by Calculated Risk on 11/23/2016 07:00:00 AM

Wednesday, November 23, 2016

MBA: Mortgage "Purchase Applications Drive Increase in Latest Weekly Survey "

From the MBA: Purchase Applications Drive Increase in Latest MBA Weekly Survey

Mortgage applications increased 5.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 18, 2016.

... The Refinance Index decreased 3 percent from the previous week to its lowest level since January 2016. The seasonally adjusted Purchase Index increased 19 percent from one week earlier. The unadjusted Purchase Index increased 13 percent compared with the previous week and was 11 percent higher than the same week one year ago.

“Mortgage rates have continued to move higher in the post-election period, as investors worldwide are looking for increases in growth and inflation, with the 30-year mortgage rate reaching its highest weekly average since the beginning of 2016,” said Michael Fratantoni, Chief Economist and Senior Vice President of Research & Technology at the Mortgage Bankers Association. “Refinance volume dropped further over the week, particularly for refinances of FHA and VA loans. Purchase volume increased sharply for the week compared to both last week, which included the Veteran’s Day holiday, and last year, with purchase volume up more than 11 percent on a year over year basis. The increase in purchase activity was driven by borrowers seeking larger loans and that drove up the average loan amount on home purchase applications to $310 thousand, the highest in the survey, which dates back to 1990.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to its highest level since January 2016, 4.16 percent, from 3.95 percent, with points unchanged at 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

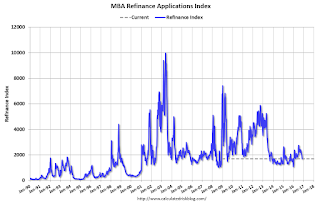

Click on graph for larger image.The first graph shows the refinance index since 1990.

With the current level of mortgage rates, refinance activity will probably decline further.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index was "11 percent higher than the same week one year ago".

Tuesday, November 22, 2016

Wednesday: New Home Sales, Unemployment Claims, FOMC Minutes, and More

by Calculated Risk on 11/22/2016 06:55:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 250 thousand initial claims, up from 235 thousand the previous week.

• Also at 8:30 AM, Durable Goods Orders for October from the Census Bureau. The consensus is for a 1.5% increase in durable goods orders.

• At 9:00 AM, FHFA House Price Index for September 2016. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.7% month-to-month increase for this index.

• At 10:00 AM, New Home Sales for September from the Census Bureau. The consensus is for an decrease in sales to 590 thousand Seasonally Adjusted Annual Rate (SAAR) in October from 593 thousand in September.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (final for November). The consensus is for a reading of 91.6, unchanged from the preliminary reading 91.6.

• At 2:00 PM, FOMC Minutes for Meeting of November 1-2

Chemical Activity Barometer "Continues Strong Performance" in November

by Calculated Risk on 11/22/2016 03:34:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Continues Strong Performance with Eighth Consecutive Gain

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), featured another solid gain of 0.3 percent in November, following a gain of 0.3 percent in October and a 0.4 percent gain in September and August. Accounting for adjustments, the CAB is up 4.2 percent over this time last year, a marked increase over earlier comparisons and the greatest year-over-year gain since August 2014. All data is measured on a three-month moving average (3MMA). On an unadjusted basis the CAB climbed 0.3 percent in November, following a 0.2 percent gain in October.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

Currently CAB has increased solidly over the last several months, and this suggests an increase in Industrial Production over the next year.

A Few Comments on October Existing Home Sales

by Calculated Risk on 11/22/2016 12:45:00 PM

Earlier: Existing Home Sales increased in October to 5.60 million SAAR

First, these October existing home sales closed escrow before the recent increase in mortgage rates (rates started increasing after the election). Also, the recent increase in mortgage rates will probably have little impact on November closed sales, since most of those sales were already in process.

With the recent increase in rates, I'd expect some decline in sales volume as happened following the "taper tantrum" in 2013. So we might see sales fall to 5 million SAAR or below over the next 6 months. That would still be solid existing home sales. We might also see a little more inventory in the coming months, and therefore less price appreciation.

Usually a change in interest rates impacts new home sales first, because new home sales are reported when the contract is signed, whereas existing home sales are reported when the contract closes. So we might see some impact on new home sales for November (not October since that was before the recent increase).

On inventory, here is a repeat of some comments I wrote earlier: I expected some increase in inventory last year, but that didn't happened. Inventory is still very low and falling year-over-year (down 4.3% year-over-year in October). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases.

Two of the key reasons inventory is low: 1) A large number of single family home and condos were converted to rental units. Last year, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors, and rents have increased substantially, and the investors are not selling (even though prices have increased too). Most of these rental conversions were at the lower end, and that is limiting the supply for first time buyers. 2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80, in another 10 to 20 years for the boomers). Instead we are seeing a surge in home improvement spending, and this is also limiting supply.

Of course low inventory keeps potential move-up buyers from selling too. If someone looks around for another home, and inventory is lean, they may decide to just stay and upgrade.

A key point: Some areas are already seeing more inventory. For example, there is more inventory in some coastal areas of California, in New York city and for high rise condos in Miami.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in October (red column) were the highest for October since 2006 (NSA).

Note that sales NSA are in the slower Fall period, and will really slow seasonally in January and February.

Existing Home Sales increased in October to 5.60 million SAAR

by Calculated Risk on 11/22/2016 10:09:00 AM

From the NAR: Existing-Home Sales Jump Again in October

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, grew 2.0 percent to a seasonally adjusted annual rate of 5.60 million in October from an upwardly revised 5.49 million in September. October's sales pace is 5.9 percent above a year ago (5.29 million) and surpasses June's pace (5.57 million) as the highest since February 2007 (5.79 million). ...

Total housing inventory 3 at the end of October declined 0.5 percent to 2.02 million existing homes available for sale, and is now 4.3 percent lower than a year ago (2.11 million) and has fallen year-over-year for 17 straight months. Unsold inventory is at a 4.3-month supply at the current sales pace, which is down from 4.4 months in September.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October (5.60 million SAAR) were 2.0% higher than last month, and were 5.9% above the October 2015 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 2.02 million in October from 2.03 million in September. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 2.02 million in October from 2.03 million in September. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 4.3% year-over-year in October compared to October 2015.

Inventory decreased 4.3% year-over-year in October compared to October 2015. Months of supply was at 4.3 months in October.

This was above consensus expectations. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Monday, November 21, 2016

Tuesday: Existing Home Sales

by Calculated Risk on 11/21/2016 07:37:00 PM

Tuesday:

• At 10:00 AM, Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 5.42 million SAAR, down from 5.47 million in September.

Housing economist Tom Lawler expects the NAR to report sales of 5.47 million SAAR in October, unchanged from September's preliminary pace.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for November.

Quarterly Housing Starts by Intent

by Calculated Risk on 11/21/2016 03:11:00 PM

In addition to housing starts for October, the Census Bureau also released the Q3 "Started and Completed by Purpose of Construction" report last week.

It is important to remember that we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released last week showed there were 150,000 single family starts, built for sale, in Q3 2016, and that was close to the 148,000 new homes sold for the same quarter, so inventory increased slightly in Q3 (Using Not Seasonally Adjusted data for both starts and sales).

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Click on graph for larger image.

Click on graph for larger image.Single family starts built for sale were up about 2% compared to Q3 2015.

Owner built starts were up 4% year-over-year. And condos built for sale not far above the record low.

The 'units built for rent' has increased significantly in recent years, but is now moving more sideways.

Vehicle Sales Forecast: Sales Over 17 Million SAAR Again in November, Possible Record Year in 2016

by Calculated Risk on 11/21/2016 11:07:00 AM

The automakers will report November vehicle sales on Thursday, December 1st.

Note: There were 25 selling days in November 2016, up from 23 in November 2015.

From WardsAuto: Forecast November U.S. Light-Vehicle Sales Leave Potential for Record Year

U.S. light-vehicle sales results are expected to track above the year-to-date pace for the third straight month in November, leaving open the possibility that 2016 still could finish with record volume.Here is a table (source: BEA) showing the 5 top years for light vehicle sales through October, and the top 5 full years. 2016 will probably finish in the top 3, and could be the best year ever - just beating last year.

With an upward bias, November sales are forecast to end at a 17.7 million-unit seasonally adjusted annual rate, the third consecutive month the SAAR finished above the year-to-date total, which stands at 17.3 million through October.

...

If November’s outlook holds firm, year-to-date volume will total 15.8 million units, a smidgeon above 11-month 2015’s 15.7 million, but keeping the prospect alive that 2016 could end as a record year.

...

WardsAuto is forecasting 2016 to end ahead of 2015. An initial look at December points to a 17.8 million SAAR. Based on the November-December projections, sales will end the year slightly above 17.4 million units, barely topping 2015’s record volume of 17.396 million.

emphasis added

| Light Vehicle Sales, Top 5 Years and Through October | ||||

|---|---|---|---|---|

| Through October | Full Year | |||

| Year | Sales (000s) | Year | Sales (000s) | |

| 1 | 2000 | 14,877 | 2015 | 17,396 |

| 2 | 2001 | 14,487 | 2000 | 17,350 |

| 3 | 2015 | 14,443 | 2001 | 17,122 |

| 4 | 2016 | 14,409 | 2005 | 16,948 |

| 5 | 2005 | 14,307 | 1999 | 16,894 |

Chicago Fed "Economic Growth Increased Slightly in October"

by Calculated Risk on 11/21/2016 09:13:00 AM

From the Chicago Fed: Economic Growth Increased Slightly in October

The Chicago Fed National Activity Index (CFNAI) increased to –0.08 in October from –0.23 in September. All four broad categories of indicators that make up the index increased from September, but all four categories again made nonpositive contributions to the index in October.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, edged down to –0.27 in October from –0.20 in September. October’s CFNAI-MA3 suggests that growth in national economic activity was somewhat below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was somewhat below the historical trend in October (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, November 20, 2016

Sunday Night Futures

by Calculated Risk on 11/20/2016 07:34:00 PM

Weekend:

• Schedule for Week of Nov 20, 2016

• Some early Thoughts on the Impact of the Trump Economic Policies

• Goldman: "2017 Outlook: Under New Management"

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for October. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures: S&P and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $46.14 per barrel and Brent at $47.36 per barrel. A year ago, WTI was at $39, and Brent was at $42 - so oil prices are up year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.13 per gallon - a year ago prices were at $2.09 per gallon - so gasoline prices are up slightly year-over-year.