by Calculated Risk on 12/15/2016 05:19:00 PM

Thursday, December 15, 2016

Larry Kudlow is usually wrong

Larry Kudlow is usually wrong and frequently absurd, as an example, in June 2005 Kudlow wrote "The Housing Bears are Wrong Again" and called me (or people like me) "bubbleheads".

Homebuilders led the stock parade this week with a fantastic 11 percent gain. This is a group that hedge funds and bubbleheads love to hate. All the bond bears have been dead wrong in predicting sky-high mortgage rates. So have all the bubbleheads who expect housing-price crashes in Las Vegas or Naples, Florida, to bring down the consumer, the rest of the economy, and the entire stock market.I guess I was one of those "bubbleheads"!

In December 2007, he wrote: Bush Boom Continues

There’s no recession coming. The pessimistas were wrong. It’s not going to happen. At a bare minimum, we are looking at Goldilocks 2.0. (And that’s a minimum). Goldilocks is alive and well. The Bush boom is alive and well. It’s finishing up its sixth consecutive year with more to come. Yes, it’s still the greatest story never told.Note the date of the article. The recession started in December 2007!

Note: At the beginning of 2007 I predicted a recession would start that year - made it by one month. It seems I'm always on the opposite side from Kudlow of each forecast - and one of us has been consistently wrong.

In 2014, Kudlow claimed: "I've always believed the 1990s were Ronald Reagan's third term."

In that piece, Kudlow was rewriting his own history. Near the beginning of Clinton's first term, Kudlow was arguing Clinton's policies would take the economy into a deep recession or even depression. Kudlow was wrong then (I remember because I was on the other side of that debate), so he can't claim he "always believed" now. Nonsense.

Also in 2007, Kudlow wrote: A Stock Market Vote of Confidence for Bush:

"I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."Well, maybe Kudlow had a point ... but not for the President he was writing about.

Now Larry Kudlow will be the new administration's chief economist. Oh my.

Key Measures Show Inflation close to 2% in November

by Calculated Risk on 12/15/2016 11:49:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.2% annualized rate) in November. The 16% trimmed-mean Consumer Price Index also rose 0.2% (1.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for November here. Motor fuel was up 36% annualized in November.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (2.4% annualized rate) in November. The CPI less food and energy rose 0.2% (1.8% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.5%, the trimmed-mean CPI rose 2.1%, and the CPI less food and energy rose 2.1%. Core PCE is for October and increased 1.7% year-over-year.

On a monthly basis, median CPI was at 2.2% annualized, trimmed-mean CPI was at 1.9% annualized, and core CPI was at 1.8% annualized.

Using these measures, inflation has generally been moving up, and most of these measures are close to the Fed's 2% target (Core PCE is still below).

NAHB: Builder Confidence increased to 70 in December

by Calculated Risk on 12/15/2016 10:08:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 70 in December, up from 63 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Closes Year on a High Note

Builder confidence in the market for newly-built single-family homes jumped seven points to a level of 70 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). This is the highest reading since July 2005.

...

“Though this significant increase in builder confidence could be considered an outlier, the fact remains that the economic fundamentals continue to look good for housing,” said NAHB Chief Economist Robert Dietz. “The rise in the HMI is consistent with recent gains for the stock market and consumer confidence. At the same time, builders remain sensitive to rising mortgage rates and continue to deal with shortages of lots and labor.”

...

All three HMI components posted healthy gains in December. The component gauging current sales conditions increased seven points to 76 while the index charting sales expectations in the next six months jumped nine points to 78. Meanwhile, the component measuring buyer traffic rose six points to 53, marking the first time this gauge has topped 50 since October 2005.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose six points to 51, the Midwest posted a three-point gain to 61, the South rose one point to 67 and the West registered a two-point gain to 79.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was well above the consensus forecast of 63, and is another solid reading.

NY and Philly Fed Manufacturing Expand in December

by Calculated Risk on 12/15/2016 09:01:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity grew modestly in New York State, according to firms responding to the December 2016 Empire State Manufacturing Survey. The headline general business conditions index climbed eight points to 9.0. The new orders index rose to 11.4, and the shipments index was unchanged at 8.5.And from the Philly Fed: December 2016 Manufacturing Business Outlook Survey

...

As in November, both employment indexes remained negative in December. The index for number of employees was little changed at -12.2, a sign that employment levels continued to wane, and the average workweek index, at -7.0, pointed to a decline in hours worked. ...

Indexes for the six-month outlook strengthened, and suggested that respondents were very optimistic about future conditions. The index for future business conditions shot up twenty points to 50.2, its highest level in nearly five years, with 61 percent of respondents expecting conditions to improve in the months ahead.

emphasis added

The index for current manufacturing activity in the region increased from a reading of 7.6 in November to 21.5 this month. Nearly 34 percent of the firms reported increases in activity this month, compared with 24 percent last month. The general activity index has remained positive for five consecutive months, and the activity index reading was the highest since November 2014 [at 12.2].Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

...

The current employment index improved 9 points [to 6.4], its first positive reading in 12 months. Firms also reported an increase in work hours this month: The average workweek index, which increased 2 points, has now been positive for two consecutive months. ...

The diffusion index for future general activity increased from a reading of 29.3 in November to 52.6 this month. The index is now at its highest reading since January 2015.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through December), and five Fed surveys are averaged (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through November (right axis).

It seems likely the ISM manufacturing index will show faster expansion again in December.

Weekly Initial Unemployment Claims decrease to 254,000

by Calculated Risk on 12/15/2016 08:32:00 AM

The DOL reported:

In the week ending December 10, the advance figure for seasonally adjusted initial claims was 254,000, a decrease of 4,000 from the previous week's unrevised level of 258,000. The 4-week moving average was 257,750, an increase of 5,250 from the previous week's unrevised average of 252,500.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 93 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 257,750.

This was close to the consensus forecast. The low level of claims suggests relatively few layoffs.

Wednesday, December 14, 2016

Thursday: CPI, Unemployment Claims, NY and Philly Mfg Surveys

by Calculated Risk on 12/14/2016 08:26:00 PM

Thursday:

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 255 thousand initial claims, down from 258 thousand the previous week.

• At 8:30 AM, The Consumer Price Index for November from the BLS. The consensus is for 0.2% increase in CPI, and a 0.2% increase in core CPI.

• At 8:30 AM, The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of 3.0, up from 1.5.

• At 8:30 AM, the Philly Fed manufacturing survey for December. The consensus is for a reading of 10.0, up from 7.6.

• At 10:00 AM, The December NAHB homebuilder survey. The consensus is for a reading of 63, unchanged from 63 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

Quick FOMC Analysis

by Calculated Risk on 12/14/2016 04:42:00 PM

The Fed raised the Fed Funds rate 25bp to a range of "1/2 to 3/4 percent".

On the assessment of appropriate monetary policy, one FOMC member sees just one 25bp rate hike in 2017, four members see two hikes, six members see three hikes, and five see four or more. This is an increase of one additional rate hike from previous expectations.

Note: Merrill Lynch published a note after the announcement, and they are forecasting just one rate hike in 2017.

By the end of 2018, 5 members see a total of five rate hikes over the next two years, and three members see six. There are outliers - one member sees just one hike over the next two years, and one member sees 11 rate hikes!

Based on Fed Chair Yellen's comments, most FOMC members are waiting to see the fiscal proposals before incorporating those policies in their forecasts. Yellen said at the press conference: "all the FOMC participants recognize that there is considerable uncertainty about how economic policies may change and what effect they will have on the economy."

So right now I think the Fed is on hold. Many analysts are thinking the next rate hike might happen in March, but that probably won't give the Fed enough time to consider the impact of various fiscal proposals. So my guess - depending on the proposals and the incoming data - is the next rate hike might happen in June (or later in the year).

FOMC Projections and Press Conference Link

by Calculated Risk on 12/14/2016 02:11:00 PM

Statement here. 25 bps rate hike.

Yellen press conference video here.

On the projections, GDP was mostly unchanged.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2016 | 2017 | 2018 | 2019 |

| Dec 2016 | 1.8 to 1.9 | 1.9 to 2.3 | 1.8 to 2.2 | 1.8 to 2.0 |

| Sept 2016 | 1.7 to 1.9 | 1.9 to 2.2 | 1.9 to 2.2 | 1.7 to 2.0 |

The unemployment rate was at 4.6% in November and 4.9% in October, so the unemployment rate projections were revised down slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2016 | 2017 | 2018 | 2019 |

| Dec 2016 | 4.7 to 4.8 | 4.5 to 4.6 | 4.3 to 4.7 | 4.3 to 4.8 |

| Sept 2016 | 4.7 to 4.9 | 4.5 to 4.7 | 4.4 to 4.7 | 4.4 to 4.8 |

As of October, PCE inflation was up 1.4% from October 2015. With oil prices up year-over-year, PCE inflation has been moving up. So inflation was revised up for 2016, but there was little change for 2017 and 2018.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2016 | 2017 | 2018 | 2019 |

| Dec 2016 | 1.5 | 1.7 to 2.0 | 1.9 to 2.0 | 2.0 to 2.1 |

| Sept 2016 | 1.2 to 1.4 | 1.7 to 1.9 | 1.8 to 2.0 | 1.9 to 2.0 |

PCE core inflation was up 1.7% in October year-over-year. Core PCE inflation was unrevised for 2016.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2016 | 2017 | 2018 | 2019 |

| Dec 2016 | 1.7 to 1.8 | 1.8 to 1.9 | 1.9 to 2.0 | 2.0 |

| Sept 2016 | 1.6 to 1.8 | 1.7 to 1.9 | 1.9 to 2.0 | 2.0 |

FOMC Statement: 25bps Rate Hike

by Calculated Risk on 12/14/2016 02:02:00 PM

Information received since the Federal Open Market Committee met in November indicates that the labor market has continued to strengthen and that economic activity has been expanding at a moderate pace since mid-year. Job gains have been solid in recent months and the unemployment rate has declined. Household spending has been rising moderately but business fixed investment has remained soft. Inflation has increased since earlier this year but is still below the Committee's 2 percent longer-run objective, partly reflecting earlier declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation have moved up considerably but still are low; most survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market conditions will strengthen somewhat further. Inflation is expected to rise to 2 percent over the medium term as the transitory effects of past declines in energy and import prices dissipate and the labor market strengthens further. Near-term risks to the economic outlook appear roughly balanced. The Committee continues to closely monitor inflation indicators and global economic and financial developments. In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 1/2 to 3/4 percent. The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. In light of the current shortfall of inflation from 2 percent, the Committee will carefully monitor actual and expected progress toward its inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction, and it anticipates doing so until normalization of the level of the federal funds rate is well under way. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions. Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; James Bullard; Stanley Fischer; Esther L. George; Loretta J. Mester; Jerome H. Powell; Eric Rosengren; and Daniel K. Tarullo.

emphasis added

Sacramento Housing in November: Sales up 19%, Active Inventory down 4.8% YoY

by Calculated Risk on 12/14/2016 11:31:00 AM

Important note: In November 2015, sales were impacted by a regulation change, TILA-RESPA Integrated Disclosure (TRID), so the strong year-over-year increase in many markets last month is because of the weak sales last November.

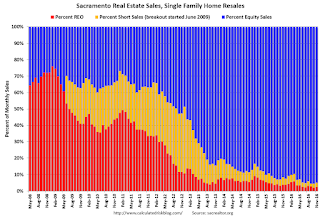

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In November, total sales were up 19.0% from November 2015, and conventional equity sales were up 22.9% compared to the same month last year.

In November, 4.4% of all resales were distressed sales. This was up from 4.4% last month, and down from 8.3% in November 2015.

The percentage of REOs was at 2.4%, and the percentage of short sales was 2.6%.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 4.8% year-over-year (YoY) in October. This was the nineteenth consecutive monthly YoY decrease in inventory in Sacramento.

Cash buyers accounted for 11.1% of all sales - this has been steadily declining (frequently investors).

Summary: This data suggests a normal market with few distressed sales, and less investor buying - but with limited inventory.