by Calculated Risk on 11/17/2016 11:19:00 AM

Thursday, November 17, 2016

Key Measures Show Inflation close to 2% in October

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.1% annualized rate) in October. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.2% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for October here. Motor fuel was up 122% annualized in October!

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.4% (4.4% annualized rate) in October. The CPI less food and energy rose 0.1% (1.8% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.5%, the trimmed-mean CPI rose 2.0%, and the CPI less food and energy rose 2.1%. Core PCE is for September and increased 1.7% year-over-year.

On a monthly basis, median CPI was at 2.1% annualized, trimmed-mean CPI was at 2.2% annualized, and core CPI was at 1.8% annualized.

Using these measures, inflation has generally been moving up, and most of these measures are close to the Fed's 2% target (Core PCE is still below).

Yellen: Rate Hike "appropriate relatively soon"

by Calculated Risk on 11/17/2016 09:26:00 AM

From Fed Chair Janet Yellen's testimony before the Joint Economic Committee, U.S. Congress, Washington, D.C.: The Economic Outlook

I will turn now to the implications of recent economic developments and the economic outlook for monetary policy. The stance of monetary policy has supported improvement in the labor market this year, along with a return of inflation toward the FOMC's 2 percent objective. In September, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent and stated that, while the case for an increase in the target range had strengthened, it would, for the time being, wait for further evidence of continued progress toward its objectives.A rate hike in December is very likely. The incoming data has been strong (see housing starts and unemployment claims today that were released after her comments were prepared).

At our meeting earlier this month, the Committee judged that the case for an increase in the target range had continued to strengthen and that such an increase could well become appropriate relatively soon if incoming data provide some further evidence of continued progress toward the Committee's objectives. This judgment recognized that progress in the labor market has continued and that economic activity has picked up from the modest pace seen in the first half of this year. And inflation, while still below the Committee's 2 percent objective, has increased somewhat since earlier this year. Furthermore, the Committee judged that near-term risks to the outlook were roughly balanced.

Waiting for further evidence does not reflect a lack of confidence in the economy. Rather, with the unemployment rate remaining steady this year despite above-trend job gains, and with inflation continuing to run below its target, the Committee judged that there was somewhat more room for the labor market to improve on a sustainable basis than the Committee had anticipated at the beginning of the year. Nonetheless, the Committee must remain forward looking in setting monetary policy. Were the FOMC to delay increases in the federal funds rate for too long, it could end up having to tighten policy relatively abruptly to keep the economy from significantly overshooting both of the Committee's longer-run policy goals. Moreover, holding the federal funds rate at its current level for too long could also encourage excessive risk-taking and ultimately undermine financial stability.

The FOMC continues to expect that the evolution of the economy will warrant only gradual increases in the federal funds rate over time to achieve and maintain maximum employment and price stability. This assessment is based on the view that the neutral federal funds rate--meaning the rate that is neither expansionary nor contractionary and keeps the economy operating on an even keel--appears to be currently quite low by historical standards. Consistent with this view, growth in aggregate spending has been moderate in recent years despite support from the low level of the federal funds rate and the Federal Reserve's large holdings of longer-term securities. With the federal funds rate currently only somewhat below estimates of the neutral rate, the stance of monetary policy is likely moderately accommodative, which is appropriate to foster further progress toward the FOMC's objectives. But because monetary policy is only moderately accommodative, the risk of falling behind the curve in the near future appears limited, and gradual increases in the federal funds rate will likely be sufficient to get to a neutral policy stance over the next few years.

emphasis added

Weekly Initial Unemployment Claims decrease to 235,000, Lowest since 1973

by Calculated Risk on 11/17/2016 08:55:00 AM

The DOL reported:

In the week ending November 12, the advance figure for seasonally adjusted initial claims was 235,000, a decrease of 19,000 from the previous week's unrevised level of 254,000. This is the lowest level for initial claims since November 24, 1973 when it was 233,000. The 4-week moving average was 253,500, a decrease of 6,500 from the previous week's revised average. The previous week's average was revised up by 250 from 259,750 to 260,000.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 89 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 253,500.

This was lower than the consensus forecast. The low level of claims suggests relatively few layoffs.

Housing Starts increased to 1.323 Million Annual Rate in October

by Calculated Risk on 11/17/2016 08:40:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in October were at a seasonally adjusted annual rate of 1,323,000. This is 25.5 percent above the revised September estimate of 1,054,000 and is 23.3 percent above the October 2015 rate of 1,073,000.

Single-family housing starts in October were at a rate of 869,000; this is 10.7 percent above the revised September figure of 785,000. The October rate for units in buildings with five units or more was 445,000.

Building Permits:

Privately-owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 1,229,000. This is 0.3 percent above the revised September rate of 1,225,000 and is 4.6 percent above the October 2015 estimate of 1,175,000.

Single-family authorizations in October were at a rate of 762,000; this is 2.7 percent above the revised September figure of 742,000. Authorizations of units in buildings with five units or more were at a rate of 439,000 in October.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased significantly in October compared to September. Multi-family starts are up sharply year-over-year.

Multi-family is volatile, and this was a bounce back from the decline last month.

Single-family starts (blue) increased in October, and are up 22% year-over-year. This is the highest level for single family starts since 2007.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in October were above expectations - and at the highest level since 2007 - and August and September were revised up. A strong report. I'll have more later ...

Wednesday, November 16, 2016

Thursday: Housing Starts, CPI, Yellen, Unemployment Claims

by Calculated Risk on 11/16/2016 08:38:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 257 thousand initial claims, up from 254 thousand the previous week.

• Also at 8:30 AM, The Consumer Price Index for October from the BLS. The consensus is for 0.4% increase in CPI, and a 0.2% increase in core CPI.

• Also at 8:30 AM, Housing Starts for October. The consensus is for 1.168 million, up from the September rate.

• Also at 8:30 AM, the Philly Fed manufacturing survey for November. The consensus is for a reading of 8.0, down from 9.7.

• At 10:00 AM, Testimony by Fed Chair Janet Yellen, The Economic Outlook, Before the Joint Economic Committee of Congress, U.S. Congress, Washington, D.C.

Earlier: Industrial Production unchanged in October

by Calculated Risk on 11/16/2016 03:21:00 PM

Earlier today from the Fed: Industrial production and Capacity Utilization

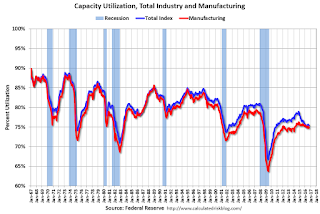

Industrial production was unchanged in October after decreasing 0.2 percent in September. Although the level of industrial production in September was the same as the previous estimate, revisions to the index for utilities raised the rate of change in total industrial production in August and lowered it in September. In October, manufacturing output increased 0.2 percent, and mining posted a gain of 2.1 percent for its largest increase since March 2014. The index for utilities dropped 2.6 percent, as warmer-than-normal temperatures reduced the demand for heating. At 104.3 percent of its 2012 average, total industrial production in October was 0.9 percent lower than its year-earlier level. Capacity utilization for the industrial sector edged down 0.1 percentage point in October to 75.3 percent, a rate that is 4.7 percentage points below its long-run (1972–2015) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 8.7 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 75.3% is 4.7% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production was unchanged in October at 104.2. This is 19.3% above the recession low, and is close to the pre-recession peak.

This was below expectations of a 0.1% increase.

AIA: Architecture Billings Index increases in October

by Calculated Risk on 11/16/2016 12:31:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index rebounds after two down months

After seeing consecutive months of contracting demand for the first time in four years, the Architecture Billings Index (ABI) saw a modest increase demand for design services. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the October ABI score was 50.8, up from the mark of 48.4 in the previous month. This score reflects a slight increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 55.4, down sharply from a reading of 59.4 the previous month.

“There was a collective sense of uncertainty throughout the design and construction industry leading up to the presidential election,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Hopefully we’ll get a sense of what direction we will be headed once we get a clearer read on how the new administration’s policies might impact the overall economy as well as the construction industry.”

...

• Regional averages: South (53.7), West (49.7), Northeast (47.3) Midwest (46.8)

• Sector index breakdown: multi-family residential (51.2) commercial / industrial (49.8), mixed practice (49.5), institutional (49.1)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.8 in October, up from 48.4 in September. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 8 of the last 12 months, suggesting a further increase in CRE investment through mid-2017.

NAHB: Builder Confidence at 63 in November

by Calculated Risk on 11/16/2016 10:08:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 63 in November, unchanged from 63 in October. Any number above 50 indicates that more builders view sales conditions as good than poor.

This graph show the NAHB index since Jan 1985.

This was at the consensus forecast of 63, and is another solid reading.

MBA: "Mortgage Applications Decrease in Latest MBA Weekly Survey"

by Calculated Risk on 11/16/2016 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 9.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 11, 2016.

... The Refinance Index decreased 11 percent from the previous week to its lowest level since March 2016. The seasonally adjusted Purchase Index decreased 6 percent from one week earlier to its lowest level since January 2016. The unadjusted Purchase Index decreased 10 percent compared with the previous week and was 3 percent higher than the same week one year ago.

"Following the election, mortgage rates saw their biggest week over week increase since the taper tantrum in June 2013, and reached their highest level since January of this year,” said David H. Stevens, CMB, President and CEO of the Mortgage Bankers Association. “Investor expectations of faster growth and higher inflation are driving the jump up in rates, and rates have now increased for five of the past six weeks, spurring a commensurate drop in refinance activity."

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to its highest level since January 2016, 3.95 percent, from 3.77 percent, with points increasing to 0.39 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note that this was for the week ending Nov 11th. Rates bumped up further on Monday this week, and the survey next week will probably show a further sharp decline in refinance activity.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index was "3 percent higher than the same week one year ago".

Tuesday, November 15, 2016

Today is Tanta's Birthday! Wednesday: PPI, Industrial Production, Homebuilder Survey

by Calculated Risk on 11/15/2016 07:30:00 PM

Happy Birthday T!

For new readers, Tanta was my co-blogger back in 2007 and 2008. She was a brilliant, writer - very funny - and a mortgage expert. Sadly, she passed away in 2008, and I like to celebrate her life on her birthday.

I strongly recommend Tanta's "The Compleat UberNerd" posts for an understanding of the mortgage industry. And here are many of her other posts.

On her passing, from the NY Times: Doris Dungey, Prescient Finance Blogger, Dies at 47, from the WaPo: Doris J. Dungey; Blogger Chronicled Mortgage Crisis, from me: Sad News: Tanta Passes Away

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Producer Price Index for October from the BLS. The consensus is for a 0.3% increase in prices, and a 0.2% increase in core PPI.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for October. The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to be unchanged at 75.4%.

• At 10:00 AM, The November NAHB homebuilder survey. The consensus is for a reading of 63, unchanged from 63 in October. Any number above 50 indicates that more builders view sales conditions as good than poor.