by Calculated Risk on 11/30/2016 10:02:00 AM

Wednesday, November 30, 2016

NAR: Pending Home Sales Index increased 0.1% in October, up 1.8% year-over-year

From the NAR: Pending Home Sales Crawl Forward in October

Pending home sales were mostly unchanged in October, but did squeak out a meager gain for the second consecutive month, according to the National Association of Realtors®.This was below expectations of a 0.8% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in November and December.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, inched up 0.1 percent to 110.0 in October from a slight downward revision of 109.9 in September. With last month's small increase, the index is now 1.8 percent higher than last October (108.1).

...

The PHSI in the Northeast nudged forward 0.4 percent to 96.9 in October, and is now 3.9 percent above a year ago. In the Midwest the index rose 1.6 percent to 106.3 in October, and is now 1.2 percent higher than October 2015.

Pending home sales in the South declined 1.3 percent to an index of 120.1 in October but are still 0.8 percent higher than last October. The index in the West climbed 0.7 percent in October to 108.3, and is now 2.5 percent above a year ago.

emphasis added

Personal Income increased 0.6% in October, Spending increased 0.3%

by Calculated Risk on 11/30/2016 08:37:00 AM

The BEA released the Personal Income and Outlays report for October:

Personal income increased $98.6 billion (0.6 percent) in October according to estimates released today by the Bureau of Economic Analysis. ... personal consumption expenditures (PCE) increased $38.1 billion (0.3 percent).The October PCE price index increased 1.4 percent year-over-year (compared to 1.2 percent YoY in September) and the October PCE price index, excluding food and energy, increased 1.7 percent year-over-year (same as in September).

...

Real PCE increased 0.1 percent. The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

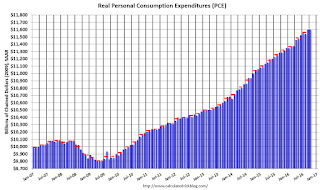

The following graph shows real Personal Consumption Expenditures (PCE) through October 2016 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was above consensus, and the increase in PCE was at consensus expectations.

A solid increase in personal income.

ADP: Private Employment increased 216,000 in November

by Calculated Risk on 11/30/2016 08:19:00 AM

Private sector employment increased by 216,000 jobs from October to November according to the November ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was well abvoe the consensus forecast for 160,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “Businesses hired aggressively in November and there is little evidence that the uncertainty surrounding the presidential election dampened hiring. In addition, because of the tightening labor market, retailers may be accelerating seasonal hiring to secure an adequate workforce to meet holiday demand, although total expected seasonal hiring may be no higher than last year’s.”

The BLS report for November will be released Friday, and the consensus is for 170,000 non-farm payroll jobs added in November.

MBA: Mortgage Refinance Activity Declines 16 Percent in Latest Weekly Survey

by Calculated Risk on 11/30/2016 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 9.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 25, 2016. This week’s results included an adjustment for the Thanksgiving holiday.

... The Refinance Index decreased 16 percent from the previous week. The seasonally adjusted Purchase Index decreased 0.2 percent from one week earlier. The unadjusted Purchase Index decreased 34 percent compared with the previous week and was 3 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to its highest level since July 2015, 4.23 percent, from 4.16 percent, with points increasing to 0.41 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With the current level of mortgage rates, refinance activity will probably decline further.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index was "3 percent higher than the same week one year ago".

Tuesday, November 29, 2016

Wednesday: ADP Employment, Personal Income and Outlays, Pending Home Sales, Beige Book, and More

by Calculated Risk on 11/29/2016 08:32:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 160,000 payroll jobs added in November, up from 147,000 added in October.

• At 8:30 AM, Personal Income and Outlays for October. The consensus is for a 0.4% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:45 AM, Chicago Purchasing Managers Index for November. The consensus is for a reading of 52.0, up from 50.6 in October.

• At 10:00 AM, Pending Home Sales Index for October. The consensus is for a 0.8% increase in the index.

• At 11:00 AM, The New York Fed will release their Q3 2016 Household Debt and Credit Report

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Freddie Mac: Mortgage Serious Delinquency rate increased slightly in October

by Calculated Risk on 11/29/2016 05:29:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate increased in October to 1.03%, up from 1.02% in September. Freddie's rate is down from 1.38% in October 2015.

This was the first month-to-month increase since January of this year, but the trend is still down.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The Freddie Mac serious delinquency rate has fallen 0.35 percentage points over the last year, and at that rate of improvement, the serious delinquency rate could be below 1% in November or December.

Note: Fannie Mae will probably report tomorrow.

FDIC: Fewer Problem banks, Residential REO Declined in Q3

by Calculated Risk on 11/29/2016 02:13:00 PM

The FDIC released the Quarterly Banking Profile for Q3 today:

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported aggregate net income of $45.6 billion in the third quarter of 2016, up $5.2 billion (12.9 percent) from a year earlier. The increase in earnings was mainly attributable to a $10 billion (9.2 percent) increase in net interest income and a $1.2 billion (1.9 percent) rise in noninterest income. One-time accounting and expense items at three institutions had an impact on the growth in income. Banks increased their loan-loss provisions by $2.9 billion (34 percent) from a year earlier. Financial results for the third quarter of 2016 are included in the FDIC’s latest Quarterly Banking Profile released today.

...

“Revenue and net income rose from a year ago, loan balances increased, asset quality improved, and the number of unprofitable banks and ‘problem banks’ continued to fall,” Gruenberg said. “Community banks also reported solid results for the quarter with strong income, revenue, and loan growth.

“Nevertheless, the banking industry continues to operate in a challenging environment,” he said. “Low interest rates for an extended period have led some institutions to reach for yield, which has increased their exposure to interest-rate risk, liquidity risk, and credit risk. Current oil and gas prices continue to affect borrowers that depend on the energy sector and have had an adverse effect on asset quality. These challenges will only intensify as interest rates normalize.”

...

Deposit Insurance Fund’s Reserve Ratio Rises to 1.18 Percent: The DIF increased $2.8 billion during the third quarter, from $77.9 billion at the end of June to $80.7 billion at the end of September, largely driven by $2.6 billion in assessment income. The DIF reserve ratio rose from 1.17 percent to 1.18 percent during the quarter. Because the reserve ratio surpassed 1.15 percent on June 30, lower regular FDIC assessment rates on all insured institutions went into effect in the third quarter. On average, regular quarterly assessments were about one-third lower than in the previous quarter, although temporary assessment surcharges on banks with assets greater than $10 billion led to an increase in total assessments at most large banks.

emphasis added

Click on graph for larger image.

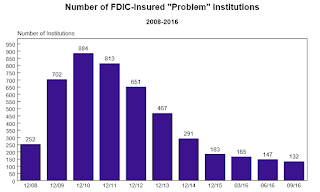

Click on graph for larger image.The FDIC reported the number of problem banks declined (Note: graph shows problem banks for Q1, Q2 and Q3 2016, and year end prior to 2016):

“Problem List” Shows Further Improvement: The number of banks on the FDIC’s Problem List fell from 147 to 132 during the third quarter. This is the smallest number of problem banks in more than seven years and is down significantly from the peak of 888 in the first quarter of 2011. Total assets of problem banks fell from $29.0 billion to $24.9 billion during the third quarter.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $4.12 billion in Q2 2016 to $3.98 billion in Q3. This is the lowest level of REOs since Q1 2007.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $4.12 billion in Q2 2016 to $3.98 billion in Q3. This is the lowest level of REOs since Q1 2007.This graph shows the nominal dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

Since REOs are reported in dollars, and house prices have increased, it is unlikely FDIC institution REOs will get back to the $2.0 to $2.5 billion range back that happened in 2003 to 2005. FDIC REOs will probably bottom closer to $3 billion.

Real Prices and Price-to-Rent Ratio in September

by Calculated Risk on 11/29/2016 11:59:00 AM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.5% year-over-year in September

It has been ten years since the bubble peak. In the Case-Shiller release this morning, the National Index, not seasonally adjusted (NSA) was reported as being at a new nominal high. The seasonally adjusted (SA) index was reported as being only 0.8% below the bubble peak. However, in real terms, the National index (SA) is still about 15.7% below the bubble peak.

The year-over-year increase in prices is mostly moving sideways now around 5%. In September, the index was up 5.5% YoY.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $276,000 today adjusted for inflation (38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is back to February 2006 levels, and the Case-Shiller Composite 20 Index (SA) is back to June 2005 levels, and the CoreLogic index (NSA) is back to August 2005.

Real House Prices

CPI less Shelter is unchanged over the last two, so real prices increased the same as nominal prices.

In real terms, the National index is back to March 2004 levels, the Composite 20 index is back to November 2003, and the CoreLogic index back to February 2004.

In real terms, house prices are back to late 2003 / early 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to August 2003 levels, the Composite 20 index is back to April 2003 levels, and the CoreLogic index is back to July 2003.

In real terms, and as a price-to-rent ratio, prices are back to late 2003 - and the price-to-rent ratio maybe moving a little more sideways now.

Case-Shiller: National House Price Index increased 5.5% year-over-year in September

by Calculated Risk on 11/29/2016 09:16:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for September ("September" is a 3 month average of July, August and September prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: The S&P CoreLogic Case-Shiller National Index Reaches New High as Home Price Gains Continue

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, surpassed the peak set in July 2006 as the housing boom topped out. The National index reported a 5.5% annual gain in September, up from 5.1% last month. The 10-City Composite posted a 4.3% annual increase, up from 4.2% the previous month. The 20-City Composite reported a yearover-year gain of 5.1%, unchanged from August.

Seattle, Portland, and Denver reported the highest year-over-year gains among the 20 cities over each of the last eight months. In September, Seattle led the way with an 11.0% year-over-year price increase, followed by Portland with 10.9%, and Denver with an 8.7% increase. 12 cities reported greater price increases in the year ending September 2016 versus the year ending August 2016.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.4% in September. Both the 10-City Composite and the 20-City Composite posted a 0.1% increase in September. After seasonal adjustment, the National Index recorded a 0.8% month-over-month increase, the 10-City Composite posted a 0.2% month-over-month increase, and the 20-City Composite reported a 0.4% month-over-month increase. 15 of 20 cities reported increases in September before seasonal adjustment; after seasonal adjustment, all 20 cities saw prices rise.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 10.7% from the peak, and up 0.2% in September (SA).

The Composite 20 index is off 8.5% from the peak, and up 0.4% (SA) in September.

The National index is off 0.8% from the peak (SA), and up 0.8% (SA) in September. The National index is up 34.0% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.3% compared to September 2015.

The Composite 20 SA is up 5.1% year-over-year.

The National index SA is up 5.5% year-over-year.

Note: According to the data, prices increased in all 20 cities month-over-month seasonally adjusted.

I'll have more later.

Q3 GDP Revised Up to 3.2% Annual Rate

by Calculated Risk on 11/29/2016 08:46:00 AM

From the BEA: Gross Domestic Product: Third Quarter 2016 (Second Estimate)

Real gross domestic product increased at an annual rate of 3.2 percent in the third quarter of 2016, according to the "second" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 1.4 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised up from 2.1% to 2.8%. (decent PCE). Non-Residential investment in structures was revised up from 5.4% to +10.1%. This was above the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 2.9 percent. With the second estimate for the third quarter, the general picture of economic growth remains the same; the increase in personal consumption expenditures was larger than previously estimated ...

emphasis added