by Calculated Risk on 2/02/2017 08:33:00 AM

Thursday, February 02, 2017

Weekly Initial Unemployment Claims decrease to 246,000

The DOL reported:

In the week ending January 28, the advance figure for seasonally adjusted initial claims was 246,000, a decrease of 14,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 259,000 to 260,000. The 4-week moving average was 248,000, an increase of 2,250 from the previous week's revised average. The previous week's average was revised up by 250 from 245,500 to 245,750.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 248,000.

This was below the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, February 01, 2017

Thursday: Unemployment Claims

by Calculated Risk on 2/01/2017 06:37:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 253 thousand initial claims, down from 259 thousand the previous week.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Higher Despite Help From The Fed

Mortgage rates were higher to end the day, but not as high as they might have been without the Fed Statement. The day began with a series of strong economic reports. The ADP Employment Report was much stronger than expected, as was the employment component of the ISM Manufacturing report. Investors connect those dots to increased risk of a strong number in this Friday's all-important Employment Situation Report (the big jobs report). ... The Fed helped push rates back in the other direction this afternoon. While there were numerous minor changes in their verbiage, none of them did anything to accelerate the rate hike timeline or to threaten the Fed's current policy of reinvesting the interest it earns on its portfolio. That's one of the key reasons that rates are still historically low. With that, multiple lenders were able to improve rate sheets this afternoon. The net effect was still a slight move higher for closing costs, but the damage would have been much worse without the Fed.Here is a table from Mortgage News Daily:

emphasis added

U.S. Light Vehicle Sales decrease to 17.5 million annual rate in January

by Calculated Risk on 2/01/2017 02:38:00 PM

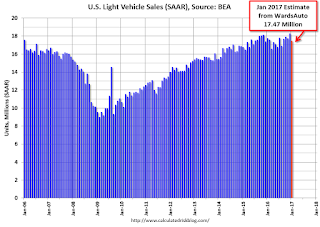

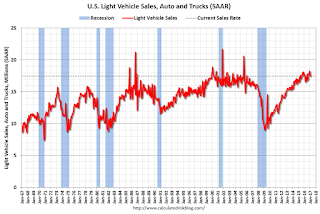

Based on a preliminary estimate from WardsAuto, light vehicle sales were at a 17.47 million SAAR in January.

That is down about 2% from January 2016, and down 4.5% from the 18.29 million annual sales rate last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for January (red, light vehicle sales of 17.47 million SAAR from WardsAuto).

This was below the consensus forecast of 17.7 million for January.

After two consecutive years of record sales, it looks like sales will mostly move sideways in 2017.

Note: dashed line is current estimated sales rate.

FOMC Statement: No Change to Policy

by Calculated Risk on 2/01/2017 02:01:00 PM

Information received since the Federal Open Market Committee met in December indicates that the labor market has continued to strengthen and that economic activity has continued to expand at a moderate pace. Job gains remained solid and the unemployment rate stayed near its recent low. Household spending has continued to rise moderately while business fixed investment has remained soft. Measures of consumer and business sentiment have improved of late. Inflation increased in recent quarters but is still below the Committee's 2 percent longer-run objective. Market-based measures of inflation compensation remain low; most survey-based measures of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace, labor market conditions will strengthen somewhat further, and inflation will rise to 2 percent over the medium term. Near-term risks to the economic outlook appear roughly balanced. The Committee continues to closely monitor inflation indicators and global economic and financial developments.

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1/2 to 3/4 percent. The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. In light of the current shortfall of inflation from 2 percent, the Committee will carefully monitor actual and expected progress toward its inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction, and it anticipates doing so until normalization of the level of the federal funds rate is well under way. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Patrick Harker; Robert S. Kaplan; Neel Kashkari; Jerome H. Powell; and Daniel K. Tarullo.

emphasis added

Construction Spending decreased in December

by Calculated Risk on 2/01/2017 11:34:00 AM

Earlier today, the Census Bureau reported that overall construction spending decreased in December:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during December 2016 was estimated at a seasonally adjusted annual rate of $1,181.5 billion, 0.2 percent below the revised November estimate of $1,184.4 billion. The December figure is 4.2 percent above the December 2015 estimate of $1,133.7 billion.Private spending increased, however public spending decreased in December:

The value of construction in 2016 was $1,162.4 billion, 4.5 percent above the $1,112.4 billion spent in 2015.

Spending on private construction was at a seasonally adjusted annual rate of $897.0 billion, 0.2 percent above the revised November estimate of $894.8 billion. ...

In December, the estimated seasonally adjusted annual rate of public construction spending was $284.5 billion, 1.7 percent below the revised November estimate of $289.6 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been generally increasing, and is still 31% below the bubble peak.

Non-residential spending is now 4% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 13% below the peak in March 2009, and 8% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 4%. Non-residential spending is up 9% year-over-year. Public spending is down 2% year-over-year.

Looking forward, all categories of construction spending should increase in 2017.

This was below the consensus forecast of a 0.2% increase for December, however the previous months were revised up.

ISM Manufacturing index increased to 56.0 in January

by Calculated Risk on 2/01/2017 10:03:00 AM

The ISM manufacturing index indicated expansion in January. The PMI was at 56.0% in January, up from 54.5% in December. The employment index was at 56.1%, up from 52.8% last month, and the new orders index was at 60.4%, up from 60.3%.

From the Institute for Supply Management: January 2017 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in January, and the overall economy grew for the 92nd consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee; “The January PMI® registered 56 percent, an increase of 1.5 percentage points from the seasonally adjusted December reading of 54.5 percent. The New Orders Index registered 60.4 percent, an increase of 0.1 percentage point from the seasonally adjusted December reading of 60.3 percent. The Production Index registered 61.4 percent, 2 percentage points higher than the seasonally adjusted December reading of 59.4 percent. The Employment Index registered 56.1 percent, an increase of 3.3 percentage points from the seasonally adjusted December reading of 52.8 percent. Inventories of raw materials registered 48.5 percent, an increase of 1.5 percentage points from the December reading of 47 percent. The Prices Index registered 69 percent in January, an increase of 3.5 percentage points from the December reading of 65.5 percent, indicating higher raw materials prices for the 11th consecutive month. The PMI®, New Orders, and Production Indexes all registered their highest levels since November of 2014, and comments from the panel are generally positive regarding demand levels and business conditions.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 55.0%, and suggests manufacturing expanded at as faster pace in January than in December.

Another solid report.

ADP: Private Employment increased 246,000 in January

by Calculated Risk on 2/01/2017 08:32:00 AM

Private sector employment increased by 246,000 jobs from December 2016 to January 2017 according to the January ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was well above the consensus forecast for 168,000 private sector jobs added in the ADP report.

...

“The U.S. labor market is hitting on all cylinders and we saw small and midsized businesses perform exceptionally well,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Further analysis shows that services gains have rebounded from their tepid December pace, adding 201,000 jobs. The goods producers added 46,000 jobs, which is the strongest job growth that sector has seen in the last two years.”

Mark Zandi, chief economist of Moody’s Analytics said, “2017 got off to a strong start in the job market. Job growth is solid across most industries and company sizes. Even the energy sector is adding to payrolls again.”

The BLS report for January will be released Friday, and the consensus is for 175,000 non-farm payroll jobs added in January.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 2/01/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 27, 2017. The previous week’s results included an adjustment for the MLK Day holiday.

... The Refinance Index decreased 1 percent from the previous week. The seasonally adjusted Purchase Index decreased 6 percent from one week earlier. The unadjusted Purchase Index increased 12 percent compared with the previous week and was 2 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,000 or less) increased to its highest level since December 2016, 4.39 percent, from 4.35 percent, with points increasing to 0.34 from 0.30 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

It would take a substantial decrease in mortgage rates to see a significant increase in refinance activity - although we might see more cash-out refis.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the recent increase in mortgage rates, purchase activity is still holding up.

However refinance activity has declined significantly.

Tuesday, January 31, 2017

Wednesday: FOMC, Auto Sales, ISM Mfg, ADP Employment, Construction Spending

by Calculated Risk on 1/31/2017 08:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 168,000 payroll jobs added in January, up from 153,000 added in December.

• At 10:00 AM, ISM Manufacturing Index for January. The consensus is for the ISM to be at 55.0, up from 54.7 in December. The employment index was at 53.1% in December, and the new orders index was at 60.2%.

• At 10:00 AM, Construction Spending for December. The consensus is for a 0.2% increase in construction spending.

• All day, Light vehicle sales for January. The consensus is for light vehicle sales to decrease to 17.7 million SAAR in January, from 18.4 million in December (Seasonally Adjusted Annual Rate).

• At 2:00 PM, FOMC Meeting Announcement. No change to FOMC policy is expected at this meeting.

Lawler: Table of Distressed Sales and All Cash Sales for Selected Cities in December

by Calculated Risk on 1/31/2017 05:11:00 PM

Economist Tom Lawler sent me the table below of short sales, foreclosures and all cash sales for selected cities in December.

On distressed: The total "distressed" share is down year-over-year in all of these markets.

Short sales and foreclosures are mostly down in these areas.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors continue to pull back, the share of all cash buyers continues to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Dec- 2016 | Dec- 2015 | Dec- 2016 | Dec- 2015 | Dec- 2016 | Dec- 2015 | Dec- 2016 | Dec- 2015 | |

| Las Vegas | 4.8% | 6.8% | 6.2% | 5.9% | 11.0% | 12.7% | 28.7% | 28.4% |

| Reno** | 1.0% | 4.0% | 3.0% | 2.0% | 4.0% | 6.0% | ||

| Phoenix | 1.7% | 3.7% | 2.1% | 2.9% | 3.8% | 6.6% | 23.1% | 23.9% |

| Sacramento | 2.3% | 4.0% | 2.6% | 4.0% | 4.9% | 8.0% | 15.3% | 16.2% |

| Minneapolis | 1.6% | 2.6% | 5.5% | 9.0% | 7.1% | 11.6% | 12.8% | 13.3% |

| Mid-Atlantic | 3.4% | 4.2% | 9.3% | 12.5% | 12.7% | 16.7% | 16.5% | 18.7% |

| So. California* | 4.8% | 7.0% | 21.1% | 21.0% | ||||

| Florida SF | 2.0% | 3.3% | 7.4% | 14.4% | 9.3% | 17.7% | 28.3% | 33.7% |

| Florida C/TH | 1.2% | 2.1% | 5.7% | 12.1% | 6.9% | 14.1% | 55.8% | 60.5% |

| Miami-Dade Co SF | 3.7% | 6.7% | 11.2% | 28.7% | 14.9% | 35.3% | 27.1% | 34.5% |

| Miami-Dade Co CTH | 2.3% | 2.9% | 10.8% | 17.0% | 13.1% | 19.9% | 57.6% | 64.5% |

| Northeast Florida | 13.1% | 24.0% | ||||||

| Chicago (city) | 14.6% | 17.9% | ||||||

| Spokane | 8.4% | 14.4% | ||||||

| Chicago (city) | 14.6% | 17.9% | ||||||

| Rhode Island | 9.5% | 11.0% | ||||||

| Toledo | 25.6% | 33.4% | ||||||

| Tucson | 23.7% | 28.0% | ||||||

| Knoxville | 21.6% | 25.4% | ||||||

| Peoria | 28.3% | 24.0% | ||||||

| Georgia*** | 20.7% | 22.7% | ||||||

| Omaha | 15.7% | 19.0% | ||||||

| Richmond VA | 8.5% | 11.4% | 15.4% | 19.8% | ||||

| Memphis | 10.3% | 15.6% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||