from the lows (as a percent of total employment), but still somewhat low.

So the unemployment rate is back to a low level, but the economy isn't as heavily depending on construction.

Overall the Inland Empire economy is in much better shape today.

Preliminary February Consumer Sentiment declines to 95.7

by Calculated Risk on 2/10/2017 10:04:00 AM

The preliminary University of Michigan consumer sentiment index for February was at 95.7, down from 98.5 in January.

Consumer confidence retreated from the decade-peak recorded in January, with the decline centered in the Expectations Index. To be sure, confidence remains quite favorable, with only five higher readings in the past decade. Importantly, the data do not reflect any closing of the partisan divide. The Michigan survey includes several free-response questions which ask respondents to answer in their own words, without any prompting or proposed answer categories. When asked to describe any recent news that they had heard about the economy, 30% spontaneously mentioned some favorable aspect of Trump’s policies, and 29% unfavorably referred to Trump’s economic policies. Thus a total of nearly six-in-ten consumers made a positive or negative mention of government policies. In the long history of the surveys, this total had never reached even half that amount, except for five surveys in 2013 and 2014 that were solely dominated by negative references to the debt and fiscal cliff crises. Moreover, never before have these spontaneous references to economic policies had such a large impact on the Sentiment Index: a difference of 37 Index points between those that referred to favorable and unfavorable policies.

emphasis added

Click on graph for larger image.

Consumer sentiment is a concurrent indicator (not a leading indicator).

Merrill Lynch: Market Participants "underestimating the risk of an uncertainty shock to the economy"

by Calculated Risk on 2/10/2017 08:48:00 AM

A few excerpts from a piece by economist Ethan Harris at Merrill Lynch:

One of our key views is that some analysts are underestimating the risk of an uncertainty shock to the economy in the coming months. ... Thus far policy actions by President Trump have generally been positive for the markets and the economy. His most aggressive economic policy actions to date involve using appointments and executive orders to promote much lighter enforcement of existing regulations.

Beyond that, the likely path of policy remains very uncertain. ... It seems as though economists and investors have set aside these concerns as too hard to handicap.

We think this is a mistake. Until there is more clarity on policy we will remain in a very cautious mood. In particular, we think economic activity could slow and confidence could fade as consumers, investors and firms try to figure out whether they are net winners or losers from all of the policy changes.

Thursday, February 09, 2017

Prime Working-Age Population near 2007 Peak

by Calculated Risk on 2/09/2017 03:26:00 PM

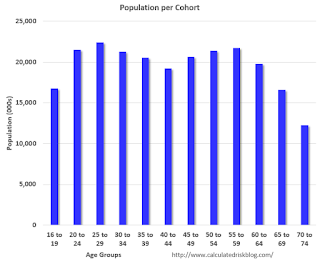

The prime working age population peaked in 2007, and bottomed at the end of 2012. As of January 2017, there are still fewer people in the 25 to 54 age group than in 2007.

However the prime working age (25 to 54) will probably hit a new peak this year.

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story. Here is a graph of the prime working age population (25 to 54 years old) - and prime plus (20 to 59 years old) from 1948 through January 2017.

Note: This is population, not work force.

There was a huge surge in the prime working age population in the '70s, '80s and '90s.

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

The good news is the prime working age group has started to grow again, and is now growing at 0.5% per year - and this should boost economic activity. And it appears the prime working age group will exceed the previous peak this year.

If we look at the prime plus working age (20 to 59 age groups, the story is a little different. This prime plus group is still growing, but the growth will probably slow over the next few years as the younger boomers start retiring.

The cohorts with the next highest participation rates are 55 to 59 years old, and 20 to 24 years old. So these two groups are included in the first graph in the red line.

We could also add 60 to 64 too in the prime plus group (not included in first graph)

Note that 16 to 19 is only for four years; all other cohorts are five year groups.

The largest cohort is now in the 25 to 29 age group (this cohort is one reason I've been positive on rentals for the last 5+ years).

With these large cohorts moving into the prime working age - and the prime working age population growing again - this is a reason for optimism.

EIA: "U.S. energy trade with Mexico: U.S. export value more than twice import value in 2016"

by Calculated Risk on 2/09/2017 11:56:00 AM

From the EIA: U.S. energy trade with Mexico: U.S. export value more than twice import value in 2016

Energy trade between Mexico and the United States has historically been driven by Mexico’s sales of crude oil to the United States and by U.S. net exports of refined petroleum products to Mexico. Through 2014, Mexico’s exports of crude oil to the United States were the most valuable component of bilateral energy trade, with the overall value of Mexico’s U.S. crude oil sales far exceeding the value of U.S. net sales of petroleum products, primarily gasoline and diesel fuel, to Mexico. From 2006 through 2010, for example, the value of U.S. energy imports from Mexico were two to three times greater than the value of U.S. energy exports to Mexico.

The bilateral energy trade situation with Mexico has changed significantly in recent years. In 2015 and 2016, the value of U.S. energy exports to Mexico, including rapidly growing volumes of both petroleum products and natural gas, exceeded the value of U.S. energy imports from Mexico as volumes of Mexican crude oil sold in the United States continued to decline. For 2016, the value of U.S. energy exports to Mexico was $20.2 billion, while the value of U.S. energy imports from that country was $8.7 billion.

CR Note: The recent change in energy trade with Mexico will probably come as a surprise to many.

CR Note: The recent change in energy trade with Mexico will probably come as a surprise to many.

Weekly Initial Unemployment Claims decrease to 234,000

by Calculated Risk on 2/09/2017 08:40:00 AM

The DOL reported:

In the week ending February 4, the advance figure for seasonally adjusted initial claims was 234,000, a decrease of 12,000 from the previous week's unrevised level of 246,000. The 4-week moving average was 244,250, a decrease of 3,750 from the previous week's unrevised average of 248,000. This is the lowest level for this average since November 3, 1973 when it was 244,000.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 244,250.

This was below the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, February 08, 2017

Mortgage rates decline for the third straight day

by Calculated Risk on 2/08/2017 06:22:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Doing Very Well This Week

Mortgage rates fell for the third straight day today. Each day has seen moderate improvement. Taken together, they add up to a strong move lower from last week's levels (which were roughly in the lower-middle of the post-election range). The result is that some lenders are at or near their lowest rates in nearly 3 MONTHS (yesterday it was 3 WEEKS). The average lender has only had 3 days during that time where rates were any better.Here is a table from Mortgage News Daily:

There are plenty of opinions about what's behind this week's falling rates ranging from politics to last week's jobs report causing a shift in Fed rate hike expectations. All that matters is that investors have shifted to a more risk-averse stance resulting in better demand for less risky assets like bonds. Higher demand for bonds means lower rates.

4.125% remains the most common conventional 30yr fixed quote for top tier scenarios. There are now very few lenders still stuck up at 4.25% (keep in mind that we're talking about a perfect loan file with no negative adjustments for loan-to-value, FICO, etc..)

emphasis added

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 2/08/2017 02:22:00 PM

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices were down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts. This decline in 2015 was also probably related to weakness in China.

Prices in 2017 are up year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through early February 2017 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 17% from a year ago, and CME futures are up about 40% year-over-year.

Lawler on Household Projections

by Calculated Risk on 2/08/2017 10:51:00 AM

From housing economist Tom Lawler: Household Projections: New Population Estimates + New Administration = Time for an Update

When the Census Bureau released its estimates for the U.S. population in December, most press coverage focused on which states saw the fastest population growth last year. What many missed, however, was that the Census Bureau significantly reduced its population estimates for each of the past several years, with the major reason for the downward revisions stemming from reduced estimates of net international migration. The latter reductions were the result up an updated methodology used to estimate foreign-born emigration, as discussed in the following excerpt from the 2016 vintage “release notes.”

“The Vintage 2016 net international migration estimates reflect the following changes to the methodology since the release of the Vintage 2015 estimates:Here are some summary statistics on “Vintage 2016” population estimates (resident population” compared to “Vintage 2015” population estimates. I’m including Census projections for 2016 that had been based on Vintage 2015 estimates (used for CPS-based data for 2016) as well as a December 1, 2016 estimate based on Vintage 2016.

“We updated the foreign-born emigration subcomponent in two ways: 1) we modified the emigrant group definitions used to calculate estimates of foreign-born emigration; 2) we applied averaged rates from multiple 5-year ACS files for non-recent arrivals (Mexican born who arrived more than 10 years ago, Asian born who arrived more than five years ago, and Non-Mexican born who arrived more than 10 years ago). These changes resolve negative rates produced by the previous residual method, which had resulted in zero emigration for certain emigrant groups. Consequently, foreign-born emigration will be higher and net international migration will be lower than the previous vintage.”

| U.S. Resident Population, Vintage 2015 vs. Vintage 2016 | |||

|---|---|---|---|

| Vintage 2015 | Vintage 2016 | Change | |

| 7/1/2010 | 309,346,863 | 309,348,193 | 1,330 |

| 7/1/2011 | 311,718,857 | 311,663,358 | -55,499 |

| 7/1/2012 | 314,102,623 | 313,998,379 | -104,244 |

| 7/1/2013 | 316,427,395 | 316,204,908 | -222,487 |

| 7/1/2014 | 318,907,401 | 318,563,456 | -343,945 |

| 7/1/2015 | 321,418,820 | 320,896,618 | -522,202 |

| 7/1/2016 | 323,889,854 | 323,127,513 | -762,341 |

| 12/1/2016 | 325,032,763 | 324,142,480 | -890,283 |

The next table shows Census estimates of Net International Migration from the “Vintage 2015” population estimates compared to the most recent (“Vintage 2016”) estimates.

| Net International Migration, July 1 - July 1, Vintage 2015 vs. Vintage 2016 | |||

|---|---|---|---|

| Vintage 2015 | Vintage 2016 | Change | |

| 2011 | 910,951 | 854,172 | -56,779 |

| 2012 | 948,321 | 899,576 | -48,745 |

| 2013 | 992,215 | 873,972 | -118,243 |

| 2014 | 1,133,261 | 977,801 | -155,460 |

| 2015 | 1,150,528 | 1,036,826 | -113,702 |

| 2016* | 1,160,000 | 999,163 | -160,837 |

| *Estimate for Vintage 2015 projections | |||

These downward population revisions were reflected in last Friday’s employment report, which showed the impact of updated population estimates on the 16+ year civilian non-institutional population assumptions used to produce employment and labor force estimates based on the “household” (CPS) survey.

| 16+ Civilian Non-Institutional Population, Household Employment Report, December 2016 (000’s) | |||

|---|---|---|---|

| Vintage 2015 | Vintage 2016 | Change | |

| Total | 254,742 | 253,911 | -831 |

| White | 198,845 | 198,376 | -469 |

| Black | 32,105 | 32,029 | -76 |

| Asian | 15,433 | 15,175 | -258 |

| Other | 8,359 | 8,331 | -28 |

| Hispanic or Latino Ethnicity* | 41,190 | 40,838 | -352 |

| *Persons whose ethnicity is described as Hispanic or Latino may be of any race | |||

While Census has not yet updated its estimates of age distribution of the population, data released as part of last Friday’s report allow one to estimate downward revisions in the 16+ civilian non-institutional population by age.

| 16+ Civilian Non-Institutional Population by Age Group Derived from* Household Employment Report, December 2016 (000's) | |||

|---|---|---|---|

| Age Group | Vintage 2015 | Vintage 2017 | Change |

| 16-24 | 38,348 | 38,265 | -83 |

| 25-34 | 43,839 | 43,692 | -147 |

| 35-44 | 39,919 | 39,763 | -156 |

| 45-54 | 42,212 | 42,103 | -109 |

| 55-64 | 41,587 | 41,468 | -119 |

| 65-74 | 28,913 | 28,794 | -119 |

| 75+ | 19,924 | 19,826 | -98 |

| Total | 254,742 | 253,911 | -831 |

| *LEHC estimates | |||

These new population estimates will, of course, be used by Census to produce household estimates based on the 2017 CPS/ASEC. However, Census typically does not revise previous-year estimates to reflect revisions in population estimates. As such, the change in the CPS/ASEC household estimate for March 2017 compared to the March 2017 estimate will probably be about 450,000 or so lower than it would have been without the recent methodological change used to estimate net international migration

These latest population revisions, including updated projections from Census for 2017, suggest that household projections based on the latest long-term population projections made by Census in December 2014 are woefully out of date. Here is a table comparing the population projections in that report for 2014, 2015, 2016, and 2017 compared to the most recent population estimates and projections (the latter of which only extend to 2017).

| 2015 Population Projections vs. Latest Estimates/Projections, U.S. Resident Population (000’s) | |||

|---|---|---|---|

| Projection from December 2014 | Latest Estimates/ Projections | Change | |

| 7/1/2014 | 318,748 | 318,563 | -185 |

| 7/1/2015 | 321,369 | 320,877 | -492 |

| 7/1/2016 | 323,996 | 323,128 | -868 |

| 7/1/2017 | 326,626 | 325,534 | -1,092 |

As the table shows, the most recent projection of the US resident population for 2017 is almost 1.1 million lower than the projection from late 2014.

Given (1) the improved methodology to estimate net international migration, and (2) the Trump administration’s potential policies on immigration, it seems extremely likely that an updated long-term population projection would produce hugely different population projections for years subsequent to 2017 than those shown in the “latest” Census projections from late 2014. E.g., here is a table showing the components of change from Census’ long-term population projections from late 2014.

Given (1) the improved methodology to estimate net international migration, and (2) the Trump administration’s potential policies on immigration, it seems extremely likely that an updated long-term population projection would produce hugely different population projections for years subsequent to 2017 than those shown in the “latest” Census projections from late 2014. E.g., here is a table showing the components of change from Census’ long-term population projections from late 2014.While updated estimates suggest that net international migration averaged about 900,000 over the past 5 years, the late 2014 projections assumed an average of about 1.256 million from 2015 to 2020. Even without the “Trump win” that number would currently be considered way to high, and today such a projection seems, in the words of demographer Dr. Vizzini, “inconceivable.”

For folks wondering why I am comparing recent estimates to a Census projection from December 2014, the reason is that the December 2014 projection is that latest the Census has released, and those projections have been used by quite a few analysts/institutions/organizations/etc. to produce and publish long-term projections of the number of US households. Indeed, in an unluckily-timed report released just eight days before the Census released it “Vintage 2016” population numbers, the Joint Center for Housing Studies published new household projections based on Census population projections from December 2014! (There are other serious problems with the JCHS report, but I won’t dwell on those).

So ... If one both incorporated the latest Census population projections (including its new methodology for measuring net international migration), AND used updated assumptions on births, deaths, and net international migration for the next several years, what would an updated population projection look like? E.g., how should one translate what Trump and Trump officials (as well as Congressional officials) have said about immigration into a projection of net international migration? Frankly, I don’t know.

But let’s just make an “educated guess” that net international migration would be at a level lower than it recently has been, and let’s arbitrarily pick an average of 750,000. Combed with reasonable projections for birth and dealt rates, that would produce a population projection of something like that shown in the table below. (I am not adjusting Census’ latest projection for 2017).

| US Resident Population Estimates and Projections (000's) | |||

|---|---|---|---|

| December 2014 Projection | "More Trumpian" | Difference | |

| 7/1/2015 | 321,369 | 320,877 | -492 |

| 7/1/2016 | 323,996 | 323,128 | -868 |

| 7/1/2017 | 326,626 | 325,534 | -1,092 |

| 7/1/2018 | 329,256 | 327,647 | -1,609 |

| 7/1/2019 | 331,884 | 329,751 | -2,133 |

| 7/1/2020 | 334,503 | 331,840 | -2,663 |

If such a lower net international migration number were to occur, then a “more reasonable” projection of the US resident population in 2020 would be a whopping 2.663 million below the projection in Census’ December 2014 population forecast used by quite a few analysts to project US household growth. The vast bulk of this reduction would be (1) in the adult population, and (2) in the foreign-born population. I have not yet attempted to see how such a different population projection would translate into a household projection, but some might call it “YUGE” enough to warrant throwing out household projections based on the “latest official” Census population projections, and instead focus on an updated forecast based on more reasonable population projections.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 2/08/2017 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 3, 2017.

... The Refinance Index increased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 9 percent compared with the previous week and was 4 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,000 or less) decreased to 4.35 percent from 4.39 percent, with points remaining unchanged at 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

It would take a substantial decrease in mortgage rates to see a significant increase in refinance activity - although we might see more cash-out refis.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the recent increase in mortgage rates, purchase activity is still holding up.

However refinance activity has declined significantly.