by Calculated Risk on 11/15/2016 05:20:00 PM

Tuesday, November 15, 2016

FNC: Residential Property Values increased 6.0% year-over-year in September

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their September 2016 index data. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.4% from August to September (Composite 100 index, not seasonally adjusted).

The 10 city MSA increased 0.4% (NSA), the 20-MSA RPI increased 0.5%, and the 30-MSA RPI also increased 0.5% in September. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The index is still down 9.2% from the peak in 2006 (not inflation adjusted).

This graph shows the year-over-year change based on the FNC index (four composites) through September 2016. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the other indexes are also showing the year-over-year change in the mid single digit range.

Note: The September Case-Shiller index will be released on Tuesday, November 29th.

The Cupboard is Full

by Calculated Risk on 11/15/2016 01:22:00 PM

The recent economic data has been solid. From Merrill Lynch today:

Retail spending surged 0.8% mom in October, building on a 1.0% pop in September (revised up from 0.6%). Core retail sales also came in at a robust 0.8%, which was well above expectations of 0.4%. In addition, September and August core sales were revised up to 0.3% from 0.1% and 0.1% from -0.1%, respectively. Election uncertainty looked to have had no impact on the consumer, though Hurricane Matthew may have been a drag since eating & drinking sales tumbled 0.7% mom. These data boosted our 4Q GDP tracking estimate by 0.4pp to 2.4%, as well as our 3Q estimate by 0.2pp to 3.2%And from the Atlanta Fed GDPNow:

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2016 is 3.3 percent on November 15, up from 3.1 percent on November 9. The forecast of fourth-quarter real personal consumption expenditures growth increased from 2.6 percent to 2.9 percent after this morning's retail sales report from the U.S. Census Bureau.We've seen a record 73 consecutive months of job gains (80 months if we remove the impact of the 2010 decennial census). And there is still some labor slack, so there is room for more job growth (as an example, part time for economic reasons is still elevated).

And wages are picking up.

Click on graph for larger image.

Click on graph for larger image.This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.8% YoY in October. This series is noisy, however overall wage growth is trending up - especially over the last year and a half.

And demographics are improving!

Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through October 2016.

There was a huge surge in the prime working age population in the '70s, '80s and '90s.

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

The good news is the prime working age group has started to grow again, and is now growing at 0.5% per year - and this should boost economic activity. And it appears the prime working age group will exceed the previous peak later this year.

And the demographics for housing is even better.

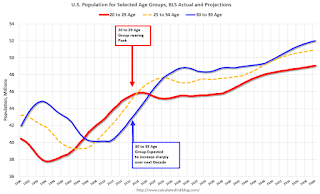

This graph shows the longer term trend for three key age groups: 20 to 29, 25 to 34, and 30 to 39 (the groups overlap).

This graph shows the longer term trend for three key age groups: 20 to 29, 25 to 34, and 30 to 39 (the groups overlap).This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group will peak in 2018 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak in 2023. This suggests demand for apartments will soften in a few years.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next decade.

These demographics are positive for home buying, and this is a key reason I expect single family housing starts to continue to increase in coming years.

Sure, there are problems. Not everyone has participated in the current expansion. Wealth and income inequality are record extremes. There is too much student debt. And climate change is posing a real threat to the economy in the future. I could offer proposals to address those issues without negatively impacting the current expansion, and we will see if those issues are addressed in the coming years.

However, the bottom line is the cupboard is full. The expansion should continue for some time. What could possibly go wrong?

NY Fed: November "General business conditions index climbed eight points to 1.5"

by Calculated Risk on 11/15/2016 10:33:00 AM

Earlier from the NY Fed: Empire State Manufacturing Survey

Business activity stabilized in New York State, according to firms responding to the November 2016 Empire State Manufacturing Survey. The headline general business conditions index climbed out of negative territory for the first time in four months, rising eight points to 1.5.This was above the consensus forecast of -2.3, and suggests manufacturing expanded in the NY region in November.

...

Both employment indexes remained negative in November. The index for number of employees dropped six points to -10.9, a sign that employment levels were contracting, and the average workweek index, little changed at -10.9, pointed to a decline in hours worked.

...

Indexes for the six-month outlook suggested that respondents were somewhat less optimistic about future conditions than they were last month. ... Indexes for future employment and the future average workweek, at 10.9 and 10.0, respectively, indicated that firms expected to expand employee rolls and hours worked in the months ahead.

Retail Sales increased 0.8% in October

by Calculated Risk on 11/15/2016 08:38:00 AM

On a monthly basis, retail sales increased 0.8 percent from September to October (seasonally adjusted), and sales were up 4.3% from October 2015.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for October, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $465.9 billion, an increase of 0.8 percent from the previous month, and 4.3 percent above October 2015. ... The August 2016 to September 2016 percent change was revised from up 0.6 percent to up 1.0 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.7% in October.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 4.5% on a YoY basis.

Retail and Food service sales ex-gasoline increased by 4.5% on a YoY basis.The increase in October was above expectations and the previous two months were revised up; a very strong report.

Monday, November 14, 2016

Tuesday: Retail Sales

by Calculated Risk on 11/14/2016 07:25:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Skyrocket to 4%. New Normal?

It's been a long time since anyone could say that top tier conventional conforming 30yr fixed mortgage rates were at 4%. Indeed, even last Monday, the thought of 4% rates would border on preposterous. But what a difference a week makes! Over the past 3 days, rates have moved higher at a pace that's only matched by the worst 3 consecutive days of the mid 2013 taper tantrum.Tuesday:

emphasis added

• At 8:30 AM ET, Retail sales for October will be released. The consensus is for 0.6% increase in retail sales in October.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for November. The consensus is for a reading of -2.3, up from -6.8.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for September. The consensus is for a 0.2% increase in inventories.

Update: U.S. Heavy Truck Sales Slump Over?

by Calculated Risk on 11/14/2016 03:22:00 PM

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the October 2016 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the recession, falling to a low of 181 thousand in April and May 2009, on a seasonally adjusted annual rate basis (SAAR). Then sales increased more than 2 1/2 times, and hit 479 thousand SAAR in June 2015.

Heavy truck sales have since declined again - probably mostly due to the weakness in the oil sector - and were at 374 thousand SAAR in October.

Even with the recent oil related decline, heavy truck sales are at about the average (and median) of the last 20 years.

Click on graph for larger image.

Sales have been at about the same level for four consecutive months. It is possible the oil related slump in heavy truck sales is over.

Mortgage Rates and Ten Year Yield, Expect 4% Mortgage Rates

by Calculated Risk on 11/14/2016 11:03:00 AM

Rates are rising with the expectation of much larger deficits next year (tax cuts combined with more spending).

With the ten year yield rising to 2.25% today, and based on an historical relationship, 30-year rates should currently be around 4.1%.

As of this morning, Mortgage News Daily reports that 30 year fixed rate mortgages are around 4%. Pretty close to expected.

The graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

So expect mortgage rates to rise this week to around 4%.

Also, we should see a sharp drop in refinance activity.

Currently I don't think this increase in rates will have a significant impact on the housing market.

Update: Real Estate Agent Boom and Bust

by Calculated Risk on 11/14/2016 09:00:00 AM

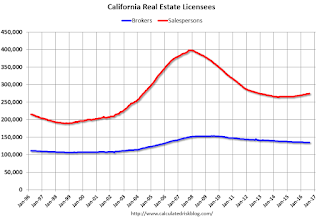

Way back in 2005, I posted a graph of the Real Estate Agent Boom. Here is another update to the graph.

The graph shows the number of real estate licensees in California.

The number of agents peaked at the end of 2007 (housing activity peaked in 2005, and prices in 2006).

The number of salesperson's licenses is off 31.1% from the peak, and is increasing again (up 3.9% from low). The number of salesperson's licenses has fallen to June 2004 levels.

Brokers' licenses are off 12.1% from the peak and have only fallen to March 2006 levels, but are still slowly declining (down 1% year-over-year).

It appears we are starting to see a pickup in Real Estate licensees in California, although the number of Brokers is still declining.

Sunday, November 13, 2016

Sunday Night Futures

by Calculated Risk on 11/13/2016 07:25:00 PM

Weekend:

• Schedule for Week of Nov 13, 2016

• Goldman: "Economic Implications of the Trump Agenda"

Monday:

• No major economic releases scheduled

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are up 7 and DOW futures are up 50 (fair value).

Oil prices were down over the last week with WTI futures at $43.56 per barrel and Brent at $44.94 per barrel. A year ago, WTI was at $41, and Brent was at $42 - so oil prices are up year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.16 per gallon - a year ago prices were at $2.18 per gallon - so gasoline prices are mostly unchanged year-over-year.

Goldman: "Economic Implications of the Trump Agenda"

by Calculated Risk on 11/13/2016 10:19:00 AM

A few excerpts from an analysis piece by Goldman Sachs economists Sven Jari Stehn and Alec Phillips:

• President-elect Trump’s proposals, if enacted, would have significant implications for the US economic outlook over the next few years, some positive and some negative. The positive fiscal impulse from his tax reform and infrastructure proposals could provide a near-term boost to growth and, depending on the specifics, could have positive longer-run supply side effects.CR Note: No one knows exactly what Mr. Trump will propose. As an example, Trump has promised his supporters that he would not touch Social Security and Medicare, but House Speaker Paul Ryan has already suggested that cuts to Medicare are on the table. And note that Goldman does not "anticipate significant changes on immigration policy", yet that was Trump's initial campaign proposal. We have to wait and see what the exact proposals will be.

• However, other proposals could lead to new restrictions on foreign trade and immigration, which could have negative implications for growth, particularly over the longer term. ...

• We expect scaled-down versions of the tax reform and infrastructure policies to be enacted. We do not anticipate significant changes on immigration policy, but incremental restrictions seem likely. Mr. Trump’s monetary policy views are still unclear, but slightly more hawkish appointments appear likely at this stage. Trade policy is the greatest unknown, but we expect that Mr. Trump would follow through on at least some of the trade policies he has outlined.

• Keeping in mind that our simulations are subject to considerable uncertainty, we draw three main conclusions. First, Mr. Trump’s policies could boost growth in 2017 and 2018, but are likely to weigh on growth thereafter if trade and immigration restrictions are enacted, or if Fed policy turns more restrictive. Second, core inflation and the funds rate are likely to be higher for the next few years in almost all scenarios. Third, the risks around our base case appear asymmetric: a larger fiscal package could boost growth moderately more in the near term, but a more adverse policy mix would likely lead to a significant slowdown, higher inflation and tighter policy in subsequent years.

emphasis added